Shares of CrowdStrike are lower in premarket trading after several Wall Street analysts revised their ratings and lowered price targets. These actions come as analysts attempt to assess the impact of a global IT outage that crippled millions of computers, grounded flights, disrupted banks, and even delayed the opening of the London Stock Exchange last Friday.

CrowdStrike's update, which began impacting IT systems globally early Friday, was a memorable day, especially the 'blue screen of death.'

As many noted on X, Friday's global IT disruption felt like 'Y2K' had happened this time.

SFO feeling like Y2K rn. #Crowdstrike #microsoft #outage pic.twitter.com/q0CgMY326j

— Meagan (@lushzeb) July 19, 2024

Everyone welcome international blue screen day, its basically Y2K but it's real and it put the world on halt. Thanks, Crowdstrike. pic.twitter.com/BpOBY83LYR

— Mazzranache (@TrickyKetchup) July 19, 2024

Now that the cyber security firm's reputation is at stake, analysts, such as those from Guggenheim Securities, have cut their rating on the stock from 'Buy' to 'Neutral' because the incident will jeopardize current deals in the company's pipeline as customers contemplate using threat protection software from rivals.

Guggenheim analyst John DiFucci told clients that his downgrade reflects "likely resistance to new deals in the near-term, as a result of anticipated fallout from the apparent quality assurance issue that caused a massive disruption of IT systems across the globe."

"The company's response to the issue it caused was impressive, but nevertheless, it caused significant disruption to businesses (and people) across the world," DiFucci said.

Piper Sandler analyst Rob Owens slashed his price target on Crowdstrike from $400 to $310. He maintained a 'Neutral' rating on the cybersecurity firm because of the difficulty surrounding the ability in the near term to quantify last week's software update fiasco.

"We expect the incident to hurt CrowdStrike order closures in fiscal 2Q25, and the company could see major reputational damage to its category-leading position in enterprise security, hurting its win rates against Palo Alto Networks, Wiz and SentinelOne," Bloomberg Intelligence analyst Mandeep Singh wrote in a note.

Wedbush analyst Daniel Ives said the incident was "clearly a major black eye for CrowdStrike," adding the shares will likely remain under pressure and "create opportunity for some competitive displacements."

The Information reported over the weekend that a chief information security officer at a major Fortune 100 company and a person who advises Fortune 100 companies on cybersecurity said several large companies are considering rival antivirus software to CrowdStrike after last week's incident. This comes as Tesla CEO Elon Musk posted on X that his company "deleted CrowdStrike from all our systems."

We just deleted Crowdstrike from all our systems, so no rollouts at all

— Elon Musk (@elonmusk) July 19, 2024

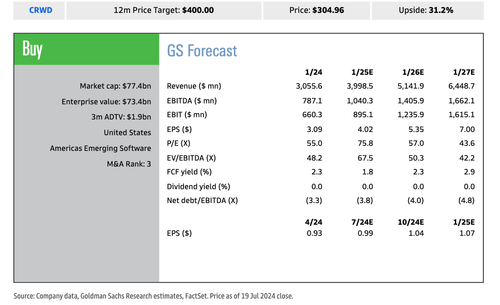

Goldman's Gabriela Borges told clients in a note this morning that a deal slowdown could be possible for the company in the weeks ahead but maintains a 'Buy' rating with a $400 price target.

"We expect to see some deal cycle elongation between July 19 and July 31 (the end of CrowdStrike's 2QFY), which will likely impact close rates as customers pause to remediate any issues and reinforce their existing architectures, as well as better understand what went wrong with the CrowdStrike upgrade. This may also impact the close of the quarter for other security vendors as customers push out adding new vendors to their ecosystem or expanding their contracts. However, our recent conversations reaffirm our view that there will likely be minimal share shifts in endpoint post this event," Borges said.

With that understanding, she continued:

"We maintain our 12-month price target at $400 based on 55x Q5-Q8 FCF. Key risks include enterprise TAM saturation, competition from Microsoft, Palo Alto and SentinelOne, and a slowdown in endpoint demand environment."

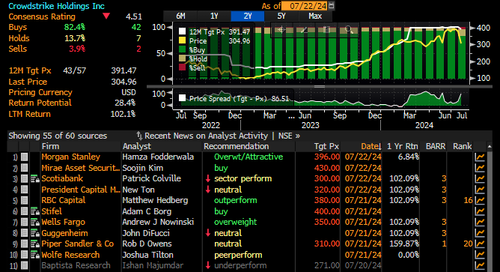

Even with some pessimism growing, Wall Street still heavily favors CrowdStrike, with 82.4% or 42 analysts who cover it having a 'Buy' rating, according to Bloomberg data. About 4% of the analysts or 2 have 'Sell' ratings, with 13.7% or seven analysts with 'Neutral' ratings.

Shares are down 4% in premarket trading, following an 11% plunge on Friday.

Who will dare to catch the falling knife?

Shares of CrowdStrike are lower in premarket trading after several Wall Street analysts revised their ratings and lowered price targets. These actions come as analysts attempt to assess the impact of a global IT outage that crippled millions of computers, grounded flights, disrupted banks, and even delayed the opening of the London Stock Exchange last Friday.

CrowdStrike’s update, which began impacting IT systems globally early Friday, was a memorable day, especially the ‘blue screen of death.’

As many noted on X, Friday’s global IT disruption felt like ‘Y2K’ had happened this time.

SFO feeling like Y2K rn. #Crowdstrike #microsoft #outage pic.twitter.com/q0CgMY326j

— Meagan (@lushzeb) July 19, 2024

Everyone welcome international blue screen day, its basically Y2K but it’s real and it put the world on halt. Thanks, Crowdstrike. pic.twitter.com/BpOBY83LYR

— Mazzranache (@TrickyKetchup) July 19, 2024

Now that the cyber security firm’s reputation is at stake, analysts, such as those from Guggenheim Securities, have cut their rating on the stock from ‘Buy’ to ‘Neutral’ because the incident will jeopardize current deals in the company’s pipeline as customers contemplate using threat protection software from rivals.

Guggenheim analyst John DiFucci told clients that his downgrade reflects “likely resistance to new deals in the near-term, as a result of anticipated fallout from the apparent quality assurance issue that caused a massive disruption of IT systems across the globe.”

“The company’s response to the issue it caused was impressive, but nevertheless, it caused significant disruption to businesses (and people) across the world,” DiFucci said.

Piper Sandler analyst Rob Owens slashed his price target on Crowdstrike from $400 to $310. He maintained a ‘Neutral’ rating on the cybersecurity firm because of the difficulty surrounding the ability in the near term to quantify last week’s software update fiasco.

“We expect the incident to hurt CrowdStrike order closures in fiscal 2Q25, and the company could see major reputational damage to its category-leading position in enterprise security, hurting its win rates against Palo Alto Networks, Wiz and SentinelOne,” Bloomberg Intelligence analyst Mandeep Singh wrote in a note.

Wedbush analyst Daniel Ives said the incident was “clearly a major black eye for CrowdStrike,” adding the shares will likely remain under pressure and “create opportunity for some competitive displacements.”

The Information reported over the weekend that a chief information security officer at a major Fortune 100 company and a person who advises Fortune 100 companies on cybersecurity said several large companies are considering rival antivirus software to CrowdStrike after last week’s incident. This comes as Tesla CEO Elon Musk posted on X that his company “deleted CrowdStrike from all our systems.”

We just deleted Crowdstrike from all our systems, so no rollouts at all

— Elon Musk (@elonmusk) July 19, 2024

Goldman’s Gabriela Borges told clients in a note this morning that a deal slowdown could be possible for the company in the weeks ahead but maintains a ‘Buy’ rating with a $400 price target.

“We expect to see some deal cycle elongation between July 19 and July 31 (the end of CrowdStrike’s 2QFY), which will likely impact close rates as customers pause to remediate any issues and reinforce their existing architectures, as well as better understand what went wrong with the CrowdStrike upgrade. This may also impact the close of the quarter for other security vendors as customers push out adding new vendors to their ecosystem or expanding their contracts. However, our recent conversations reaffirm our view that there will likely be minimal share shifts in endpoint post this event,” Borges said.

With that understanding, she continued:

“We maintain our 12-month price target at $400 based on 55x Q5-Q8 FCF. Key risks include enterprise TAM saturation, competition from Microsoft, Palo Alto and SentinelOne, and a slowdown in endpoint demand environment.”

Even with some pessimism growing, Wall Street still heavily favors CrowdStrike, with 82.4% or 42 analysts who cover it having a ‘Buy’ rating, according to Bloomberg data. About 4% of the analysts or 2 have ‘Sell’ ratings, with 13.7% or seven analysts with ‘Neutral’ ratings.

Shares are down 4% in premarket trading, following an 11% plunge on Friday.

Who will dare to catch the falling knife?

Loading…