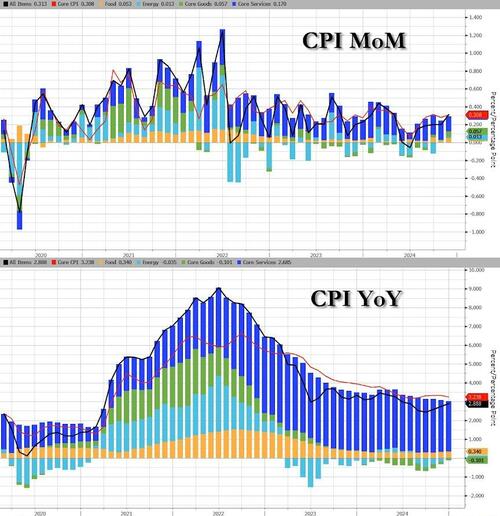

After rising for 5 straight months, analysts expected headline consumer prices to continue accelerating in December (+0.4% MoM exp) and it did exactly that - the highest MoM print since March, leading the YoY CPI to rise 2.9% (the highest since July)...

Source: Bloomberg

CPI details:

Food

The index for food increased 0.3% in December, after rising 0.4% in November. The food at home index also rose 0.3% over the month. Four of the six major grocery store food group indexes increased in December. The index for cereals and bakery products rose 1.2% over the month, after falling 1.1% in November. The meats, poultry, fish, and eggs index increased 0.6 percent in December, as the eggs index rose 3.2 percent. The index for other food at home rose 0.3 percent over the month and the index for dairy and related products increased 0.2 percent.

Energy

The energy index increased 2.6% in December, after rising 0.2% in November. The gasoline index increased 4.4% over the month. (Before seasonal adjustment, gasoline prices decreased 1.1 percent in December.) The natural gas index rose 2.4 percent over the month and the index for electricity rose 0.3 percent in December. The energy index decreased 0.5 percent over the past 12 months. The gasoline index fell 3.4% over this 12-month span and the fuel oil index fell 13.1 percent over that period. In contrast, the index for electricity increased 2.8 percent over the last 12 months and the index for natural gas rose 4.9 percent.

All items less food and energy

The index for all items less food and energy rose 0.2 percent in December, after rising 0.3 percent in each of the 4 preceding months.

- The shelter index increased 0.3 percent in December, as it did in November.

- The index for owners’ equivalent rent also rose 0.3 percent over the month, as did the index for rent.

- The lodging away from home index fell 1.0 percent in December, after rising 3.2 percent in November.

- The medical care index increased 0.1 percent over the month, after rising 0.3 percent in October and November.

- The index for physicians’ services increased 0.1 percent in December and the index for hospital services rose 0.2 percent over the month.

- The airline fares index rose 3.9 percent in December, after rising 0.4 percent in the previous month.

- The index for used cars and trucks rose 1.2 percent over the month and the index for new vehicles increased 0.5 percent.

- Other indexes that increased in December include motor vehicle insurance, recreation, apparel, and education.

- In contrast, the index for personal care fell 0.2 percent in December after rising 0.4 percent in November. The indexes for communication and alcoholic beverages also declined over the month. The household furnishings and operations index was unchanged in December

The resurgence of energy costs drove the hot headline CPI along with Core Services...

Source: Bloomberg

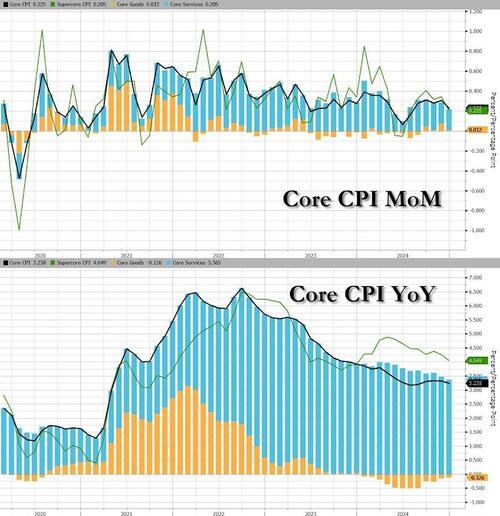

Core CPI (ex Food and Energy) dipped to +0.2% MoM (below the 0.3% exp) and the YoY pace of inflation slowed to 3.24% YoY. Core CPI rose EVERY month under Biden...

Source: Bloomberg

Core Goods price inflation slowed MoM (but deflation is gone on a YoY basis)...

Source: Bloomberg

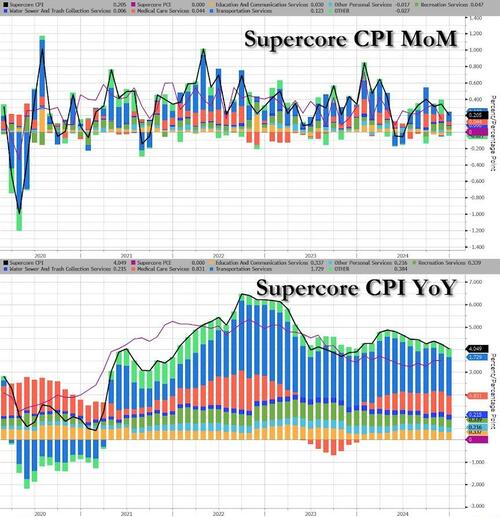

The Fed's favorite indicator of the CPI bunch - SuperCore or Services CPI ex-Shelter - rose 0.28% MoM (slowing the pace of annual inflation to +4.17%)...

Source: Bloomberg

Transportation Services were not MoM...

Source: Bloomberg

Overall, it's energy costs that are re-emerging as a drive of inflation... thanks Joe!

Source: Bloomberg

...and Energy prices aren't going down anytime soon in the CPI world... thanks Joe!

Source: Bloomberg

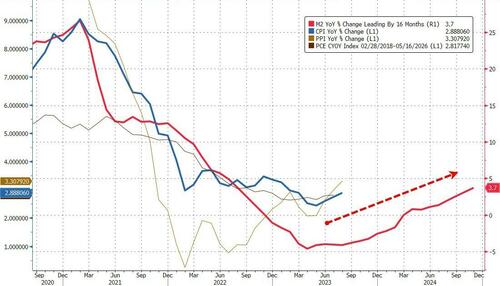

...and don't expect headline CPI (or PPI or PCE) to slowdown anytime soon, given the growth in the money supply...

Source: Bloomberg

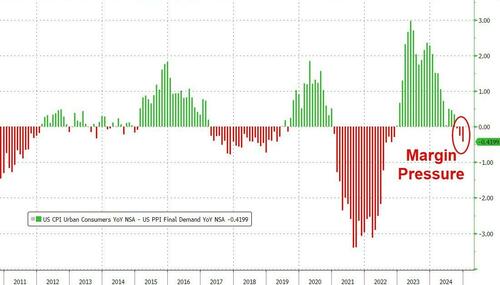

The question is - will corporates 'eat' the input cost pain or pass them on to consumers?

Source: Bloomberg

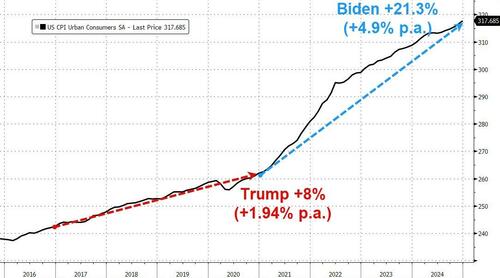

While Producer Prices under Biden rose at triple the rate they did under Trump, Consumer Prices soared 21.25% under Biden (+4.9% p.a.) vs 8%, 1.94% p.a. under Trump...

Source: Bloomberg

Finally, equity traders were braced for a volatile day ahead of the print, with options implying moves of 1.1% in either direction for the S&P 500, the most for a CPI day since March 2023.

After rising for 5 straight months, analysts expected headline consumer prices to continue accelerating in December (+0.4% MoM exp) and it did exactly that – the highest MoM print since March, leading the YoY CPI to rise 2.9% (the highest since July)…

Source: Bloomberg

CPI details:

Food

The index for food increased 0.3% in December, after rising 0.4% in November. The food at home index also rose 0.3% over the month. Four of the six major grocery store food group indexes increased in December. The index for cereals and bakery products rose 1.2% over the month, after falling 1.1% in November. The meats, poultry, fish, and eggs index increased 0.6 percent in December, as the eggs index rose 3.2 percent. The index for other food at home rose 0.3 percent over the month and the index for dairy and related products increased 0.2 percent.

Energy

The energy index increased 2.6% in December, after rising 0.2% in November. The gasoline index increased 4.4% over the month. (Before seasonal adjustment, gasoline prices decreased 1.1 percent in December.) The natural gas index rose 2.4 percent over the month and the index for electricity rose 0.3 percent in December. The energy index decreased 0.5 percent over the past 12 months. The gasoline index fell 3.4% over this 12-month span and the fuel oil index fell 13.1 percent over that period. In contrast, the index for electricity increased 2.8 percent over the last 12 months and the index for natural gas rose 4.9 percent.

All items less food and energy

The index for all items less food and energy rose 0.2 percent in December, after rising 0.3 percent in each of the 4 preceding months.

- The shelter index increased 0.3 percent in December, as it did in November.

- The index for owners’ equivalent rent also rose 0.3 percent over the month, as did the index for rent.

- The lodging away from home index fell 1.0 percent in December, after rising 3.2 percent in November.

- The medical care index increased 0.1 percent over the month, after rising 0.3 percent in October and November.

- The index for physicians’ services increased 0.1 percent in December and the index for hospital services rose 0.2 percent over the month.

- The airline fares index rose 3.9 percent in December, after rising 0.4 percent in the previous month.

- The index for used cars and trucks rose 1.2 percent over the month and the index for new vehicles increased 0.5 percent.

- Other indexes that increased in December include motor vehicle insurance, recreation, apparel, and education.

- In contrast, the index for personal care fell 0.2 percent in December after rising 0.4 percent in November. The indexes for communication and alcoholic beverages also declined over the month. The household furnishings and operations index was unchanged in December

The resurgence of energy costs drove the hot headline CPI along with Core Services…

Source: Bloomberg

Core CPI (ex Food and Energy) dipped to +0.2% MoM (below the 0.3% exp) and the YoY pace of inflation slowed to 3.24% YoY. Core CPI rose EVERY month under Biden…

Source: Bloomberg

Core Goods price inflation slowed MoM (but deflation is gone on a YoY basis)…

Source: Bloomberg

The Fed’s favorite indicator of the CPI bunch – SuperCore or Services CPI ex-Shelter – rose 0.28% MoM (slowing the pace of annual inflation to +4.17%)…

Source: Bloomberg

Transportation Services were not MoM…

Source: Bloomberg

Overall, it’s energy costs that are re-emerging as a drive of inflation… thanks Joe!

Source: Bloomberg

…and Energy prices aren’t going down anytime soon in the CPI world… thanks Joe!

Source: Bloomberg

…and don’t expect headline CPI (or PPI or PCE) to slowdown anytime soon, given the growth in the money supply…

Source: Bloomberg

The question is – will corporates ‘eat’ the input cost pain or pass them on to consumers?

Source: Bloomberg

While Producer Prices under Biden rose at triple the rate they did under Trump, Consumer Prices soared 21.25% under Biden (+4.9% p.a.) vs 8%, 1.94% p.a. under Trump…

Source: Bloomberg

Finally, equity traders were braced for a volatile day ahead of the print, with options implying moves of 1.1% in either direction for the S&P 500, the most for a CPI day since March 2023.

Loading…