Richmond Fed manufacturing and Phuilly Fed services surveys both disappointed today - both signaling economic contraction, new orders declining, and employment pressures. The decline in business sentiment matches what we saw from New York last week and remains disconnected from the improvement we are seeing in consumer confidence...

Source: Bloomberg

...a product of the latter's likely focus on the stock market (and gasoline prices)... which was up again today (for the Nasdaq and S&P 500 hitting new record closing highs). Small Caps and The Dow ended the day red...

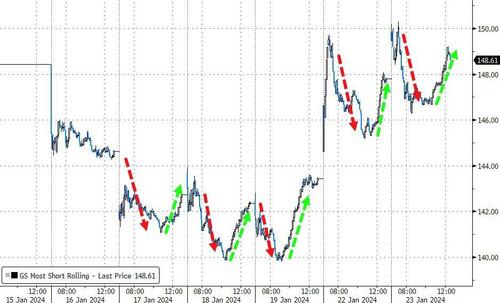

For the 5th day in a row, 'most-shorted' stocks saw the same trading pattern - opening bid gap higher, immediate selling pressure into EU close, then another squeeze into the close highs...

Source: Bloomberg

'Magnificent 7' stocks were higher today but not convincingly - are we back in the 3 days up, 3 days sideways trend...

Source: Bloomberg

Treasuries were sold today, erasing yesterday's gains as the long-end underperformed (30Y +5bps, 2Y -1bps), leaving the long-end up on the week (while the rest of the curve is hovering around unch)...

Source: Bloomberg

...which left the yield curve (2s30s) bear-steepening back up to almost dis-inverted...

Source: Bloomberg

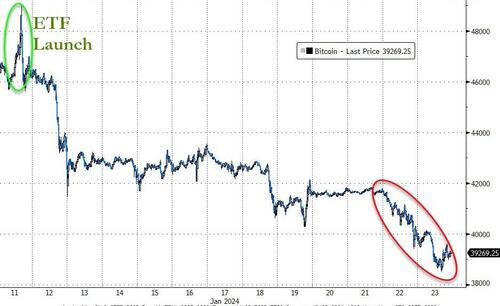

But crypto made the biggest headlines, tumbling below $39,000 at its lows today (from over $49,000 the day that the spot ETFs launched). But, it doesn't appear to be the ETFs that are driving it...

Source: Bloomberg

The dollar spike back to last week's 2024 highs today

Source: Bloomberg

The dollar's reversal low was at its 50DMA, and today's high reversal was at the 200DMA...

Source: Bloomberg

Gold ended the day higher despite the dollar gains...

Source: Bloomberg

Oil ended unchanged after WTI tested $75 intraday at the top of recent range...

Source: Bloomberg

Finally, Chinese authorities tried (and failed) again to put a floor under their wealth-destroying equity-market-collapse - jawboning a multi-billion-dollar buying package (that barely managed to get the broadest measures of Chinese stocks higher)...

Asian traders are at their wit's end:

“I have reached the stage whereby my confidence as a trader is lost,” Singapore Hedge Fund 'Asia Genesis' CIO Chua Soon Hock wrote in a letter to investors. Reflecting on the unprecedented moves for China stocks (down) and Japan stocks (up), Chua wrote January “has proven that my past experience is no longer valid and instead, is working against me.”

“I still do not understand the inconsistency of China policy makers not fighting against deflation,” the fund manager continued, adding that:

“I have lost my knowledge, trading and psychological edge... The principle of risk-reward for both the short term and long term has turned on its head."

Revolution through routed wealth (do nothing - or keep pretending to do something - and hope it bottoms out) or wrecked buying power (stimmy-driven rebound sparks surge in inflation) - either way, not a good horizon for Beijing.

Richmond Fed manufacturing and Phuilly Fed services surveys both disappointed today – both signaling economic contraction, new orders declining, and employment pressures. The decline in business sentiment matches what we saw from New York last week and remains disconnected from the improvement we are seeing in consumer confidence…

Source: Bloomberg

…a product of the latter’s likely focus on the stock market (and gasoline prices)… which was up again today (for the Nasdaq and S&P 500 hitting new record closing highs). Small Caps and The Dow ended the day red…

For the 5th day in a row, ‘most-shorted’ stocks saw the same trading pattern – opening bid gap higher, immediate selling pressure into EU close, then another squeeze into the close highs…

Source: Bloomberg

‘Magnificent 7’ stocks were higher today but not convincingly – are we back in the 3 days up, 3 days sideways trend…

Source: Bloomberg

Treasuries were sold today, erasing yesterday’s gains as the long-end underperformed (30Y +5bps, 2Y -1bps), leaving the long-end up on the week (while the rest of the curve is hovering around unch)…

Source: Bloomberg

…which left the yield curve (2s30s) bear-steepening back up to almost dis-inverted…

Source: Bloomberg

But crypto made the biggest headlines, tumbling below $39,000 at its lows today (from over $49,000 the day that the spot ETFs launched). But, it doesn’t appear to be the ETFs that are driving it...

Source: Bloomberg

The dollar spike back to last week’s 2024 highs today

Source: Bloomberg

The dollar’s reversal low was at its 50DMA, and today’s high reversal was at the 200DMA…

Source: Bloomberg

Gold ended the day higher despite the dollar gains…

Source: Bloomberg

Oil ended unchanged after WTI tested $75 intraday at the top of recent range…

Source: Bloomberg

Finally, Chinese authorities tried (and failed) again to put a floor under their wealth-destroying equity-market-collapse – jawboning a multi-billion-dollar buying package (that barely managed to get the broadest measures of Chinese stocks higher)…

Asian traders are at their wit’s end:

“I have reached the stage whereby my confidence as a trader is lost,” Singapore Hedge Fund ‘Asia Genesis’ CIO Chua Soon Hock wrote in a letter to investors. Reflecting on the unprecedented moves for China stocks (down) and Japan stocks (up), Chua wrote January “has proven that my past experience is no longer valid and instead, is working against me.”

“I still do not understand the inconsistency of China policy makers not fighting against deflation,” the fund manager continued, adding that:

“I have lost my knowledge, trading and psychological edge… The principle of risk-reward for both the short term and long term has turned on its head.”

Revolution through routed wealth (do nothing – or keep pretending to do something – and hope it bottoms out) or wrecked buying power (stimmy-driven rebound sparks surge in inflation) – either way, not a good horizon for Beijing.

Loading…