Authored by Alex Newman via The Epoch Times (emphasis ours),

With inflation plaguing the economy as the U.S. dollar is increasingly being sidelined in international trade, potentially even at risk of losing its status as the global reserve currency, lawmakers in Washington and state capitals are touting gold and precious metals as the solution.

From congressional efforts that would once again back the U.S. dollar with gold to state-level initiatives to facilitate commerce in precious metals, proposals are proliferating. Some have already advanced.

Private-sector players are getting in on the action, too, arguing that gold can be a defense against economic calamity as foreign governments and central banks stockpile record amounts of precious metals.

In a series of interviews with The Epoch Times, state and federal lawmakers working to restore gold as money argued that this was the best way to defend the dollar, stabilize the economy, rein in government spending, and protect U.S. interests.

A bill introduced in Congress this year by U.S. Rep. Alex Mooney (R-W.Va.), dubbed the Gold Standard Restoration Act (H.R. 2435), would redefine the dollar in terms of a fixed weight in gold. The legislation would also require authorities to exchange paper currency for gold.

“How can you look at a country that’s 32 trillion in debt with out-of-control spending and think it’s the right standard to go by?” Mr. Mooney asked in a phone interview with The Epoch Times, warning of peril ahead for the dollar if its gold backing was not restored.

“Returning to the gold standard would bolster domestic and international confidence in the U.S. dollar because its value would be tied to something of actual worth, not just the ‘full faith and credit’ of the U.S. government,” added Mr. Mooney, who has been sounding the alarm throughout his political career. “This would preserve the U.S. dollar’s global reserve status.”

Meanwhile, in Texas, lawmakers concerned about the stability of the dollar and the U.S. economy are working to facilitate commerce in gold through the Texas Gold Depository.

“You have to look at history,” said Texas Rep. Mark Dorazio, a Republican who introduced the bill to facilitate intrastate trade in gold. “Over the last 6,000 years of history, gold and silver have kept their value and served as the standard.”

“It is the go-to in economic crisis and instability—everyone knows you go to gold,” the lawmaker told The Epoch Times in a phone interview.

“Everybody I talk to likes the idea of using our depository to conduct business,” he added. “Plus it would make money for the state. It’s a win-win for everyone.”

Ron Paul, a longtime champion of the gold standard and sound money who spent decades in Congress attempting to draw attention to the issue and wrote a best-selling book called “End The Fed,” told The Epoch Times that gold is likely to play a major role in the future.

As what he called the “Mickey Mouse” dollar continues to lose dominance, “something will have to replace it, [and] now we are seeing that,” he said, warning that “the Chinese are buying a lot of gold.”

Dr. Paul ridiculed the IMF’s Special Drawing Rights and emerging central bank “digital” currencies without inherent value as potential alternatives, saying something tangible such as gold is what's needed.

“If there’s a digital currency that is truly backed with gold, that might be helpful,” he said.

Ultimately, Dr. Paul said he would repeal legal tender laws, abolish the Federal Reserve, and allow the market to decide what should be used as money.

“Gold and silver became money spontaneously thousands of years ago, and metals have worked well,” he said, praising state and federal efforts on precious metals. “We need sound money.”

Despite his pessimism about the economy, Paul, who gained national prominence during his runs for president, celebrated the growing number of states declaring gold and silver to be legal tender.

“The Constitution is very much on their side,” he said.

Among other benefits, this can facilitate trade in precious metals by removing sales taxes and eliminating other obstacles, he said.

“This is a silent revolution going on at the grassroots level, passing legislation on this,” Paul said, adding that gold could protect countries, states, and even individuals. “That is a help in changing attitudes.”

As government debt and inflation continue to grow amid moves by U.S. adversaries to displace the dollar, interest in precious metals will continue to expand, multiple experts told The Epoch Times.

What Happened to Gold?

Until about 50 years ago, the U.S. dollar was still officially backed by gold. Because other currencies were mostly exchangeable for dollars on demand, the global monetary system was in effect underpinned by gold—at least in theory.

In fact, for thousands of years, precious metals have served as money. Economists say this is because they are durable, portable, scarce, and inherently valuable.

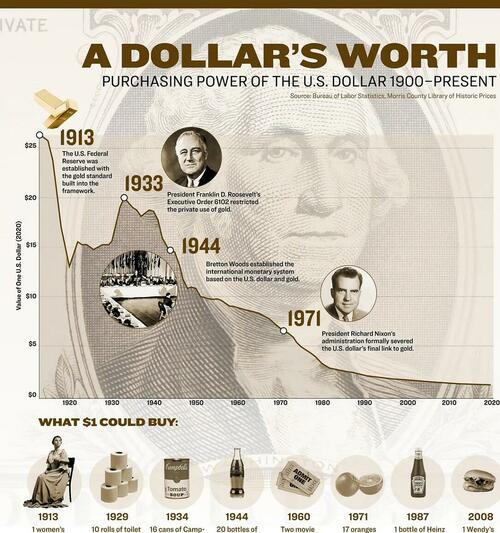

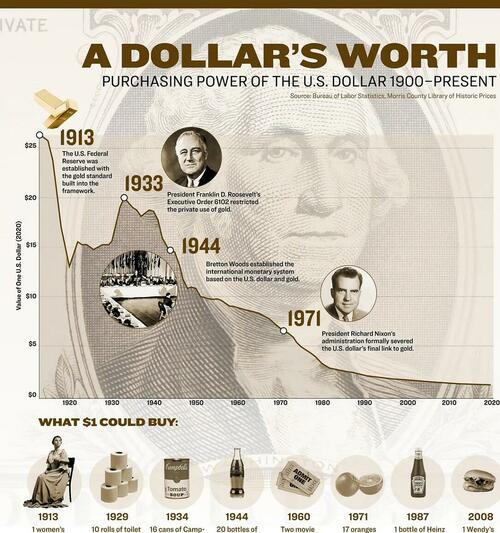

But with a series of major policy changes, beginning with the establishment of the Federal Reserve in 1913 followed by a 1933 executive order by President Franklin D. Roosevelt limiting gold holdings, that began to change.

Under the leadership of President Richard Nixon, the U.S. government formally severed the dollar’s final link to gold in 1971, ending the ability of even foreign powers to exchange their dollars for gold.

That was a turning point. Conventional wisdom holds that the move by Nixon resulted in the end of the gold standard forever as most of the world was suddenly plunged into what is known as a “fiat” monetary system. Fiat means the currency has value by government edict, rather than any inherent value.

Economist John Maynard Keynes famously referred to the metal as a “barbarous relic,” a view that has proliferated in academia and in central banking circles.

But the world is now facing escalating economic and monetary turmoil. Just last week, Fitch downgraded U.S. debt in a historic blow as debt levels surge and the purchasing power of currencies worldwide plummets.

The problems with the dollar are growing. As reported in May, U.S. adversaries such as the Chinese Communist Party are actively working to reshape the global monetary system and replace the dollar.

Even traditional U.S. allies such as France and Brazil are now doing international deals in other currencies.

Multiple experts explained that Biden administration and Federal Reserve policies were contributing to the trend through high spending and loose monetary policy blamed for inflation.

Calls for major monetary reform at the international level have been steadily growing for decades, and have ramped up further in light of current events.

Numerous world leaders and central bankers, including the People’s Bank of China, have proposed an international reserve currency to displace the dollar, and senior U.S. policymakers have even flirted with the idea publicly.

But in the United States, more traditional options for drastic reforms involving metals are being explored, too. Indeed, developments are causing many experts and lawmakers to take a fresh look at the “barbarous relic.”

At the same time, reports that authorities in the BRICS nations (Brazil, Russia, India, China, and South Africa) will consider a gold-backed currency are fueling interest in monetary metals worldwide.

Non-Western central banks are buying gold in record quantities, according to the World Gold Council, and analysts expect that demand to remain strong.

"We think this trend of central bank buying is likely to continue amid heightened geopolitical risks and elevated inflation," Swiss bank UBS said in a note to clients in late May.

Gold Standard to the Rescue?

Several congressional Republicans who spoke with The Epoch Times pointed to current events to highlight what they say is the urgency of legislation to protect the dollar by once again tying it to gold.

Mr. Mooney of West Virginia, the chief sponsor behind the “Gold Standard Restoration Act,” explained that severing the link between the dollar and gold has produced extreme spending, inflation, and other problems.

“We need to learn from history,” he told The Epoch Times. “When President Nixon unfortunately took us off the gold standard, it made everything worse. He claimed at the time it was going to control inflation, but the opposite occurred.”

“It was a huge mistake,” continued Mr. Mooney, who introduced the bill in the last Congress as well. “Inflation is still out of control to this day.”

Because the dollar is no longer tied to gold, and because the federal government is rapidly losing the trust of Americans and people worldwide, the dollar’s status as the global reserve currency is at risk, he said.

“They keep playing monetary games at the Fed, with borrowing and printing money, and that makes the dollar less stable and more susceptible to international competition,” the congressman warned, adding that the Chinese Communist Party is taking full advantage.

But eventually, change may be forced upon the United States.

“If we get to the point where we literally can’t pay our debts anymore—where we default on our loans—it would force some fiscal restraint in our country, but it would also jeopardize the dollar and give a great opportunity for communist China and other countries to not use the dollar anymore as the standard,” he said.

Mr. Mooney also pointed to increasingly erratic U.S. foreign policy such as the Afghanistan withdrawal “debacle,” saying other governments were now reconsidering whether the United States is truly as stable as previously believed.

Aside from restoring the gold standard, Mr. Mooney said it was imperative for the U.S. government to come up with a plan to control spending. “Democrats have absolutely no plan to do that,” he said.

He also warned that if current trends continue, economic disaster is a certainty.

“I can’t tell you what the exact limit is, but I never thought we’d be able to get this far,” he said, blasting the $5 trillion in new debt added under the current administration as “totally irresponsible.”

The only answer is to get back to a real standard where the dollar is backed by gold, he said. “If we got back to the gold standard, at least we would have a restriction there in terms of government spending,” Mr. Mooney added.

Read more here...

Authored by Alex Newman via The Epoch Times (emphasis ours),

With inflation plaguing the economy as the U.S. dollar is increasingly being sidelined in international trade, potentially even at risk of losing its status as the global reserve currency, lawmakers in Washington and state capitals are touting gold and precious metals as the solution.

From congressional efforts that would once again back the U.S. dollar with gold to state-level initiatives to facilitate commerce in precious metals, proposals are proliferating. Some have already advanced.

Private-sector players are getting in on the action, too, arguing that gold can be a defense against economic calamity as foreign governments and central banks stockpile record amounts of precious metals.

In a series of interviews with The Epoch Times, state and federal lawmakers working to restore gold as money argued that this was the best way to defend the dollar, stabilize the economy, rein in government spending, and protect U.S. interests.

A bill introduced in Congress this year by U.S. Rep. Alex Mooney (R-W.Va.), dubbed the Gold Standard Restoration Act (H.R. 2435), would redefine the dollar in terms of a fixed weight in gold. The legislation would also require authorities to exchange paper currency for gold.

“How can you look at a country that’s 32 trillion in debt with out-of-control spending and think it’s the right standard to go by?” Mr. Mooney asked in a phone interview with The Epoch Times, warning of peril ahead for the dollar if its gold backing was not restored.

“Returning to the gold standard would bolster domestic and international confidence in the U.S. dollar because its value would be tied to something of actual worth, not just the ‘full faith and credit’ of the U.S. government,” added Mr. Mooney, who has been sounding the alarm throughout his political career. “This would preserve the U.S. dollar’s global reserve status.”

Meanwhile, in Texas, lawmakers concerned about the stability of the dollar and the U.S. economy are working to facilitate commerce in gold through the Texas Gold Depository.

“You have to look at history,” said Texas Rep. Mark Dorazio, a Republican who introduced the bill to facilitate intrastate trade in gold. “Over the last 6,000 years of history, gold and silver have kept their value and served as the standard.”

“It is the go-to in economic crisis and instability—everyone knows you go to gold,” the lawmaker told The Epoch Times in a phone interview.

“Everybody I talk to likes the idea of using our depository to conduct business,” he added. “Plus it would make money for the state. It’s a win-win for everyone.”

Ron Paul, a longtime champion of the gold standard and sound money who spent decades in Congress attempting to draw attention to the issue and wrote a best-selling book called “End The Fed,” told The Epoch Times that gold is likely to play a major role in the future.

As what he called the “Mickey Mouse” dollar continues to lose dominance, “something will have to replace it, [and] now we are seeing that,” he said, warning that “the Chinese are buying a lot of gold.”

Dr. Paul ridiculed the IMF’s Special Drawing Rights and emerging central bank “digital” currencies without inherent value as potential alternatives, saying something tangible such as gold is what’s needed.

“If there’s a digital currency that is truly backed with gold, that might be helpful,” he said.

Ultimately, Dr. Paul said he would repeal legal tender laws, abolish the Federal Reserve, and allow the market to decide what should be used as money.

“Gold and silver became money spontaneously thousands of years ago, and metals have worked well,” he said, praising state and federal efforts on precious metals. “We need sound money.”

Despite his pessimism about the economy, Paul, who gained national prominence during his runs for president, celebrated the growing number of states declaring gold and silver to be legal tender.

“The Constitution is very much on their side,” he said.

Among other benefits, this can facilitate trade in precious metals by removing sales taxes and eliminating other obstacles, he said.

“This is a silent revolution going on at the grassroots level, passing legislation on this,” Paul said, adding that gold could protect countries, states, and even individuals. “That is a help in changing attitudes.”

As government debt and inflation continue to grow amid moves by U.S. adversaries to displace the dollar, interest in precious metals will continue to expand, multiple experts told The Epoch Times.

What Happened to Gold?

Until about 50 years ago, the U.S. dollar was still officially backed by gold. Because other currencies were mostly exchangeable for dollars on demand, the global monetary system was in effect underpinned by gold—at least in theory.

In fact, for thousands of years, precious metals have served as money. Economists say this is because they are durable, portable, scarce, and inherently valuable.

But with a series of major policy changes, beginning with the establishment of the Federal Reserve in 1913 followed by a 1933 executive order by President Franklin D. Roosevelt limiting gold holdings, that began to change.

Under the leadership of President Richard Nixon, the U.S. government formally severed the dollar’s final link to gold in 1971, ending the ability of even foreign powers to exchange their dollars for gold.

That was a turning point. Conventional wisdom holds that the move by Nixon resulted in the end of the gold standard forever as most of the world was suddenly plunged into what is known as a “fiat” monetary system. Fiat means the currency has value by government edict, rather than any inherent value.

Economist John Maynard Keynes famously referred to the metal as a “barbarous relic,” a view that has proliferated in academia and in central banking circles.

But the world is now facing escalating economic and monetary turmoil. Just last week, Fitch downgraded U.S. debt in a historic blow as debt levels surge and the purchasing power of currencies worldwide plummets.

The problems with the dollar are growing. As reported in May, U.S. adversaries such as the Chinese Communist Party are actively working to reshape the global monetary system and replace the dollar.

Even traditional U.S. allies such as France and Brazil are now doing international deals in other currencies.

Multiple experts explained that Biden administration and Federal Reserve policies were contributing to the trend through high spending and loose monetary policy blamed for inflation.

Calls for major monetary reform at the international level have been steadily growing for decades, and have ramped up further in light of current events.

Numerous world leaders and central bankers, including the People’s Bank of China, have proposed an international reserve currency to displace the dollar, and senior U.S. policymakers have even flirted with the idea publicly.

But in the United States, more traditional options for drastic reforms involving metals are being explored, too. Indeed, developments are causing many experts and lawmakers to take a fresh look at the “barbarous relic.”

At the same time, reports that authorities in the BRICS nations (Brazil, Russia, India, China, and South Africa) will consider a gold-backed currency are fueling interest in monetary metals worldwide.

Non-Western central banks are buying gold in record quantities, according to the World Gold Council, and analysts expect that demand to remain strong.

“We think this trend of central bank buying is likely to continue amid heightened geopolitical risks and elevated inflation,” Swiss bank UBS said in a note to clients in late May.

Gold Standard to the Rescue?

Several congressional Republicans who spoke with The Epoch Times pointed to current events to highlight what they say is the urgency of legislation to protect the dollar by once again tying it to gold.

Mr. Mooney of West Virginia, the chief sponsor behind the “Gold Standard Restoration Act,” explained that severing the link between the dollar and gold has produced extreme spending, inflation, and other problems.

“We need to learn from history,” he told The Epoch Times. “When President Nixon unfortunately took us off the gold standard, it made everything worse. He claimed at the time it was going to control inflation, but the opposite occurred.”

“It was a huge mistake,” continued Mr. Mooney, who introduced the bill in the last Congress as well. “Inflation is still out of control to this day.”

Because the dollar is no longer tied to gold, and because the federal government is rapidly losing the trust of Americans and people worldwide, the dollar’s status as the global reserve currency is at risk, he said.

“They keep playing monetary games at the Fed, with borrowing and printing money, and that makes the dollar less stable and more susceptible to international competition,” the congressman warned, adding that the Chinese Communist Party is taking full advantage.

But eventually, change may be forced upon the United States.

“If we get to the point where we literally can’t pay our debts anymore—where we default on our loans—it would force some fiscal restraint in our country, but it would also jeopardize the dollar and give a great opportunity for communist China and other countries to not use the dollar anymore as the standard,” he said.

Mr. Mooney also pointed to increasingly erratic U.S. foreign policy such as the Afghanistan withdrawal “debacle,” saying other governments were now reconsidering whether the United States is truly as stable as previously believed.

Aside from restoring the gold standard, Mr. Mooney said it was imperative for the U.S. government to come up with a plan to control spending. “Democrats have absolutely no plan to do that,” he said.

He also warned that if current trends continue, economic disaster is a certainty.

“I can’t tell you what the exact limit is, but I never thought we’d be able to get this far,” he said, blasting the $5 trillion in new debt added under the current administration as “totally irresponsible.”

The only answer is to get back to a real standard where the dollar is backed by gold, he said. “If we got back to the gold standard, at least we would have a restriction there in terms of government spending,” Mr. Mooney added.

Read more here…

Loading…