Credit Suisse is mulling several drastic options as it seeks to emerge from losses and scandals, including exiting the US market, firing more than 10% of its 45,000 global workforce, and splitting its investment bank into three - which would include the creation of a "bad bank" to silo risky assets, the Financial Times and Reuters report.

Under proposals presented to the Board of Directors, the Zurich-based bank is looking to avoid a damaging capital raise by selling off profitable units such as its securitized products business. According to FT, bank officials are desperate to avoid going to the market for funding in light of the group's depressed share price - which hit its lowest level in at least 30 years in recent weeks amid a series of downgrades.

The bank - which has been hit with a corporate spying scandal, a record trading loss, shuttered investment funds and a deluge of lawsuits in recent years - tasked new CEO Ulrich Körner with carrying out a 'radical shake-up' which is expected to be announced during the bank's third-quarter results on October 27.

"We have said we will update on progress on our comprehensive strategy review when we announce our third-quarter earnings," the bank said in a statement. "It would be premature to comment on any potential outcomes before then."

The latest proposals under consideration would see the investment bank divided into three parts: the group’s advisory business, which could be spun off at some later point; a bad bank to hold high-risk assets that will be wound down; and the rest of the business. -FT

According to the report, Credit Suisse directors Michael Klein and Blythe Masters floated an idea to offer investment bankers an equity stake in the business, in what has been viewed as an early sign of a spin-off of the division. Another idea reported by Bloomberg is a potential plan by the board to rejuvenate the bank's First Boston brand for the investment bank. That said, neither idea are 'viewed as a priority' according to FT.

On Thursday it was reported that the bank's co-head of flow credit sales, Geoffrey Drayson - who was hired in 2013 - is leaving.

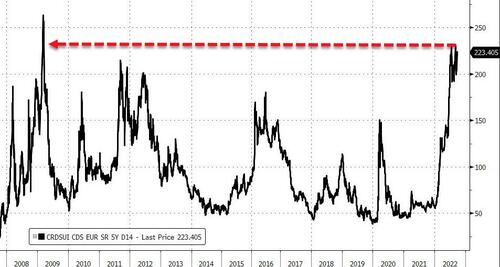

With its equity price at record lows, we also note that Credit Suisse default risk (based on 5Y CDS) is at its highest since Lehman...

Winding down 'problematic positions'

The board has also discussed reviving the bank's "Strategic Resolution Unit" (SRU) to house high-risk assets and non-core businesses that don't align with a focus on wealth management, such as the New York-based securitized products unit which has been earmarked for disposal. The SRU was previously used by the bank to conduct a strategic realignment under former CEO Tidjane Thiam.

The securitized products business packages debts such as mortgages and yacht loans and then sells them as securities. A sale of the unit would "would reduce the bank’s capital commitment but also deprive the bank of one of its most profitable business lines," according to the report.

Looks like we have our winner https://t.co/0ppmkvTjEq

— zerohedge (@zerohedge) September 22, 2022

In August, Deutsche Bank analysts predicted that paring back the investment bank while growing other business lines and strengthening its capital rations would leave a US$4bn hole in the group's capital position.

"Running down other parts of the investment bank and selling smaller businesses across divisions could help over time, but this would likely come too late to avoid an equity raise," wrote Deutsche analysts Benjamin Goy and Sharath Kumar Ramanathan.

Credit Suisse is mulling several drastic options as it seeks to emerge from losses and scandals, including exiting the US market, firing more than 10% of its 45,000 global workforce, and splitting its investment bank into three – which would include the creation of a “bad bank” to silo risky assets, the Financial Times and Reuters report.

Under proposals presented to the Board of Directors, the Zurich-based bank is looking to avoid a damaging capital raise by selling off profitable units such as its securitized products business. According to FT, bank officials are desperate to avoid going to the market for funding in light of the group’s depressed share price – which hit its lowest level in at least 30 years in recent weeks amid a series of downgrades.

The bank – which has been hit with a corporate spying scandal, a record trading loss, shuttered investment funds and a deluge of lawsuits in recent years – tasked new CEO Ulrich Körner with carrying out a ‘radical shake-up’ which is expected to be announced during the bank’s third-quarter results on October 27.

“We have said we will update on progress on our comprehensive strategy review when we announce our third-quarter earnings,” the bank said in a statement. “It would be premature to comment on any potential outcomes before then.”

The latest proposals under consideration would see the investment bank divided into three parts: the group’s advisory business, which could be spun off at some later point; a bad bank to hold high-risk assets that will be wound down; and the rest of the business. -FT

According to the report, Credit Suisse directors Michael Klein and Blythe Masters floated an idea to offer investment bankers an equity stake in the business, in what has been viewed as an early sign of a spin-off of the division. Another idea reported by Bloomberg is a potential plan by the board to rejuvenate the bank’s First Boston brand for the investment bank. That said, neither idea are ‘viewed as a priority’ according to FT.

On Thursday it was reported that the bank’s co-head of flow credit sales, Geoffrey Drayson – who was hired in 2013 – is leaving.

With its equity price at record lows, we also note that Credit Suisse default risk (based on 5Y CDS) is at its highest since Lehman…

Winding down ‘problematic positions’

The board has also discussed reviving the bank’s “Strategic Resolution Unit” (SRU) to house high-risk assets and non-core businesses that don’t align with a focus on wealth management, such as the New York-based securitized products unit which has been earmarked for disposal. The SRU was previously used by the bank to conduct a strategic realignment under former CEO Tidjane Thiam.

The securitized products business packages debts such as mortgages and yacht loans and then sells them as securities. A sale of the unit would “would reduce the bank’s capital commitment but also deprive the bank of one of its most profitable business lines,” according to the report.

Looks like we have our winner https://t.co/0ppmkvTjEq

— zerohedge (@zerohedge) September 22, 2022

In August, Deutsche Bank analysts predicted that paring back the investment bank while growing other business lines and strengthening its capital rations would leave a US$4bn hole in the group’s capital position.

“Running down other parts of the investment bank and selling smaller businesses across divisions could help over time, but this would likely come too late to avoid an equity raise,” wrote Deutsche analysts Benjamin Goy and Sharath Kumar Ramanathan.

[embedded content]