A weird week of macro data - strong jobless claims but weak labor market data from UMich; housing starts soared but new home sales crashed; rapidly slowing inflation all driven by goods deflation (as crude prices begin rising again). So macro surprises have flatlined for a week or two - even as financial conditions continue to loosen dramatically...

Source: Bloomberg

As Goldman's Chris Hussey notes, "This week we got further data suggesting that we have not only landed softly, but that the principal concern of a successfully soft landing economy -- that growth takes off again, triggering renewed inflation, and prolonging the Fed hiking cycle -- is likely behind us."

Small Caps soared almost 3% this week (its 6th straight week higher), now up 25% from the lows on Oct 27th. The Dow lagged on the week, but still managed gains while Nasdaq and S&P rallied for the 8th week in a row (the longest streak since 2017)...

Today was 0-DTE selling pressure again, like Wednesday (but on a smaller scale) and Thursday (which worked briefly but then was face-ripped).

The black line is the S&P 500. The red line is 0-DTE options delta flow...

Wednesday, it worked...

Thursday, it almost worked...

'Crap' stocks - ok, profit-less tech - surged this week, but not before Wednesday's 0-DTE-inspired crash wrecked some dreams...

Source: Bloomberg

...and no this is not the same chart, 'most shorted' stocks also followed the same pattern with a big squeeze at the cash open every day this week...

Source: Bloomberg

...and the biggest losers have become the biggest winners as financial conditions have eased...

Source: Bloomberg

The Bullish consensus is getting serious...

Source: Bloomberg

Are investors really excited about The Fed being forced to massively slash rates?

Rate-cut expectations surged to a new high this week, now pricing in 163bps of cuts in 2024...

Source: Bloomberg

If The Fed needs to cut rates that far, that fast, it won't be because of slowing inflation - it will be because of accelerating depression... which ain't good for stonks.

Nevertheless, the market is now pricing a 90% chance of The Fed starting to cut rates in March...

Source: Bloomberg

So much for the FedSpeak trying to jawbone the market back from its extreme reaction to Powell.

They better hope that cyclical inflation doesn't 'cycle' back higher (cough Red Sea cough)... and/or that acyclical inflation falls fast...

Source: Bloomberg

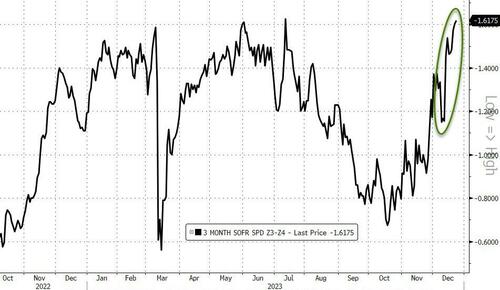

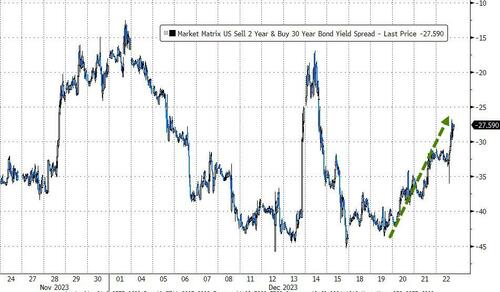

Treasuries were mixed this week with the short-end the best performer by far but the long bond was the only segment of the curve to end higher on the week...

Source: Bloomberg

Which bull-steepened the curve quite notably on the week...

Source: Bloomberg

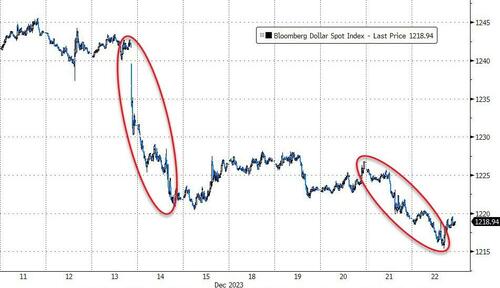

The dollar fell to its weakest since July, down for the 5th week in the last 6...

Source: Bloomberg

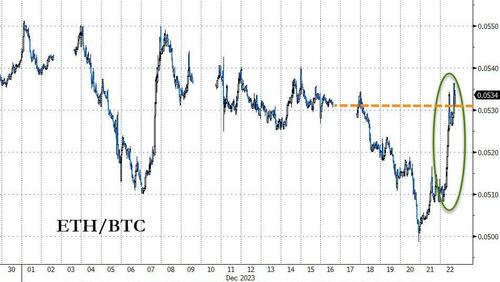

Ethereum soared today relative to bitcoin, but only enough to bring it back to unchanged (relative to bitcoin) on the week...

Source: Bloomberg

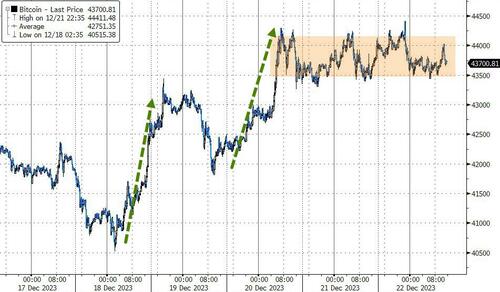

On the week, both ETH and BTC were up around 4% (while Solana soared 35%), with BTC holding around $44,000...

Source: Bloomberg

Gold is up 4 of the last 5 days, rising for the 5th week of the last 6 and back above $2050 spot to three-week highs...

Source: Bloomberg

Oil prices rose for the second week in a row, after seven straight weeks lower. The 3% jump in WTI was the best week since mid-October (finding resistance at $75)...

Source: Bloomberg

Finally, from a valuation perspective, things are getting a little pricey. It now takes the average American 1279 hours of work to earn enough to buy The Dow...

Source: Bloomberg

That's quite a jump from the 225-hour average from 1965 to 1995 before Greenspan unleashed the activist Fed.

A weird week of macro data – strong jobless claims but weak labor market data from UMich; housing starts soared but new home sales crashed; rapidly slowing inflation all driven by goods deflation (as crude prices begin rising again). So macro surprises have flatlined for a week or two – even as financial conditions continue to loosen dramatically…

Source: Bloomberg

As Goldman’s Chris Hussey notes, “This week we got further data suggesting that we have not only landed softly, but that the principal concern of a successfully soft landing economy — that growth takes off again, triggering renewed inflation, and prolonging the Fed hiking cycle — is likely behind us.”

Small Caps soared almost 3% this week (its 6th straight week higher), now up 25% from the lows on Oct 27th. The Dow lagged on the week, but still managed gains while Nasdaq and S&P rallied for the 8th week in a row (the longest streak since 2017)…

Today was 0-DTE selling pressure again, like Wednesday (but on a smaller scale) and Thursday (which worked briefly but then was face-ripped).

The black line is the S&P 500. The red line is 0-DTE options delta flow…

Wednesday, it worked…

Thursday, it almost worked…

‘Crap’ stocks – ok, profit-less tech – surged this week, but not before Wednesday’s 0-DTE-inspired crash wrecked some dreams…

Source: Bloomberg

…and no this is not the same chart, ‘most shorted’ stocks also followed the same pattern with a big squeeze at the cash open every day this week…

Source: Bloomberg

…and the biggest losers have become the biggest winners as financial conditions have eased…

Source: Bloomberg

The Bullish consensus is getting serious…

Source: Bloomberg

Are investors really excited about The Fed being forced to massively slash rates?

Rate-cut expectations surged to a new high this week, now pricing in 163bps of cuts in 2024…

Source: Bloomberg

If The Fed needs to cut rates that far, that fast, it won’t be because of slowing inflation – it will be because of accelerating depression… which ain’t good for stonks.

Nevertheless, the market is now pricing a 90% chance of The Fed starting to cut rates in March…

Source: Bloomberg

So much for the FedSpeak trying to jawbone the market back from its extreme reaction to Powell.

They better hope that cyclical inflation doesn’t ‘cycle’ back higher (cough Red Sea cough)… and/or that acyclical inflation falls fast…

Source: Bloomberg

Treasuries were mixed this week with the short-end the best performer by far but the long bond was the only segment of the curve to end higher on the week…

Source: Bloomberg

Which bull-steepened the curve quite notably on the week…

Source: Bloomberg

The dollar fell to its weakest since July, down for the 5th week in the last 6…

Source: Bloomberg

Ethereum soared today relative to bitcoin, but only enough to bring it back to unchanged (relative to bitcoin) on the week…

Source: Bloomberg

On the week, both ETH and BTC were up around 4% (while Solana soared 35%), with BTC holding around $44,000…

Source: Bloomberg

Gold is up 4 of the last 5 days, rising for the 5th week of the last 6 and back above $2050 spot to three-week highs…

Source: Bloomberg

Oil prices rose for the second week in a row, after seven straight weeks lower. The 3% jump in WTI was the best week since mid-October (finding resistance at $75)…

Source: Bloomberg

Finally, from a valuation perspective, things are getting a little pricey. It now takes the average American 1279 hours of work to earn enough to buy The Dow…

Source: Bloomberg

That’s quite a jump from the 225-hour average from 1965 to 1995 before Greenspan unleashed the activist Fed.

Loading…