Doug Wilson, Portfolio Manager, One River Digital Asset Management LLC

Just Another Cycle

Commodities are the lifeline to the global economy. We eat energy. Periods of strong demand often reveal strains in supply chains that lead to rapid price appreciation. Capital investment follows, with return expectations extrapolated from high prices and record margins. A downdraft in demand exposes excess investment, prices decline, and the weakest links in the supply chain are culled. Long periods of low prices lead to complacency, strong demand strains supply chains, and a rhythmic cycle emerges: boom, bust, recovery.

Natural gas in the early 2000s is an interesting example. From 2002 to 2008, natural gas prices experienced a period of dramatic price appreciation from $2.00/MMBtu to $16.00/MMBtu as economic activity accelerated and existing supply sources strained to keep pace. The market was sending a clear price signal to energy producers: to discover and capitalize on new sources of supply. This price signal had a ripple effect, as it also impacted associated sectors like power production, chemicals, and coal mining.

Cash flows from flush production found their way into Research & Development budgets that discovered technologies like Hydraulic Fracturing and Horizontal Drilling. A few hundred feet at first, now well laterals are measured in miles. Natural Gas Turbine efficiency (Heat Rate) improved dramatically. This new capital equipment and production were financed with organic cash flows initially, but then quickly morphed into aggressive rounds of debt and equity financing. This debt-fueled capital expansion of commodity industries was justified by the fact that prices were high, margins were at record levels, and the new technology allowed producers to be more efficient – lowering the unit cost of production. Recovery of capital was projected to happen in record time. It also brought rounds of leverage buyouts and acquisitions, most notably the 2007 TXU Energy LBO.

As we all know, the influx of new capital underwritten based on peak commodity prices and peak operating margins resulted in an unprecedented amount of supply additions across the natural gas, power sectors, uranium, and coal. This influx of supply, combined with a global downturn, compressed BOTH prices and margins significantly. Debt service could not be sustained. As a result:

-

TXU went bankrupt - along with many other Independent Power Producers (Mirant, Reliant, Calpine, etc.),

-

Countless gas exploration & production (E&P) companies sought bankruptcy protection,

-

Every single public coal company declared bankruptcy.

Ultimately, ownership was transferred from equity holders to lenders. The market participants that had eagerly embraced these assets quickly wrote them off as worthless – "Going to ZERO." This presented a terrific entry point for longer-term, patient capital.

These ignored assets are now generating amongst the highest free cash flow yield across all industries. The catalyst for recovery was the rationing of new investment, enabled by the restructuring of capital.

Bitcoin Mining is following the same pattern now.

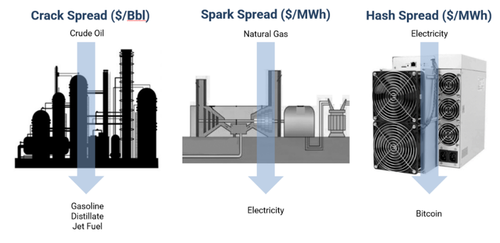

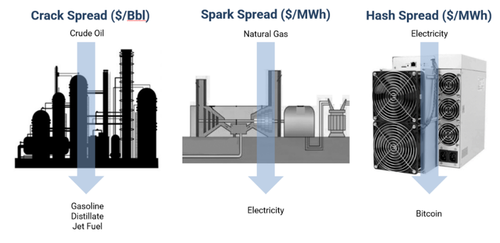

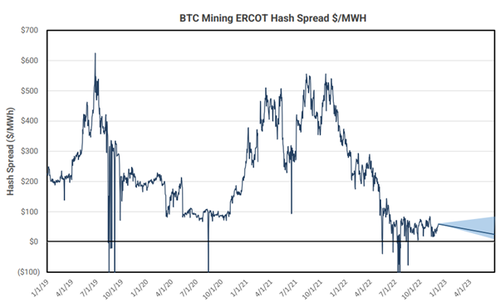

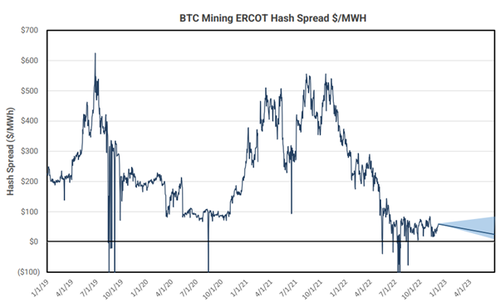

For context, the Bitcoin mining sector experienced an unprecedented BOOM in the autumn of 2021. This was driven by elevated commodity prices (Bitcoin at $67,734 on 11/9/2021) and record mining margins (Hash Spread1 of $550/MWh) brought about by the reduction in competition post China’s ban on Bitcoin Mining. This combination of high prices and record margins attracted new capital to the sector with the promise of rapid payback underwritten by continued projections of success.

Similar to past energy sector commodity BUSTS, the influx of new investments in Bitcoin mining resulted in a dramatic compression of Bitcoin mining margins from a peak of $550/MWh to $50/MWh.

Mining operations are currently profitable, but unable to service their financial obligations. So, they now must turn to bankruptcy. Since our webinar in July, our investment pipeline has expanded significantly as more Bitcoin mining lenders and borrowers find themselves in distress.

Similar to prior commodity cycles, our expectation is that ownership will pass from equity owners to lenders. We expect these new owners will run these businesses for cash flow as opposed to growth. Growth capital will avoid this sector for years, like prior commodity busts.

Even with the depression of prices, there are real cash flows in Bitcoin mining. The Bitcoin network rewarded miners with $15.3 million of Bitcoin rewards per day thus far this month, which annualizes to $5.8 billion.

Bitcoin is going through yet another brutal adjustment. Each one is different. The unique feature in this cycle is that institutional miners were far more involved in this recent bull market, and the unwinding of that looks like a classic BOOM to BUST cycle in commodity markets. It will pass with discipline. Traders are hunting for the bottom in asset markets. Credit markets are providing the pristine opportunity to earn very strong yields in a low-price environment with considerable optionality to a recovery. The credit opportunity steers you away from calling the bottom of the cycle and focuses more on the necessary ingredients to get ready for the next upturn – disciplined capital.

Doug Wilson, Portfolio Manager, One River Digital Asset Management LLC

Just Another Cycle

Commodities are the lifeline to the global economy. We eat energy. Periods of strong demand often reveal strains in supply chains that lead to rapid price appreciation. Capital investment follows, with return expectations extrapolated from high prices and record margins. A downdraft in demand exposes excess investment, prices decline, and the weakest links in the supply chain are culled. Long periods of low prices lead to complacency, strong demand strains supply chains, and a rhythmic cycle emerges: boom, bust, recovery.

Natural gas in the early 2000s is an interesting example. From 2002 to 2008, natural gas prices experienced a period of dramatic price appreciation from $2.00/MMBtu to $16.00/MMBtu as economic activity accelerated and existing supply sources strained to keep pace. The market was sending a clear price signal to energy producers: to discover and capitalize on new sources of supply. This price signal had a ripple effect, as it also impacted associated sectors like power production, chemicals, and coal mining.

Cash flows from flush production found their way into Research & Development budgets that discovered technologies like Hydraulic Fracturing and Horizontal Drilling. A few hundred feet at first, now well laterals are measured in miles. Natural Gas Turbine efficiency (Heat Rate) improved dramatically. This new capital equipment and production were financed with organic cash flows initially, but then quickly morphed into aggressive rounds of debt and equity financing. This debt-fueled capital expansion of commodity industries was justified by the fact that prices were high, margins were at record levels, and the new technology allowed producers to be more efficient – lowering the unit cost of production. Recovery of capital was projected to happen in record time. It also brought rounds of leverage buyouts and acquisitions, most notably the 2007 TXU Energy LBO.

As we all know, the influx of new capital underwritten based on peak commodity prices and peak operating margins resulted in an unprecedented amount of supply additions across the natural gas, power sectors, uranium, and coal. This influx of supply, combined with a global downturn, compressed BOTH prices and margins significantly. Debt service could not be sustained. As a result:

-

TXU went bankrupt – along with many other Independent Power Producers (Mirant, Reliant, Calpine, etc.),

-

Countless gas exploration & production (E&P) companies sought bankruptcy protection,

-

Every single public coal company declared bankruptcy.

Ultimately, ownership was transferred from equity holders to lenders. The market participants that had eagerly embraced these assets quickly wrote them off as worthless – “Going to ZERO.” This presented a terrific entry point for longer-term, patient capital.

These ignored assets are now generating amongst the highest free cash flow yield across all industries. The catalyst for recovery was the rationing of new investment, enabled by the restructuring of capital.

Bitcoin Mining is following the same pattern now.

For context, the Bitcoin mining sector experienced an unprecedented BOOM in the autumn of 2021. This was driven by elevated commodity prices (Bitcoin at $67,734 on 11/9/2021) and record mining margins (Hash Spread1 of $550/MWh) brought about by the reduction in competition post China’s ban on Bitcoin Mining. This combination of high prices and record margins attracted new capital to the sector with the promise of rapid payback underwritten by continued projections of success.

Similar to past energy sector commodity BUSTS, the influx of new investments in Bitcoin mining resulted in a dramatic compression of Bitcoin mining margins from a peak of $550/MWh to $50/MWh.

Mining operations are currently profitable, but unable to service their financial obligations. So, they now must turn to bankruptcy. Since our webinar in July, our investment pipeline has expanded significantly as more Bitcoin mining lenders and borrowers find themselves in distress.

Similar to prior commodity cycles, our expectation is that ownership will pass from equity owners to lenders. We expect these new owners will run these businesses for cash flow as opposed to growth. Growth capital will avoid this sector for years, like prior commodity busts.

Even with the depression of prices, there are real cash flows in Bitcoin mining. The Bitcoin network rewarded miners with $15.3 million of Bitcoin rewards per day thus far this month, which annualizes to $5.8 billion.

Bitcoin is going through yet another brutal adjustment. Each one is different. The unique feature in this cycle is that institutional miners were far more involved in this recent bull market, and the unwinding of that looks like a classic BOOM to BUST cycle in commodity markets. It will pass with discipline. Traders are hunting for the bottom in asset markets. Credit markets are providing the pristine opportunity to earn very strong yields in a low-price environment with considerable optionality to a recovery. The credit opportunity steers you away from calling the bottom of the cycle and focuses more on the necessary ingredients to get ready for the next upturn – disciplined capital.

Loading…