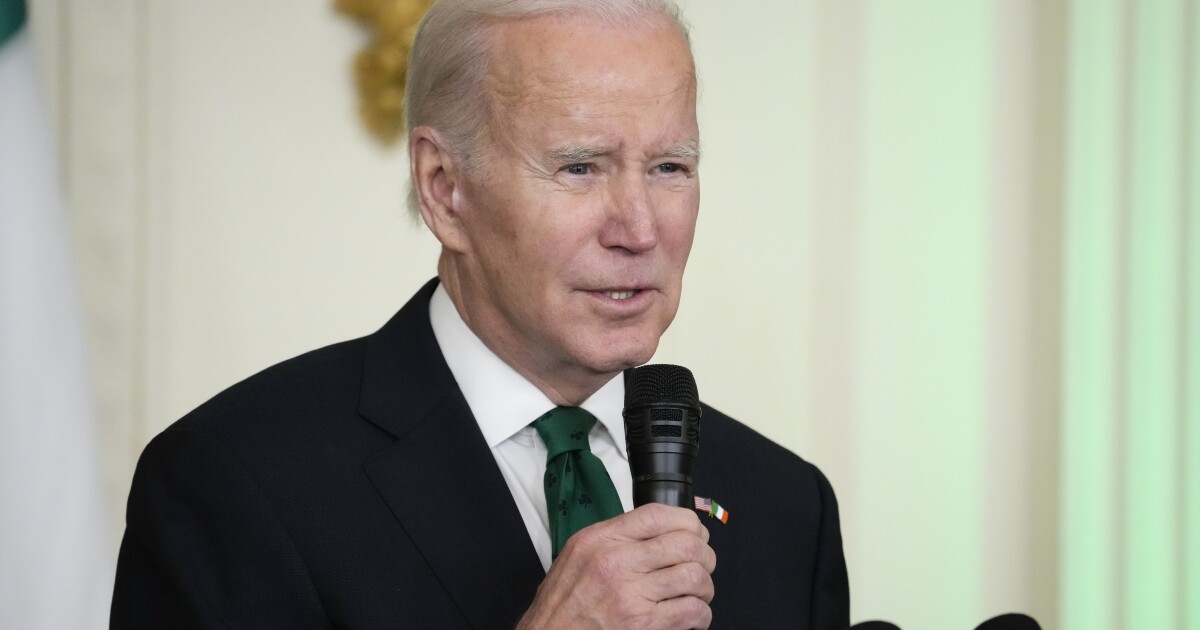

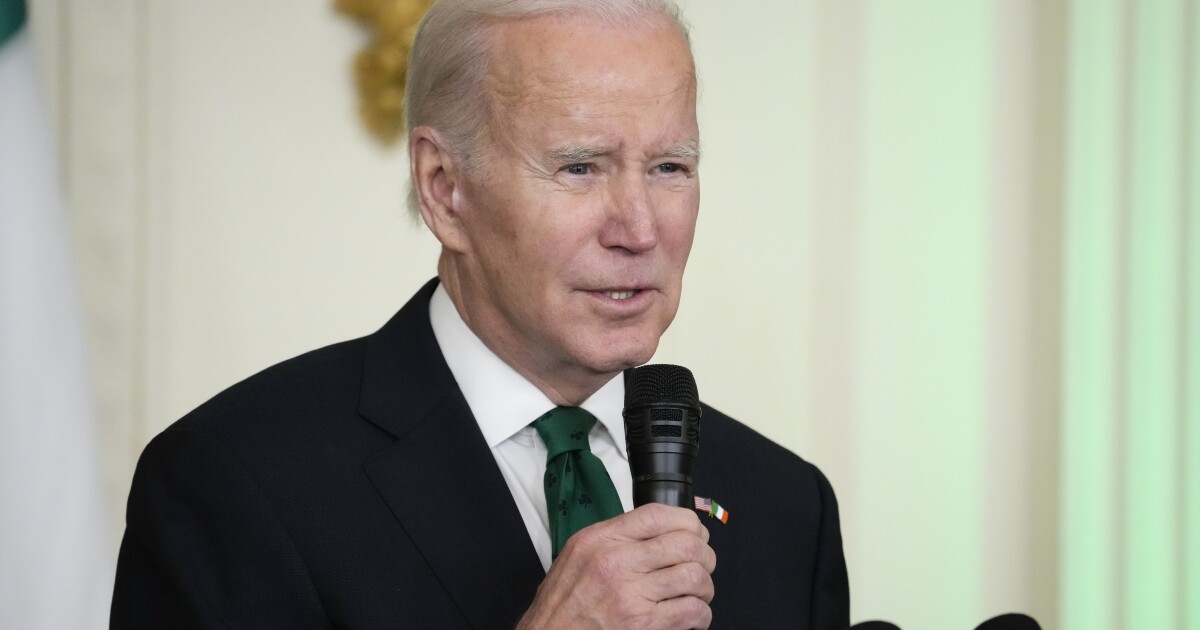

President Joe Biden is attempting to prove his economic chops one week after the biggest bank collapse since 2008.

But with the public already skeptical of Democrats’ management of the economy, Biden is poised to announce his likely reelection campaign on the back foot.

BIDEN’S TIKTOK TICKING TIME BOMB

Biden “fueled” inflation through his partisan spending packages, which “forced” the Federal Reserve Bank to increase interest rates and “undermined” financial institutions, from Silicon Valley Bank to Signature Bank and now First Republic Bank, according to GOP strategists such as Republican National Committee spokesman Gates McGavick.

“Now Biden wants to make the same mistakes with his disastrous $6.9 trillion spending spree,” McGavick told the Washington Examiner of the president’s 2024 fiscal budget. “Biden wants to make everything worse while Americans are living with the consequences of his failed economy.”

Despite inflation, Democrats are confident they have a positive case to make to the public regarding the economy, citing low unemployment as one indication the country will sidestep a recession and stick a so-called soft landing. Yet they are running out of time to win the argument before a hard debt ceiling deadline and potential default this summer. The Supreme Court is also tipped to issue an opinion on immigration-related federal authority Title 42 in June, the rescission of which could precipitate an increase in border crossings and for which Biden appears ill-prepared.

“His budget reflects [his] priorities and how he’s focusing on holding tax cheats accountable, extending the solvency of Medicare, protecting Social Security, investing in manufacturing jobs in the United States,” one senior Democratic official said. “That is a budget that reflects the values of Democrats and President Biden.”

Biden’s “swift action” concerning SVB “saved a lot of jobs and small businesses,” added Democratic strategist Mike Nellis.

“His administration is taking measures to prevent future crises like this from happening again,” the CEO of political digital agency Authentic said. “The economy created 300,000 jobs last month, while inflation is slowing. Overall, President Biden is doing his job, and he’s doing it quite well.”

Biden has been criticized for his delayed responses to, for example, the Chinese spy balloon and the toxic train derailment in East Palestine, Ohio. But his administration was relatively quick to react to a run on SVB by depositors last week, which was prompted by the technology-focused bank’s admission it had lost $1.8 billion because its securities, Treasury and mortgage bonds, had been devalued due to interest rates. After officials shuttered cryptocurrency-heavy Signature Bank as well, Treasury Secretary Janet Yellen, Federal Reserve Chairman Jerome Powell, and Federal Deposit Insurance Corporation Chairman Martin Gruenberg said the federal government would insure SVB and Signature deposits beyond the $250,000 cap and establish an emergency lending program for other distressed financial institutions.

Yet 18 months before next year’s election, Biden’s moves did not seem to mitigate the need for Yellen to broker a $30 billion deal with 11 other banks to demonstrate private sector support for troubled First Republic Bank. Biden, too, has differentiated his response from that of former President Barack Obama to the financial crisis of 2008, repeating he did not approve a taxpayer-funded bailout and that “those responsible for this mess” should be held accountable.

“When banks fail due to mismanagement and excessive risk taking, it should be easier for regulators to claw back compensation from executives, to impose civil penalties, and to ban executives from working in the banking industry again,” he wrote in a statement. “Congress must act to impose tougher penalties for senior bank executives whose mismanagement contributed to their institutions failing.”

Biden has specifically called on lawmakers to empower FDIC to claw back compensation from executives of failed banks, including through stock sales, in addition to barring executives from retaining their positions in the banking industry after their institution has entered receivership and to fine those executives.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

SVB’s collapse coincides with the publication this week of the Labor Department’s February inflation report. Consumer prices increased by 0.4% from January and by 6% since this time last year. While the data met market expectations, the numbers raise the prospect that the Federal Reserve will up interest rates next week by at least a quarter percentage point. The central bank is striving for an annual inflation rate of 3% despite SVB becoming insolvent, in part, because of its monetary policy.

Biden routinely underperforms in polls when respondents are asked about his economic management. A Quinnipiac University survey released this week found Biden’s negative 38%-55% job approval among all respondents was slightly higher among registered voters (39%-55%) and slightly lower when all respondents were quizzed on the economy (36%-59%). Biden’s average overall approval among all respondents is 44%-52% and 38%-58% with respect to the economy, according to RealClearPolitics.