And so, the second G7 central bank to launch an easing cycle in the past 24 hours (the BOC was the first) is in the history books.

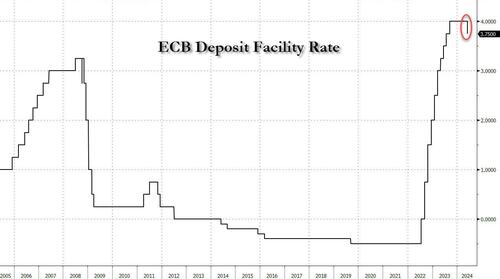

Moments ago the ECB confirmed that, as widely previewed and expected, it cut rates by 25bps as follows:

- ECB Cuts Deposit Facility Rate by 25bps to 3.75%; Est. 3.75%

- ECB Cuts Main Refinancing Rate by 25bps to 4.25%; Est. 4.25%

- ECB Cuts Marginal Lending Facility Rate by 25bps to 4.50%; Est. 4.50%

Commenting in its statement on the first ECB rate cut since 2019, the central bank said that "based on an updated assessment of the inflation outlook, the dynamics of underlying inflation and the strength of monetary policy transmission, it is now appropriate to moderate the degree of monetary policy restriction after nine months of holding rates steady. Since the Governing Council meeting in September 2023, inflation has fallen by more than 2.5 percentage points and the inflation outlook has improved markedly. Underlying inflation has also eased, reinforcing the signs that price pressures have weakened, and inflation expectations have declined at all horizons. Monetary policy has kept financing conditions restrictive. By dampening demand and keeping inflation expectations well anchored, this has made a major contribution to bringing inflation back down."

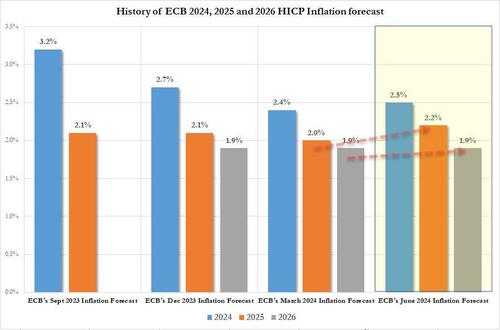

At the same time, despite the progress over recent quarters, the ECB noted that "domestic price pressures remain strong as wage growth is elevated, and inflation is likely to stay above target well into next year. The latest Eurosystem staff projections for both headline and core inflation have been revised up for 2024 and 2025 compared with the March projections. Staff now see headline inflation averaging 2.5% in 2024, 2.2% in 2025 and 1.9% in 2026. For inflation excluding energy and food, staff project an average of 2.8% in 2024, 2.2% in 2025 and 2.0% in 2026. Economic growth is expected to pick up to 0.9% in 2024, 1.4% in 2025 and 1.6% in 2026."

Translation: goodbye 2% inflation target.

Finally, in conclusion for those expecting guidance about more rate cuts, this is how the ECB previewed its next actions:

The Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner. It will keep policy rates sufficiently restrictive for as long as necessary to achieve this aim. The Governing Council will continue to follow a data-dependent and meeting-by-meeting approach to determining the appropriate level and duration of restriction. In particular, its interest rate decisions will be based on its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation and the strength of monetary policy transmission. The Governing Council is not pre-committing to a particular rate path.

Also of note, here are the ECB’s new economic projections:

- ECB Sees 2025 Inflation at 2.2%; Prior Forecast 2%

- ECB Sees 2026 Inflation at 1.9%; Prior Forecast 1.9%

Yes, the ECB raised its 2025 inflation target as it cuts rates.

Bottom line: no surprises, with the ECB cutting rates as expected, and remaining murky on the future, but the take home message is clear: any 2% inflation target the central bank may have had is dead.

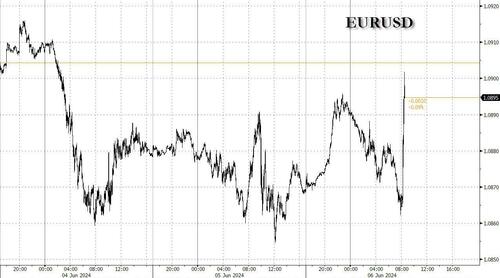

The market reaction was generally as expected, with the lack of dovish guidance lifting the EURUSD from 1.0863 to 1.09 over the course of 10-minutes.

At the same time, Bund Sep'24 fell from 131.14 to 130.93 before then extending to a trough of 130.82 around eight minutes later. BTP-Bund yield spread has widened modestly from around 129bp to just over 130bp.

Equities also came under pressure: the Dax Jun'24 fell from 18739 to 18711 and then slipping further to 18686 10-minutes later

Summarizing the decision, Newsquawk writes that overall, the decision was largely as expected with the ECB cutting by 25bp and not committing to any rate path with decision ahead to be data-dependent and meeting-by-meeting. The details from the statement (see below) err on the hawkish side and as such, thus far. the ECB can be described as a hawkish-cut with data-dependence taking centre stage.

Within the statement the ECB acknowledged that the outlook for inflation has improved markedly, however despite recent progress ‘ domestic price pressures remain strong as wage growth is elevated, and inflation is likely to stay above target well into next year.' Furthermore, the ECB continues to pledge to keep policy “sufficiently restrictive for as long as necessary to attain the 2% goal. On that. HICP forecasts were lifted for 2024 and 2025 on the headline and both by more than expected, with the core views also raised as well. Furthermore, the 2026 GDP view was maintained defying some calls for a moderation.

And so, the second G7 central bank to launch an easing cycle in the past 24 hours (the BOC was the first) is in the history books.

Moments ago the ECB confirmed that, as widely previewed and expected, it cut rates by 25bps as follows:

- ECB Cuts Deposit Facility Rate by 25bps to 3.75%; Est. 3.75%

- ECB Cuts Main Refinancing Rate by 25bps to 4.25%; Est. 4.25%

- ECB Cuts Marginal Lending Facility Rate by 25bps to 4.50%; Est. 4.50%

Commenting in its statement on the first ECB rate cut since 2019, the central bank said that “based on an updated assessment of the inflation outlook, the dynamics of underlying inflation and the strength of monetary policy transmission, it is now appropriate to moderate the degree of monetary policy restriction after nine months of holding rates steady. Since the Governing Council meeting in September 2023, inflation has fallen by more than 2.5 percentage points and the inflation outlook has improved markedly. Underlying inflation has also eased, reinforcing the signs that price pressures have weakened, and inflation expectations have declined at all horizons. Monetary policy has kept financing conditions restrictive. By dampening demand and keeping inflation expectations well anchored, this has made a major contribution to bringing inflation back down.”

At the same time, despite the progress over recent quarters, the ECB noted that “domestic price pressures remain strong as wage growth is elevated, and inflation is likely to stay above target well into next year. The latest Eurosystem staff projections for both headline and core inflation have been revised up for 2024 and 2025 compared with the March projections. Staff now see headline inflation averaging 2.5% in 2024, 2.2% in 2025 and 1.9% in 2026. For inflation excluding energy and food, staff project an average of 2.8% in 2024, 2.2% in 2025 and 2.0% in 2026. Economic growth is expected to pick up to 0.9% in 2024, 1.4% in 2025 and 1.6% in 2026.”

Translation: goodbye 2% inflation target.

Finally, in conclusion for those expecting guidance about more rate cuts, this is how the ECB previewed its next actions:

The Governing Council is determined to ensure that inflation returns to its 2% medium-term target in a timely manner. It will keep policy rates sufficiently restrictive for as long as necessary to achieve this aim. The Governing Council will continue to follow a data-dependent and meeting-by-meeting approach to determining the appropriate level and duration of restriction. In particular, its interest rate decisions will be based on its assessment of the inflation outlook in light of the incoming economic and financial data, the dynamics of underlying inflation and the strength of monetary policy transmission. The Governing Council is not pre-committing to a particular rate path.

Also of note, here are the ECB’s new economic projections:

- ECB Sees 2025 Inflation at 2.2%; Prior Forecast 2%

- ECB Sees 2026 Inflation at 1.9%; Prior Forecast 1.9%

Yes, the ECB raised its 2025 inflation target as it cuts rates.

Bottom line: no surprises, with the ECB cutting rates as expected, and remaining murky on the future, but the take home message is clear: any 2% inflation target the central bank may have had is dead.

The market reaction was generally as expected, with the lack of dovish guidance lifting the EURUSD from 1.0863 to 1.09 over the course of 10-minutes.

At the same time, Bund Sep’24 fell from 131.14 to 130.93 before then extending to a trough of 130.82 around eight minutes later. BTP-Bund yield spread has widened modestly from around 129bp to just over 130bp.

Equities also came under pressure: the Dax Jun’24 fell from 18739 to 18711 and then slipping further to 18686 10-minutes later

Summarizing the decision, Newsquawk writes that overall, the decision was largely as expected with the ECB cutting by 25bp and not committing to any rate path with decision ahead to be data-dependent and meeting-by-meeting. The details from the statement (see below) err on the hawkish side and as such, thus far. the ECB can be described as a hawkish-cut with data-dependence taking centre stage.

Within the statement the ECB acknowledged that the outlook for inflation has improved markedly, however despite recent progress ‘ domestic price pressures remain strong as wage growth is elevated, and inflation is likely to stay above target well into next year.’ Furthermore, the ECB continues to pledge to keep policy “sufficiently restrictive for as long as necessary to attain the 2% goal. On that. HICP forecasts were lifted for 2024 and 2025 on the headline and both by more than expected, with the core views also raised as well. Furthermore, the 2026 GDP view was maintained defying some calls for a moderation.

Loading…