Authored by Doug Casey via the International Man,

International Man: Everyone knows that the US government has been bankrupt for many years. But we thought it might be instructive to see its current cash-flow situation.

The US government’s budget is the biggest in the history of the world and is growing at an uncontrollable rate.

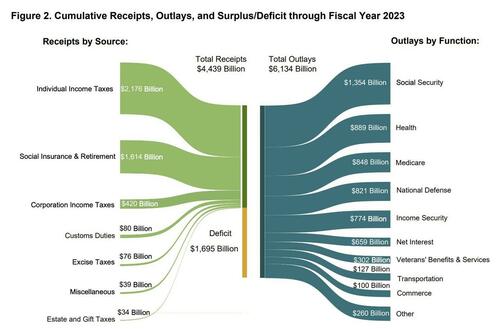

Below is a chart of the budget for the most recent fiscal year, which had a deficit of nearly $1.7 trillion.

Before we get into the specific items in the budget, what is your take on the Big Picture for the US budget?

Doug Casey: The biggest expenditure for the US government are so-called entitlements. It’s strange how the word “entitlements” has been legitimized. Are people really entitled to the government paying for their health, retirement, and welfare? In a moral society, the answer is: No. Entitlements destroy personal responsibility, legitimize theft, destroy wealth, and create antagonisms.

The fact is that once people have an “entitlement,” they come to rely on it, and you can’t easily take it away. The Chinese call that breaking somebody’s rice bowl. In the case of the American welfare state, it’s more a question of breaking a whipped dog’s doggy bowl. It’s a shame because many have come to rely on their mother, the State, not entirely through their own fault. The US has become pervasively corrupt.

The World Economic Forum (WEF)—a pox upon them—isn’t entirely incorrect when it arrogantly calls most people “useless mouths.” An increasing number produce absolutely nothing but only consume at the expense of others. Courtesy of the State.

There’s little doubt in my mind that the government’s expenses are going way up as people demand more. While receipts go down as the Greater Depression deepens. Which it will, as the economy is burdened by evermore taxes, regulations, and currency debasement. That’s on top of the gigantic debt the government and country are buried under.

The government reminds me of a poker player on tilt, betting more and more crazily in hope of magic or luck to bail him out. It always ends badly.

We’ve watched this progression accelerate since at least the 1960’s—a slow motion train wreck. But the inevitable has finally turned into the imminent.

International Man: What are your thoughts on Social Security, Health, and Medicare?

With an aging population, it seems politically impossible to make any meaningful cuts here. On the contrary, spending in these areas is likely to explode.

Doug Casey: They should be abolished. I’ve said this many times before, but it bears repeating as often as possible because everybody forgets the most basic of the basics. Namely, the government, as an instrument of force, should be limited to protecting people from physical force. And nothing else.

That implies a police system to defend people from force within, a military to defend against foreign aggressors, and a court system to allow people to adjudicate disputes without resorting to force. I’d further argue that those three things are so important to the conduct of a civil society that they shouldn’t be left to the kind of people who inevitably gravitate towards government. But that’s a different subject.

Looking at these three things you mentioned in particular, they’re complete disasters. They’re fiscally unsound, will bankrupt the US government, and, therefore, bankrupt the country itself, especially with an aging population.

Social Security seemed like a good idea at the time so that poor people wouldn’t be left totally without an income in old age. But the fact is that Social Security is a classic Ponzi scheme. Its taxes have gone from a trivial percentage to 12.4%.

It’s so high that people are on the bottom end of society, who it’s meant to help, are precluded from saving on their own. Social Security is both a practical and moral disaster.

As for Medicare, how is it your problem if another has failed to take care of his body? Your body is your primary possession. Should it also be your problem if somebody fails to take care of his car? Should the State fix all your property?

Should the government have anything to do with health? No. It’s strictly a matter of personal responsibility. Of course, if the State believes it owns you, like a milk cow, the cattle can expect food to show up, as will medicine if they get sick.

Government entitlement schemes encourage everyone to try to live at the expense of his neighbors. They’re intrinsically dehumanizing, corrupting, and degrading. They’re a bad deal all around.

International Man: With the most precarious geopolitical situation since World War 2, “National Defense” seems unlikely to be cut.

Instead, so-called defense spending is all but certain to increase.

What is your take?

Doug Casey: The United States’ “defense” spending exceeds that of the next 10 nations combined, including Russia and China. Most of that spending goes into the maw of five major defense companies. A decade or two ago, there used to be 30 or 40 defense companies. But they’ve now consolidated, the better to deal with Big Government.

They increasingly make only expensive high-tech weapons, which may prove totally useless in today’s environment. For instance, the US is currently suffering an invasion of feet people across the southern border—millions and millions of young males, of alien race, language, religion, and culture, in the last two years alone. We may yet wind up with a civil war in the US, on top of several insane foreign wars.

These high-tech weapons, in the process of bankrupting the US and enriching the defense establishment, will prove largely useless. Meanwhile, military personnel are being gutted. It’s no secret that the services can’t recruit enough people to keep their numbers where they want them. That’s in good measure because ESG and DEI have been insinuated throughout the military like slow-acting poisons. The military is no longer a meritocracy. Now, it’s critical to be the right color and gender. George Patton would quit in disgust.

On top of all that, defense spending is a provocation to other countries. It’s like waving around a giant golden hammer. They’re correctly afraid that everything has started to look like a nail to the US.

International Man: The net interest expense on the national debt was $659 billion in FY 2023, which is sure to rise.

The US government needs to roll over a significant portion of its existing debt issued when interest rates were 0% in an environment of much higher and rising rates.

What are your thoughts on this item?

Doug Casey: Interest on the debt is the next big thing, in addition to entitlements and out-of-control “defense” spending.

They used to say, “Don’t worry about the national debt; we owe it to ourselves,” which was always ridiculous because some specific people always owed it to other specific people.

But the US can no longer generate adequate capital to fund the government’s debt. And I hasten to point out that the government is not “We the People.” The government is a separate entity, with its own interests, as distinct as General Motors.

In the recent past, the national debt has been financed not by Americans, but by foreigners. At this point, however, foreigners no longer want to own the debt of a bankrupt entity whose currency is nothing but a floating abstraction. The government can only finance its debt by selling it to its central bank, the Fed, which creates new dollars to buy the debt.

As the dollar inevitably loses value, interest rates will rise. That’s regardless of what the Fed does or doesn’t want. The market will demand higher interest rates to finance the debt. You don’t want to own bonds.

International Man: US government expenses seem to have nowhere to go but up.

Is there any chance the US government can reform and return to a sustainable basis?

If not, what are the implications?

Doug Casey: The US government is bankrupt. It’s not just the official $34 trillion. The real number is several times higher, considering contingent liabilities. It’s probably more like $100 trillion. This debt will never be repaid. The US government is like Wiley Coyote after he runs off a cliff.

In addition, the average American is deeply in debt—student loans, mortgage debt, credit card debt, auto debt, and much more. The country is in big trouble. Frankly, there’s no practical way out at this point except to officially declare bankruptcy.

I realize serious change is impossible since the situation is so out of control. But here are six things to imagine—for a start:

1. Allow the collapse of all bankrupt entities. No bailouts, subsidies, or guarantees for banks, insurers, corporations, or anything.

There will be plenty in the coming years. Bailout money is always wasted. Most of the real wealth now owned by the bankrupt entities will still exist.

It will simply change ownership. But that’s not nearly enough. At this point, it would be a half-measure, a 3-foot rope over a 12-foot gap. If you allow the collapse of unprofitable enterprises without changing the conditions that created the problem, recovery is going to be even harder. So…

2. Deregulate. Contrary to what almost everyone thinks, the main purpose of regulation is not to protect consumers but to entrench the current order. Regulation prevents new institutions from arising quickly and cheaply.

Does the Department of Agriculture really need 100,000 employees to regulate fewer than two million farms in the US? Abolish it.

Has the Department of Energy, created in 1977 to somehow solve a temporary crisis, done anything of value with its 110,000 employees and contractors and $32 billion annual budget? Abolish it.

How about the terminally corrupt Bureau of Indian Affairs, which has outlived whatever usefulness it might have had by 100 years. Abolish it.

The FTC, SEC, FCC, FAA, DOT, HHS, HUD, Labor, Commerce, and many more, serve little or no useful public purpose. Eliminate them, and the entire economy would blossom – except for the parasitical lobbying and legal trades. There are hundreds of agencies like these. Most aren’t just useless. They’re actively destructive.

3. Abolish the Fed. This is the actual engine of inflation. Money is just a medium of exchange and a store of value; you don’t need a central bank to have money. In fact, central banks are always destructive. They benefit only the cronies who get their money first.

What would we use as money? It doesn’t matter as long as it’s a commodity that can’t be created out of thin air. Gold is the obvious choice. Bitcoin may turn out to be excellent.

The whole idea of a central bank is a swindle. Massive bailouts and optional wars can’t be done without it.

4. Cut taxes by 50%… to start. The economy would boom. The money won’t be needed with all the agencies gone. Certainly not if the next two points are followed.

5. Default on the national debt. I realize this is a shocker unless you recall that the debt will never be paid anyway. Why should the next several generations have to pay for the stupidity of their parents?

A default sounds dishonorable—and it is in civil society. But government is different. It hasn’t been “We the People” for a long time; it’s now a self-dealing behemoth run by cronies. It’s like a building with a rotten foundation—better to bring it down with a controlled demolition than wait for it fall unpredictably.

Governments default all the time, though most defaults are subtle, through inflation. In an outright default, however, the only people who get hurt are those who lent money to an institution that can only repay them by stealing money from others. They should be punished.

6. Disentangle and disengage. The entanglements the US needs to escape prominently include the UN and NATO. Spending could easily be cut 50%. The US combat troops now in over 100 foreign countries can come home. They’re not “defending” anything but local collaborators while picking up bad habits and antagonizing the locals. Spending on the military and its sport wars significantly adds to the economy’s problems.

Editor’s Note: The economic trajectory is troubling. Unfortunately, there’s little any individual can practically do to change the course of these trends in motion.

The best you can and should do is to stay informed so that you can protect yourself in the best way possible, and even profit from the situation.

That’s precisely why bestselling author Doug Casey and his colleagues just released an urgent new PDF report that explains what could come next and what you can do about it.

Authored by Doug Casey via the International Man,

International Man: Everyone knows that the US government has been bankrupt for many years. But we thought it might be instructive to see its current cash-flow situation.

The US government’s budget is the biggest in the history of the world and is growing at an uncontrollable rate.

Below is a chart of the budget for the most recent fiscal year, which had a deficit of nearly $1.7 trillion.

Before we get into the specific items in the budget, what is your take on the Big Picture for the US budget?

Doug Casey: The biggest expenditure for the US government are so-called entitlements. It’s strange how the word “entitlements” has been legitimized. Are people really entitled to the government paying for their health, retirement, and welfare? In a moral society, the answer is: No. Entitlements destroy personal responsibility, legitimize theft, destroy wealth, and create antagonisms.

The fact is that once people have an “entitlement,” they come to rely on it, and you can’t easily take it away. The Chinese call that breaking somebody’s rice bowl. In the case of the American welfare state, it’s more a question of breaking a whipped dog’s doggy bowl. It’s a shame because many have come to rely on their mother, the State, not entirely through their own fault. The US has become pervasively corrupt.

The World Economic Forum (WEF)—a pox upon them—isn’t entirely incorrect when it arrogantly calls most people “useless mouths.” An increasing number produce absolutely nothing but only consume at the expense of others. Courtesy of the State.

There’s little doubt in my mind that the government’s expenses are going way up as people demand more. While receipts go down as the Greater Depression deepens. Which it will, as the economy is burdened by evermore taxes, regulations, and currency debasement. That’s on top of the gigantic debt the government and country are buried under.

The government reminds me of a poker player on tilt, betting more and more crazily in hope of magic or luck to bail him out. It always ends badly.

We’ve watched this progression accelerate since at least the 1960’s—a slow motion train wreck. But the inevitable has finally turned into the imminent.

International Man: What are your thoughts on Social Security, Health, and Medicare?

With an aging population, it seems politically impossible to make any meaningful cuts here. On the contrary, spending in these areas is likely to explode.

Doug Casey: They should be abolished. I’ve said this many times before, but it bears repeating as often as possible because everybody forgets the most basic of the basics. Namely, the government, as an instrument of force, should be limited to protecting people from physical force. And nothing else.

That implies a police system to defend people from force within, a military to defend against foreign aggressors, and a court system to allow people to adjudicate disputes without resorting to force. I’d further argue that those three things are so important to the conduct of a civil society that they shouldn’t be left to the kind of people who inevitably gravitate towards government. But that’s a different subject.

Looking at these three things you mentioned in particular, they’re complete disasters. They’re fiscally unsound, will bankrupt the US government, and, therefore, bankrupt the country itself, especially with an aging population.

Social Security seemed like a good idea at the time so that poor people wouldn’t be left totally without an income in old age. But the fact is that Social Security is a classic Ponzi scheme. Its taxes have gone from a trivial percentage to 12.4%.

It’s so high that people are on the bottom end of society, who it’s meant to help, are precluded from saving on their own. Social Security is both a practical and moral disaster.

As for Medicare, how is it your problem if another has failed to take care of his body? Your body is your primary possession. Should it also be your problem if somebody fails to take care of his car? Should the State fix all your property?

Should the government have anything to do with health? No. It’s strictly a matter of personal responsibility. Of course, if the State believes it owns you, like a milk cow, the cattle can expect food to show up, as will medicine if they get sick.

Government entitlement schemes encourage everyone to try to live at the expense of his neighbors. They’re intrinsically dehumanizing, corrupting, and degrading. They’re a bad deal all around.

International Man: With the most precarious geopolitical situation since World War 2, “National Defense” seems unlikely to be cut.

Instead, so-called defense spending is all but certain to increase.

What is your take?

Doug Casey: The United States’ “defense” spending exceeds that of the next 10 nations combined, including Russia and China. Most of that spending goes into the maw of five major defense companies. A decade or two ago, there used to be 30 or 40 defense companies. But they’ve now consolidated, the better to deal with Big Government.

They increasingly make only expensive high-tech weapons, which may prove totally useless in today’s environment. For instance, the US is currently suffering an invasion of feet people across the southern border—millions and millions of young males, of alien race, language, religion, and culture, in the last two years alone. We may yet wind up with a civil war in the US, on top of several insane foreign wars.

These high-tech weapons, in the process of bankrupting the US and enriching the defense establishment, will prove largely useless. Meanwhile, military personnel are being gutted. It’s no secret that the services can’t recruit enough people to keep their numbers where they want them. That’s in good measure because ESG and DEI have been insinuated throughout the military like slow-acting poisons. The military is no longer a meritocracy. Now, it’s critical to be the right color and gender. George Patton would quit in disgust.

On top of all that, defense spending is a provocation to other countries. It’s like waving around a giant golden hammer. They’re correctly afraid that everything has started to look like a nail to the US.

International Man: The net interest expense on the national debt was $659 billion in FY 2023, which is sure to rise.

The US government needs to roll over a significant portion of its existing debt issued when interest rates were 0% in an environment of much higher and rising rates.

What are your thoughts on this item?

Doug Casey: Interest on the debt is the next big thing, in addition to entitlements and out-of-control “defense” spending.

They used to say, “Don’t worry about the national debt; we owe it to ourselves,” which was always ridiculous because some specific people always owed it to other specific people.

But the US can no longer generate adequate capital to fund the government’s debt. And I hasten to point out that the government is not “We the People.” The government is a separate entity, with its own interests, as distinct as General Motors.

In the recent past, the national debt has been financed not by Americans, but by foreigners. At this point, however, foreigners no longer want to own the debt of a bankrupt entity whose currency is nothing but a floating abstraction. The government can only finance its debt by selling it to its central bank, the Fed, which creates new dollars to buy the debt.

As the dollar inevitably loses value, interest rates will rise. That’s regardless of what the Fed does or doesn’t want. The market will demand higher interest rates to finance the debt. You don’t want to own bonds.

International Man: US government expenses seem to have nowhere to go but up.

Is there any chance the US government can reform and return to a sustainable basis?

If not, what are the implications?

Doug Casey: The US government is bankrupt. It’s not just the official $34 trillion. The real number is several times higher, considering contingent liabilities. It’s probably more like $100 trillion. This debt will never be repaid. The US government is like Wiley Coyote after he runs off a cliff.

In addition, the average American is deeply in debt—student loans, mortgage debt, credit card debt, auto debt, and much more. The country is in big trouble. Frankly, there’s no practical way out at this point except to officially declare bankruptcy.

I realize serious change is impossible since the situation is so out of control. But here are six things to imagine—for a start:

1. Allow the collapse of all bankrupt entities. No bailouts, subsidies, or guarantees for banks, insurers, corporations, or anything.

There will be plenty in the coming years. Bailout money is always wasted. Most of the real wealth now owned by the bankrupt entities will still exist.

It will simply change ownership. But that’s not nearly enough. At this point, it would be a half-measure, a 3-foot rope over a 12-foot gap. If you allow the collapse of unprofitable enterprises without changing the conditions that created the problem, recovery is going to be even harder. So…

2. Deregulate. Contrary to what almost everyone thinks, the main purpose of regulation is not to protect consumers but to entrench the current order. Regulation prevents new institutions from arising quickly and cheaply.

Does the Department of Agriculture really need 100,000 employees to regulate fewer than two million farms in the US? Abolish it.

Has the Department of Energy, created in 1977 to somehow solve a temporary crisis, done anything of value with its 110,000 employees and contractors and $32 billion annual budget? Abolish it.

How about the terminally corrupt Bureau of Indian Affairs, which has outlived whatever usefulness it might have had by 100 years. Abolish it.

The FTC, SEC, FCC, FAA, DOT, HHS, HUD, Labor, Commerce, and many more, serve little or no useful public purpose. Eliminate them, and the entire economy would blossom – except for the parasitical lobbying and legal trades. There are hundreds of agencies like these. Most aren’t just useless. They’re actively destructive.

3. Abolish the Fed. This is the actual engine of inflation. Money is just a medium of exchange and a store of value; you don’t need a central bank to have money. In fact, central banks are always destructive. They benefit only the cronies who get their money first.

What would we use as money? It doesn’t matter as long as it’s a commodity that can’t be created out of thin air. Gold is the obvious choice. Bitcoin may turn out to be excellent.

The whole idea of a central bank is a swindle. Massive bailouts and optional wars can’t be done without it.

4. Cut taxes by 50%… to start. The economy would boom. The money won’t be needed with all the agencies gone. Certainly not if the next two points are followed.

5. Default on the national debt. I realize this is a shocker unless you recall that the debt will never be paid anyway. Why should the next several generations have to pay for the stupidity of their parents?

A default sounds dishonorable—and it is in civil society. But government is different. It hasn’t been “We the People” for a long time; it’s now a self-dealing behemoth run by cronies. It’s like a building with a rotten foundation—better to bring it down with a controlled demolition than wait for it fall unpredictably.

Governments default all the time, though most defaults are subtle, through inflation. In an outright default, however, the only people who get hurt are those who lent money to an institution that can only repay them by stealing money from others. They should be punished.

6. Disentangle and disengage. The entanglements the US needs to escape prominently include the UN and NATO. Spending could easily be cut 50%. The US combat troops now in over 100 foreign countries can come home. They’re not “defending” anything but local collaborators while picking up bad habits and antagonizing the locals. Spending on the military and its sport wars significantly adds to the economy’s problems.

Editor’s Note: The economic trajectory is troubling. Unfortunately, there’s little any individual can practically do to change the course of these trends in motion.

The best you can and should do is to stay informed so that you can protect yourself in the best way possible, and even profit from the situation.

That’s precisely why bestselling author Doug Casey and his colleagues just released an urgent new PDF report that explains what could come next and what you can do about it.

Loading…