Authored by Pepe Escobar via The Cradle,

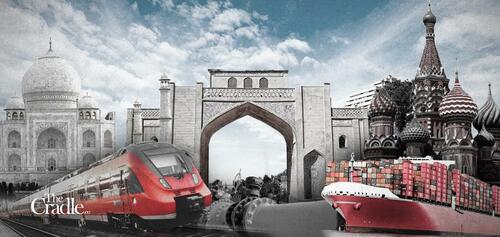

Mega Eurasian organizations and their respective projects are now converging at record speed, with one global pole way ahead of the other.

The War of Economic Corridors is now proceeding full speed ahead, with the game-changing first cargo flow of goods from Russia to India via the International North South Transportation Corridor (INSTC) already in effect.

Very few, both in the east and west, are aware of how this actually has long been in the making: the Russia-Iran-India agreement for implementing a shorter and cheaper Eurasian trade route via the Caspian Sea (compared to the Suez Canal), was first signed in 2000, in the pre-9/11 era.

The INSTC in full operational mode signals a powerful hallmark of Eurasian integration – alongside the Belt and Road Initiative (BRI), the Shanghai Cooperation Organization (SCO), the Eurasian Economic Union (EAEU), and last but not least, what I described as “Pipelineistan” two decades ago.

Caspian is key

Let’s have a first look on how these vectors are interacting.

The genesis of the current acceleration lies in Russian President Vladimir Putin’s recent visit to Ashgabat, Turkmenistan’s capital, for the 6th Caspian Summit. This event not only brought the evolving Russia-Iran strategic partnership to a deeper level, but crucially, all five Caspian Sea littoral states agreed that no NATO warships or bases will be allowed on site.

That essentially configures the Caspian as a virtual Russian lake, and in a minor sense, Iranian – without compromising the interests of the three “stans,” Azerbaijan, Kazakhstan and Turkmenistan. For all practical purposes, Moscow has tightened its grip on Central Asia a notch.

As the Caspian Sea is connected to the Black Sea by canals off the Volga built by the former USSR, Moscow can always count on a reserve navy of small vessels – invariably equipped with powerful missiles – that may be transferred to the Black Sea in no time if necessary.

Stronger trade and financial links with Iran now proceed in tandem with binding the three “stans” to the Russian matrix. Gas-rich republic Turkmenistan for its part has been historically idiosyncratic – apart from committing most of its exports to China.

Under an arguably more pragmatic young new leader, President Serdar Berdimuhamedow, Ashgabat may eventually opt to become a member of the SCO and/or the EAEU.

Caspian littoral state Azerbaijan on the other hand presents a complex case: an oil and gas producer eyed by the European Union (EU) to become an alternative energy supplier to Russia – although this is not happening anytime soon.

The West Asia connection

Iran’s foreign policy under President Ebrahim Raisi is clearly on a Eurasian and Global South trajectory. Tehran will be formally incorporated into the SCO as a full member in the upcoming summit in Samarkand in September, while its formal application to join the BRICS has been filed.

Purnima Anand, head of the BRICS International Forum, has stated that Turkey, Saudi Arabia and Egypt are also very much keen on joining BRICS. Should that happen, by 2024 we could be on our way to a powerful West Asia, North Africa hub firmly installed inside one of the key institutions of the multipolar world.

As Putin heads to Tehran next week for trilateral Russia, Iran, Turkey talks, ostensibly about Syria, Turkish President Recep Tayyip Erdogan is bound to bring up the subject of BRICS.

Tehran is operating on two parallel vectors. In the event the Joint Comprehensive Plan of Action (JCPOA) is revived – a quite dim possibility as it stands, considering the latest shenanigans in Vienna and Doha – that would represent a tactical victory. Yet moving towards Eurasia is on a whole new strategic level.

In the INSTC framework, Iran will make maximum good use of the geostrategically crucial port of Bandar Abbas – straddling the Persian Gulf and the Gulf of Oman, at the crossroads of Asia, Africa and the Indian subcontinent.

Yet as much as it may be portrayed as a major diplomatic victory, it’s clear that Tehran will not be able to make full use of BRICS membership if western – especially US – sanctions are not totally lifted.

Pipelines and the “stans”

A compelling argument can be made that Russia and China might eventually fill the western technology void in the Iranian development process. But there’s a lot more that platforms such as the INSTC, the EAEU and even BRICS can accomplish.

Across “Pipelineistan,” the War of Economic Corridors gets even more complex. Western propaganda simply cannot admit that Azerbaijan, Algeria, Libya, Russia’s allies at OPEC, and even Kazakhstan are not exactly keen on increasing their oil production to help Europe.

Kazakhstan is a tricky case: it is the largest oil producer in Central Asia and set to be a major natural gas supplier, right after Russia and Turkmenistan. More than 250 oil and gas fields are operated in Kazakhstan by 104 companies, including western energy giants such as Chevron, Total, ExxonMobil and Royal Dutch Shell.

While exports of oil, natural gas and petroleum products comprise 57 percent of Kazakhstan’s exports, natural gas is responsible for 85 percent of Turkmenistan’s budget (with 80 percent of exports committed to China). Interestingly, Galkynysh is the second largest gas field on the planet.

Compared to the other “stans,” Azerbaijan is a relatively minor producer (despite oil accounting for 86 percent of its total exports) and basically a transit nation. Baku’s super-wealth aspirations center on the Southern Gas Corridor, which includes no less than three pipelines: Baku-Tblisi-Erzurum (BTE); the Turkish-driven Trans-Anatolian Natural Gas Pipeline (TANAP); and the Trans-Adriatic (TAP).

The problem with this acronym festival – BTE, TANAP, TAP – is that they all need massive foreign investment to increase capacity, which the EU sorely lacks because every single euro is committed by unelected Brussels Eurocrats to “support” the black hole that is Ukraine. The same financial woes apply to a possible Trans-Caspian Pipeline which would further link to both TANAP and TAP.

In the War of Economic Corridors – the “Pipelineistan” chapter – a crucial aspect is that most Kazakh oil exports to the EU go through Russia, via the Caspian Pipeline Consortium (CPC). As an alternative, the Europeans are mulling on a still fuzzy Trans-Caspian International Transport Route, also known as the Middle Corridor (Kazakhstan-Turkmenistan-Azerbaijan-Georgia-Turkey). They actively discussed it in Brussels last month.

The bottom line is that Russia remains in full control of the Eurasia pipeline chessboard (and we’re not even talking about the Gazprom-operated pipelines Power of Siberia 1 and 2 leading to China).

Gazprom executives know all too well that a fast increase of energy exports to the EU is out of the question. They also factor the Tehran Convention – that helps prevent and control pollution and maintain the environmental integrity of the Caspian Sea, signed by all five littoral members.

Breaking BRI in Russia

China, for its part, is confident that one of its prime strategic nightmares may eventually disappear. The notorious “escape from Malacca” is bound to materialize, in cooperation with Russia, via the Northern Sea Route, which will shorten the trade and connectivity corridor from East Asia to Northern Europe from 11,200 nautical miles to only 6,500 nautical miles. Call it the polar twin of the INSTC.

This also explains why Russia has been busy building a vast array of state-of-the-art icebreakers.

So here we have an interconnection of New Silk Roads (the INSTC proceeds in parallel with BRI and the EAEU), Pipelineistan, and the Northern Sea Route on the way to turn western trade domination completely upside down.

Of course, the Chinese have had it planned for quite a while. The first White Paper on China’s Arctic policy, in January 2018, already showed how Beijing is aiming, “jointly with other states” (that means Russia), to implement sea trade routes in the Arctic within the framework of the Polar Silk Road.

And like clockwork, Putin subsequently confirmed that the Northern Sea Route should interact and complement the Chinese Maritime Silk Road.

Russia-China Economic cooperation is evolving on so many complex, convergent levels that just to keep track of it all is a dizzying experience.

A more detailed analysis will reveal some of the finer points, for instance how BRI and SCO interact, and how BRI projects will have to adapt to the heady consequences of Moscow’s Operation Z in Ukraine, with more emphasis being placed on developing Central and West Asian corridors.

It’s always crucial to consider that one of Washington’s key strategic objectives in the relentless hybrid war against Russia was always to break BRI corridors that crisscross Russian territory.

As it stands, it’s important to realize that dozens of BRI projects in industry and investment and cross-border inter-regional cooperation will end up consolidating the Russian concept of the Greater Eurasia Partnership – which essentially revolves around establishing multilateral cooperation with a vast range of nations belonging to organizations such as the EAEU, the SCO, BRICS and ASEAN.

Welcome to the new Eurasian mantra: Make Economic Corridors, Not War.

Authored by Pepe Escobar via The Cradle,

Mega Eurasian organizations and their respective projects are now converging at record speed, with one global pole way ahead of the other.

The War of Economic Corridors is now proceeding full speed ahead, with the game-changing first cargo flow of goods from Russia to India via the International North South Transportation Corridor (INSTC) already in effect.

Very few, both in the east and west, are aware of how this actually has long been in the making: the Russia-Iran-India agreement for implementing a shorter and cheaper Eurasian trade route via the Caspian Sea (compared to the Suez Canal), was first signed in 2000, in the pre-9/11 era.

The INSTC in full operational mode signals a powerful hallmark of Eurasian integration – alongside the Belt and Road Initiative (BRI), the Shanghai Cooperation Organization (SCO), the Eurasian Economic Union (EAEU), and last but not least, what I described as “Pipelineistan” two decades ago.

Caspian is key

Let’s have a first look on how these vectors are interacting.

The genesis of the current acceleration lies in Russian President Vladimir Putin’s recent visit to Ashgabat, Turkmenistan’s capital, for the 6th Caspian Summit. This event not only brought the evolving Russia-Iran strategic partnership to a deeper level, but crucially, all five Caspian Sea littoral states agreed that no NATO warships or bases will be allowed on site.

That essentially configures the Caspian as a virtual Russian lake, and in a minor sense, Iranian – without compromising the interests of the three “stans,” Azerbaijan, Kazakhstan and Turkmenistan. For all practical purposes, Moscow has tightened its grip on Central Asia a notch.

As the Caspian Sea is connected to the Black Sea by canals off the Volga built by the former USSR, Moscow can always count on a reserve navy of small vessels – invariably equipped with powerful missiles – that may be transferred to the Black Sea in no time if necessary.

Stronger trade and financial links with Iran now proceed in tandem with binding the three “stans” to the Russian matrix. Gas-rich republic Turkmenistan for its part has been historically idiosyncratic – apart from committing most of its exports to China.

Under an arguably more pragmatic young new leader, President Serdar Berdimuhamedow, Ashgabat may eventually opt to become a member of the SCO and/or the EAEU.

Caspian littoral state Azerbaijan on the other hand presents a complex case: an oil and gas producer eyed by the European Union (EU) to become an alternative energy supplier to Russia – although this is not happening anytime soon.

The West Asia connection

Iran’s foreign policy under President Ebrahim Raisi is clearly on a Eurasian and Global South trajectory. Tehran will be formally incorporated into the SCO as a full member in the upcoming summit in Samarkand in September, while its formal application to join the BRICS has been filed.

Purnima Anand, head of the BRICS International Forum, has stated that Turkey, Saudi Arabia and Egypt are also very much keen on joining BRICS. Should that happen, by 2024 we could be on our way to a powerful West Asia, North Africa hub firmly installed inside one of the key institutions of the multipolar world.

As Putin heads to Tehran next week for trilateral Russia, Iran, Turkey talks, ostensibly about Syria, Turkish President Recep Tayyip Erdogan is bound to bring up the subject of BRICS.

Tehran is operating on two parallel vectors. In the event the Joint Comprehensive Plan of Action (JCPOA) is revived – a quite dim possibility as it stands, considering the latest shenanigans in Vienna and Doha – that would represent a tactical victory. Yet moving towards Eurasia is on a whole new strategic level.

In the INSTC framework, Iran will make maximum good use of the geostrategically crucial port of Bandar Abbas – straddling the Persian Gulf and the Gulf of Oman, at the crossroads of Asia, Africa and the Indian subcontinent.

Yet as much as it may be portrayed as a major diplomatic victory, it’s clear that Tehran will not be able to make full use of BRICS membership if western – especially US – sanctions are not totally lifted.

Pipelines and the “stans”

A compelling argument can be made that Russia and China might eventually fill the western technology void in the Iranian development process. But there’s a lot more that platforms such as the INSTC, the EAEU and even BRICS can accomplish.

Across “Pipelineistan,” the War of Economic Corridors gets even more complex. Western propaganda simply cannot admit that Azerbaijan, Algeria, Libya, Russia’s allies at OPEC, and even Kazakhstan are not exactly keen on increasing their oil production to help Europe.

Kazakhstan is a tricky case: it is the largest oil producer in Central Asia and set to be a major natural gas supplier, right after Russia and Turkmenistan. More than 250 oil and gas fields are operated in Kazakhstan by 104 companies, including western energy giants such as Chevron, Total, ExxonMobil and Royal Dutch Shell.

While exports of oil, natural gas and petroleum products comprise 57 percent of Kazakhstan’s exports, natural gas is responsible for 85 percent of Turkmenistan’s budget (with 80 percent of exports committed to China). Interestingly, Galkynysh is the second largest gas field on the planet.

Compared to the other “stans,” Azerbaijan is a relatively minor producer (despite oil accounting for 86 percent of its total exports) and basically a transit nation. Baku’s super-wealth aspirations center on the Southern Gas Corridor, which includes no less than three pipelines: Baku-Tblisi-Erzurum (BTE); the Turkish-driven Trans-Anatolian Natural Gas Pipeline (TANAP); and the Trans-Adriatic (TAP).

The problem with this acronym festival – BTE, TANAP, TAP – is that they all need massive foreign investment to increase capacity, which the EU sorely lacks because every single euro is committed by unelected Brussels Eurocrats to “support” the black hole that is Ukraine. The same financial woes apply to a possible Trans-Caspian Pipeline which would further link to both TANAP and TAP.

In the War of Economic Corridors – the “Pipelineistan” chapter – a crucial aspect is that most Kazakh oil exports to the EU go through Russia, via the Caspian Pipeline Consortium (CPC). As an alternative, the Europeans are mulling on a still fuzzy Trans-Caspian International Transport Route, also known as the Middle Corridor (Kazakhstan-Turkmenistan-Azerbaijan-Georgia-Turkey). They actively discussed it in Brussels last month.

The bottom line is that Russia remains in full control of the Eurasia pipeline chessboard (and we’re not even talking about the Gazprom-operated pipelines Power of Siberia 1 and 2 leading to China).

Gazprom executives know all too well that a fast increase of energy exports to the EU is out of the question. They also factor the Tehran Convention – that helps prevent and control pollution and maintain the environmental integrity of the Caspian Sea, signed by all five littoral members.

Breaking BRI in Russia

China, for its part, is confident that one of its prime strategic nightmares may eventually disappear. The notorious “escape from Malacca” is bound to materialize, in cooperation with Russia, via the Northern Sea Route, which will shorten the trade and connectivity corridor from East Asia to Northern Europe from 11,200 nautical miles to only 6,500 nautical miles. Call it the polar twin of the INSTC.

This also explains why Russia has been busy building a vast array of state-of-the-art icebreakers.

So here we have an interconnection of New Silk Roads (the INSTC proceeds in parallel with BRI and the EAEU), Pipelineistan, and the Northern Sea Route on the way to turn western trade domination completely upside down.

Of course, the Chinese have had it planned for quite a while. The first White Paper on China’s Arctic policy, in January 2018, already showed how Beijing is aiming, “jointly with other states” (that means Russia), to implement sea trade routes in the Arctic within the framework of the Polar Silk Road.

And like clockwork, Putin subsequently confirmed that the Northern Sea Route should interact and complement the Chinese Maritime Silk Road.

Russia-China Economic cooperation is evolving on so many complex, convergent levels that just to keep track of it all is a dizzying experience.

A more detailed analysis will reveal some of the finer points, for instance how BRI and SCO interact, and how BRI projects will have to adapt to the heady consequences of Moscow’s Operation Z in Ukraine, with more emphasis being placed on developing Central and West Asian corridors.

It’s always crucial to consider that one of Washington’s key strategic objectives in the relentless hybrid war against Russia was always to break BRI corridors that crisscross Russian territory.

As it stands, it’s important to realize that dozens of BRI projects in industry and investment and cross-border inter-regional cooperation will end up consolidating the Russian concept of the Greater Eurasia Partnership – which essentially revolves around establishing multilateral cooperation with a vast range of nations belonging to organizations such as the EAEU, the SCO, BRICS and ASEAN.

Welcome to the new Eurasian mantra: Make Economic Corridors, Not War.