By Natalia Kniazhevich, Bloomberg Markets Live analyst and reporter

As oil prices have climbed to around $110 a barrel, US producers have been restarting projects that had stalled.

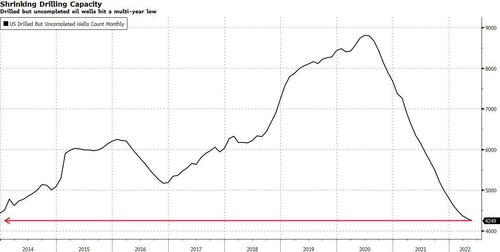

They’re starting to run low on these extra wells, which could limit future domestic production.

The number of drilled but not completed oil wells -- also known as DUCs -- has been shrinking for almost two years, and is now at its lowest level since the series started at the end of 2013.

The oil production process involves, at a high level, two separate steps: drilling and fracking. When a company drills a well it can leave it uncompleted, which happens when oil prices are low. That’s exactly what we saw during the early part of the pandemic.

When prices, like now, are soaring, companies complete wells and begin to extract crude. But with a limited number of DUCs left, drilling more oil in the US will involve tapping more new wells, a harder process for companies facing pressure to meet ESG targets and maintain capital discipline.

By Natalia Kniazhevich, Bloomberg Markets Live analyst and reporter

As oil prices have climbed to around $110 a barrel, US producers have been restarting projects that had stalled.

They’re starting to run low on these extra wells, which could limit future domestic production.

The number of drilled but not completed oil wells — also known as DUCs — has been shrinking for almost two years, and is now at its lowest level since the series started at the end of 2013.

The oil production process involves, at a high level, two separate steps: drilling and fracking. When a company drills a well it can leave it uncompleted, which happens when oil prices are low. That’s exactly what we saw during the early part of the pandemic.

When prices, like now, are soaring, companies complete wells and begin to extract crude. But with a limited number of DUCs left, drilling more oil in the US will involve tapping more new wells, a harder process for companies facing pressure to meet ESG targets and maintain capital discipline.