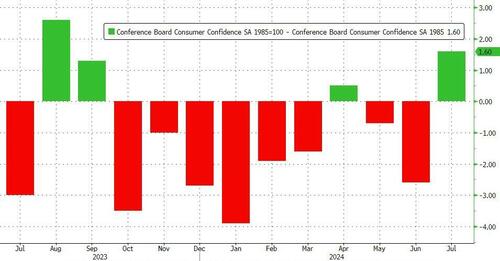

After 8 of the last 9 months seeing consumer confidence revised lower, July's Conference Board data was revised significantly higher (from 100.3 to 101.9)...

Source: Bloomberg

And August's headline print was considerably better than expected (103.3 vs 100.8 exp) with the expectations gauge adjusted significantly higher for July and higher still in August...

Source: Bloomberg

The Present Situation remains languishing near COVID lockdown lows, which is perhaps explained by the fact that the overall trend in the labor market indicator remains weaker...

Source: Bloomberg

...and purchase plans for homes, cars, and appliances all plunged.

Source: Bloomberg

But some good news is that inflation expectations tumbled back to pre-COVID levels...

Source: Bloomberg

This soft survey data supports The Fed's dovish stance (if you look hard enough), but given the lack of buying interest, it seems the consumer is more than stretched.

After 8 of the last 9 months seeing consumer confidence revised lower, July’s Conference Board data was revised significantly higher (from 100.3 to 101.9)…

Source: Bloomberg

And August’s headline print was considerably better than expected (103.3 vs 100.8 exp) with the expectations gauge adjusted significantly higher for July and higher still in August…

Source: Bloomberg

The Present Situation remains languishing near COVID lockdown lows, which is perhaps explained by the fact that the overall trend in the labor market indicator remains weaker…

Source: Bloomberg

…and purchase plans for homes, cars, and appliances all plunged.

Source: Bloomberg

But some good news is that inflation expectations tumbled back to pre-COVID levels…

Source: Bloomberg

This soft survey data supports The Fed’s dovish stance (if you look hard enough), but given the lack of buying interest, it seems the consumer is more than stretched.

Loading…