Copper inventories in Asian warehouses are swelling at an incredibly fast pace as the base metal that led the 'Next AI Trade' is under pressure once again, hitting the lowest levels in four months. The refined metal is flowing out of China into neighboring warehouses in South Korea and Taiwan, indicating that more downside for prices is ahead.

This chart is probably not what Taiwan wants to see pic.twitter.com/OCbAdWeCrz

— zerohedge (@zerohedge) July 24, 2024

Goldman's Adam Gillard told clients this AM that the copper "surplus continues to build; think price grinds lower despite the recent positioning cleanse until the State Grid return."

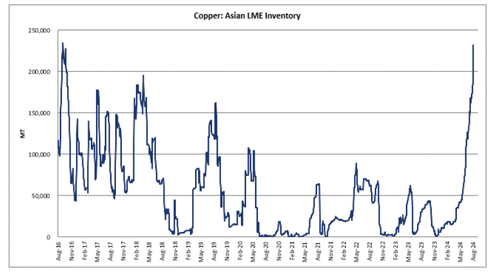

Gillard highlighted that copper stockpiles at the London Metal Exchange in Asia have surged to their highest levels since mid-2018. Since peaking at $10,889 in mid-May, LME 3-month rolling forward copper prices have declined by over 18%, currently hovering around $8,928.

Although Asian inventory builds from legacy Chinese tolling exports are not new, today's 40k MT delivery was a surprise basis July Chinese exports (because we thought most of what China exported had become visible already). The bull stock-out thesis was in part predicated on a tight supply chain given negative carry and high rates. Said another way, there shouldn't be this much metal left in the woodwork to become visible.

Asian LME inventory is the highest since mid-2018.

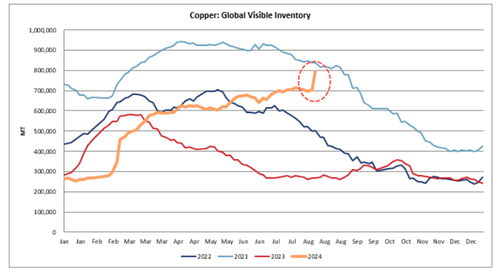

Gillard observed that the surge in stockpiles at warehouses is now showing up in global inventory levels:

Global visible inventory: Taking 40k MT from July US imports (difference vs trend) and adding to CMX inventories results in total visible copper inventory of 794k MT vs 262k MT a/o January 1.

An abrupt surge...

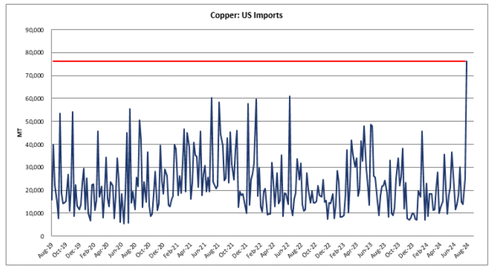

"Whilst we concede it's sketchy data BBG are reporting July US imports at 76k MT, an ATH (in response to May CMX / LME arb blowout)," Gillard noted about US imports of the base metal.

Rising warehouse inventories indicate a continued slowdown in China. Bloomberg reported that the world's second-largest economy has started "exporting in unusually high volumes in recent months," effectively exporting deflation. Additionally, concerns about a slowdown in the US have surfaced in recent days.

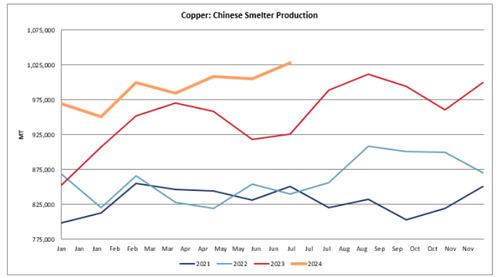

However, Chinese smelter production is still running above average.

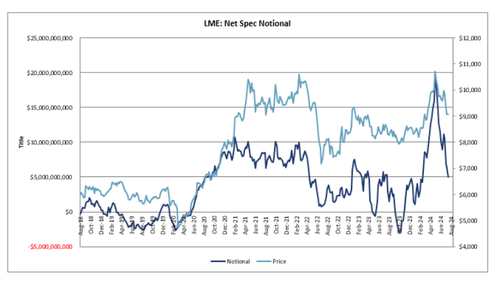

Gillard also noted, "LME spec length has dropped to $4bn vs $19bn at the highs during the recent sell off."

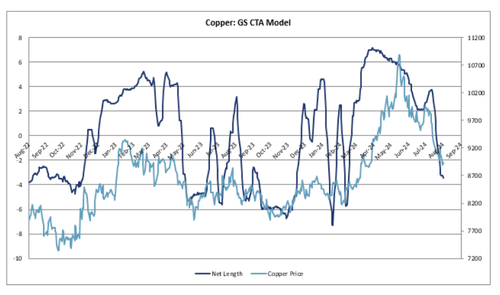

And he said CTAs are still shot.

In mid-May, around the time copper prices peaked, Jeff Currie, who led commodities research at Goldman Sachs for nearly three decades and now serves as the chief strategy officer of the energy pathways team at Carlyle Group, stated that the copper trade was the "most compelling trade" he has seen in his "30 plus years of doing this" because it's "got green CapEx, it's got AI, remember AI can't happen without the energy demand and the constraint on the electricity grid is going to be copper."

On May 15, The Market Ear penned a note to subs about an "overheated" copper market.

On June 8, Trafigura Chief Economist Saad Rahim said, "Prices of non-ferrous metals have moved much higher than fundamentals in the physical spot market might indicate or justify, especially for copper."

Hmm.

Hey Grok, why is China stockpiling copper as if it is preparing for war pic.twitter.com/gKXEmDweCE

— zerohedge (@zerohedge) August 7, 2024

What's clear is that the AI theme has run its course for now, overshadowed by China exporting deflation to the world.

Copper inventories in Asian warehouses are swelling at an incredibly fast pace as the base metal that led the ‘Next AI Trade’ is under pressure once again, hitting the lowest levels in four months. The refined metal is flowing out of China into neighboring warehouses in South Korea and Taiwan, indicating that more downside for prices is ahead.

This chart is probably not what Taiwan wants to see pic.twitter.com/OCbAdWeCrz

— zerohedge (@zerohedge) July 24, 2024

Goldman’s Adam Gillard told clients this AM that the copper “surplus continues to build; think price grinds lower despite the recent positioning cleanse until the State Grid return.”

Gillard highlighted that copper stockpiles at the London Metal Exchange in Asia have surged to their highest levels since mid-2018. Since peaking at $10,889 in mid-May, LME 3-month rolling forward copper prices have declined by over 18%, currently hovering around $8,928.

Although Asian inventory builds from legacy Chinese tolling exports are not new, today’s 40k MT delivery was a surprise basis July Chinese exports (because we thought most of what China exported had become visible already). The bull stock-out thesis was in part predicated on a tight supply chain given negative carry and high rates. Said another way, there shouldn’t be this much metal left in the woodwork to become visible.

Asian LME inventory is the highest since mid-2018.

Gillard observed that the surge in stockpiles at warehouses is now showing up in global inventory levels:

Global visible inventory: Taking 40k MT from July US imports (difference vs trend) and adding to CMX inventories results in total visible copper inventory of 794k MT vs 262k MT a/o January 1.

An abrupt surge…

“Whilst we concede it’s sketchy data BBG are reporting July US imports at 76k MT, an ATH (in response to May CMX / LME arb blowout),” Gillard noted about US imports of the base metal.

Rising warehouse inventories indicate a continued slowdown in China. Bloomberg reported that the world’s second-largest economy has started “exporting in unusually high volumes in recent months,” effectively exporting deflation. Additionally, concerns about a slowdown in the US have surfaced in recent days.

However, Chinese smelter production is still running above average.

Gillard also noted, “LME spec length has dropped to $4bn vs $19bn at the highs during the recent sell off.”

And he said CTAs are still shot.

In mid-May, around the time copper prices peaked, Jeff Currie, who led commodities research at Goldman Sachs for nearly three decades and now serves as the chief strategy officer of the energy pathways team at Carlyle Group, stated that the copper trade was the “most compelling trade” he has seen in his “30 plus years of doing this” because it’s “got green CapEx, it’s got AI, remember AI can’t happen without the energy demand and the constraint on the electricity grid is going to be copper.”

On May 15, The Market Ear penned a note to subs about an “overheated” copper market.

On June 8, Trafigura Chief Economist Saad Rahim said, “Prices of non-ferrous metals have moved much higher than fundamentals in the physical spot market might indicate or justify, especially for copper.”

Hmm.

Hey Grok, why is China stockpiling copper as if it is preparing for war pic.twitter.com/gKXEmDweCE

— zerohedge (@zerohedge) August 7, 2024

What’s clear is that the AI theme has run its course for now, overshadowed by China exporting deflation to the world.

Loading…