Guo Wengui, also known as Guo Haoyun, and by his English names Miles Kwok and Miles Guo, is a politically connected, self-proclaimed exiled Chinese billionaire who tried to start a U.S.-China war.

On Feb. 15, the billionaire filed for Chapter 11, personal bankruptcy protection in US Bankruptcy Court in Bridgeport, CT, listing assets of just $3,850 and liabilities between $100 million and $500 million. Guo’s declaration came after a Hong Kong money manager, Pacific Alliance Group, sued him over unpaid debts.

That certainly didn’t add up. Only three months after filing for bankruptcy, Guo had spent nearly $2 million on legal fees. Yet on May 11, he filed a waiver of personal bankruptcy with the court through his lawyer, stating he had no more funds to pay his legal fees.

During the bankruptcy hearing, Guo claimed he owned no house, no car, and no credit cards. That certainly didn’t square up with the lavish lifestyle he flaunted on social media – replete with mansion, private jet and yacht.

So is this story really about bankruptcy? Or a very elaborate ruse?

‘I Wanna Be a Part of It, New York, New York’

Guo was born to a modest family in February 1967 in a rural area of Shandong province. According to the news site China Youth Network, he went through proverbial, eye-opening experiences as a teenager, such as skipping school, brawling and gambling. He married at 18; got his own brother killed for an argument revolving around a mere 7,000 yuan; and was sentenced to three years in prison and four years probation for fraud.

Guo rose to fame by building a real estate empire in Beijing, which earned him titles such as “Capital Giant”, “Power Hunter” and “Pirate of the Caribbean” from awed Chinese netizens. In 2017, Interpol issued a Red Notice for Guo, who had already fled to the US in 2015 after being accused by the Chinese government of fraud, bribery, and money laundering. He denied all charges.

Yet according to information publicly available, Guo committed a series of financial frauds, including a $539 million scam targeting small investors in the United States, a $470 million fraudulent loan in China, and a $43 million cryptocurrency Ponzi scheme.

In recent years, Guo has had a quite active life online, amassing special notoriety for his fierce criticism of the Chinese Communist Party.

According to China’s Chongqing Public Security Bureau, Guo has been building a case since August 2017 for political asylum in the US by concocting a series of online exposés.

Some of these, revolving around Hunter Biden’s sex antics , caught the attention of US media. Guo’s central spin at the time was that “We have to express…the Chinese Communist Party used these to threaten Hunter and [Joe] Biden.” But he provided no proof of this.

In 2017, Guo gained the attention of Foreign Affairs in an article co-written by Rush Doshi, who’s now senior director for China at the US National Security Council. The article focused on how Guo – without providing sources or conclusive evidence – threw lurid allegations at Chinese Vice President Wang Qishan, the head of President Xi Jinping’s anti-corruption campaign.

“Guo Wengui, an expatriate Chinese billionaire, began to make explosive allegations on YouTube and Twitter about China’s leaders,” Doshi and co-author George Yin explained.

“President Xi Jinping, Guo claimed, had sought incriminating information about Wang Qishan, Xi’s right-hand man and the chief of his anti-corruption campaign. The figure tasked with rooting out China’s official graft, Guo suggested, was himself corrupt — if not directly, then through his family’s alleged financial holdings. Guo’s claims seemed designed to sever China’s most important political relationship before this fall’s 19th Party Congress, where officials will determine Xi’s longevity as president and select members for China’s top decision-making bodies.”

Guo’s patrons included disgraced Chinese security officials Ma Jian, Vice-Minister of Public Security 2006-2015 and Zhou Yongkang, Minister of Public Security 2002-2007.

A powerful member of the Politburo’s Standing Committee, Zhou was expelled from the Communist Party in 2014 and sentenced to life in prison the following year. In 2018, Ma was sentenced to life in prison for taking bribes from Guo, according to court proceedings. Another of Guo’s handlers, Politburo member Sun Zhengcai, got a life sentence for bribery in 2018.

Sun was the Communist Party boss in the western megacity Chongqing. After Sun’s disgrace, the supervision of Guo passed to China’s vice-minister of police Sun Lijun (no relation), and Justice Minister Fu Zenghua. Sun Lijun was convicted of corruption in July 2022 and awaits sentencing. Fu is under arrest and awaiting trial.

What stands out is that throughout this period Guo acted as an agent of elements in China’s security services purged and convicted for corruption.

Later, in 2021, Guo switched to promoting the allegation that Chinese hackers had shifted presidential election votes from Trump to Joe Biden.

Guo’s politicking is just as intriguing as his business adventures. Especially because of his status as former protégé of the very powerful ex-Vice Minister of State Security Ma Jian, who was himself a mentor of security chief Zhou Yongkang, then a Politburo member.

It’s not an accident that Guo fled China soon after Ma and Zhou were arrested as part of President Xi’s anti-corruption campaign. At the time, Guo was in a bitter business dispute with his former partner and politically connected tycoon Li You. That was bringing unwanted attention to his financial dealings.

The central plot in this murky saga revolves around opaque developments inside the all-powerful Ministry of State Security (MSS) in the early 2010s, when Xi Jinping came to power.

Guo’s intelligence handlers, Ma and Zhou, were allies of Ling Jihua, who was former President Hu Jintao’s chief of staff. The crucial link between Ma and Ling was provided by Sun Zhengcai, the former party secretary of Chongqing, also a Politburo member.

As we’ve seen, Zhou, Ling, and Sun all ended up in jail – targets of Xi’s anti-corruption campaign. But, remarkably, not Guo – who according to former Chinese government officials was Ma’s MSS agent in charge of special ops overseas.

Guo’s job in 2012 was to sabotage the ascension of Xi by spreading an array of fake news in China and among the Chinese diaspora. That failed.

Nonetheless, Guo remained at work as an MSS agent until at least October 2021, according to well-placed Chinese sources. Considering his recent activities and the fact he was lavishly embraced by prominent US China hawks, it appears that his assignment was to cause maximum damage to US-China relations, arguably derailing them to a point of no return.

How to Profit From Lavish Overseas Funds

Guo impressed his American hosts with a show of vast wealth. After fleeing China he took up residence in New York in a $70 million apartment in the Sherry-Netherland Hotel on Fifth Avenue overlooking Central Park.

His bragging rights included buying more than 200 custom-tailored suits a year; spending more than $20 million in legal fees around the world; smoking $10,000 cigars; and drinking limited editions of the Chinese liquor Moutai. All that, of course, neatly fit his claim to bankruptcy court of holding only $3,850 in personal assets.

In his bankruptcy filing, Guo argued to the court that his expenses were funded by his family. The luxury apartment in New York was owned by the family company; a villa was owned by his wife’s company; daily expenses and all those customized suits were provided by Golden Spring, a New York-based company owned by his son Guo Qiang.

Qu Guojiao, or Natasha Qu, Guo Wengui’s former financial assistant, still living in China, revealed in an exclusive interview that in the space of over 20 years, Guo set up more than 100 companies in Hong Kong, China, the United Kingdom, the United States, the British Virgin Islands and the Cayman Islands. None of these were under his name, she said. Yet regardless of who and which company holds them, the ultimate flow of funds and shareholding arrangements always proceeded at Guo’s own discretion, Qu said.

Guo is known to have amassed a huge fortune by colluding with corrupt Chinese powerbrokers and business tycoons: that’s the reason for his fame among Chinese netizens as a “Capital Giant”. Yet most of the funds came from unknown sources, and were never under his name.

The Blair Connection

As previously reported by the respected Chinese business newspaper Caixin Global, one of Guo’s main sources of money materialized with the help of former British Prime Minister Tony Blair. With Blair’s endorsement, Guo raised $3 billion from the Abu Dhabi royal family.

Blair flew on a luxury private jet during a visit to the Middle East in 2013 when he was the U.N. Quartet’s Middle East envoy; he was accompanied by Guo, who was responsible for paying for the flight, according to Caixin.

Guo won the Blairs’ favor when he bought 5,000 copies of Blair’s wife Cherie’s new autobiographical book in Chinese, Speaking for Myself, in August 2009. In 2013, Blair introduced Guo to a group of dignitaries from the Abu Dhabi royal family, the newspaper reported.

In 2014 Guo, with the support of all-powerful Ma Jian, then Chinese vice minister of security, used Blair’s position as the Special Envoy to the Middle East Quartet to gain the trust of the Abu Dhabi royals. Guo ended up signing a contract with them in Macau on Dec. 16 that year, setting up a “China-Arab Fund,” according to China Daily.

The first $1.5 billion was paid from Abu Dhabi’s Cayman Islands-registered company Roscalitar 2 to one of Guo Wengui’s bank accounts the following day. Guo’s assistant at the time, Qu, confirmed in the interview that the money was used to buy Hong Kong stocks, property, a yacht and other assets.

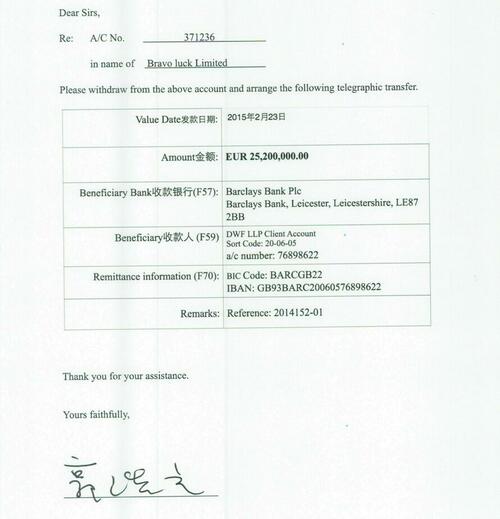

(CAPTION: Voucher signed and authorized by Guo Wengui for the transfer of €25.2 million from Bravo Luck Ltd to DWF LLP for the balance of the purchase of the Lady May yacht)

Natasha Qu stated: “In December 2014, the Abu Dhabi side transferred 1.5 billion to Guo Wengui, who immediately instructed her to transfer the money to HK International Funds Investment Ltd, a company controlled by Guo Wengui through her and Guo Qiang.”

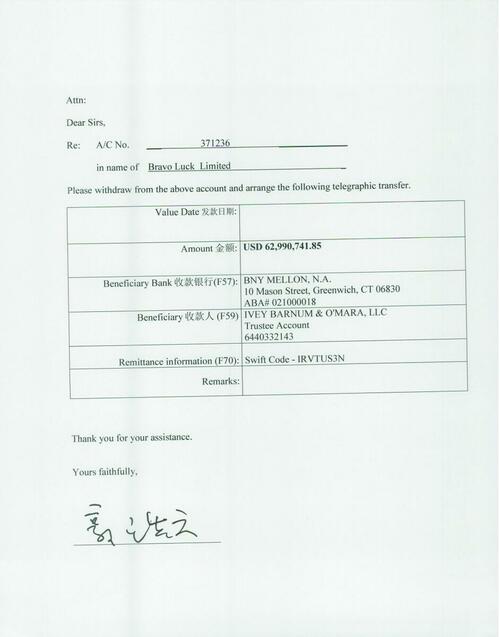

Guo, according to Qu, “asked to transfer a total of $520 million in two installments to the Bravo Luck Ltd account. Payments were then made through the Bravo Luck Ltd account to purchase the Lady May yacht, the luxury apartment in New York, and money was also transferred to Guo Qiang himself and to his controlled [company] Golden Spring” at its Hong Kong head office.

(CAPTION: Voucher signed and authorized by Guo Wengui for transfer from Bravo Luck Ltd $62,990,741.85 to IVEY Barnum & O’Mara LLC for the balance of the apartment in the Sherry Netherland Hotel in New York)

Natasha Qu adds: “Although Guo Wengui had more than a hundred companies in Hong Kong and the British Virgin Islands, none of them had any real business and there was basically no money in the company accounts. They were set up simply to raise and transfer money. All of Guo Wengui’s spending in those two or three years both at home and abroad came from this Abu Dhabi money.”

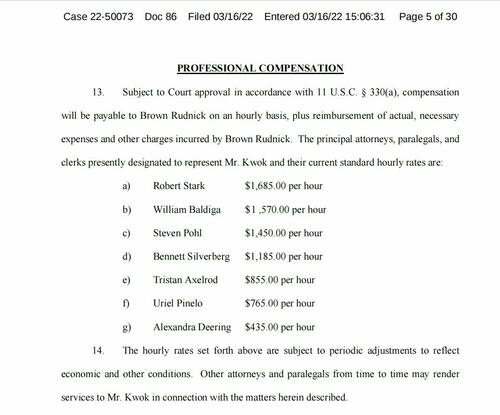

There’s no information as to whether any of these funds are still left. What is clear is that Guo kept spending right up until and after his recent bankruptcy filing. After claiming he was flat broke, Guo hired three big-name lawyers from top US law firm Brown Rudnick LLP each charging more than $1,000 an hour, according to news reports of the bankruptcy filing.

(Lawyers’ fees listed in the court papers submitted by Guo Wengui)

Documents in Guo’s bankruptcy case show that the day before filing for bankruptcy, he sent $1 million to law firm Brown & Rudnick from Lamp Capital Ltd (Lamp Capital). In addition to this firm, Guo also hired the services of Stretto Insolvency Solutions and V&L Financial Services, according to court filings. In May 2022 Guo set up an $8 million loan from his own New York-based company Golden Spring to pay for insolvency administration and financial services.

Should I Stay (Bankrupt) or Should I Go?

It’s not clear how wealthy Guo Wengui really is, and what are his real assets.

One of the most contentious assets in the years-long litigation between Hong Kong’s Pacific Alliance Group and Guo Wengui is the now-famous Lady May yacht, where federal officials had arrested Steve Bannon in 2020 for alleged fraud. Guo claimed that he sold the yacht to his daughter Guo Mei for $1, and that it is docked in a Spanish harbor.

Natasha Qu reports that “the yacht was purchased in February 2015 by Guo Wengui for €28 million, with funds from the first US$1.5 billion released by the China-Arab Fund, in the name of Hong Kong International Fund Investment Ltd, and registered in the same name.”

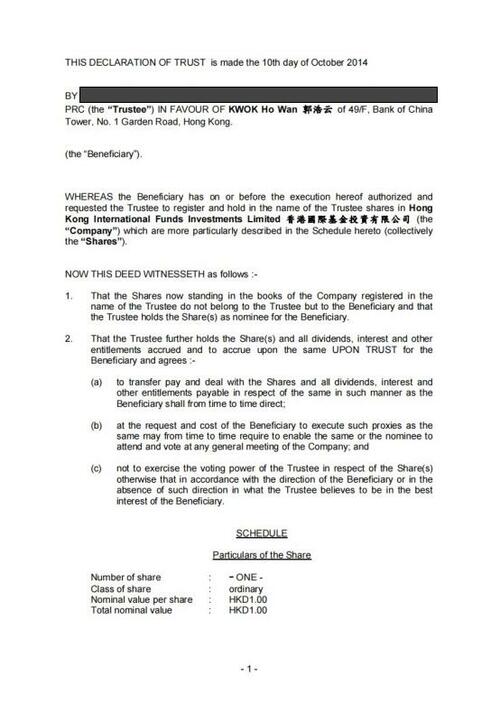

Qu says she transferred the ownership of Lady May to Guo Mei for US$1 on June 17, 2017, as instructed by Guo. Back in October 2014, Guo asked Natasha Qu to sign a Declaration of Trust to hold Hong Kong International Fund Investment Limited for him, after which the company was transferred to Natasha Qu to hold on his behalf for the price of HK$1.

The Declaration of Trust made it clear that all actions of the trustee, Natasha Qu, in relation to the shareholding of the company were to be done in accordance with the instructions of the beneficiary, Guo Wengui. After Qu signed the Declaration of Trust, she said the document was taken away by Guo and kept by his lawyer.

As Natasha Qu explains, “When the Hong Kong police investigated Guo Wengui for money laundering in 2017, Guo asked me to prepare the paperwork for a trip to the United States to transfer the entirety of Hong Kong International Fund Investment Limited to Guo Mei.”

(CAPTION: Declaration of trust signed by Natasha Qu to hold Hong Kong International Fund Investment Limited for Guo Wengui).

After he fled to the US, Guo tried his best to package himself as deeply hostile to Beijing. Guo’s patrons in the security services were convicted of major crimes or under investigation, and he feared arrest under corruption charges. According to the New York Times, Guo was on China’s most-wanted list for bribery, fraud and money laundering.

Guo spent lavishly to win the support of associates of President Donald Trump. He hired former White House strategist Steve Bannon for a $1 million a year retainer. In 2020, alongside Bannon, Guo announced the creation of the “New Federal State of China,” supposedly to overthrow China’s Communist Party.

The “Federal State” held an event in New York on June 4, 2022, with Bannon and a group of former senior Trump aides, including White House trade advisor Peter Navarro and speechwriter Jason Miller.

Before the “Federal State” adventure, Guo set up the Rule of Law Foundation in 2018; launched a G series of investment projects such as GTV and G Coin, as well as farm loans, G-Club cards and Xi Coin. These ventures brought in hundreds of millions of dollars in sales and donations, but landed him in legal trouble.

In May 2020, the Securities and Exchange Commission (SEC) imposed a $539 million penalty for Guo’s US$487 million in illegal private placements of GTV and G Coin. The remaining projects are also being investigated to varying degrees, including a “farm loan” of almost US$200 million at the end of 2020 and over US$100 million from the sale of one billion H-coins in 2021. The whereabouts and use of these funds are a complete mystery.

Guo Wengui’s personal bankruptcy case is still pending. Under court order, Guo, as the owner of the Lady May yacht, promised on April 6 to allow the yacht to return to the US by July 15 and to post a US$37 million bond. On April 17, the bankruptcy court held Guo in contempt for hiding his yacht overseas.

On May 11, Guo voluntarily filed to dismiss his personal bankruptcy case. This bizarre behavior caught the attention of major news media.

Bankruptcy Court Acts

On June 16, the Connecticut Bankruptcy Court noted that Guo Wengui and his family had interests in numerous limited liability companies and allegedly hid assets and defrauded creditors by depositing substantial personal assets among numerous subordinates and family members.

The court ultimately denied Guo’s motion to dismiss, appointed a trustee for the bankruptcy assets, continued the bankruptcy proceedings, and appointed a trustee to conduct a worldwide investigation into Guo’s assets and whether Guo had acted in good faith in filing for bankruptcy.

If creditors pursuing their investigation find that Guo has hidden assets and filed for bankruptcy, he may be found guilty of violating US bankruptcy laws as well as bankruptcy fraud. That would land him in serious legal trouble. And this time there won’t be any powerful Ministry of State Security patrons to lend a helping hand.

Guo Wengui, also known as Guo Haoyun, and by his English names Miles Kwok and Miles Guo, is a politically connected, self-proclaimed exiled Chinese billionaire who tried to start a U.S.-China war.

On Feb. 15, the billionaire filed for Chapter 11, personal bankruptcy protection in US Bankruptcy Court in Bridgeport, CT, listing assets of just $3,850 and liabilities between $100 million and $500 million. Guo’s declaration came after a Hong Kong money manager, Pacific Alliance Group, sued him over unpaid debts.

That certainly didn’t add up. Only three months after filing for bankruptcy, Guo had spent nearly $2 million on legal fees. Yet on May 11, he filed a waiver of personal bankruptcy with the court through his lawyer, stating he had no more funds to pay his legal fees.

During the bankruptcy hearing, Guo claimed he owned no house, no car, and no credit cards. That certainly didn’t square up with the lavish lifestyle he flaunted on social media – replete with mansion, private jet and yacht.

So is this story really about bankruptcy? Or a very elaborate ruse?

‘I Wanna Be a Part of It, New York, New York’

Guo was born to a modest family in February 1967 in a rural area of Shandong province. According to the news site China Youth Network, he went through proverbial, eye-opening experiences as a teenager, such as skipping school, brawling and gambling. He married at 18; got his own brother killed for an argument revolving around a mere 7,000 yuan; and was sentenced to three years in prison and four years probation for fraud.

Guo rose to fame by building a real estate empire in Beijing, which earned him titles such as “Capital Giant”, “Power Hunter” and “Pirate of the Caribbean” from awed Chinese netizens. In 2017, Interpol issued a Red Notice for Guo, who had already fled to the US in 2015 after being accused by the Chinese government of fraud, bribery, and money laundering. He denied all charges.

Yet according to information publicly available, Guo committed a series of financial frauds, including a $539 million scam targeting small investors in the United States, a $470 million fraudulent loan in China, and a $43 million cryptocurrency Ponzi scheme.

In recent years, Guo has had a quite active life online, amassing special notoriety for his fierce criticism of the Chinese Communist Party.

According to China’s Chongqing Public Security Bureau, Guo has been building a case since August 2017 for political asylum in the US by concocting a series of online exposés.

Some of these, revolving around Hunter Biden’s sex antics , caught the attention of US media. Guo’s central spin at the time was that “We have to express…the Chinese Communist Party used these to threaten Hunter and [Joe] Biden.” But he provided no proof of this.

In 2017, Guo gained the attention of Foreign Affairs in an article co-written by Rush Doshi, who’s now senior director for China at the US National Security Council. The article focused on how Guo – without providing sources or conclusive evidence – threw lurid allegations at Chinese Vice President Wang Qishan, the head of President Xi Jinping’s anti-corruption campaign.

“Guo Wengui, an expatriate Chinese billionaire, began to make explosive allegations on YouTube and Twitter about China’s leaders,” Doshi and co-author George Yin explained.

“President Xi Jinping, Guo claimed, had sought incriminating information about Wang Qishan, Xi’s right-hand man and the chief of his anti-corruption campaign. The figure tasked with rooting out China’s official graft, Guo suggested, was himself corrupt — if not directly, then through his family’s alleged financial holdings. Guo’s claims seemed designed to sever China’s most important political relationship before this fall’s 19th Party Congress, where officials will determine Xi’s longevity as president and select members for China’s top decision-making bodies.”

Guo’s patrons included disgraced Chinese security officials Ma Jian, Vice-Minister of Public Security 2006-2015 and Zhou Yongkang, Minister of Public Security 2002-2007.

A powerful member of the Politburo’s Standing Committee, Zhou was expelled from the Communist Party in 2014 and sentenced to life in prison the following year. In 2018, Ma was sentenced to life in prison for taking bribes from Guo, according to court proceedings. Another of Guo’s handlers, Politburo member Sun Zhengcai, got a life sentence for bribery in 2018.

Sun was the Communist Party boss in the western megacity Chongqing. After Sun’s disgrace, the supervision of Guo passed to China’s vice-minister of police Sun Lijun (no relation), and Justice Minister Fu Zenghua. Sun Lijun was convicted of corruption in July 2022 and awaits sentencing. Fu is under arrest and awaiting trial.

What stands out is that throughout this period Guo acted as an agent of elements in China’s security services purged and convicted for corruption.

Later, in 2021, Guo switched to promoting the allegation that Chinese hackers had shifted presidential election votes from Trump to Joe Biden.

Guo’s politicking is just as intriguing as his business adventures. Especially because of his status as former protégé of the very powerful ex-Vice Minister of State Security Ma Jian, who was himself a mentor of security chief Zhou Yongkang, then a Politburo member.

It’s not an accident that Guo fled China soon after Ma and Zhou were arrested as part of President Xi’s anti-corruption campaign. At the time, Guo was in a bitter business dispute with his former partner and politically connected tycoon Li You. That was bringing unwanted attention to his financial dealings.

The central plot in this murky saga revolves around opaque developments inside the all-powerful Ministry of State Security (MSS) in the early 2010s, when Xi Jinping came to power.

Guo’s intelligence handlers, Ma and Zhou, were allies of Ling Jihua, who was former President Hu Jintao’s chief of staff. The crucial link between Ma and Ling was provided by Sun Zhengcai, the former party secretary of Chongqing, also a Politburo member.

As we’ve seen, Zhou, Ling, and Sun all ended up in jail – targets of Xi’s anti-corruption campaign. But, remarkably, not Guo – who according to former Chinese government officials was Ma’s MSS agent in charge of special ops overseas.

Guo’s job in 2012 was to sabotage the ascension of Xi by spreading an array of fake news in China and among the Chinese diaspora. That failed.

Nonetheless, Guo remained at work as an MSS agent until at least October 2021, according to well-placed Chinese sources. Considering his recent activities and the fact he was lavishly embraced by prominent US China hawks, it appears that his assignment was to cause maximum damage to US-China relations, arguably derailing them to a point of no return.

How to Profit From Lavish Overseas Funds

Guo impressed his American hosts with a show of vast wealth. After fleeing China he took up residence in New York in a $70 million apartment in the Sherry-Netherland Hotel on Fifth Avenue overlooking Central Park.

His bragging rights included buying more than 200 custom-tailored suits a year; spending more than $20 million in legal fees around the world; smoking $10,000 cigars; and drinking limited editions of the Chinese liquor Moutai. All that, of course, neatly fit his claim to bankruptcy court of holding only $3,850 in personal assets.

In his bankruptcy filing, Guo argued to the court that his expenses were funded by his family. The luxury apartment in New York was owned by the family company; a villa was owned by his wife’s company; daily expenses and all those customized suits were provided by Golden Spring, a New York-based company owned by his son Guo Qiang.

Qu Guojiao, or Natasha Qu, Guo Wengui’s former financial assistant, still living in China, revealed in an exclusive interview that in the space of over 20 years, Guo set up more than 100 companies in Hong Kong, China, the United Kingdom, the United States, the British Virgin Islands and the Cayman Islands. None of these were under his name, she said. Yet regardless of who and which company holds them, the ultimate flow of funds and shareholding arrangements always proceeded at Guo’s own discretion, Qu said.

Guo is known to have amassed a huge fortune by colluding with corrupt Chinese powerbrokers and business tycoons: that’s the reason for his fame among Chinese netizens as a “Capital Giant”. Yet most of the funds came from unknown sources, and were never under his name.

The Blair Connection

As previously reported by the respected Chinese business newspaper Caixin Global, one of Guo’s main sources of money materialized with the help of former British Prime Minister Tony Blair. With Blair’s endorsement, Guo raised $3 billion from the Abu Dhabi royal family.

Blair flew on a luxury private jet during a visit to the Middle East in 2013 when he was the U.N. Quartet’s Middle East envoy; he was accompanied by Guo, who was responsible for paying for the flight, according to Caixin.

Guo won the Blairs’ favor when he bought 5,000 copies of Blair’s wife Cherie’s new autobiographical book in Chinese, Speaking for Myself, in August 2009. In 2013, Blair introduced Guo to a group of dignitaries from the Abu Dhabi royal family, the newspaper reported.

In 2014 Guo, with the support of all-powerful Ma Jian, then Chinese vice minister of security, used Blair’s position as the Special Envoy to the Middle East Quartet to gain the trust of the Abu Dhabi royals. Guo ended up signing a contract with them in Macau on Dec. 16 that year, setting up a “China-Arab Fund,” according to China Daily.

The first $1.5 billion was paid from Abu Dhabi’s Cayman Islands-registered company Roscalitar 2 to one of Guo Wengui’s bank accounts the following day. Guo’s assistant at the time, Qu, confirmed in the interview that the money was used to buy Hong Kong stocks, property, a yacht and other assets.

(CAPTION: Voucher signed and authorized by Guo Wengui for the transfer of €25.2 million from Bravo Luck Ltd to DWF LLP for the balance of the purchase of the Lady May yacht)

Natasha Qu stated: “In December 2014, the Abu Dhabi side transferred 1.5 billion to Guo Wengui, who immediately instructed her to transfer the money to HK International Funds Investment Ltd, a company controlled by Guo Wengui through her and Guo Qiang.”

Guo, according to Qu, “asked to transfer a total of $520 million in two installments to the Bravo Luck Ltd account. Payments were then made through the Bravo Luck Ltd account to purchase the Lady May yacht, the luxury apartment in New York, and money was also transferred to Guo Qiang himself and to his controlled [company] Golden Spring” at its Hong Kong head office.

(CAPTION: Voucher signed and authorized by Guo Wengui for transfer from Bravo Luck Ltd $62,990,741.85 to IVEY Barnum & O’Mara LLC for the balance of the apartment in the Sherry Netherland Hotel in New York)

Natasha Qu adds: “Although Guo Wengui had more than a hundred companies in Hong Kong and the British Virgin Islands, none of them had any real business and there was basically no money in the company accounts. They were set up simply to raise and transfer money. All of Guo Wengui’s spending in those two or three years both at home and abroad came from this Abu Dhabi money.”

There’s no information as to whether any of these funds are still left. What is clear is that Guo kept spending right up until and after his recent bankruptcy filing. After claiming he was flat broke, Guo hired three big-name lawyers from top US law firm Brown Rudnick LLP each charging more than $1,000 an hour, according to news reports of the bankruptcy filing.

(Lawyers’ fees listed in the court papers submitted by Guo Wengui)

Documents in Guo’s bankruptcy case show that the day before filing for bankruptcy, he sent $1 million to law firm Brown & Rudnick from Lamp Capital Ltd (Lamp Capital). In addition to this firm, Guo also hired the services of Stretto Insolvency Solutions and V&L Financial Services, according to court filings. In May 2022 Guo set up an $8 million loan from his own New York-based company Golden Spring to pay for insolvency administration and financial services.

Should I Stay (Bankrupt) or Should I Go?

It’s not clear how wealthy Guo Wengui really is, and what are his real assets.

One of the most contentious assets in the years-long litigation between Hong Kong’s Pacific Alliance Group and Guo Wengui is the now-famous Lady May yacht, where federal officials had arrested Steve Bannon in 2020 for alleged fraud. Guo claimed that he sold the yacht to his daughter Guo Mei for $1, and that it is docked in a Spanish harbor.

Natasha Qu reports that “the yacht was purchased in February 2015 by Guo Wengui for €28 million, with funds from the first US$1.5 billion released by the China-Arab Fund, in the name of Hong Kong International Fund Investment Ltd, and registered in the same name.”

Qu says she transferred the ownership of Lady May to Guo Mei for US$1 on June 17, 2017, as instructed by Guo. Back in October 2014, Guo asked Natasha Qu to sign a Declaration of Trust to hold Hong Kong International Fund Investment Limited for him, after which the company was transferred to Natasha Qu to hold on his behalf for the price of HK$1.

The Declaration of Trust made it clear that all actions of the trustee, Natasha Qu, in relation to the shareholding of the company were to be done in accordance with the instructions of the beneficiary, Guo Wengui. After Qu signed the Declaration of Trust, she said the document was taken away by Guo and kept by his lawyer.

As Natasha Qu explains, “When the Hong Kong police investigated Guo Wengui for money laundering in 2017, Guo asked me to prepare the paperwork for a trip to the United States to transfer the entirety of Hong Kong International Fund Investment Limited to Guo Mei.”

(CAPTION: Declaration of trust signed by Natasha Qu to hold Hong Kong International Fund Investment Limited for Guo Wengui).

After he fled to the US, Guo tried his best to package himself as deeply hostile to Beijing. Guo’s patrons in the security services were convicted of major crimes or under investigation, and he feared arrest under corruption charges. According to the New York Times, Guo was on China’s most-wanted list for bribery, fraud and money laundering.

Guo spent lavishly to win the support of associates of President Donald Trump. He hired former White House strategist Steve Bannon for a $1 million a year retainer. In 2020, alongside Bannon, Guo announced the creation of the “New Federal State of China,” supposedly to overthrow China’s Communist Party.

The “Federal State” held an event in New York on June 4, 2022, with Bannon and a group of former senior Trump aides, including White House trade advisor Peter Navarro and speechwriter Jason Miller.

Before the “Federal State” adventure, Guo set up the Rule of Law Foundation in 2018; launched a G series of investment projects such as GTV and G Coin, as well as farm loans, G-Club cards and Xi Coin. These ventures brought in hundreds of millions of dollars in sales and donations, but landed him in legal trouble.

In May 2020, the Securities and Exchange Commission (SEC) imposed a $539 million penalty for Guo’s US$487 million in illegal private placements of GTV and G Coin. The remaining projects are also being investigated to varying degrees, including a “farm loan” of almost US$200 million at the end of 2020 and over US$100 million from the sale of one billion H-coins in 2021. The whereabouts and use of these funds are a complete mystery.

Guo Wengui’s personal bankruptcy case is still pending. Under court order, Guo, as the owner of the Lady May yacht, promised on April 6 to allow the yacht to return to the US by July 15 and to post a US$37 million bond. On April 17, the bankruptcy court held Guo in contempt for hiding his yacht overseas.

On May 11, Guo voluntarily filed to dismiss his personal bankruptcy case. This bizarre behavior caught the attention of major news media.

Bankruptcy Court Acts

On June 16, the Connecticut Bankruptcy Court noted that Guo Wengui and his family had interests in numerous limited liability companies and allegedly hid assets and defrauded creditors by depositing substantial personal assets among numerous subordinates and family members.

The court ultimately denied Guo’s motion to dismiss, appointed a trustee for the bankruptcy assets, continued the bankruptcy proceedings, and appointed a trustee to conduct a worldwide investigation into Guo’s assets and whether Guo had acted in good faith in filing for bankruptcy.

If creditors pursuing their investigation find that Guo has hidden assets and filed for bankruptcy, he may be found guilty of violating US bankruptcy laws as well as bankruptcy fraud. That would land him in serious legal trouble. And this time there won’t be any powerful Ministry of State Security patrons to lend a helping hand.