By John Kemp, senior market analyst

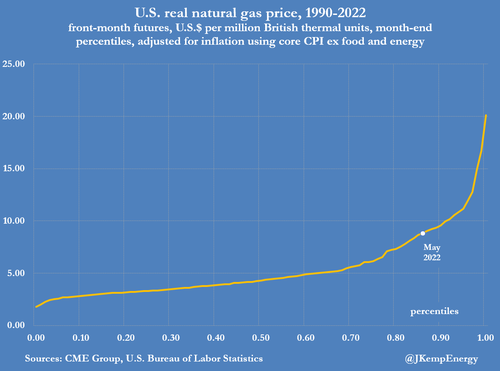

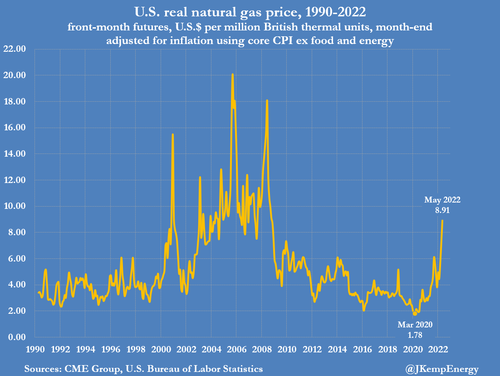

U.S. gas prices have climbed to the highest for more than 13 years as inventories remain well below average while the drought and lack of hydro generation threatens to stretch them even further. Front-month futures prices for gas delivered at Henry Hub in Louisiana have climbed to around $9 per million British thermal units, up from $3 at the same point a year ago.

Prices are the highest after adjusting for inflation since October 2008, when the financial crisis was intensifying and the economy was heading deeper into the great recession.

In real terms, front-month prices are in the 86th percentile for all months since 1990, signalling the need for significant steps to relieve the gas shortage.

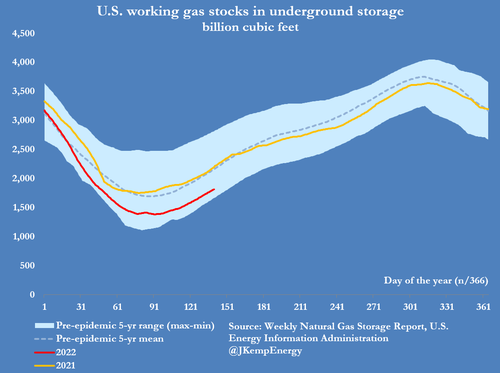

Last week, working stocks in underground storage were 348 billion cubic feet (16%) below the pre-pandemic five-year seasonal average (“Weekly natural gas storage report”, Energy Information Administration, May 26).

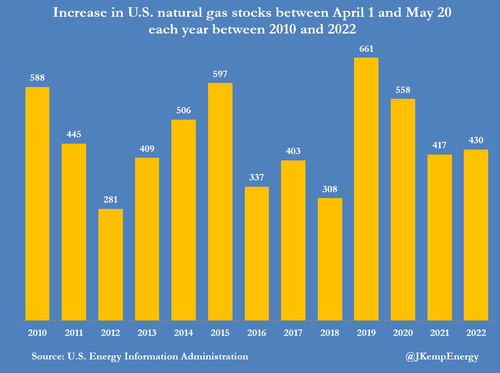

Inventories increased by just 430 bcf between April 1 and May 20, below the pre-pandemic seasonal average of 461 bcf, so the storage deficit is increasing rather than reducing.

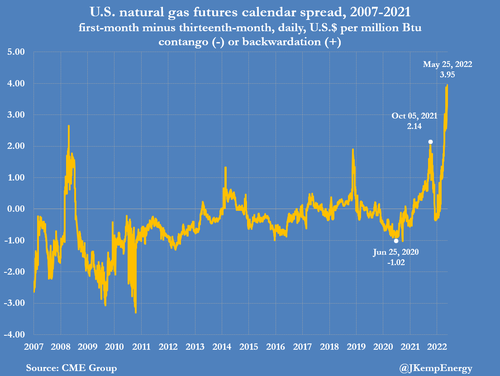

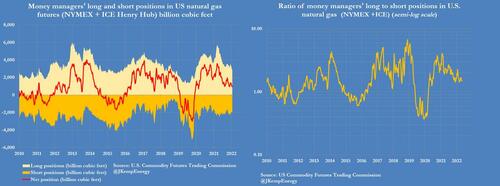

The result is that the one-year calendar spread has moved into a record backwardation of almost $4 per million British thermal units as traders anticipate stocks will remain tight.

High prices signal the need to reduce consumption, including by switching from gas-fired to coal-fired generation as much as possible, while maximising drilling and production.

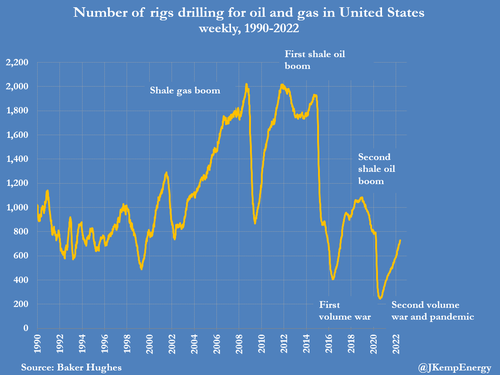

The total number of rigs drilling for gas has climbed to 150, the highest since late 2019, and up from just 100 this time a year ago, according to field services company Baker Hughes. The number of oil rigs, which produce associated gas as a by-product, has climbed to 576, up from 343 a year ago, and the highest since just before the first wave of the pandemic arrived in early 2020.

Increased drilling should ensure gas production continues increasing throughout the rest of this year and into the first quarter of 2023.

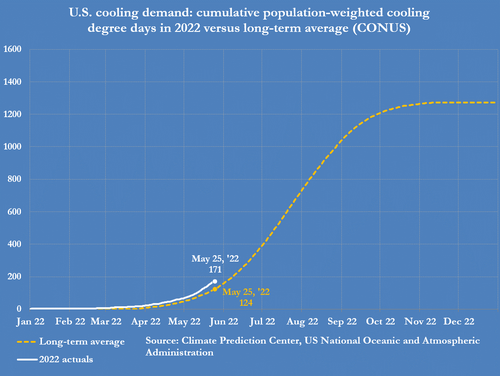

But the last two months have been hotter-than-normal for the time of year boosting air-conditioning and refrigeration demand. The Lower 48 states have experienced a total of 171 population-weighted cooling degree days so far this year compared with a long-term seasonal average of 124.

At the same time, the worsening drought across the western states is cutting power generation from hydro-electric sources and increasing reliance on gas-fired generators. In California, drought could cut hydro to just 8% of total generation, from a median of 15% in recent years, according to the EIA.

Increased gas-fired generation is likely to make up around half the shortfall (“Drought effects on California electricity generation and western power markets”, EIA, May 2022).

Large volumes of gas will also continue to be exported in the form of LNG to Europe and Asia to cover high demand in those regions, especially for alternatives to Russian gas, tightening the market further.

Traders expect the market to remain tight, with exceptionally high prices signalling the need for even more drilling and running non-gas generation units for as many hours as possible this summer.

By John Kemp, senior market analyst

U.S. gas prices have climbed to the highest for more than 13 years as inventories remain well below average while the drought and lack of hydro generation threatens to stretch them even further. Front-month futures prices for gas delivered at Henry Hub in Louisiana have climbed to around $9 per million British thermal units, up from $3 at the same point a year ago.

Prices are the highest after adjusting for inflation since October 2008, when the financial crisis was intensifying and the economy was heading deeper into the great recession.

In real terms, front-month prices are in the 86th percentile for all months since 1990, signalling the need for significant steps to relieve the gas shortage.

Last week, working stocks in underground storage were 348 billion cubic feet (16%) below the pre-pandemic five-year seasonal average (“Weekly natural gas storage report”, Energy Information Administration, May 26).

Inventories increased by just 430 bcf between April 1 and May 20, below the pre-pandemic seasonal average of 461 bcf, so the storage deficit is increasing rather than reducing.

The result is that the one-year calendar spread has moved into a record backwardation of almost $4 per million British thermal units as traders anticipate stocks will remain tight.

High prices signal the need to reduce consumption, including by switching from gas-fired to coal-fired generation as much as possible, while maximising drilling and production.

The total number of rigs drilling for gas has climbed to 150, the highest since late 2019, and up from just 100 this time a year ago, according to field services company Baker Hughes. The number of oil rigs, which produce associated gas as a by-product, has climbed to 576, up from 343 a year ago, and the highest since just before the first wave of the pandemic arrived in early 2020.

Increased drilling should ensure gas production continues increasing throughout the rest of this year and into the first quarter of 2023.

But the last two months have been hotter-than-normal for the time of year boosting air-conditioning and refrigeration demand. The Lower 48 states have experienced a total of 171 population-weighted cooling degree days so far this year compared with a long-term seasonal average of 124.

At the same time, the worsening drought across the western states is cutting power generation from hydro-electric sources and increasing reliance on gas-fired generators. In California, drought could cut hydro to just 8% of total generation, from a median of 15% in recent years, according to the EIA.

Increased gas-fired generation is likely to make up around half the shortfall (“Drought effects on California electricity generation and western power markets”, EIA, May 2022).

Large volumes of gas will also continue to be exported in the form of LNG to Europe and Asia to cover high demand in those regions, especially for alternatives to Russian gas, tightening the market further.

Traders expect the market to remain tight, with exceptionally high prices signalling the need for even more drilling and running non-gas generation units for as many hours as possible this summer.