Authored by Mike Shedlock via MishTalk.com,

The EU has launched an Excessive Debt Proceeding against France. It won’t stop there.

Debt Proceedings

Please note the EU Rebukes France, Italy and Others Over Excessive Debt.

The assessments of the 27 EU states’ budgets and economies will be published by the European Commission on Wednesday, with France, Italy and Belgium among the member states to be reprimanded over their accumulated excessive new debt.

The Commission said it was satisfied that “the opening of a deficit-based excessive deficit procedure is warranted” in the case of seven countries. The group also included Hungary, Malta, Poland and Slovakia.

The EU suspended debt and deficit regulations to help countries cope with the economic fallout of the COVID-19 pandemic and Russia’s invasion of Ukraine.

The rules are now back in place and now any EU country going over debt and deficit limits run the risk of legal action.

EU’s Golden Rules

According to the reformed rules, an EU member state’s debt may not exceed 60% of gross domestic product (GDP).

Highly indebted EU countries with debt levels over 90% of GDP have to reduce their debt ratio by one percentage point annually, countries

Additionally, the general government deficit — the shortfall between government revenue and spending — must be kept below 3%.

According to the commission’s economic forecast, France is at -5.5%, Italy is at -4.4% and Belgium is at -4.4% and will breach this deficit limit in 2024.

Austria, Finland, Estonia, Hungary, Malta, Poland, Romania, and Slovakia also have deficits that are too high according to the rules. Spain is at exactly -3.0%.

Snap Elections

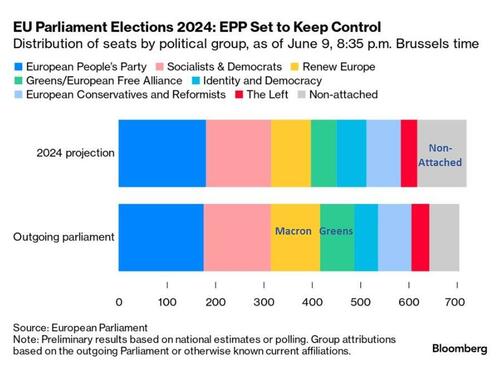

French President Emmanuel Macron was hammered in the European Parliamentary elections as expected in this corner, and generally elsewhere.

Winners: The Far Right

Losers: Renew Europe (Macron), and the Greens.

The response by Macron caught everyone off guard. He dissolved parliament and called for snap elections.

On June 9, I commented Marine Le Pen Set for Record Win, Macron Calls Snap French Election

Act of Trust or Act of Desperation?

Macron called for French parliament elections only, not presidential elections.

But if he gets blown out in the Parliamentary elections he will have zero chance of doing anything.

Hmm. Is this a desperate act to pin the blame on Parliament for whatever happens next? Macron himself cannot run again so why not?

Sudden Procedures

Hilarious. Le Pen appears on the horizon and suddenly the Commission opens up an "excessive deficit procedure" against France. Then they blame "excessive French power" in the EU. Is anyone fooled by this? They're using the ECB to bend political candidates to their will. 🇪🇺 https://t.co/u1YcZiCyvB

— Philip Pilkington (@philippilk) June 19, 2024

I fail to see how this does anything but aid Le Pen in the upcoming parliamentary election.

However, if Macron is clobbered, Jordan Bardella, the leader of Rassemblement National (RN, National Rally, Marine Le Pen’s party), may emerge as Prime Minister.

An Act of Trust?

This pompous WEF puppet. 😡 Macron on his decision to dissolve parliament

— Info Battle Maiden (@info_maiden) June 9, 2024

“I have decided to give you back the choice of our parliamentary future through a vote..this is a serious & weighty decision, but above all it is an act of trust. Confidence in you, my dear compatriots, in… pic.twitter.com/XWqcBVvAqV

Yeah right.

If Macron is blasted again, he is likely to transfer the problem to RN to fix. That is Macron’s real gambit, not this BS about trust.

Macron is ineligible to run again, so he is making a calculated move. It makes sense if you think about it in these terms.

How Does the Election Work?

Politico Explains: French members of parliament are not elected on the basis of proportional representation, but instead through a complicated two-round vote across 577 constituencies where local dynamics play a big role.

France will go to the polls on June 30, with runoffs planned for July 7. In each constituency, if no candidate wins 50 percent of the vote in the first round, the top two candidates advance to the second round, as does any other candidate who got the support of at least 12.5 percent of registered voters. The candidate with the most votes in the second round wins the seat as a member of parliament.

If the far right gets a majority in the parliament, the French president would have to enter into a “cohabitation” arrangement with the National Rally and appoint a far-right prime minister. Bardella, the president of the National Rally, has said he would not seek to lead a government unless he had a majority. That presumably means he will need coalition partners — or it’s an electoral strategy to bag a big turnout.

By lead a government Politico means become Prime Minister.

It may be in the best long term interest of Bardella to leave the fiscal issues to Macron for the near future.

No one wants to take the blame for the impending crash.

Another question is how much effort Le Pen will invest in coalition talks, given her desire to keep her political capital intact ahead of the 2027 presidential election. If her party leads a government that has a bumpy ride in office, it could reduce her chances of seizing the big prize.

See how complicated this political jockeying is? It sure as hell has nothing to do with trust.

And that’s not all.

Jews for Le Pen

Please note France’s Jews Consider the Unthinkable: Voting for a Party With an Antisemitic Past

Serge Klarsfeld is a world-renowned Nazi hunter, a historian of the Holocaust and a moral authority in France who has pushed the country to reckon with its dark history of antisemitism.

That is why many in France were shocked this week when Klarsfeld defended the far-right party of Marine Le Pen, which counts among its founders a former Nazi paramilitary soldier. Klarsfeld, an 88-year-old Holocaust survivor, said that the main threat to France’s Jews now comes from the far left and that he wouldn’t hesitate to vote for Le Pen’s party, the National Rally, in the coming parliamentary elections if the alternative were a coalition of leftist parties, the New Popular Front.

“The National Rally supports Jews, supports the state of Israel,” Klarsfeld said on national television. “When there is an anti-Jewish party and a pro-Jewish party, I will vote for the pro-Jewish party.”

“I never would have imagined voting in favor of the National Rally to blockade against antisemitism,” the writer Alain Finkielkraut told French magazine Le Point this month. “The current situation is heartbreaking for the Jews of France.”

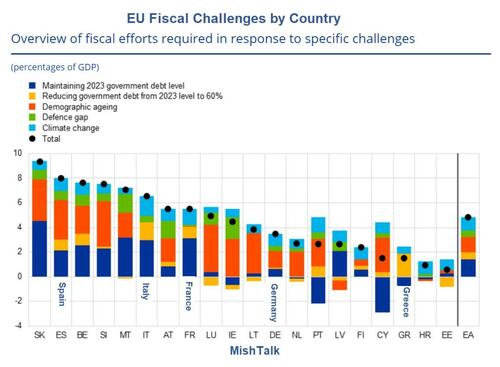

Long Term Fiscal Issues

In addition to the Excessive Debt Proceedings against many countries, every EU county has defense spending issues, climate spending issues, and demographic issues as shown in the lead chart.

The lead chart is from the ECB report Longer-Term Challenges for Fiscal Policy in the Euro Area

In the future, various longer-term challenges are likely to exert pressure on public finances in the euro area. On top of the existing fiscal burdens – as reflected in the high debt ratios in a number of euro area countries, which were exacerbated by the pandemic and the subsequent energy crisis – there are several important longer-term challenges for fiscal dynamics. This article starts by reviewing some of the most important challenges and discussing their fiscal relevance, with a focus on demographic ageing (Section 2), the end of the “peace dividend” (Section 3), digitalisation (Section 4) and climate change (Section 5). Acknowledging the uncertainties surrounding any quantification of these challenges, Section 6 then presents some tentative – purely indicative – estimates of the additional fiscal effort that could be required to ensure the long-term sustainability of public finances in the presence of such developments. The implications of digitalisation are excluded from that exercise, given the particular uncertainty that surrounds their quantification. Section 7 then provides some concluding remarks.

As you can see, it’s a mess in may areas. Here are a few of them.

Fiscal Costs of Ageing Societies

The euro area is experiencing demographic ageing. The region is witnessing a significant decline in fertility rates, coupled with steady increases in life expectancy, resulting in an ageing population. At the level of the European Union as a whole, average remaining life expectancy at the age of 65 has increased over the last two decades, rising from 17.8 years in 2002 to 19.5 years in 2022

This demographic ageing presents challenges for government finances. With the number of elderly citizens increasing relative to the working-age population, pay‑as-you-go pension systems face mounting financial pressures. Furthermore, ageing populations typically require more extensive healthcare services and long‑term care.

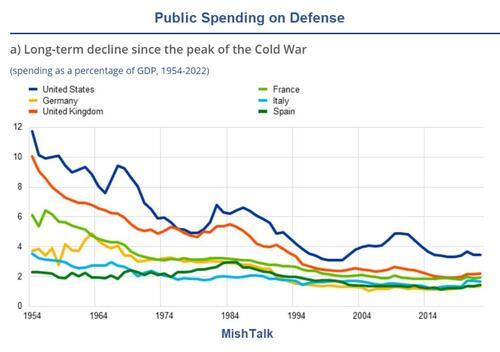

Fiscal Costs of the End of the “Peace Dividend”

Macron wants an EU army and more support for Ukraine. How’s that supposed to happen?

Fiscal Effects of Climate Change

Transitioning to a low-carbon economy entails significant upfront costs and policy challenges. Mitigation measures (such as investment in renewable energy infrastructure, energy efficiency improvements and other emission reduction strategies) require substantial financial resources and long-term planning. Green investment, both public and private, will be essential in order to facilitate the transition to a sustainable economy.

Cumulative Impact – Lead Chart

Achieving a government debt-to-GDP ratio of 60% by 2070 from today’s debt levels would require euro area governments to immediately and permanently increase their primary balances by 2% of GDP on average.

Moreover, additional fiscal burdens may well emerge in the medium term. For instance, the model-based simulations used in this article exclude the digitalisation gap, the long-term implications of which are still hard to grasp. Furthermore, one does not need to go back very far in time to find a large fiscal shock appearing out of the blue: the euro area’s government debt-to-GDP ratio increased by a total of 13 percentage points in 2020 in response to the COVID-19 pandemic. At the same time, the simulation of climate change is based on simplified assumptions and on the unlikely premise that limiting global warming to 1.5°C is still feasible. It also does not capture the impact of societal repercussions (such as conflict), tipping points or macroeconomic effects (such as changes to prices and productivity). This suggests that there could be substantial additional fiscal costs associated with climate change.

Hoot of the Day

To achieve a government debt-to-GDP ratio of 60 percent, EU countries will have to reduce spending or raise taxes by 2 percent of GDP, on average, every year for 46 years.

That also presumes no recessions or other emergencies in that timeframe. And this is supposed to be a serious proposal.

Let’s just say it’s not going to happen. But these clowns are likely to try, if for no other reason than punish Le Pen.

Meanwhile, Back in the States

In case you missed it, please consider Why Angry Renters Will Decide the Election, Take II

Economists say wages are now rising faster than the CPI. That’s not true for those who rent or wish to buy a house.

Authored by Mike Shedlock via MishTalk.com,

The EU has launched an Excessive Debt Proceeding against France. It won’t stop there.

Debt Proceedings

Please note the EU Rebukes France, Italy and Others Over Excessive Debt.

The assessments of the 27 EU states’ budgets and economies will be published by the European Commission on Wednesday, with France, Italy and Belgium among the member states to be reprimanded over their accumulated excessive new debt.

The Commission said it was satisfied that “the opening of a deficit-based excessive deficit procedure is warranted” in the case of seven countries. The group also included Hungary, Malta, Poland and Slovakia.

The EU suspended debt and deficit regulations to help countries cope with the economic fallout of the COVID-19 pandemic and Russia’s invasion of Ukraine.

The rules are now back in place and now any EU country going over debt and deficit limits run the risk of legal action.

EU’s Golden Rules

According to the reformed rules, an EU member state’s debt may not exceed 60% of gross domestic product (GDP).

Highly indebted EU countries with debt levels over 90% of GDP have to reduce their debt ratio by one percentage point annually, countries

Additionally, the general government deficit — the shortfall between government revenue and spending — must be kept below 3%.

According to the commission’s economic forecast, France is at -5.5%, Italy is at -4.4% and Belgium is at -4.4% and will breach this deficit limit in 2024.

Austria, Finland, Estonia, Hungary, Malta, Poland, Romania, and Slovakia also have deficits that are too high according to the rules. Spain is at exactly -3.0%.

Snap Elections

French President Emmanuel Macron was hammered in the European Parliamentary elections as expected in this corner, and generally elsewhere.

Winners: The Far Right

Losers: Renew Europe (Macron), and the Greens.

The response by Macron caught everyone off guard. He dissolved parliament and called for snap elections.

On June 9, I commented Marine Le Pen Set for Record Win, Macron Calls Snap French Election

Act of Trust or Act of Desperation?

Macron called for French parliament elections only, not presidential elections.

But if he gets blown out in the Parliamentary elections he will have zero chance of doing anything.

Hmm. Is this a desperate act to pin the blame on Parliament for whatever happens next? Macron himself cannot run again so why not?

Sudden Procedures

Hilarious. Le Pen appears on the horizon and suddenly the Commission opens up an “excessive deficit procedure” against France. Then they blame “excessive French power” in the EU. Is anyone fooled by this? They’re using the ECB to bend political candidates to their will. 🇪🇺 https://t.co/u1YcZiCyvB

— Philip Pilkington (@philippilk) June 19, 2024

I fail to see how this does anything but aid Le Pen in the upcoming parliamentary election.

However, if Macron is clobbered, Jordan Bardella, the leader of Rassemblement National (RN, National Rally, Marine Le Pen’s party), may emerge as Prime Minister.

An Act of Trust?

This pompous WEF puppet. 😡 Macron on his decision to dissolve parliament

“I have decided to give you back the choice of our parliamentary future through a vote..this is a serious & weighty decision, but above all it is an act of trust. Confidence in you, my dear compatriots, in… pic.twitter.com/XWqcBVvAqV

— Info Battle Maiden (@info_maiden) June 9, 2024

Yeah right.

If Macron is blasted again, he is likely to transfer the problem to RN to fix. That is Macron’s real gambit, not this BS about trust.

Macron is ineligible to run again, so he is making a calculated move. It makes sense if you think about it in these terms.

How Does the Election Work?

Politico Explains: French members of parliament are not elected on the basis of proportional representation, but instead through a complicated two-round vote across 577 constituencies where local dynamics play a big role.

France will go to the polls on June 30, with runoffs planned for July 7. In each constituency, if no candidate wins 50 percent of the vote in the first round, the top two candidates advance to the second round, as does any other candidate who got the support of at least 12.5 percent of registered voters. The candidate with the most votes in the second round wins the seat as a member of parliament.

If the far right gets a majority in the parliament, the French president would have to enter into a “cohabitation” arrangement with the National Rally and appoint a far-right prime minister. Bardella, the president of the National Rally, has said he would not seek to lead a government unless he had a majority. That presumably means he will need coalition partners — or it’s an electoral strategy to bag a big turnout.

By lead a government Politico means become Prime Minister.

It may be in the best long term interest of Bardella to leave the fiscal issues to Macron for the near future.

No one wants to take the blame for the impending crash.

Another question is how much effort Le Pen will invest in coalition talks, given her desire to keep her political capital intact ahead of the 2027 presidential election. If her party leads a government that has a bumpy ride in office, it could reduce her chances of seizing the big prize.

See how complicated this political jockeying is? It sure as hell has nothing to do with trust.

And that’s not all.

Jews for Le Pen

Please note France’s Jews Consider the Unthinkable: Voting for a Party With an Antisemitic Past

Serge Klarsfeld is a world-renowned Nazi hunter, a historian of the Holocaust and a moral authority in France who has pushed the country to reckon with its dark history of antisemitism.

That is why many in France were shocked this week when Klarsfeld defended the far-right party of Marine Le Pen, which counts among its founders a former Nazi paramilitary soldier. Klarsfeld, an 88-year-old Holocaust survivor, said that the main threat to France’s Jews now comes from the far left and that he wouldn’t hesitate to vote for Le Pen’s party, the National Rally, in the coming parliamentary elections if the alternative were a coalition of leftist parties, the New Popular Front.

“The National Rally supports Jews, supports the state of Israel,” Klarsfeld said on national television. “When there is an anti-Jewish party and a pro-Jewish party, I will vote for the pro-Jewish party.”

“I never would have imagined voting in favor of the National Rally to blockade against antisemitism,” the writer Alain Finkielkraut told French magazine Le Point this month. “The current situation is heartbreaking for the Jews of France.”

Long Term Fiscal Issues

In addition to the Excessive Debt Proceedings against many countries, every EU county has defense spending issues, climate spending issues, and demographic issues as shown in the lead chart.

The lead chart is from the ECB report Longer-Term Challenges for Fiscal Policy in the Euro Area

In the future, various longer-term challenges are likely to exert pressure on public finances in the euro area. On top of the existing fiscal burdens – as reflected in the high debt ratios in a number of euro area countries, which were exacerbated by the pandemic and the subsequent energy crisis – there are several important longer-term challenges for fiscal dynamics. This article starts by reviewing some of the most important challenges and discussing their fiscal relevance, with a focus on demographic ageing (Section 2), the end of the “peace dividend” (Section 3), digitalisation (Section 4) and climate change (Section 5). Acknowledging the uncertainties surrounding any quantification of these challenges, Section 6 then presents some tentative – purely indicative – estimates of the additional fiscal effort that could be required to ensure the long-term sustainability of public finances in the presence of such developments. The implications of digitalisation are excluded from that exercise, given the particular uncertainty that surrounds their quantification. Section 7 then provides some concluding remarks.

As you can see, it’s a mess in may areas. Here are a few of them.

Fiscal Costs of Ageing Societies

The euro area is experiencing demographic ageing. The region is witnessing a significant decline in fertility rates, coupled with steady increases in life expectancy, resulting in an ageing population. At the level of the European Union as a whole, average remaining life expectancy at the age of 65 has increased over the last two decades, rising from 17.8 years in 2002 to 19.5 years in 2022

This demographic ageing presents challenges for government finances. With the number of elderly citizens increasing relative to the working-age population, pay‑as-you-go pension systems face mounting financial pressures. Furthermore, ageing populations typically require more extensive healthcare services and long‑term care.

Fiscal Costs of the End of the “Peace Dividend”

Macron wants an EU army and more support for Ukraine. How’s that supposed to happen?

Fiscal Effects of Climate Change

Transitioning to a low-carbon economy entails significant upfront costs and policy challenges. Mitigation measures (such as investment in renewable energy infrastructure, energy efficiency improvements and other emission reduction strategies) require substantial financial resources and long-term planning. Green investment, both public and private, will be essential in order to facilitate the transition to a sustainable economy.

Cumulative Impact – Lead Chart

Achieving a government debt-to-GDP ratio of 60% by 2070 from today’s debt levels would require euro area governments to immediately and permanently increase their primary balances by 2% of GDP on average.

Moreover, additional fiscal burdens may well emerge in the medium term. For instance, the model-based simulations used in this article exclude the digitalisation gap, the long-term implications of which are still hard to grasp. Furthermore, one does not need to go back very far in time to find a large fiscal shock appearing out of the blue: the euro area’s government debt-to-GDP ratio increased by a total of 13 percentage points in 2020 in response to the COVID-19 pandemic. At the same time, the simulation of climate change is based on simplified assumptions and on the unlikely premise that limiting global warming to 1.5°C is still feasible. It also does not capture the impact of societal repercussions (such as conflict), tipping points or macroeconomic effects (such as changes to prices and productivity). This suggests that there could be substantial additional fiscal costs associated with climate change.

Hoot of the Day

To achieve a government debt-to-GDP ratio of 60 percent, EU countries will have to reduce spending or raise taxes by 2 percent of GDP, on average, every year for 46 years.

That also presumes no recessions or other emergencies in that timeframe. And this is supposed to be a serious proposal.

Let’s just say it’s not going to happen. But these clowns are likely to try, if for no other reason than punish Le Pen.

Meanwhile, Back in the States

In case you missed it, please consider Why Angry Renters Will Decide the Election, Take II

Economists say wages are now rising faster than the CPI. That’s not true for those who rent or wish to buy a house.

Loading…