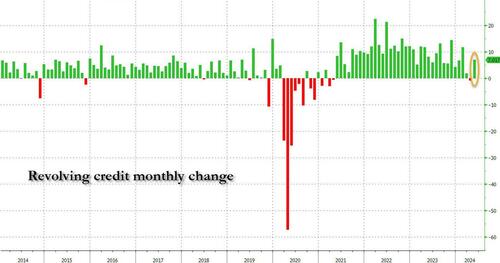

One month after we recorded the first decline in revolving credit (i.e., credit card debt), since the covid crisis, the expectation was for continued consumer retrenching and more credit card paydowns at a time of record high APRs. However, it is far easier to drag the horse to the water and to get him to drink, than to keep spending-addicted US consumers away from their credit cards all time high APRs be demand, and according to today's latest release of Consumer Credit data from the Fed in May revolving credit surged by a whopping $7 billion, a sharp reversal to the April drop of $0.9 bilion and the biggest increase since February.

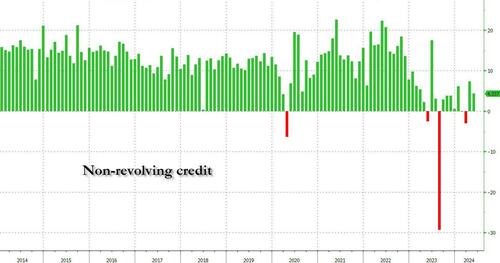

At the same time, non-revolving credit - student and auto loans - posted a modest $4.3 billion increase, down from the $7.3 billion in April but a big jump from the $3 billion drop in April.

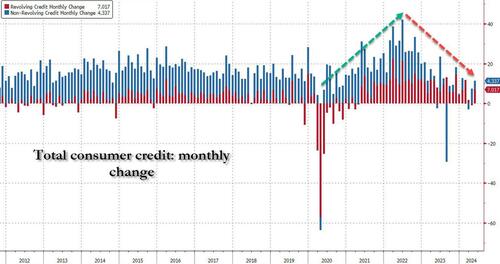

Combining the two, in May total consumer credit rose by $11.3 billion the biggest jump since February which however was an outlier monthly driven entirely by a burst of credit card spending. And while May was clearly an unexpectedly strong month, the trend is clear: we peak in early 2022 and it has all been downhill since then.

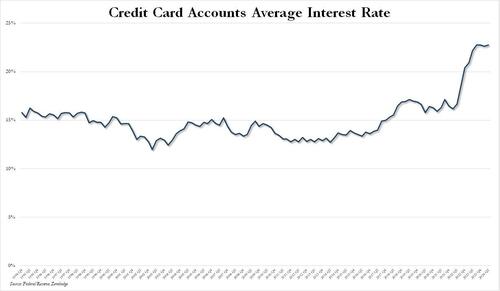

Finally, a vivid reminder that once credit card rates go up they almost never go down, in Q2 the average interest rate on credit card accounts rose again, up to 22.76% from 22.63% in Q1 and 1 basis point below the all time high.

While so far consumers have pretended they can afford to pay this interest upon interest, there will come a day when the brick wall will finally be reached and the US consumer's Wile E Coyote moment will finally come meet its gravitational implosion.

One month after we recorded the first decline in revolving credit (i.e., credit card debt), since the covid crisis, the expectation was for continued consumer retrenching and more credit card paydowns at a time of record high APRs. However, it is far easier to drag the horse to the water and to get him to drink, than to keep spending-addicted US consumers away from their credit cards all time high APRs be demand, and according to today’s latest release of Consumer Credit data from the Fed in May revolving credit surged by a whopping $7 billion, a sharp reversal to the April drop of $0.9 bilion and the biggest increase since February.

At the same time, non-revolving credit – student and auto loans – posted a modest $4.3 billion increase, down from the $7.3 billion in April but a big jump from the $3 billion drop in April.

Combining the two, in May total consumer credit rose by $11.3 billion the biggest jump since February which however was an outlier monthly driven entirely by a burst of credit card spending. And while May was clearly an unexpectedly strong month, the trend is clear: we peak in early 2022 and it has all been downhill since then.

Finally, a vivid reminder that once credit card rates go up they almost never go down, in Q2 the average interest rate on credit card accounts rose again, up to 22.76% from 22.63% in Q1 and 1 basis point below the all time high.

While so far consumers have pretended they can afford to pay this interest upon interest, there will come a day when the brick wall will finally be reached and the US consumer’s Wile E Coyote moment will finally come meet its gravitational implosion.

Loading…