US Macro Surprise data slumped for the 5th straight week, back into negative territory at its weakest weekly close since Nov 2021...

Source: Bloomberg

China 'stimulus' (cutting only 5Y prime rates) overnight offered some hope against the relentless tightening of financial conditions by The Fed and that buoyed stocks ahead of the open (and OpEx). But that all ended after the cash open (OpEx) and what had been a relatively calm week of selloffs turned more violent as gamma expired away and stocks puked. Then as the final drips of gamma were wrung out into the close, stocks went literally vertical with The Dow and S&P briefly tagging unchanged...

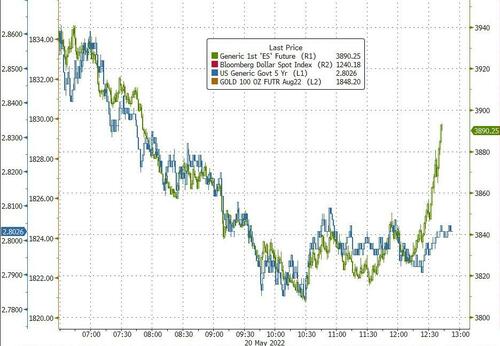

So futures started falling at 0500ET, accelerated lower the open around 0930ET, bottomed for the day at 1330ET, then in the last 30 minutes of the day, ramped it all back.

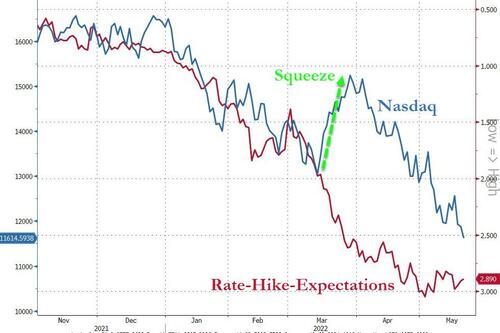

On the week, Nasdaq was the biggest loser, down almost 5%...

In the last 8 weeks, following that late-March meltup, The Dow is down 13% and Nasdaq -25%...

Source: Bloomberg

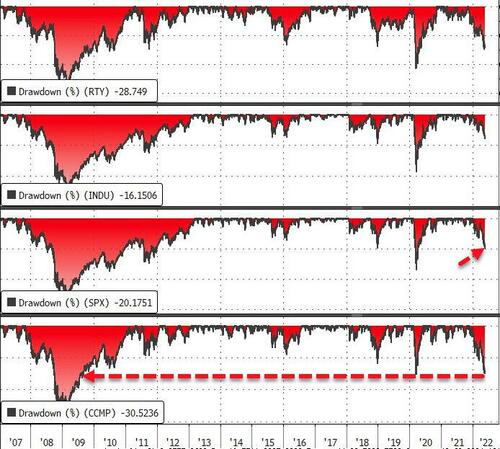

The S&P is now in a bear market, along with Small Caps and Nasdaq, which is suffering its biggest drawdown since the great financial crisis...

Source: Bloomberg

In the last 30 mins of the day, the machines tried to get back above the key 3855 'bear market' level for the S&P

Source: Bloomberg

Some context for this move in stocks, completely decoupled from bonds and FX...

Source: Bloomberg

It's been a tough day, week, month for some...

You said at opening today there was gonna be a rally lmfao

— Clayton (@Zolruh) May 20, 2022

And we entered the technical definition of a bear market an hour after you said that

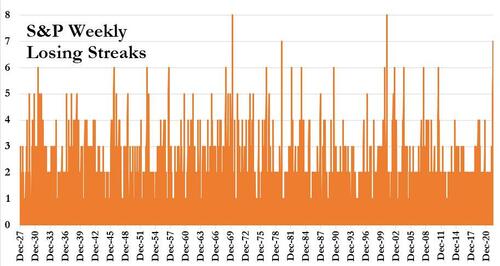

S&P is down 7 straight weeks, its longest losing-streak since March 2001.

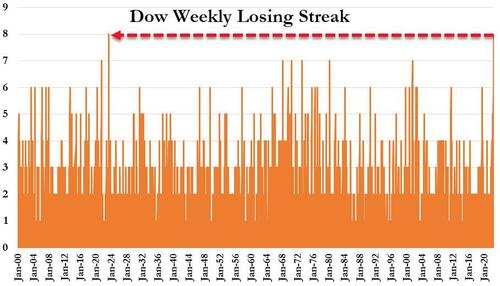

Dow is down 8 straight weeks, its longest losing-streak since May 1923.

The S&P broke below 3855, down 20% from its record highs to its lowest since March 2021, testing below the Fib 38.2% retracement of the post-COVID crash rally level at 3815...

Source: Bloomberg

FANG stocks have fallen for 8 straight weeks, seeing over $ 2 trillion in market cap erased from record highs (over $220 billion this week alone)...

Source: Bloomberg

The last week saw a significant regime shift in the stock-bond relationship...

Source: Bloomberg

VIX rose on the week (most notably after the VIXpiration) but remains decoupled from stocks...

Source: Bloomberg

Still a little more to go before it's "priced in"...

Source: Bloomberg

two hikes in and we are at a bear market, and QT hasn't even started.

— zerohedge (@zerohedge) May 20, 2022

"9 or 10 hikes more" pic.twitter.com/AY0ASDggqw

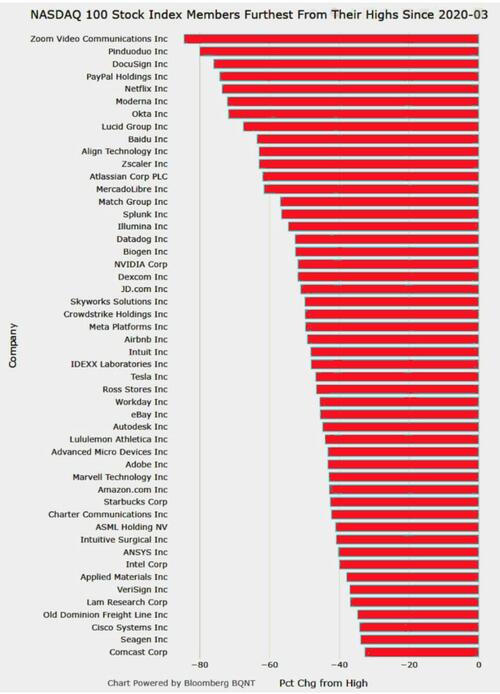

And here are the biggest loser from their post-COVID highs...

Source: Bloomberg

Treasuries were notably bid this week, led by the longer-end

Source: Bloomberg

...as the curve flattened significantly...

Source: Bloomberg

10Y yields tagged 3.00% during the week and then puked back lower, to their lowest close in a month

Source: Bloomberg

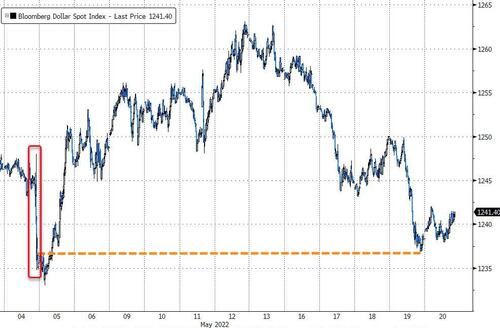

The dollar suffered its first weekly drop in 8 weeks and the biggest weekly drop since the election in Nov 2020...(finding support at the spike lows from FOMC meeting)...

Source: Bloomberg

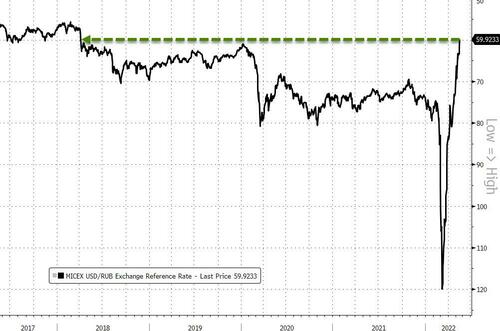

Meanwhile, the Ruble soared to greater than 4 year highs against the dollar (and 7 year highs against the euro)...

Source: Bloomberg

Bitcoin ended the week lower from last Friday's "close" but has traded in a relatively narrow range since then (albeit trading at the lows of that range now, back below $30k)...

Source: Bloomberg

Gold had a solid week amid the weaker dollar, bouncing off $1800 twice...

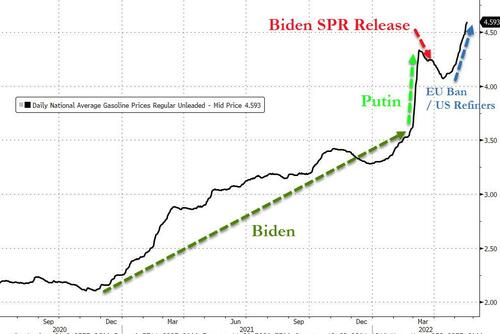

Oil prices also rallied once again - as Biden's SPR release actually began - with WTI closing back above $110...

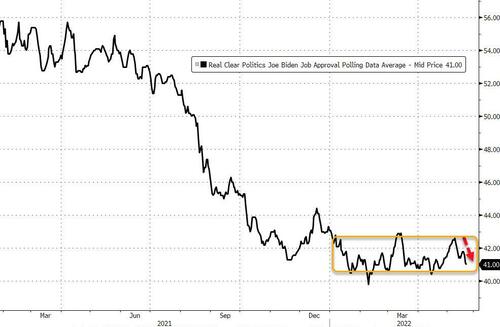

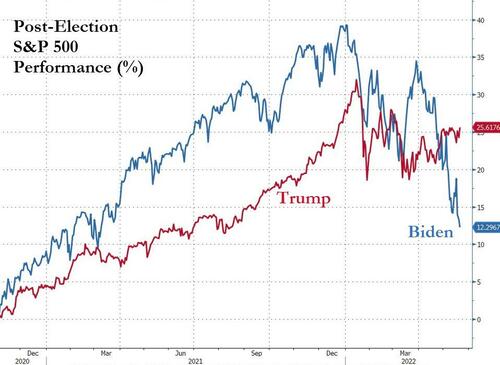

Finally, we wonder which Biden's polls will find more problematic...

Source: Bloomberg

A bear market in stocks...

Source: Bloomberg

Or record high and surging gas prices...

Source: Bloomberg

But, hey, at least we don't get 'mean tweets' anymore, right?

US Macro Surprise data slumped for the 5th straight week, back into negative territory at its weakest weekly close since Nov 2021…

Source: Bloomberg

China ‘stimulus’ (cutting only 5Y prime rates) overnight offered some hope against the relentless tightening of financial conditions by The Fed and that buoyed stocks ahead of the open (and OpEx). But that all ended after the cash open (OpEx) and what had been a relatively calm week of selloffs turned more violent as gamma expired away and stocks puked. Then as the final drips of gamma were wrung out into the close, stocks went literally vertical with The Dow and S&P briefly tagging unchanged…

So futures started falling at 0500ET, accelerated lower the open around 0930ET, bottomed for the day at 1330ET, then in the last 30 minutes of the day, ramped it all back.

On the week, Nasdaq was the biggest loser, down almost 5%…

In the last 8 weeks, following that late-March meltup, The Dow is down 13% and Nasdaq -25%…

Source: Bloomberg

The S&P is now in a bear market, along with Small Caps and Nasdaq, which is suffering its biggest drawdown since the great financial crisis…

Source: Bloomberg

In the last 30 mins of the day, the machines tried to get back above the key 3855 ‘bear market’ level for the S&P

Source: Bloomberg

Some context for this move in stocks, completely decoupled from bonds and FX…

Source: Bloomberg

It’s been a tough day, week, month for some…

You said at opening today there was gonna be a rally lmfao

And we entered the technical definition of a bear market an hour after you said that

— Clayton (@Zolruh) May 20, 2022

S&P is down 7 straight weeks, its longest losing-streak since March 2001.

Dow is down 8 straight weeks, its longest losing-streak since May 1923.

The S&P broke below 3855, down 20% from its record highs to its lowest since March 2021, testing below the Fib 38.2% retracement of the post-COVID crash rally level at 3815…

Source: Bloomberg

FANG stocks have fallen for 8 straight weeks, seeing over $ 2 trillion in market cap erased from record highs (over $220 billion this week alone)…

Source: Bloomberg

The last week saw a significant regime shift in the stock-bond relationship…

Source: Bloomberg

VIX rose on the week (most notably after the VIXpiration) but remains decoupled from stocks…

Source: Bloomberg

Still a little more to go before it’s “priced in”…

Source: Bloomberg

two hikes in and we are at a bear market, and QT hasn’t even started.

“9 or 10 hikes more” pic.twitter.com/AY0ASDggqw

— zerohedge (@zerohedge) May 20, 2022

And here are the biggest loser from their post-COVID highs…

Source: Bloomberg

Treasuries were notably bid this week, led by the longer-end

Source: Bloomberg

…as the curve flattened significantly…

Source: Bloomberg

10Y yields tagged 3.00% during the week and then puked back lower, to their lowest close in a month

Source: Bloomberg

The dollar suffered its first weekly drop in 8 weeks and the biggest weekly drop since the election in Nov 2020…(finding support at the spike lows from FOMC meeting)…

Source: Bloomberg

Meanwhile, the Ruble soared to greater than 4 year highs against the dollar (and 7 year highs against the euro)…

Source: Bloomberg

Bitcoin ended the week lower from last Friday’s “close” but has traded in a relatively narrow range since then (albeit trading at the lows of that range now, back below $30k)…

Source: Bloomberg

Gold had a solid week amid the weaker dollar, bouncing off $1800 twice…

Oil prices also rallied once again – as Biden’s SPR release actually began – with WTI closing back above $110…

Finally, we wonder which Biden’s polls will find more problematic…

Source: Bloomberg

A bear market in stocks…

Source: Bloomberg

Or record high and surging gas prices…

Source: Bloomberg

But, hey, at least we don’t get ‘mean tweets’ anymore, right?