While broader macroeconomic trends are always what’s most significant for the gold price during any given election, some interesting trends emerge when you look at the numbers. And when an election is contentious, historic, or chaotic as 2024’s promises to be, the outcome is all the more significant for gold.

From the January to the September preceding elections since 1980, gold prices have tended to rise. This is often attributed to the nature of the relationship between incumbent presidents and the Fed, as existing administrations put pressure on the central bank to maintain looser monetary policy to foster an illusion of economic prosperity (which presidents can then “take credit” for). Meanwhile, knowing that they’re more likely to be replaced if the other side wins, Fed chairs have an incentive to play ball.

After elections wrap up and the market digests the news, gold has shown a very slight propensity to slide. In a small majority of instances since 1980 when Reagan defeated Jimmy Carter, gold went down in the two weeks following the election. But the numbers weren’t always dramatic — only it dropped .1% in 1996. In 5 out of 11 of those elections, gold rose anywhere from .1% in 1984 to 3% in 2004.

However, between election day and the actual inauguration, a historical downward trend for gold is more definitive. In 9 out of 11 elections since 1980, gold dropped anywhere from .1% to 12.3%, with 2012 seeing a 0% change. The only year where gold rose during this period was 2008, which was more related to the global financial crisis than the election itself.

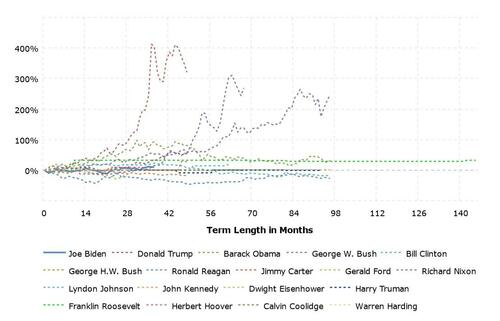

Zooming out to each president’s entire 4-year term since 1980, gold has more time to flex its power as an inflation hedge. It rose in 7 out of 11 presidential cycles, with the most dramatic rise during Barack Obama’s first term in 2008 when, in the wake of a systemic crash, it increased 133%. Conversely, Reagan’s second term saw the largest drop of around 46%.

Gold volatility also often increases during election years as the market tries to decide how to react to short-term election cycle news. But history suggests that short-term price jumps are slightly less likely to occur when Republicans win. As noted by Deseret News’s Dennis Romboy:

“Since 1980, in the two-week periods following a presidential election, Democratic victories saw an average gold price increase of 0.5% while that same period for Republican victories produced an average price drop of 1.1%, according to the U.S. Money Reserve study.”

Since the incumbent is always more likely to keep the current Fed chair in power, the tendency for sitting presidents and the Fed to work together to juice the economy remains whether the current administration is Republican or Democratic. In that sense, the Fed is non-partisan, because it seeks to preserve itself regardless of which side wins.

And if Trump becomes 2024’s Republican nominee, Powell will be particularly motivated to ease monetary policy to help keep a Democrat in the White House. Trump was the one who nominated Powell to begin with, and as often happens with Trump, he quickly became one of the Fed chair’s harshest critics. If Trump returns to office, Peter Schiff has pointed out, Powell knows he’s even more likely to be replaced than if another Republican becomes the nominee:

“I think there’s a lot of bad blood there between Powell and Trump. He knows his job is on the line, too, so that’s another reason to really try to help Biden get elected.”

As Peter said late last year, these dynamics play out so consistently that it seems preserving their power is more important to the Fed than actually helping the economy. On Powell:

“Everything he’s doing is political. The economy takes a back seat to reelect the incumbent party, which is the Democrats, which is Biden.”

That plays into the likelihood of further interest rate cuts in 2024 which would be bearish for the US dollar regardless of who wins in November. Widening budget and trade deficits, historic post-COVID money printing, an escalating war in the Middle East, and other factors are all conspiring with Powell’s (quite logical) desire to keep Democrats in power by easing monetary policy.

As an aside, it’s also important to remember that if a president is expected to replace the Fed chairman with someone new, any uncertainty around that decision can lead to a short-term bump in gold price as markets await signs of stability.

In a unique example during the run-up to the 1980 election, as described in William Greider’s 700-page opus Secrets of the Temple, Greider chronicles the reaction in global markets as speculation abounded around Jimmy Carter’s famously chaotic process for replacing G. William Miller with a new Fed chair. Treasury Secretary W. Michael Blumenthal was resigning, and Miller was leaving the Fed to take that role, leaving Carter the unenviable task of finding a new Fed chair amid rampant stagflation and a looming election the following year. Amid the confusion, safe-haven assets like gold saw increased bids as the dollar wobbled lower.

“The news from financial markets continued to be alarming. Gold was heading toward $307 an ounce. The dollar continued to fall.”

When the news got out that an announcement was imminent that Paul Volcker had been selected for the position, gold dropped again as markets breathed a sigh of relief:

“The next day, financial markets applauded…After months of decline, the dollar abruptly improved on international markets. The price of gold fell $2.60 an ounce.”

Source: Gold vs USD percentage change during various presidencies starting with the Harding administration

When an election year combines the nomination of a new Fed chairman with broader factors contributing to dollar weakness, the effects of the uncertainty are amplified. Although a Democratic re-election in 2024 would be unlikely to involve a changing of the guard at the Fed, there are still plenty of signs of dollar trouble that point to a continuing bullish setup for gold.

In just one example, noted by Michael Maharrey late last year, the Biden administration ran the largest November budget deficit in the history of the presidency:

“And it managed this feat even with a 9% increase in government receipts.”

Meanwhile, Peter has repeatedly sounded the alarm on macroeconomic factors pointing to even higher inflation in 2024 regardless of who runs the Fed, despite Powell’s 2023 victory lap over rising consumer prices:

“There’s no way that inflation is going to come down in an environment where the dollar is that weak.”

For this election year, no matter who lands in the White House, that’s bad news for anyone saving or spending US dollars — but strong signs that gold’s rally still has room to run.

While broader macroeconomic trends are always what’s most significant for the gold price during any given election, some interesting trends emerge when you look at the numbers. And when an election is contentious, historic, or chaotic as 2024’s promises to be, the outcome is all the more significant for gold.

From the January to the September preceding elections since 1980, gold prices have tended to rise. This is often attributed to the nature of the relationship between incumbent presidents and the Fed, as existing administrations put pressure on the central bank to maintain looser monetary policy to foster an illusion of economic prosperity (which presidents can then “take credit” for). Meanwhile, knowing that they’re more likely to be replaced if the other side wins, Fed chairs have an incentive to play ball.

After elections wrap up and the market digests the news, gold has shown a very slight propensity to slide. In a small majority of instances since 1980 when Reagan defeated Jimmy Carter, gold went down in the two weeks following the election. But the numbers weren’t always dramatic — only it dropped .1% in 1996. In 5 out of 11 of those elections, gold rose anywhere from .1% in 1984 to 3% in 2004.

However, between election day and the actual inauguration, a historical downward trend for gold is more definitive. In 9 out of 11 elections since 1980, gold dropped anywhere from .1% to 12.3%, with 2012 seeing a 0% change. The only year where gold rose during this period was 2008, which was more related to the global financial crisis than the election itself.

Zooming out to each president’s entire 4-year term since 1980, gold has more time to flex its power as an inflation hedge. It rose in 7 out of 11 presidential cycles, with the most dramatic rise during Barack Obama’s first term in 2008 when, in the wake of a systemic crash, it increased 133%. Conversely, Reagan’s second term saw the largest drop of around 46%.

Gold volatility also often increases during election years as the market tries to decide how to react to short-term election cycle news. But history suggests that short-term price jumps are slightly less likely to occur when Republicans win. As noted by Deseret News’s Dennis Romboy:

“Since 1980, in the two-week periods following a presidential election, Democratic victories saw an average gold price increase of 0.5% while that same period for Republican victories produced an average price drop of 1.1%, according to the U.S. Money Reserve study.”

Since the incumbent is always more likely to keep the current Fed chair in power, the tendency for sitting presidents and the Fed to work together to juice the economy remains whether the current administration is Republican or Democratic. In that sense, the Fed is non-partisan, because it seeks to preserve itself regardless of which side wins.

And if Trump becomes 2024’s Republican nominee, Powell will be particularly motivated to ease monetary policy to help keep a Democrat in the White House. Trump was the one who nominated Powell to begin with, and as often happens with Trump, he quickly became one of the Fed chair’s harshest critics. If Trump returns to office, Peter Schiff has pointed out, Powell knows he’s even more likely to be replaced than if another Republican becomes the nominee:

“I think there’s a lot of bad blood there between Powell and Trump. He knows his job is on the line, too, so that’s another reason to really try to help Biden get elected.”

As Peter said late last year, these dynamics play out so consistently that it seems preserving their power is more important to the Fed than actually helping the economy. On Powell:

“Everything he’s doing is political. The economy takes a back seat to reelect the incumbent party, which is the Democrats, which is Biden.”

That plays into the likelihood of further interest rate cuts in 2024 which would be bearish for the US dollar regardless of who wins in November. Widening budget and trade deficits, historic post-COVID money printing, an escalating war in the Middle East, and other factors are all conspiring with Powell’s (quite logical) desire to keep Democrats in power by easing monetary policy.

As an aside, it’s also important to remember that if a president is expected to replace the Fed chairman with someone new, any uncertainty around that decision can lead to a short-term bump in gold price as markets await signs of stability.

In a unique example during the run-up to the 1980 election, as described in William Greider’s 700-page opus Secrets of the Temple, Greider chronicles the reaction in global markets as speculation abounded around Jimmy Carter’s famously chaotic process for replacing G. William Miller with a new Fed chair. Treasury Secretary W. Michael Blumenthal was resigning, and Miller was leaving the Fed to take that role, leaving Carter the unenviable task of finding a new Fed chair amid rampant stagflation and a looming election the following year. Amid the confusion, safe-haven assets like gold saw increased bids as the dollar wobbled lower.

“The news from financial markets continued to be alarming. Gold was heading toward $307 an ounce. The dollar continued to fall.”

When the news got out that an announcement was imminent that Paul Volcker had been selected for the position, gold dropped again as markets breathed a sigh of relief:

“The next day, financial markets applauded…After months of decline, the dollar abruptly improved on international markets. The price of gold fell $2.60 an ounce.”

Source: Gold vs USD percentage change during various presidencies starting with the Harding administration

When an election year combines the nomination of a new Fed chairman with broader factors contributing to dollar weakness, the effects of the uncertainty are amplified. Although a Democratic re-election in 2024 would be unlikely to involve a changing of the guard at the Fed, there are still plenty of signs of dollar trouble that point to a continuing bullish setup for gold.

In just one example, noted by Michael Maharrey late last year, the Biden administration ran the largest November budget deficit in the history of the presidency:

“And it managed this feat even with a 9% increase in government receipts.”

Meanwhile, Peter has repeatedly sounded the alarm on macroeconomic factors pointing to even higher inflation in 2024 regardless of who runs the Fed, despite Powell’s 2023 victory lap over rising consumer prices:

“There’s no way that inflation is going to come down in an environment where the dollar is that weak.”

For this election year, no matter who lands in the White House, that’s bad news for anyone saving or spending US dollars — but strong signs that gold’s rally still has room to run.

Loading…