Authored by Simon White, Bloomberg Macro Strategist,

The ECB’s window for efficiently transmitting monetary policy is narrowing; traders should thus consider the portfolio implications of faster action to damp inflation.

The market’s determination to price in a pivot has complicated the process of tightening for central banks.

The Fed repeatedly insisted that it would hold rates higher for longer, but to no avail as the market stubbornly maintained the pricing-in of rate cuts soon after when rates were expected to peak.

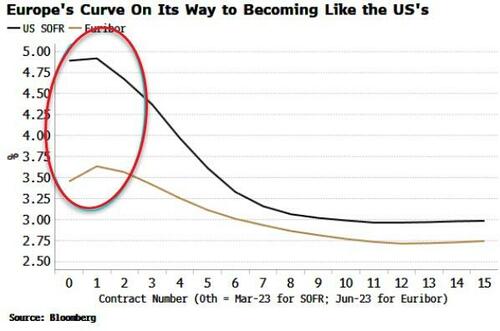

We are now close to the end of the Fed’s hiking cycle (if we will not soon be seeing cuts), meaning the short-term interest rate curve in the US is almost fully inverted (see chart below).

This implies that there are rapidly diminishing returns for the Fed to hike more, as the shape of the curve means it would not be effectively transmitted across the full yield curve and to the economy.

The ECB is behind the Fed, yet, as the chart above shows, the Euribor curve is becoming a similar shape to the US’s, i.e. it is almost fully inverted.

The curve shape is less of a problem for the Fed.

They have already raised rates 475 bps, versus 350 bps for the ECB.

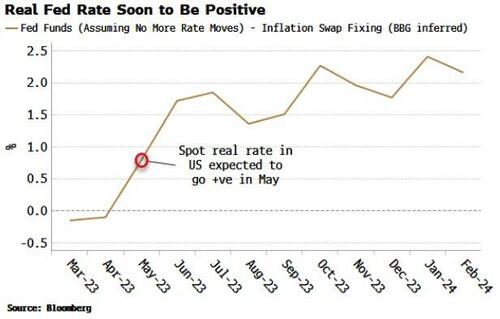

Further, spot real rates in the US should be positive by May, and reach over 2% soon after (assuming the Fed rate remains unchanged at 5%).

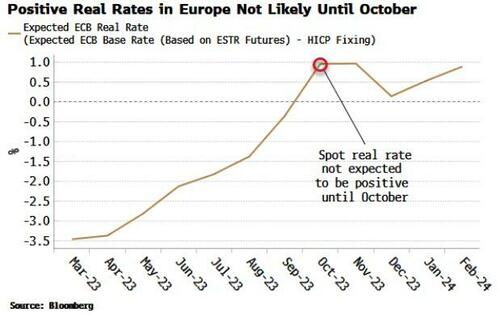

But spot real rates in Europe are not expected to be positive until October, and not get above 1% (assuming the ECB raises rates by what is currently priced, i.e. another ~60 bps expected by October/November).

The OPEC+ oil-production cut complicates the ECB’s task as CPI in Europe is highly sensitive to Brent oil prices.

However, the move so far has not really moved the dial, as Brent is still very negative on a year-on-year basis.

Nonetheless, a faster rate-hiking pace will help the important milestone of positive spot real rates to be realised sooner.

Authored by Simon White, Bloomberg Macro Strategist,

The ECB’s window for efficiently transmitting monetary policy is narrowing; traders should thus consider the portfolio implications of faster action to damp inflation.

The market’s determination to price in a pivot has complicated the process of tightening for central banks.

The Fed repeatedly insisted that it would hold rates higher for longer, but to no avail as the market stubbornly maintained the pricing-in of rate cuts soon after when rates were expected to peak.

We are now close to the end of the Fed’s hiking cycle (if we will not soon be seeing cuts), meaning the short-term interest rate curve in the US is almost fully inverted (see chart below).

This implies that there are rapidly diminishing returns for the Fed to hike more, as the shape of the curve means it would not be effectively transmitted across the full yield curve and to the economy.

The ECB is behind the Fed, yet, as the chart above shows, the Euribor curve is becoming a similar shape to the US’s, i.e. it is almost fully inverted.

The curve shape is less of a problem for the Fed.

They have already raised rates 475 bps, versus 350 bps for the ECB.

Further, spot real rates in the US should be positive by May, and reach over 2% soon after (assuming the Fed rate remains unchanged at 5%).

But spot real rates in Europe are not expected to be positive until October, and not get above 1% (assuming the ECB raises rates by what is currently priced, i.e. another ~60 bps expected by October/November).

The OPEC+ oil-production cut complicates the ECB’s task as CPI in Europe is highly sensitive to Brent oil prices.

However, the move so far has not really moved the dial, as Brent is still very negative on a year-on-year basis.

Nonetheless, a faster rate-hiking pace will help the important milestone of positive spot real rates to be realised sooner.

Loading…