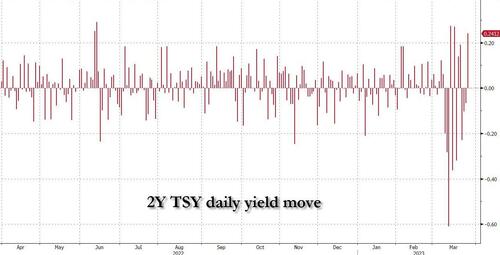

With 2Y yields swinging like a drunken sailor every day in the past three weeks, and regularly clocking at least 20bps in intraday moves as the bipolar market prices 4 rate cuts one day, and multiple rate hikes the next...

... it wasn't a stretch to expect that today's 2Y auction would be brutal, and it was.

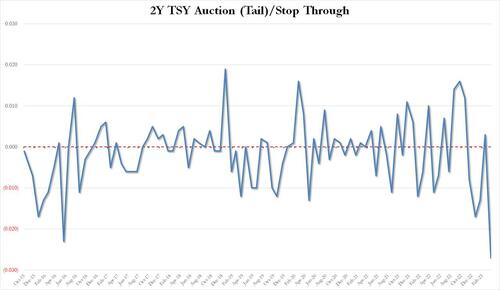

Pricing at a high yield of 3.954%, today's 2Y auction saw the lowest yield since the 3.31% in August, and was the first sub-4% yield since September. What was more notable, however, is that high yield tailed the When Issued 3.954% by a whopping 2.7bps, which was the biggest tail since our records began in October 2015.

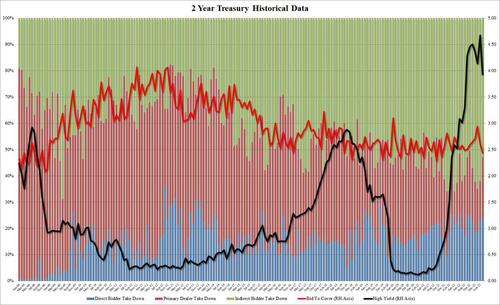

The bid to cover was also dismal, tumbling from 2.613 to 2.438, the lowest since Nov 2021; the internals were just as ugly with Indirects awarded just 52.8%, down sharply from 62.0% and far below the recent average of 58.3%. And with Directs awarded 24.2%, or not that far off the six-auction average, Dealers saw their take down soar to 23.03%, the highest since June 2022.

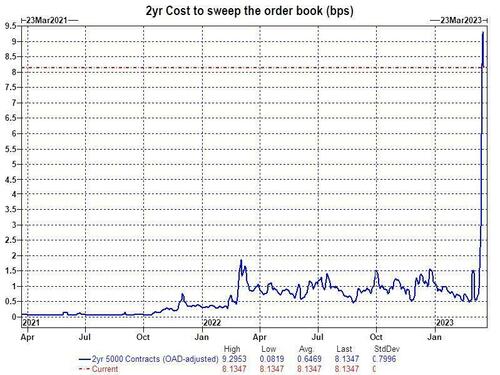

Overall, this was a surprisingly auction auction, which tailed by a record amount despite the huge concession into the 1pm deadline, which is most likely a function of the catastrophically low liquidity...

... and hence low investor demand - for the paper at a time when the market is perfectly torn whether we get even one more rate hike (latest odds of a 25bps hike were 50%) followed by multiple rate cuts... and how long until the next leg of the bank crisis claims the next victim.

With 2Y yields swinging like a drunken sailor every day in the past three weeks, and regularly clocking at least 20bps in intraday moves as the bipolar market prices 4 rate cuts one day, and multiple rate hikes the next…

… it wasn’t a stretch to expect that today’s 2Y auction would be brutal, and it was.

Pricing at a high yield of 3.954%, today’s 2Y auction saw the lowest yield since the 3.31% in August, and was the first sub-4% yield since September. What was more notable, however, is that high yield tailed the When Issued 3.954% by a whopping 2.7bps, which was the biggest tail since our records began in October 2015.

The bid to cover was also dismal, tumbling from 2.613 to 2.438, the lowest since Nov 2021; the internals were just as ugly with Indirects awarded just 52.8%, down sharply from 62.0% and far below the recent average of 58.3%. And with Directs awarded 24.2%, or not that far off the six-auction average, Dealers saw their take down soar to 23.03%, the highest since June 2022.

Overall, this was a surprisingly auction auction, which tailed by a record amount despite the huge concession into the 1pm deadline, which is most likely a function of the catastrophically low liquidity…

… and hence low investor demand – for the paper at a time when the market is perfectly torn whether we get even one more rate hike (latest odds of a 25bps hike were 50%) followed by multiple rate cuts… and how long until the next leg of the bank crisis claims the next victim.

Loading…