Submitted by Newsquawk

Summary:

- Up until a few weeks ago, expectations for the September meeting had been coalescing around the prospect of an additional 50bps hike by the ECB, taking the deposit rate to 0.5%. However, a source report on 26th August revealed that some policymakers wish to discuss a 75bps rate rise due to the deterioration in the inflation outlook, with the prospect of a looming recession not a justification for slowing or halting policy normalisation.

- Thereafter, a speech by Germany’s Schnabel reinforced the Governing Council’s tightening ambitions by noting that both the likelihood and the cost of current high inflation becoming entrenched in expectations are uncomfortably high, and she added that central banks need to act forcefully in this environment.

- August HICP data saw the headline rate climb to 9.1% Y/Y from 8.9%, and the super-core metric advance to 4.3% Y/Y from 4.0%, prompting concerns that second-round effects from energy inflation are making their way through the economy.

- Accordingly, the likes of Goldman Sachs, Credit Suisse, BofA, JPM and several others adjusted their calls in favour of a 75bps move, an outcome that markets are currently assigning with an approximate 95% probability. Looking further ahead, markets are pricing just under 175bps of tightening by year-end (including September).

- Elsewhere, aspects of the Q&A will likely focus on the ECB’s plans for its APP reinvestments after reports suggested that it could begin discussing ending reinvestments, albeit a decision is not expected to be forthcoming with rates viewed as the preferred tool for tightening.

- The accompanying staff economic forecasts will likely see upward revisions to the 2022 and 2023 inflation projections of 6.8% and 3.5% respectively, with Morgan Stanley pencilling in an upgrade to the 2024 forecast of 2.1% to 2.2%. From a growth perspective, 2022 GDP is expected to forecast trivially higher at 2.9% vs. 2.8% in June, with 2023 growth expected to be cut to 0.4% from 2.1%.

PRIOR MEETING: Despite expectations for a 25bps hike across the ECB's three key rates, policymakers opted to "go big" and deliver 50bps worth of tightening, taking the deposit rate to 0% and therefore drawing a line under the Bank's NIRP. Alongside this, the Bank refrained from providing explicit guidance for the September meeting and instead adopted a meeting-by-meeting approach. The Governing Council was also able to agree on an anti-fragmentation tool named the Transmission Protection Instrument (TPI), aimed at ensuring that the monetary policy stance is transmitted smoothly across all euro area countries. That said, PEPP will remain the first line of defence to counter risks to the transmission mechanism related to the pandemic. President Lagarde said that the Governing Council rallied around the consensus of a 50bps hike and that the ECB is accelerating the normalisation process, but not changing the ultimate point of arrival. In terms of the details of TPI, Lagarde noted that all nations are eligible, the ECB is capable of "going big" on the instrument, whilst the activation of TPI is at the discretion of the Governing Council. Furthermore, the followup press release noted that purchases under TPI could be suspended if it is judged that persistent tensions are due to country fundamentals.

RECENT ECONOMIC DEVELOPMENTS: August inflation metrics continued to advance further with Y/Y HICP climbing to 9.1% from 8.9% and the super-core metric advancing to 4.3% from 4.0%, prompting concerns that second-round effects from energy inflation are making their way through the economy. The Eurozone's 5y5y inflation expectations metric sits around 2.16% compared to 2.05% at the time of the July meeting. From a growth perspective, Q2 Q/Q GDP was revised lower to 0.6% from 0.7%. The more timely PMI data showed the August composite-wide metric falling to 48.9 from 49.9 amid a decline in services to 49.8 from 51.2 and a drop in manufacturing to 46.9 from 49.8. The report made for grim reading with S&P Global noting "the latest PMI data for the eurozone point to an economy in contraction during the third quarter of the year", adding that "cost of living pressures mean that the recovery in the services sector following the lifting of pandemic restrictions has ebbed away". On the employment front, S&P Global stated that "the rebuilding of workforces following the pandemic is also losing steam, with firms increasingly reluctant to hire additional staff". The Eurozone unemployment rate as of July, remains at its historical low of 6.6%.

RECENT COMMUNICATIONS: At Jackson Hole, Germany’s Schnabel (27th Aug) stated that both the likelihood and the cost of current high inflation becoming entrenched in expectations are uncomfortably high, adding that central banks need to act forcefully in this environment. Her German counterpart Nagel (30th Aug) echoed this sentiment noting that rate hikes should not be delayed by fears of a possible recession. Other known hawks on the Board such as Latvia's Kazaks, Austria's Holzmann and Estonia's Mueller suggested that 50bps and 75bps should be on the table for the upcoming meeting, whilst Netherland’s Knot noted that he is leaning towards a 75bps move. Elsewhere, the typically more centrist Villeroy of France (27th Aug) suggested that the Bank could be at the neutral rate before year-end with another significant step in September (his estimate of neutral is somewhere between 1-2%). Belgium's Wunsch (30th Aug) suggested that the Bank could need to raise rates to a level that starts to restrict economic activity or above what is considered the "neutral" rate. Chief Economist Lane (29th Aug) called for a more measured approach by suggesting that it makes sense to allow the financial system to absorb rate changes in a step-by-step manner, adding that "the same cumulative rate hike over a fixed interval is less likely to generate adverse feedback loops if it takes the form of a multistep calibrated series rather than a smaller number of larger rate increases". Known-dove Stournaras of Greece (30th Aug) stated that further and gradual normalisation will be appropriate, adding that the ECB does not need to take very large steps. Stournaras estimates the neutral rate to be between 0.5-1.5%.

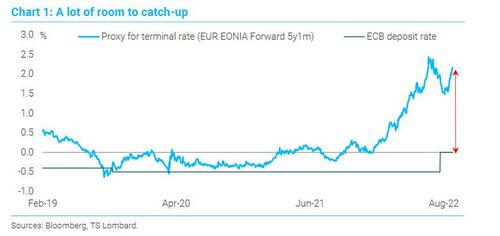

RATES: Consensus expects the ECB to raise the deposit rate by 75bps to 0.75%. However, there is a notable split in analyst views as per Reuters polling with 34/67 expecting 75bps, 29 expecting 50bps and four expecting just a 25bps move. Market pricing is more convinced over a larger-than-usual increment with 75bps priced at a circa 95% probability. Expectations for a 75bps move were stoked after a source report on 26th August revealed that some policymakers wish to discuss a 75bps rate rise due to the deterioration in the inflation outlook, with the prospect of a looming recession not a justification for slowing or halting policy normalisation. Thereafter, a speech by Germany’s Schnabel and rhetoric from other officials (see above) reinforced the Governing Council’s tightening ambitions. Accordingly, and in the wake of another firmer-than-expected Eurozone inflation report, the likes of Goldman Sachs, Credit Suisse, BofA, JPM and several others adjusted their calls in favour of a 75bps move with desks of the view that such a move would provide policymakers an opportunity to front-load hikes and signal their tightening ambitions. That said, the likes of ING, who expect just a 50bps move, think that such a magnitude would be a compromise, with a 75bps rise looking like "one bridge too far" for the doves. Beyond Thursday's decision, markets price in around 100bps of tightening (excluding this week) by year-end which would imply 50bps moves at the October and November meetings. One nuance for the press conference and highlighted by SGH Macro is that markets will be looking to see whether a 75bps move would see 25bps "borrowed or brought forward from a future hike" given that at the July meeting, President Lagarde suggested that the larger-than-expected move did not change the ultimate destination of the policy path. Elsewhere, market participants will be looking for any indications as to where the ECB sees the neutral rate (generally considered to be somewhere between 1-2%) and how far the ECB is willing to go above the neutral rate into restrictive territory.

BALANCE SHEET: At the July meeting, the Governing Council was also able to agree on an anti-fragmentation tool named the Transmission Protection Instrument (TPI), aimed at ensuring that the monetary policy stance is transmitted smoothly across all euro area countries. That said, it was noted that PEPP remains the first line of defence to counter risks to the transmission mechanism related to the pandemic. In terms of the details of TPI, Lagarde noted that all nations are eligible, the ECB is capable of "going big" on the instrument, whilst the activation of TPI is at the discretion of the Governing Council. Lagarde later clarified that the four conditions for TPI are as follows: 1. Compliance of EU fiscal framework, 2. Absence of severe macro imbalances, 3. Fiscal sustainability, 4. Sound and sustainable macro policies. The follow-up press release noted that purchases under TPI could be suspended if it is judged that persistent tensions are due to country fundamentals. Traders will be cognisant of the upcoming Italian election on September 25th. Elsewhere, aspects of the Q&A will likely focus on the ECB’s plans for its APP reinvestments. Recent reports suggested that the Bank could begin discussing ending reinvestments at an upcoming meeting, albeit September is judged to be too soon for such a discussion with rate hikes viewed as the preferred tool for tightening. As such, Lagarde is unlikely to give too much away on this front. Furthermore, when such a move comes, it will potentially need to be squared up against ongoing reinvestments under PEPP and any potential purchases under TPI.

ECONOMIC PROJECTIONS: The accompanying staff economic forecasts will likely see upward revisions to the 2022 and 2023 inflation projections of 6.8% and 3.5% respectively to somewhere in the region of 8.1% and 4.5%. As ever, the 2024 projection will be a key focus to see how the Governing Council judges the impact of current policy on the medium-term inflation outlook, with the current 2.1% forecast expected to be nudged higher to 2.2%. It is worth noting that the projections will likely need to be taken with a huge pinch of salt given the uncertainty of the outlook and the fluidity of the European gas situation. On that very point, the cut-off date for submitting forecasts will have pre-dated the recent shutting off of NS1 which subsequently sent European gas prices surging. From a growth perspective, 2022 GDP is expected to forecast trivially higher at 2.9% vs. 2.8% in June with 2023 growth expected to be cut to 0.4% from 2.1% and 2024 to be lowered to 1.6% from 2.1%.

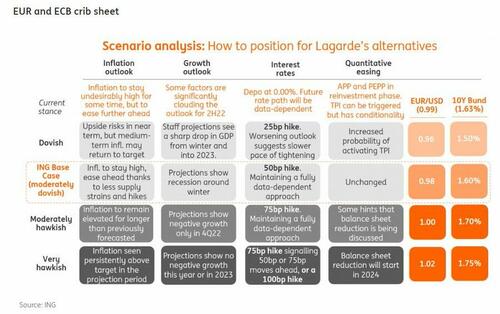

MARKET REACTIONS: Finally, ahead of tomorrow's ECB meeting, the team from ING Economics analyze four potential scenarios on a scale from dovish to ultra-hawkish and what this can mean for EUR/USD and EUR rates (full report link here):

Submitted by Newsquawk

Summary:

- Up until a few weeks ago, expectations for the September meeting had been coalescing around the prospect of an additional 50bps hike by the ECB, taking the deposit rate to 0.5%. However, a source report on 26th August revealed that some policymakers wish to discuss a 75bps rate rise due to the deterioration in the inflation outlook, with the prospect of a looming recession not a justification for slowing or halting policy normalisation.

- Thereafter, a speech by Germany’s Schnabel reinforced the Governing Council’s tightening ambitions by noting that both the likelihood and the cost of current high inflation becoming entrenched in expectations are uncomfortably high, and she added that central banks need to act forcefully in this environment.

- August HICP data saw the headline rate climb to 9.1% Y/Y from 8.9%, and the super-core metric advance to 4.3% Y/Y from 4.0%, prompting concerns that second-round effects from energy inflation are making their way through the economy.

- Accordingly, the likes of Goldman Sachs, Credit Suisse, BofA, JPM and several others adjusted their calls in favour of a 75bps move, an outcome that markets are currently assigning with an approximate 95% probability. Looking further ahead, markets are pricing just under 175bps of tightening by year-end (including September).

- Elsewhere, aspects of the Q&A will likely focus on the ECB’s plans for its APP reinvestments after reports suggested that it could begin discussing ending reinvestments, albeit a decision is not expected to be forthcoming with rates viewed as the preferred tool for tightening.

- The accompanying staff economic forecasts will likely see upward revisions to the 2022 and 2023 inflation projections of 6.8% and 3.5% respectively, with Morgan Stanley pencilling in an upgrade to the 2024 forecast of 2.1% to 2.2%. From a growth perspective, 2022 GDP is expected to forecast trivially higher at 2.9% vs. 2.8% in June, with 2023 growth expected to be cut to 0.4% from 2.1%.

PRIOR MEETING: Despite expectations for a 25bps hike across the ECB’s three key rates, policymakers opted to “go big” and deliver 50bps worth of tightening, taking the deposit rate to 0% and therefore drawing a line under the Bank’s NIRP. Alongside this, the Bank refrained from providing explicit guidance for the September meeting and instead adopted a meeting-by-meeting approach. The Governing Council was also able to agree on an anti-fragmentation tool named the Transmission Protection Instrument (TPI), aimed at ensuring that the monetary policy stance is transmitted smoothly across all euro area countries. That said, PEPP will remain the first line of defence to counter risks to the transmission mechanism related to the pandemic. President Lagarde said that the Governing Council rallied around the consensus of a 50bps hike and that the ECB is accelerating the normalisation process, but not changing the ultimate point of arrival. In terms of the details of TPI, Lagarde noted that all nations are eligible, the ECB is capable of “going big” on the instrument, whilst the activation of TPI is at the discretion of the Governing Council. Furthermore, the followup press release noted that purchases under TPI could be suspended if it is judged that persistent tensions are due to country fundamentals.

RECENT ECONOMIC DEVELOPMENTS: August inflation metrics continued to advance further with Y/Y HICP climbing to 9.1% from 8.9% and the super-core metric advancing to 4.3% from 4.0%, prompting concerns that second-round effects from energy inflation are making their way through the economy. The Eurozone’s 5y5y inflation expectations metric sits around 2.16% compared to 2.05% at the time of the July meeting. From a growth perspective, Q2 Q/Q GDP was revised lower to 0.6% from 0.7%. The more timely PMI data showed the August composite-wide metric falling to 48.9 from 49.9 amid a decline in services to 49.8 from 51.2 and a drop in manufacturing to 46.9 from 49.8. The report made for grim reading with S&P Global noting “the latest PMI data for the eurozone point to an economy in contraction during the third quarter of the year”, adding that “cost of living pressures mean that the recovery in the services sector following the lifting of pandemic restrictions has ebbed away”. On the employment front, S&P Global stated that “the rebuilding of workforces following the pandemic is also losing steam, with firms increasingly reluctant to hire additional staff”. The Eurozone unemployment rate as of July, remains at its historical low of 6.6%.

RECENT COMMUNICATIONS: At Jackson Hole, Germany’s Schnabel (27th Aug) stated that both the likelihood and the cost of current high inflation becoming entrenched in expectations are uncomfortably high, adding that central banks need to act forcefully in this environment. Her German counterpart Nagel (30th Aug) echoed this sentiment noting that rate hikes should not be delayed by fears of a possible recession. Other known hawks on the Board such as Latvia’s Kazaks, Austria’s Holzmann and Estonia’s Mueller suggested that 50bps and 75bps should be on the table for the upcoming meeting, whilst Netherland’s Knot noted that he is leaning towards a 75bps move. Elsewhere, the typically more centrist Villeroy of France (27th Aug) suggested that the Bank could be at the neutral rate before year-end with another significant step in September (his estimate of neutral is somewhere between 1-2%). Belgium’s Wunsch (30th Aug) suggested that the Bank could need to raise rates to a level that starts to restrict economic activity or above what is considered the “neutral” rate. Chief Economist Lane (29th Aug) called for a more measured approach by suggesting that it makes sense to allow the financial system to absorb rate changes in a step-by-step manner, adding that “the same cumulative rate hike over a fixed interval is less likely to generate adverse feedback loops if it takes the form of a multistep calibrated series rather than a smaller number of larger rate increases”. Known-dove Stournaras of Greece (30th Aug) stated that further and gradual normalisation will be appropriate, adding that the ECB does not need to take very large steps. Stournaras estimates the neutral rate to be between 0.5-1.5%.

RATES: Consensus expects the ECB to raise the deposit rate by 75bps to 0.75%. However, there is a notable split in analyst views as per Reuters polling with 34/67 expecting 75bps, 29 expecting 50bps and four expecting just a 25bps move. Market pricing is more convinced over a larger-than-usual increment with 75bps priced at a circa 95% probability. Expectations for a 75bps move were stoked after a source report on 26th August revealed that some policymakers wish to discuss a 75bps rate rise due to the deterioration in the inflation outlook, with the prospect of a looming recession not a justification for slowing or halting policy normalisation. Thereafter, a speech by Germany’s Schnabel and rhetoric from other officials (see above) reinforced the Governing Council’s tightening ambitions. Accordingly, and in the wake of another firmer-than-expected Eurozone inflation report, the likes of Goldman Sachs, Credit Suisse, BofA, JPM and several others adjusted their calls in favour of a 75bps move with desks of the view that such a move would provide policymakers an opportunity to front-load hikes and signal their tightening ambitions. That said, the likes of ING, who expect just a 50bps move, think that such a magnitude would be a compromise, with a 75bps rise looking like “one bridge too far” for the doves. Beyond Thursday’s decision, markets price in around 100bps of tightening (excluding this week) by year-end which would imply 50bps moves at the October and November meetings. One nuance for the press conference and highlighted by SGH Macro is that markets will be looking to see whether a 75bps move would see 25bps “borrowed or brought forward from a future hike” given that at the July meeting, President Lagarde suggested that the larger-than-expected move did not change the ultimate destination of the policy path. Elsewhere, market participants will be looking for any indications as to where the ECB sees the neutral rate (generally considered to be somewhere between 1-2%) and how far the ECB is willing to go above the neutral rate into restrictive territory.

BALANCE SHEET: At the July meeting, the Governing Council was also able to agree on an anti-fragmentation tool named the Transmission Protection Instrument (TPI), aimed at ensuring that the monetary policy stance is transmitted smoothly across all euro area countries. That said, it was noted that PEPP remains the first line of defence to counter risks to the transmission mechanism related to the pandemic. In terms of the details of TPI, Lagarde noted that all nations are eligible, the ECB is capable of “going big” on the instrument, whilst the activation of TPI is at the discretion of the Governing Council. Lagarde later clarified that the four conditions for TPI are as follows: 1. Compliance of EU fiscal framework, 2. Absence of severe macro imbalances, 3. Fiscal sustainability, 4. Sound and sustainable macro policies. The follow-up press release noted that purchases under TPI could be suspended if it is judged that persistent tensions are due to country fundamentals. Traders will be cognisant of the upcoming Italian election on September 25th. Elsewhere, aspects of the Q&A will likely focus on the ECB’s plans for its APP reinvestments. Recent reports suggested that the Bank could begin discussing ending reinvestments at an upcoming meeting, albeit September is judged to be too soon for such a discussion with rate hikes viewed as the preferred tool for tightening. As such, Lagarde is unlikely to give too much away on this front. Furthermore, when such a move comes, it will potentially need to be squared up against ongoing reinvestments under PEPP and any potential purchases under TPI.

ECONOMIC PROJECTIONS: The accompanying staff economic forecasts will likely see upward revisions to the 2022 and 2023 inflation projections of 6.8% and 3.5% respectively to somewhere in the region of 8.1% and 4.5%. As ever, the 2024 projection will be a key focus to see how the Governing Council judges the impact of current policy on the medium-term inflation outlook, with the current 2.1% forecast expected to be nudged higher to 2.2%. It is worth noting that the projections will likely need to be taken with a huge pinch of salt given the uncertainty of the outlook and the fluidity of the European gas situation. On that very point, the cut-off date for submitting forecasts will have pre-dated the recent shutting off of NS1 which subsequently sent European gas prices surging. From a growth perspective, 2022 GDP is expected to forecast trivially higher at 2.9% vs. 2.8% in June with 2023 growth expected to be cut to 0.4% from 2.1% and 2024 to be lowered to 1.6% from 2.1%.

MARKET REACTIONS: Finally, ahead of tomorrow’s ECB meeting, the team from ING Economics analyze four potential scenarios on a scale from dovish to ultra-hawkish and what this can mean for EUR/USD and EUR rates (full report link here):