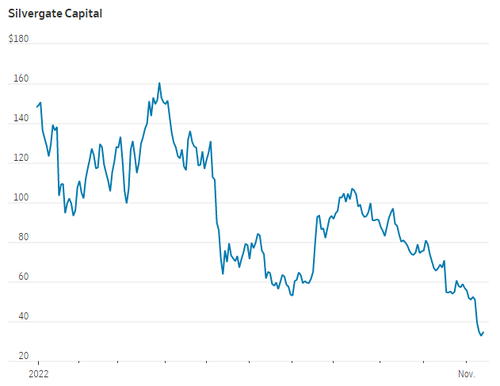

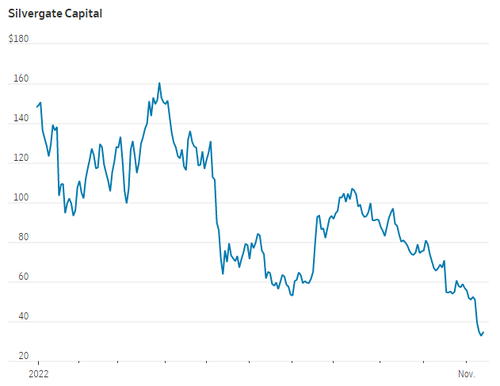

Like almost every other equity related to crypto this month, Silvergate Capital has been punished badly.

As we noted last week, the stock has had a triumphant fall from grace, plunging from highs of $160 per share in early 2022 to lows near $24 over the last few trading sessions, as each day new ugly crypto-related headlines cross the wires.

But for Silvergate, which is known as the largest and most well known regulated crypto bank in the United States that also can allow customers to send cash in real time, it looks as though business may be returning to normal...somewhat.

This morning it was announced that institutional cryptocurrency platform FalconX would be resuming its use of the Silvergate payment network. It had suspended use of the network last week.

"Concerns have abated," the platform told its clients in a memo. The halting of use of Silvergate was consistent “with our standard process to pause and reassess operations in these scenarios," the company wrote, according to a Tuesday morning Bloomberg note.

Meanwhile, Silvergate Chief Executive Officer Alan Lane said earlier this year that the bank "remains committed to supporting customers during a challenging period for the digital-asset industry," Bloomberg reported.

On his LinkedIn page Monday, Lane wrote: “I’ve said before that our business was built to support our customers during growth and market transformation. And we remain steadfast in that commitment to you, our customers.”

In the interim, as Silvergate continues to weather the storm, its stock has amassed a massive 12% of its float short, even despite the plunge in shares, according to S3.

Recall, about a week ago Silvergate confirmed it had little exposure to the FTX blowup.

Lane, Chief Executive Officer of Silvergate, said:

“In light of recent developments, I want to provide an update on Silvergate’s exposure to FTX. As of September 30, 2022, Silvergate’s total deposits from all digital asset customers totaled $11.9 billion, of which FTX represented less than 10%. Silvergate has no outstanding loans to nor investments in FTX, and FTX is not a custodian for Silvergate’s bitcoin-collateralized SEN Leverage loans. To be clear, our relationship with FTX is limited to deposits."

The company then confirmed that the rest of its leveraged loans and banking infrastructure was safe:

“To date, all SEN Leverage loans have continued to perform as expected with zero losses and no forced liquidations. As a reminder, all SEN Leverage loans are collateralized by Bitcoin, and we do not make unsecured loans or collateralize SEN Leverage loans with other digital assets.”

Like almost every other equity related to crypto this month, Silvergate Capital has been punished badly.

As we noted last week, the stock has had a triumphant fall from grace, plunging from highs of $160 per share in early 2022 to lows near $24 over the last few trading sessions, as each day new ugly crypto-related headlines cross the wires.

But for Silvergate, which is known as the largest and most well known regulated crypto bank in the United States that also can allow customers to send cash in real time, it looks as though business may be returning to normal…somewhat.

This morning it was announced that institutional cryptocurrency platform FalconX would be resuming its use of the Silvergate payment network. It had suspended use of the network last week.

“Concerns have abated,” the platform told its clients in a memo. The halting of use of Silvergate was consistent “with our standard process to pause and reassess operations in these scenarios,” the company wrote, according to a Tuesday morning Bloomberg note.

Meanwhile, Silvergate Chief Executive Officer Alan Lane said earlier this year that the bank “remains committed to supporting customers during a challenging period for the digital-asset industry,” Bloomberg reported.

On his LinkedIn page Monday, Lane wrote: “I’ve said before that our business was built to support our customers during growth and market transformation. And we remain steadfast in that commitment to you, our customers.”

In the interim, as Silvergate continues to weather the storm, its stock has amassed a massive 12% of its float short, even despite the plunge in shares, according to S3.

Recall, about a week ago Silvergate confirmed it had little exposure to the FTX blowup.

Lane, Chief Executive Officer of Silvergate, said:

“In light of recent developments, I want to provide an update on Silvergate’s exposure to FTX. As of September 30, 2022, Silvergate’s total deposits from all digital asset customers totaled $11.9 billion, of which FTX represented less than 10%. Silvergate has no outstanding loans to nor investments in FTX, and FTX is not a custodian for Silvergate’s bitcoin-collateralized SEN Leverage loans. To be clear, our relationship with FTX is limited to deposits.“

The company then confirmed that the rest of its leveraged loans and banking infrastructure was safe:

“To date, all SEN Leverage loans have continued to perform as expected with zero losses and no forced liquidations. As a reminder, all SEN Leverage loans are collateralized by Bitcoin, and we do not make unsecured loans or collateralize SEN Leverage loans with other digital assets.”