By Greg Miller of FreightWaves

Container lines are facing a triple whammy: Freight rates are weak — below breakeven in some trades — and show no signs of rising. New ships are flooding the market. And vessel leases that container lines booked at historically high rates during the boom have yet to expire. Some leases run through 2024 or 2025.

What levers can ocean carriers pull to stop the bleeding?

They do not seem to be able to raise freight rates. Demand is too low and carriers are not canceling enough sailings. They want the new ships being delivered (whether they’re owned or leased) because they benefit bottom lines via much higher fuel efficiency. Aristides Pittas, CEO of ship lessor Euroseas, said during the recent Marine Money Week conference that his company’s newbuildings “burn 40% less fuel oil than similar ships built 10 years ago.”

That leaves the long-term leases of older ships. Losses on these contracts can be mitigated.

Reports: Zim seeking early charter terminations

Israel-based Zim is the poster child of this trilemma. It’s highly exposed to falling freight rates, particularly in the Asia-U.S. East Coast market. It has a hefty orderbook of newbuildings and those ships have already begun hitting the water. And it is simultaneously highly exposed to charter costs — more so than any other ocean carrier, with over 90% of its fleet chartered versus owned.

Zim is now seeking to reduce its legacy charter liabilities, according to multiple reports.

“Zim has sought the termination of several chartered ships,” said Linerlytica. Tradewinds, citing brokers, said the carrier “is looking to terminate or even to sublet some charters of traditional Panamax container ships.” Alphaliner wrote: “Rumor has it that Zim is making some tonnage available through sublets or earlier-than-expected redeliveries.”

Without naming the carrier or carriers involved, ship brokerage Braemar said that “surplus tonnage is now being marketed, with some vessels becoming available earlier than previous charter commitments would have projected.”

FreightWaves made multiple requests for comment on these reports to Zim’s media and investor relations teams, which did not respond.

Freight rates falling back again

There was a brief period of optimism on spot freight rates in the second half of April and a perception that they had finally bottomed. Then rates started falling again.

Since the week ending May 4, the Drewry World Container Index (WCI) global spot composite has fallen 15%, to just $1,494 per forty-foot equivalent unit in the week ending Thursday. Since June 8, the WCI Shanghai-Los Angeles spot index has declined 21% to $1,581 per FEU. The WCI Shanghai-New York spot index has fallen 16% over the same period, to $2,508 per FEU.

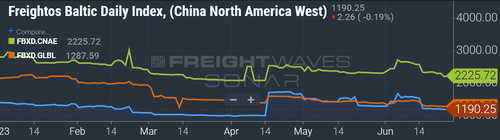

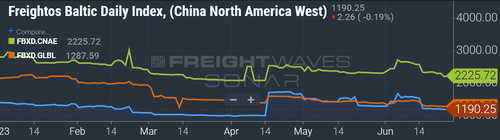

The Freightos Baltic Daily Index (FBX) global spot composite declined 7% between June 6 and Thursday, to $1,288 per FEU.

The FBX China-West Coast assessment dropped 17% over the same period to $1,190 per FEU, while the FBX China-East Coast spot assessment fell 9%, to $2,226 per FEU.

The trend is likewise negative for contract rates, which are more important to liner revenues than spot rates. Xeneta’s global index measuring contract rates fell 9.4% in June versus May and is down 51.7% year to date. The XSI subindex for U.S. import contract rates fell 11% in June versus May.

“One is left wondering where it will all end,” said Xeneta CEO Patrik Berglund.

Jefferies slashes earnings outlook on Zim

“Liners have limited pricing power and spot rates remain very weak across most routes,” said Jefferies shipping analyst Omar Nokta in a report released Tuesday, in which he slashed his earnings outlook for Zim.

Nokta previously forecast that Zim would post a net loss of $183.7 million for this year and $87.3 million for next year. On Tuesday, his 2023-2024 loss expectations for Zim ballooned by 150%. He now projects a net loss for Zim of $353.7 million this year and $324.7 million next year. Furthermore, he introduced his outlook for 2025, forecasting a further net loss of $150.8 million for the shipping line.

Investors made massive returns on their Zim shares as the COVID-era consumer boom hit new heights, but timing was everything. The stock peaked in mid-March 2022. Since then, it has plunged 87%.

Zim’s shares sank to $11.78 per share at one point on Tuesday, just pennies above the all-time low reached on the first day of trading after the IPO in late January 2021.

Like all larger ocean carriers, Zim is far from in distress and still has plenty of cash amassed during the boom: $3.5 billion as of the end of the first quarter, pro forma of the dividend payout in April.

However, it’s burning through that cushion. It would make sense to proactively limit losses from high-price legacy charters as freight rates remain below breakeven and Zim’s newbuidlings enter service.

Nokta estimated that Zim’s current quarterly cash burn is $250 million, or $1 billion per year on an annualized basis. That is “obviously not ideal, but Zim has plenty of liquidity and runway to ride out the current extreme softness in the spot market,” he maintained.

By Greg Miller of FreightWaves

Container lines are facing a triple whammy: Freight rates are weak — below breakeven in some trades — and show no signs of rising. New ships are flooding the market. And vessel leases that container lines booked at historically high rates during the boom have yet to expire. Some leases run through 2024 or 2025.

What levers can ocean carriers pull to stop the bleeding?

They do not seem to be able to raise freight rates. Demand is too low and carriers are not canceling enough sailings. They want the new ships being delivered (whether they’re owned or leased) because they benefit bottom lines via much higher fuel efficiency. Aristides Pittas, CEO of ship lessor Euroseas, said during the recent Marine Money Week conference that his company’s newbuildings “burn 40% less fuel oil than similar ships built 10 years ago.”

That leaves the long-term leases of older ships. Losses on these contracts can be mitigated.

Reports: Zim seeking early charter terminations

Israel-based Zim is the poster child of this trilemma. It’s highly exposed to falling freight rates, particularly in the Asia-U.S. East Coast market. It has a hefty orderbook of newbuildings and those ships have already begun hitting the water. And it is simultaneously highly exposed to charter costs — more so than any other ocean carrier, with over 90% of its fleet chartered versus owned.

Zim is now seeking to reduce its legacy charter liabilities, according to multiple reports.

“Zim has sought the termination of several chartered ships,” said Linerlytica. Tradewinds, citing brokers, said the carrier “is looking to terminate or even to sublet some charters of traditional Panamax container ships.” Alphaliner wrote: “Rumor has it that Zim is making some tonnage available through sublets or earlier-than-expected redeliveries.”

Without naming the carrier or carriers involved, ship brokerage Braemar said that “surplus tonnage is now being marketed, with some vessels becoming available earlier than previous charter commitments would have projected.”

FreightWaves made multiple requests for comment on these reports to Zim’s media and investor relations teams, which did not respond.

Freight rates falling back again

There was a brief period of optimism on spot freight rates in the second half of April and a perception that they had finally bottomed. Then rates started falling again.

Since the week ending May 4, the Drewry World Container Index (WCI) global spot composite has fallen 15%, to just $1,494 per forty-foot equivalent unit in the week ending Thursday. Since June 8, the WCI Shanghai-Los Angeles spot index has declined 21% to $1,581 per FEU. The WCI Shanghai-New York spot index has fallen 16% over the same period, to $2,508 per FEU.

The Freightos Baltic Daily Index (FBX) global spot composite declined 7% between June 6 and Thursday, to $1,288 per FEU.

The FBX China-West Coast assessment dropped 17% over the same period to $1,190 per FEU, while the FBX China-East Coast spot assessment fell 9%, to $2,226 per FEU.

The trend is likewise negative for contract rates, which are more important to liner revenues than spot rates. Xeneta’s global index measuring contract rates fell 9.4% in June versus May and is down 51.7% year to date. The XSI subindex for U.S. import contract rates fell 11% in June versus May.

“One is left wondering where it will all end,” said Xeneta CEO Patrik Berglund.

Jefferies slashes earnings outlook on Zim

“Liners have limited pricing power and spot rates remain very weak across most routes,” said Jefferies shipping analyst Omar Nokta in a report released Tuesday, in which he slashed his earnings outlook for Zim.

Nokta previously forecast that Zim would post a net loss of $183.7 million for this year and $87.3 million for next year. On Tuesday, his 2023-2024 loss expectations for Zim ballooned by 150%. He now projects a net loss for Zim of $353.7 million this year and $324.7 million next year. Furthermore, he introduced his outlook for 2025, forecasting a further net loss of $150.8 million for the shipping line.

Investors made massive returns on their Zim shares as the COVID-era consumer boom hit new heights, but timing was everything. The stock peaked in mid-March 2022. Since then, it has plunged 87%.

Zim’s shares sank to $11.78 per share at one point on Tuesday, just pennies above the all-time low reached on the first day of trading after the IPO in late January 2021.

Like all larger ocean carriers, Zim is far from in distress and still has plenty of cash amassed during the boom: $3.5 billion as of the end of the first quarter, pro forma of the dividend payout in April.

However, it’s burning through that cushion. It would make sense to proactively limit losses from high-price legacy charters as freight rates remain below breakeven and Zim’s newbuidlings enter service.

Nokta estimated that Zim’s current quarterly cash burn is $250 million, or $1 billion per year on an annualized basis. That is “obviously not ideal, but Zim has plenty of liquidity and runway to ride out the current extreme softness in the spot market,” he maintained.

Loading…