After yesterday's 'peak inflation'-narrative-crushing CPI print, analysts expected headline US producer prices to drop 0.1% MoM (after falling 0.5% MoM in July) and it did but core PPI rose 0.4% MoM (more than expected 0.3% MoM).

Source: Bloomberg

Core PPI rose 7.3% YoY (considerably hotter than the +7.0% expected, but less than July's +7.6%)...

Source: Bloomberg

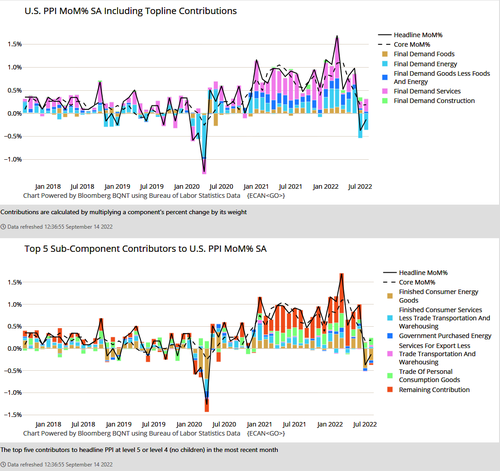

So just like CPI, we saw a rise in Services costs while Goods costs slipped...

40% of the increase in prices for final demand services can be attributed to margins for fuels and lubricants retailing, which rose 14.2 percent.

Over three-quarters of the decrease in prices for final demand goods is attributable to the index for gasoline, which fell 12.7 percent

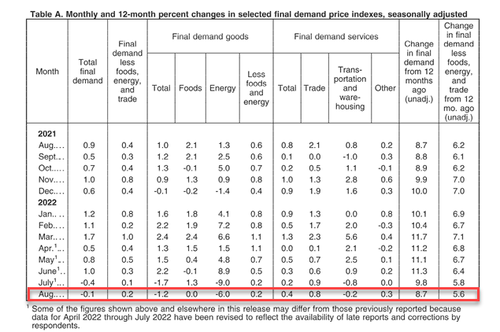

The full breakdown...

A drop in Energy costs dominated the weakness...

The pipeline for headline PPI remains upwardly focused but has been reducing in recent months and fell dramatically in August...

Source: Bloomberg

Finally, margins continue to come under pressure as the CPI-PPI spread remains red for the 20th straight month...

Source: Bloomberg

So is PPI signaling peak inflation? Or are Services costs about to surprise the market?

After yesterday’s ‘peak inflation’-narrative-crushing CPI print, analysts expected headline US producer prices to drop 0.1% MoM (after falling 0.5% MoM in July) and it did but core PPI rose 0.4% MoM (more than expected 0.3% MoM).

Source: Bloomberg

Core PPI rose 7.3% YoY (considerably hotter than the +7.0% expected, but less than July’s +7.6%)…

Source: Bloomberg

So just like CPI, we saw a rise in Services costs while Goods costs slipped…

40% of the increase in prices for final demand services can be attributed to margins for fuels and lubricants retailing, which rose 14.2 percent.

Over three-quarters of the decrease in prices for final demand goods is attributable to the index for gasoline, which fell 12.7 percent

The full breakdown…

A drop in Energy costs dominated the weakness…

The pipeline for headline PPI remains upwardly focused but has been reducing in recent months and fell dramatically in August…

Source: Bloomberg

Finally, margins continue to come under pressure as the CPI-PPI spread remains red for the 20th straight month…

Source: Bloomberg

So is PPI signaling peak inflation? Or are Services costs about to surprise the market?