By Antoine Bouvet of ING Economics

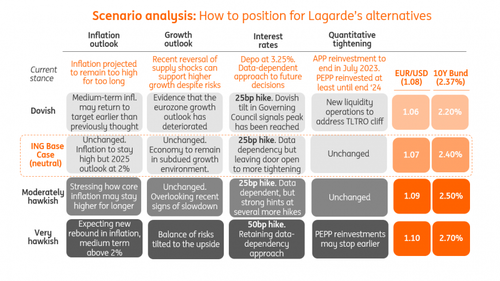

We expect the ECB to deliver a 25bp rate hike this week and signal more to come. Rates markets are already priced for this outcome, and softening economic data dents the ECB's ability to push rates above their 2023 top. The impact on EUR/USD may be short-lived, with dollar rates still likely to be the primary driver of any sustained trend in the pair.

When the European Central Bank governing council meets this week, no one will be shocked to discover that it elected to raise its policy rates by another 25bp. Our colleagues think the bank won’t stop at that and deliver at least one more hike in this cycle. One clue will be in the updated staff forecasts, although, here too, offsetting factors make a radical change unlikely. The ECB should also confirm that, as it heavily hinted at the May meeting, quantitative tightening (QT) will accelerate from July.

Rates stuck in the doldrums but low volatility is positive for risk appetite

With euro rates stuck in an increasingly narrow range since the start of 2023, there are growing doubts about the ECB’s ability to push yields to new highs with its hawkish rhetoric alone. Slowing economic data and encouraging signs on leading inflation indicators are denting its message. Contrast that to an ECB labouring the point that its focus is on still-stubbornly high core inflation, and on backward-looking indicators in general. In this light, the swap curve implying two more hikes in this cycle (including this week) feels already in tune with the ECB’s hawkish message, leaving limited upside to rates. We would go as far as saying that it is priced to perfection.

Rates upside could still come from the curve pricing one more hike in this cycle, or pricing out some of the roughly 70bp of cuts implied for 2024. Even then we doubt this would be enough to push 10Y EUR swap rates above its recent high of 3.33%. This is because we assume the curve retains its tendency to flatten when rates rise. In truth, the ‘higher for longer’ narrative was given extra credibility by the Bank of Canada resuming hikes in June after a five months hiatus, but there is a long way to go before markets imply that longer rates should rise above current policy rates. From now on, the curve’s bear-flattening tendency may be reduced, but there is a high bar to clear for euro rates to print new highs.

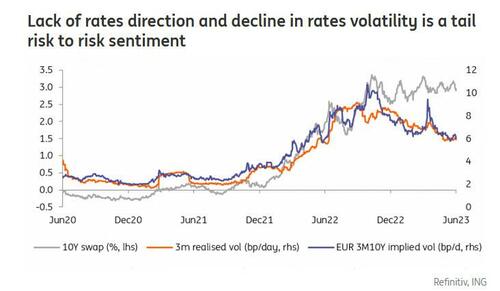

Meanwhile, the lack of rates direction is proving a boon to risk sentiment. Macro uncertainty has indeed reduced. Even if rates upside materialises, a repeat of the 2022 surge in rates is very unlikely. In short, the ECB and other central banks are much closer to the end of their hiking cycles than to their starts. Even in case of a sharp drop in rates in case of a hard landing or collapse in inflation, volatility would eventually converge lower. This explains the decline in implied and realised volatility from a peak of around 10bp per day in late 2022, to 6bp currently. This is positive for risk sentiment in rates markets and elsewhere. Sovereign spreads, for instance Italy-Germany 10Y, have narrowed to their tightest level this year, and swap spreads are also shedding the risk premium acquired during the US regional banking crisis.

The ECB balance sheet: firmly set on tightening course

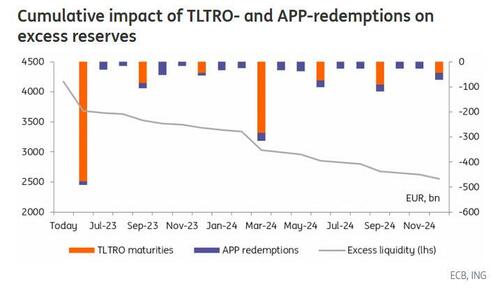

The ECB, one should think, has already made up its mind in regard to the balance sheet. The TLTROs will mature as planned – or be repaid early if banks choose – and the asset purchase programme (APP) reinvestments will stop from July. This has set also set the excess liquidity in the banking system on a declining trajectory. And we would already have seen more of a decline if the ECB were not also engaged in pushing government cash off its balance sheet and into the market. Those efforts appear to have been fruitful with government deposits at the ECB now at pre-Covid levels again.

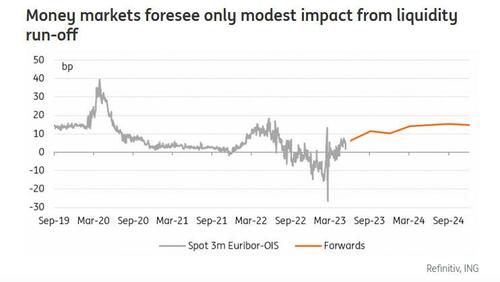

From here, one should see targeted longer-term refinancing operations (TLTROs) and APP redemptions unfold their full impact. Taken together they will have a negative net impact on excess revers of around €770bn this year and €850bn next year. Implications for the market, judging by the absolute levels of liquidity look limited, after all €3.4tr and €2.5tr respectively, are still considerably high by historical standard. And after all, the trajectory was well flagged ahead of time. The market appears to agree, looking benignly on the spreads such as the 3m Euribor/OIS which forwards see widening only modestly from currently around 2bp to 7bp towards a little over 10bp by year-end.

What the headline figures don’t tell, is that the impact is also a matter of how liquidity is distributed. One example is Italy’s banking system which has fewer excess reserves than it has outstanding in TLTROs. At the margin, we would expect the decline in excess reserves to gradually lead to more market funding activity – think interbank term deposits, commercial paper issuance or even longer funding – which in turn should pressure up rates and widen spreads.

Should some banks be seen resorting to the ECB regular market operations, which President Christine Lagarde had flagged at the last meeting as a funding alternative, then we think this would be interpreted as signs of tension in some corners of the system given that someone was willing to pay a 50bp “penalty” despite an apparent abundance of liquidity. If the ECB were to feel that risks are elevated, this meeting would be the last opportunity to address the issue ahead of a large end of June TLTRO redemption.

FX: June meeting unlikely to be the trigger for a sustained euro rally

EUR/USD decline throughout the month of May was primarily driven by the hawkish repricing in Fed rate expectations, while market pricing on ECB tightening held relatively stable. The main reference short-term rate differential for FX, the two-year swap rate gap, saw a rewidening of about 60bp since touching the -60bp peak in early May (now around -120bp) when markets were pricing in no more hikes and 75bp of cuts by the Fed in 2023.

What is clear is that the recent big shift in the EUR-USD rate differential has almost entirely been driven by the USD rate leg. We doubt this will change this week, or even beyond the short term.

Whether the ECB will pre-commit or not to another 25bp hike in July will drive the immediate reaction in EUR/USD, but we suspect that the Fed meeting the day before and above all the data releases in the US in the following weeks will generate swings in the significantly more volatile Fed rate expectations that will ultimately do the heavy lifting in driving EUR/USD moves.

Our medium-term bullish view on the pair, and our call for levels above 1.15 for the end of the year, primarily rely on a drop in USD rates rather than a material repricing higher in EUR rates.

By Antoine Bouvet of ING Economics

We expect the ECB to deliver a 25bp rate hike this week and signal more to come. Rates markets are already priced for this outcome, and softening economic data dents the ECB’s ability to push rates above their 2023 top. The impact on EUR/USD may be short-lived, with dollar rates still likely to be the primary driver of any sustained trend in the pair.

When the European Central Bank governing council meets this week, no one will be shocked to discover that it elected to raise its policy rates by another 25bp. Our colleagues think the bank won’t stop at that and deliver at least one more hike in this cycle. One clue will be in the updated staff forecasts, although, here too, offsetting factors make a radical change unlikely. The ECB should also confirm that, as it heavily hinted at the May meeting, quantitative tightening (QT) will accelerate from July.

Rates stuck in the doldrums but low volatility is positive for risk appetite

With euro rates stuck in an increasingly narrow range since the start of 2023, there are growing doubts about the ECB’s ability to push yields to new highs with its hawkish rhetoric alone. Slowing economic data and encouraging signs on leading inflation indicators are denting its message. Contrast that to an ECB labouring the point that its focus is on still-stubbornly high core inflation, and on backward-looking indicators in general. In this light, the swap curve implying two more hikes in this cycle (including this week) feels already in tune with the ECB’s hawkish message, leaving limited upside to rates. We would go as far as saying that it is priced to perfection.

Rates upside could still come from the curve pricing one more hike in this cycle, or pricing out some of the roughly 70bp of cuts implied for 2024. Even then we doubt this would be enough to push 10Y EUR swap rates above its recent high of 3.33%. This is because we assume the curve retains its tendency to flatten when rates rise. In truth, the ‘higher for longer’ narrative was given extra credibility by the Bank of Canada resuming hikes in June after a five months hiatus, but there is a long way to go before markets imply that longer rates should rise above current policy rates. From now on, the curve’s bear-flattening tendency may be reduced, but there is a high bar to clear for euro rates to print new highs.

Meanwhile, the lack of rates direction is proving a boon to risk sentiment. Macro uncertainty has indeed reduced. Even if rates upside materialises, a repeat of the 2022 surge in rates is very unlikely. In short, the ECB and other central banks are much closer to the end of their hiking cycles than to their starts. Even in case of a sharp drop in rates in case of a hard landing or collapse in inflation, volatility would eventually converge lower. This explains the decline in implied and realised volatility from a peak of around 10bp per day in late 2022, to 6bp currently. This is positive for risk sentiment in rates markets and elsewhere. Sovereign spreads, for instance Italy-Germany 10Y, have narrowed to their tightest level this year, and swap spreads are also shedding the risk premium acquired during the US regional banking crisis.

The ECB balance sheet: firmly set on tightening course

The ECB, one should think, has already made up its mind in regard to the balance sheet. The TLTROs will mature as planned – or be repaid early if banks choose – and the asset purchase programme (APP) reinvestments will stop from July. This has set also set the excess liquidity in the banking system on a declining trajectory. And we would already have seen more of a decline if the ECB were not also engaged in pushing government cash off its balance sheet and into the market. Those efforts appear to have been fruitful with government deposits at the ECB now at pre-Covid levels again.

From here, one should see targeted longer-term refinancing operations (TLTROs) and APP redemptions unfold their full impact. Taken together they will have a negative net impact on excess revers of around €770bn this year and €850bn next year. Implications for the market, judging by the absolute levels of liquidity look limited, after all €3.4tr and €2.5tr respectively, are still considerably high by historical standard. And after all, the trajectory was well flagged ahead of time. The market appears to agree, looking benignly on the spreads such as the 3m Euribor/OIS which forwards see widening only modestly from currently around 2bp to 7bp towards a little over 10bp by year-end.

What the headline figures don’t tell, is that the impact is also a matter of how liquidity is distributed. One example is Italy’s banking system which has fewer excess reserves than it has outstanding in TLTROs. At the margin, we would expect the decline in excess reserves to gradually lead to more market funding activity – think interbank term deposits, commercial paper issuance or even longer funding – which in turn should pressure up rates and widen spreads.

Should some banks be seen resorting to the ECB regular market operations, which President Christine Lagarde had flagged at the last meeting as a funding alternative, then we think this would be interpreted as signs of tension in some corners of the system given that someone was willing to pay a 50bp “penalty” despite an apparent abundance of liquidity. If the ECB were to feel that risks are elevated, this meeting would be the last opportunity to address the issue ahead of a large end of June TLTRO redemption.

FX: June meeting unlikely to be the trigger for a sustained euro rally

EUR/USD decline throughout the month of May was primarily driven by the hawkish repricing in Fed rate expectations, while market pricing on ECB tightening held relatively stable. The main reference short-term rate differential for FX, the two-year swap rate gap, saw a rewidening of about 60bp since touching the -60bp peak in early May (now around -120bp) when markets were pricing in no more hikes and 75bp of cuts by the Fed in 2023.

What is clear is that the recent big shift in the EUR-USD rate differential has almost entirely been driven by the USD rate leg. We doubt this will change this week, or even beyond the short term.

Whether the ECB will pre-commit or not to another 25bp hike in July will drive the immediate reaction in EUR/USD, but we suspect that the Fed meeting the day before and above all the data releases in the US in the following weeks will generate swings in the significantly more volatile Fed rate expectations that will ultimately do the heavy lifting in driving EUR/USD moves.

Our medium-term bullish view on the pair, and our call for levels above 1.15 for the end of the year, primarily rely on a drop in USD rates rather than a material repricing higher in EUR rates.

Loading…