Authored by Dylan Grice via TheMarket.ch,

Complacency in financial markets has given way to concern that the Federal Reserve will have to provoke a hard downturn to defeat inflation...

The complacency around inflation pricing remains unresolved. For all the ridicule that central bankers are currently taking from politicians and the press for having predicted that pandemic inflation would be transitory, long-term inflation markets steadfastly continue to predict exactly that.

The likelihood, however, is that inflation will be a problem for the next cycle. If long-term inflation expectations could remain ‹well anchored› as inflation was breaking forty-year records, we doubt they’ll become suddenly unanchored as base effects and a weakening economy push it back down over the coming months.

The complacency in broader risk markets, in contrast, which we documented towards the end of last year, has now largely given way to a growing concern about how much the coming slowdown is going to hurt. As we’ll explain below, we suspect it will be a lot (big party, big hangover), which is why we think it’s too early to be aggressive buyers notwithstanding statistical cheapness emerging in some areas.

We’ll start by running through the areas we had been highlighting as being illustrative of the market’s voracious risk appetite, but which today are beginning to send a more cautious message. We’ll also explain why we see the recent swift and spectacular response of the US housing market to higher mortgage rates as a potentially ominous metaphor for the rest of the economy. Finally, we’ll close by gazing a little further out, venturing beyond the coming slowdown to offer some ideas on what shape the next recovery might take.

US housing as a metaphor for broader asset markets

The best place to buy cheap convexity last year was in the US mortgage market, where agency bonds were trading at historic nominal tights to Treasuries. As a reminder, mortgage borrowers are implicitly long an option to refinance their loan should interest rates fall, which means that agency bond holders are short that option, which is ‹embedded› in the bond price. As a result, agency bonds are ‹negatively convex› (if interest rates rise, agency bond prices fall; if interest rates fall, agency bond prices rise a bit, but not by as much… and eventually fall).

As we showed in November of last year, by shorting agency bonds against Treasuries, investors could get long that convexity very cheaply (possibly even for free when taking account of the option hedge).

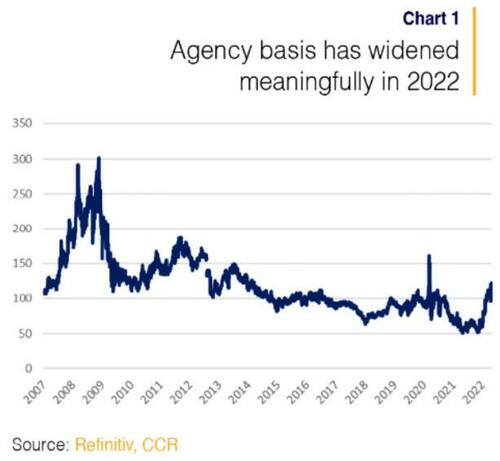

That is now beginning to play out. Chart 1 shows the spread between agencies and Treasuries has materially widened in light of the Fed’s more aggressive Quantitative Tightening plans.

Ironically, this widening in agencies has happened just as the refinancing boom has stalled, making the option that agency holders are short of worth far less (Fed purchases are a larger driver of agency pricing than the embedded option).

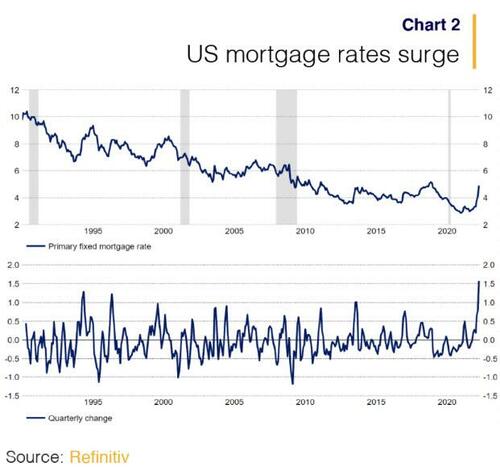

As the top panel in Chart 2 shows, the primary fixed mortgage rate in the US has risen to about 5.5%, leaving as much as 95% of the current stock of residential mortgages ‹out of the money›, according to some estimates we’ve seen.

The bottom panel shows that the quarterly change in mortgage rates has been the largest in over three decades.

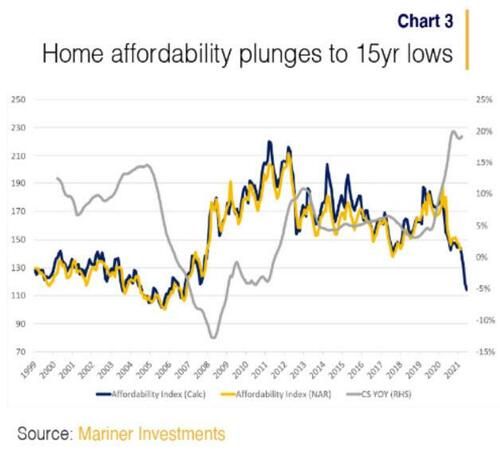

As a stark reminder of how suddenly and meaningfully interest rate changes can have real economic impact, Chart 3 shows that US housing affordability has collapsed to levels not seen since 2007, even though interest mortgage rates have essentially only returned to where they were a few years ago, house price appreciation has been such that down-payments are barely within reach.

We view this as a metaphor for the wider mainstream asset universe, which is typically a) levered, and b) valued using an NPV (net present value) of future cashflows model, embodying some kind of discount rates.

Chart 3 above doesn’t only show how extraordinarily, stimulatory, ever-lower interest rates were in making assets more affordable, it shows how eventually, asset valuations which are goosed to such an extent that they are barely affordable at low interest rates become downright unsustainable at higher ones.

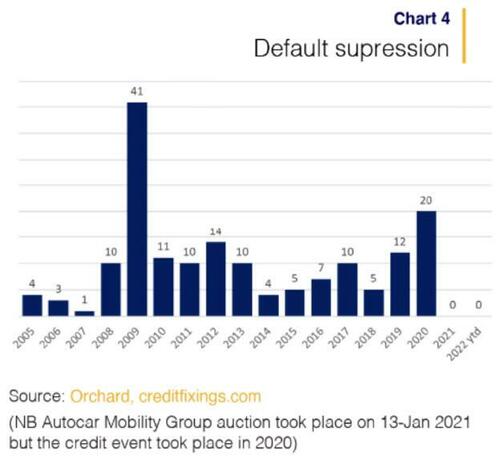

There is a parallel of sorts in the corporate world too, where defaults in 2021 were, somewhat startlingly, zero (Chart 4).

We hear anecdotally, though from what we believe to be reliable sources in the legal market, that bankruptcy lawyers have never been busier and that there’s currently a hiring frenzy underway in anticipation of busier times.

We can’t help asking ourselves: if housing asset valuations don’t work at higher interest rates, why can corporate asset valuations? Haven’t they both been similarly juiced?

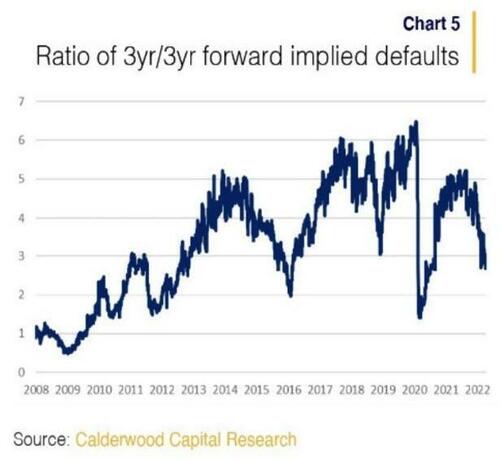

One of the areas we’ve pointed to in recent months has been the slope of the credit curve, which has been quite steep during the past cycle and reflective of a complacency over near-term prospects. A good way to see this is to calculate the ‹forward implied defaults› at different tenors in the credit curve (Chart 5).

For example, right now the 3Y IG CDX is trading at a 60bp spread while the 5Y is trading at an 80bps spread. At a 50% recovery rate (say), the 3Y is pricing in 1.2 defaults per year while the 5Y is pricing in 1.6 per year. That doesn’t sound (or look) like much of a difference.

But it means the 3Y is pricing 3.6 defaults in total (1.2 * 3) whereas the 5Y is pricing in 8 defaults (1.6 * 5). That means the curve is pricing in 3.6 defaults in the first three years, but 4.4 defaults the following two. So, while the first 3Y annual implied default rate is 1.2, the following two years annual implied default rate is 2.2, which is quite a meaningful difference.

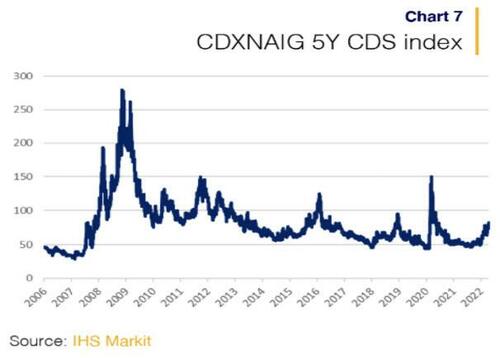

That is to say, you can get very different default risk premia depending on where you are in the curve, and the ratio of those implied default rates can be a good barometer of how confident the market is in its near-term macro visibility. Until recently, later tenors were giving significantly more reward than nearer term ones (the curve was steep), reflecting exactly such confidence/complacency. This now seems to have changed quite decisively though, suggesting that credit markets are becoming more worried than appears if looking only at the still relatively low default spreads (Chart 7).

The elephant in the room shuffles off into a dark corner

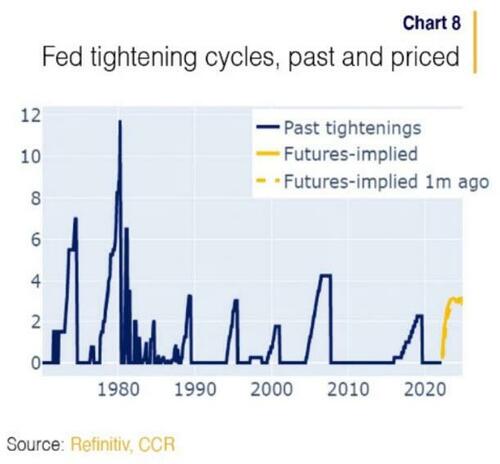

Evidently then, the complacency we saw at the end of last year is now giving way to a growing concern about what comes next. Policy futures markets, for example, are concerned about the same things and are no longer pricing in further tightening (see chart 8).

Ordinarily that would be that, and the game of guessing the date of the first rate cut by the Fed would be on.

However, these are not ordinary times. Inflation is running at multi-decade highs and it’s not clear just how much demand destruction will be required to pull it back down to historically average rates, even though historically average rates are exactly what the market is currently pricing.

Crash, then boom?

Will the coming economic slowdown/recession be enough to take inflation back to historical average rates, proving that the Fed was right after all, and that pandemic inflation was transitory? Probably. The weak demand of a slowing economy combined with base effects going into reverse will likely see inflation moderate to less nose-bleed levels in the coming months.

Will that come soon enough for the Fed to turn back to easing mode? We fear not. We suspect there will need to be a market event first and so the immediate question remains that of just how deep the coming slowdown is likely to be.

The secondary question is what comes afterwards? If the coming slowdown doesn’t take inflation down to prior recessionary troughs (around 1%/1.5% core), central banks will once again be faced with the hawk/dove dilemma: Will they be hawks, raising rates to quell unacceptably high early-cycle inflation and crushing a nascent recovery before it can get any momentum?

Or will they be doves, tolerating the higher inflation to let the economy and jobs recover, on the grounds that «the cure will be worse than the disease»? Hawks would mean a secular bear market in risk assets. Doves would mean a secular boom in inflation and equities.

As we said, it’s not the most pressing question right now, but it will be soon. We suspect the central banks in the end will be doves – which means, for risk assets: First crash, then boom.

* * *

Dylan Grice’s Popular Delusions, a twice monthly investment report that includes investment ideas ranging from macro, sector and individual securities can be subscribed to via www.calderwoodcapital.com

Authored by Dylan Grice via TheMarket.ch,

Complacency in financial markets has given way to concern that the Federal Reserve will have to provoke a hard downturn to defeat inflation…

The complacency around inflation pricing remains unresolved. For all the ridicule that central bankers are currently taking from politicians and the press for having predicted that pandemic inflation would be transitory, long-term inflation markets steadfastly continue to predict exactly that.

The likelihood, however, is that inflation will be a problem for the next cycle. If long-term inflation expectations could remain ‹well anchored› as inflation was breaking forty-year records, we doubt they’ll become suddenly unanchored as base effects and a weakening economy push it back down over the coming months.

The complacency in broader risk markets, in contrast, which we documented towards the end of last year, has now largely given way to a growing concern about how much the coming slowdown is going to hurt. As we’ll explain below, we suspect it will be a lot (big party, big hangover), which is why we think it’s too early to be aggressive buyers notwithstanding statistical cheapness emerging in some areas.

We’ll start by running through the areas we had been highlighting as being illustrative of the market’s voracious risk appetite, but which today are beginning to send a more cautious message. We’ll also explain why we see the recent swift and spectacular response of the US housing market to higher mortgage rates as a potentially ominous metaphor for the rest of the economy. Finally, we’ll close by gazing a little further out, venturing beyond the coming slowdown to offer some ideas on what shape the next recovery might take.

US housing as a metaphor for broader asset markets

The best place to buy cheap convexity last year was in the US mortgage market, where agency bonds were trading at historic nominal tights to Treasuries. As a reminder, mortgage borrowers are implicitly long an option to refinance their loan should interest rates fall, which means that agency bond holders are short that option, which is ‹embedded› in the bond price. As a result, agency bonds are ‹negatively convex› (if interest rates rise, agency bond prices fall; if interest rates fall, agency bond prices rise a bit, but not by as much… and eventually fall).

As we showed in November of last year, by shorting agency bonds against Treasuries, investors could get long that convexity very cheaply (possibly even for free when taking account of the option hedge).

That is now beginning to play out. Chart 1 shows the spread between agencies and Treasuries has materially widened in light of the Fed’s more aggressive Quantitative Tightening plans.

Ironically, this widening in agencies has happened just as the refinancing boom has stalled, making the option that agency holders are short of worth far less (Fed purchases are a larger driver of agency pricing than the embedded option).

As the top panel in Chart 2 shows, the primary fixed mortgage rate in the US has risen to about 5.5%, leaving as much as 95% of the current stock of residential mortgages ‹out of the money›, according to some estimates we’ve seen.

The bottom panel shows that the quarterly change in mortgage rates has been the largest in over three decades.

As a stark reminder of how suddenly and meaningfully interest rate changes can have real economic impact, Chart 3 shows that US housing affordability has collapsed to levels not seen since 2007, even though interest mortgage rates have essentially only returned to where they were a few years ago, house price appreciation has been such that down-payments are barely within reach.

We view this as a metaphor for the wider mainstream asset universe, which is typically a) levered, and b) valued using an NPV (net present value) of future cashflows model, embodying some kind of discount rates.

Chart 3 above doesn’t only show how extraordinarily, stimulatory, ever-lower interest rates were in making assets more affordable, it shows how eventually, asset valuations which are goosed to such an extent that they are barely affordable at low interest rates become downright unsustainable at higher ones.

There is a parallel of sorts in the corporate world too, where defaults in 2021 were, somewhat startlingly, zero (Chart 4).

We hear anecdotally, though from what we believe to be reliable sources in the legal market, that bankruptcy lawyers have never been busier and that there’s currently a hiring frenzy underway in anticipation of busier times.

We can’t help asking ourselves: if housing asset valuations don’t work at higher interest rates, why can corporate asset valuations? Haven’t they both been similarly juiced?

One of the areas we’ve pointed to in recent months has been the slope of the credit curve, which has been quite steep during the past cycle and reflective of a complacency over near-term prospects. A good way to see this is to calculate the ‹forward implied defaults› at different tenors in the credit curve (Chart 5).

For example, right now the 3Y IG CDX is trading at a 60bp spread while the 5Y is trading at an 80bps spread. At a 50% recovery rate (say), the 3Y is pricing in 1.2 defaults per year while the 5Y is pricing in 1.6 per year. That doesn’t sound (or look) like much of a difference.

But it means the 3Y is pricing 3.6 defaults in total (1.2 * 3) whereas the 5Y is pricing in 8 defaults (1.6 * 5). That means the curve is pricing in 3.6 defaults in the first three years, but 4.4 defaults the following two. So, while the first 3Y annual implied default rate is 1.2, the following two years annual implied default rate is 2.2, which is quite a meaningful difference.

That is to say, you can get very different default risk premia depending on where you are in the curve, and the ratio of those implied default rates can be a good barometer of how confident the market is in its near-term macro visibility. Until recently, later tenors were giving significantly more reward than nearer term ones (the curve was steep), reflecting exactly such confidence/complacency. This now seems to have changed quite decisively though, suggesting that credit markets are becoming more worried than appears if looking only at the still relatively low default spreads (Chart 7).

The elephant in the room shuffles off into a dark corner

Evidently then, the complacency we saw at the end of last year is now giving way to a growing concern about what comes next. Policy futures markets, for example, are concerned about the same things and are no longer pricing in further tightening (see chart 8).

Ordinarily that would be that, and the game of guessing the date of the first rate cut by the Fed would be on.

However, these are not ordinary times. Inflation is running at multi-decade highs and it’s not clear just how much demand destruction will be required to pull it back down to historically average rates, even though historically average rates are exactly what the market is currently pricing.

Crash, then boom?

Will the coming economic slowdown/recession be enough to take inflation back to historical average rates, proving that the Fed was right after all, and that pandemic inflation was transitory? Probably. The weak demand of a slowing economy combined with base effects going into reverse will likely see inflation moderate to less nose-bleed levels in the coming months.

Will that come soon enough for the Fed to turn back to easing mode? We fear not. We suspect there will need to be a market event first and so the immediate question remains that of just how deep the coming slowdown is likely to be.

The secondary question is what comes afterwards? If the coming slowdown doesn’t take inflation down to prior recessionary troughs (around 1%/1.5% core), central banks will once again be faced with the hawk/dove dilemma: Will they be hawks, raising rates to quell unacceptably high early-cycle inflation and crushing a nascent recovery before it can get any momentum?

Or will they be doves, tolerating the higher inflation to let the economy and jobs recover, on the grounds that «the cure will be worse than the disease»? Hawks would mean a secular bear market in risk assets. Doves would mean a secular boom in inflation and equities.

As we said, it’s not the most pressing question right now, but it will be soon. We suspect the central banks in the end will be doves – which means, for risk assets: First crash, then boom.

* * *

Dylan Grice’s Popular Delusions, a twice monthly investment report that includes investment ideas ranging from macro, sector and individual securities can be subscribed to via www.calderwoodcapital.com