Authored by Pepe Escobar via The Cradle,

As Beijing’s Belt and Road Initiative enters its 10th year, a strong Sino-Russian geostrategic partnership has revitalized the BRI across the Global South...

The year 2022 ended with a Zoom call to end all Zoom calls: Presidents Vladimir Putin and Xi Jinping discussing all aspects of the Russia-China strategic partnership in an exclusive video call.

Putin told Xi how “Russia and China managed to ensure record high growth rates of mutual trade,” meaning “we will be able to reach our target of $200 billion by 2024 ahead of schedule.”

On their coordination to “form a just world order based on international law,” Putin emphasized how “we share the same views on the causes, course, and logic of the ongoing transformation of the global geopolitical landscape.”

Facing “unprecedented pressure and provocations from the west,” Putin noted how Russia-China are not only defending their own interests “but also all those who stand for a truly democratic world order and the right of countries to freely determine their own destiny.”

Earlier, Xi had announced that Beijing will hold the 3rd Belt and Road Forum in 2023. This has been confirmed, off the record, by diplomatic sources. The forum was initially designed to be bi-annual, first held in 2017 and then 2019. 2021 didn’t happen because of Covid-19.

The return of the forum signals not only a renewed drive but an extremely significant landmark as the Belt and Road Initiative (BRI), launched in Astana and then Jakarta in 2013, will be celebrating its 10th anniversary.

BRI version 2.0

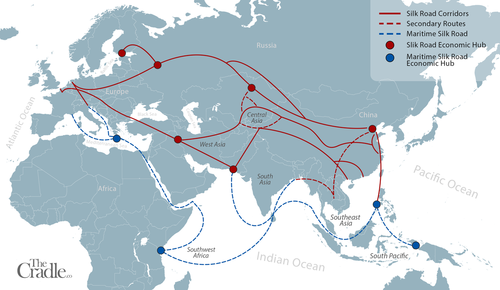

That set the tone for 2023 across the whole geopolitical and geoeconomic spectrum. In parallel to its geoconomic breadth and reach, BRI has been conceived as China’s overarching foreign policy concept up to the mid-century. Now it’s time to tweak things. BRI 2.0 projects, along its several connectivity corridors, are bound to be re-dimensioned to adapt to the post-Covid environment, the reverberations of the war in Ukraine, and a deeply debt-distressed world.

Map of BRI (Photo Credit: The Cradle)

And then there’s the interlocking of the connectivity drive via BRI with the connectivity drive via the International North South Transportation Corridor (INTSC), whose main players are Russia, Iran and India.

Expanding on the geoeconomic drive of the Russia-China partnership as discussed by Putin and Xi, the fact that Russia, China, Iran and India are developing interlocking trade partnerships should establish that BRICS members Russia, India and China, plus Iran as one of the upcoming members of the expanded BRICS+, are the ‘Quad’ that really matter across Eurasia.

The new Politburo Standing Committee in Beijing, which are totally aligned with Xi’s priorities, will be keenly focused on solidifying concentric spheres of geoeconomic influence across the Global South.

How China plays ‘strategic ambiguity’

This has nothing to do with balance of power, which is a western concept that additionally does not connect with China’s five millennia of history. Neither is this another inflection of “unity of the center” – the geopolitical representation according to which no nation is able to threaten the center, China, as long as it is able to maintain order.

These cultural factors that in the past may have prevented China from accepting an alliance under the concept of parity have now vanished when it comes to the Russia-China strategic partnership.

Back in February 2022, days before the events that led to Russia’s Special Military Operation (SMO) in Ukraine, Putin and Xi, in person, had announced that their partnership had “no limits” – even if they hold different approaches on how Moscow should deal with a Kiev lethally instrumentalized by the west to threaten Russia.

In a nutshell: Beijing will not “abandon” Moscow because of Ukraine – as much as it will not openly show support. The Chinese are playing their very own subtle interpretation of what Russians define as “strategic ambiguity.”

Connectivity in West Asia

In West Asia, BRI projects will advance especially fast in Iran, as part of the 25-year deal signed between Beijing and Tehran and the definitive demise of the Joint Comprehensive Plan of Action (JCPOA) – or Iran nuclear deal – which will translate into no European investment in the Iranian economy.

Iran is not only a BRI partner but also a full-fledged Shanghai Cooperation Organization (SCO) member. It has clinched a free trade agreement with the Eurasia Economic Union (EAEU), which consists of post-Soviet states Russia, Armenia, Belarus, Kazakhstan and Kyrgyzstan.

And Iran is, today, arguably the key interconnector of the INSTC, opening up the Indian Ocean and beyond, interconnecting not only with Russia and India but also China, Southeast Asia, and even, potentially, Europe – assuming the EU leadership will one day see which way the wind is blowing.

Map of INSTC (Photo Credit: The Cradle)

So here we have heavily US-sanctioned Iran profiting simultaneously from BRI, INSTC and the EAEU free trade deal. The three critical BRICS members – India, China, Russia – will be particularly interested in the development of the trans-Iranian transit corridor – which happens to be the shortest route between most of the EU and South and Southeast Asia, and will provide faster, cheaper transportation.

Add to this the groundbreaking planned Russia-Transcaucasia-Iran electric power corridor, which could become the definitive connectivity link capable of smashing the antagonism between Azerbaijan and Armenia.

In the Arab world, Xi has already rearranged the chessboard. Xi’s December trip to Saudi Arabia should be the diplomatic blueprint on how to rapidly establish a post-modern quid pro quo between two ancient, proud civilizations to facilitate a New Silk Road revival.

Rise of the Petro-yuan

Beijing may have lost huge export markets within the collective west – so a replacement was needed. The Arab leaders who lined up in Riyadh to meet Xi saw ten thousand sharpened (western) knives suddenly approaching and calculated it was time to strike a new balance.

That means, among other things, that Saudi Crown Prince Mohammad bin Salman (MbS) has adopted a more multipolar agenda: no more weaponizing of Salafi-Jihadism across Eurasia, and a door wide open to the Russia-China strategic partnership. Hubris strikes hard at the heart of the Hegemon.

Credit Suisse strategist Zoltan Pozsar, in two striking successive newsletters, titled War and Commodity Encumbrance (December 27) and War and Currency Statecraft (December 29), pointed out the writing on the wall.

Pozsar fully understood what Xi meant when he said China is “ready to work with the GCC” to set up a “new paradigm of all-dimensional energy cooperation” within a timeline of “three to five years.”

China will continue to import a lot of crude, long-term, from GCC nations, and way more Liquified Natural Gas (LNG). Beijing will “strengthen our cooperation in the upstream sector, engineering services, as well as [downstream] storage, transportation, and refinery. The Shanghai Petroleum and Natural Gas Exchange platform will be fully utilized for RMB settlement in oil and gas trade…and we could start currency swap cooperation.”

Pozsar summed it all up, thus: “GCC oil flowing East + renminbi invoicing = the dawn of the petroyuan.”

And not only that. In parallel, the BRI gets a renewed drive, because the previous model – oil for weapons – will be replaced with oil for sustainable development (construction of factories, new job opportunities).

And that’s how BRI meets MbS’s Vision 2030.

Apart from Michael Hudson, Poszar may be the only western economic analyst who understands the global shift in power: “The multipolar world order,” he says,” is being built not by G7 heads of state but by the ‘G7 of the East’ (the BRICS heads of state), which is a G5 really.” Because of the move toward an expanded BRICS+, he took the liberty to round up the number.

And the rising global powers know how to balance their relations too. In West Asia, China is playing slightly different strands of the same BRI trade/connectivity strategy, one for Iran and another for the Persian Gulf monarchies.

China’s Comprehensive Strategic Partnership with Iran is a 25-year deal under which China invests $400 billion into Iran’s economy in exchange for a steady supply of Iranian oil at a steep discount. While at his summit with the GCC, Xi emphasized “investments in downstream petrochemical projects, manufacturing, and infrastructure” in exchange for paying for energy in yuan.

How to play the New Great Game

BRI 2.0 was also already on a roll during a series of Southeast Asian summits in November. When Xi met with Thai Prime Minister Prayut Chan-o-cha at the APEC (Asia-Pacific Economic Cooperation) Summit in Bangkok, they pledged to finally connect the up-and-running China-Laos high-speed railway to the Thai railway system. This is a 600km-long project, linking Bangkok to Nong Khai on the border with Laos, to be completed by 2028.

And in an extra BRI push, Beijing and Bangkok agreed to coordinate the development of China’s Shenzhen-Zhuhai-Hong Kong Greater Bay Area and the Yangtze River Delta with Thailand’s Eastern Economic Corridor (EEC).

In the long run, China essentially aims to replicate in West Asia its strategy across Southeast Asia. Beijing trades more with the ASEAN than with either Europe or the US. The ongoing, painful slow motion crash of the collective west may ruffle a few feathers in a civilization that has seen, from afar, the rise and fall of Greeks, Romans, Parthians, Arabs, Ottomans, Spanish, Dutch, British. The Hegemon after all is just the latest in a long list.

In practical terms, BRI 2.0 projects will now be subjected to more scrutiny: This will be the end of impractical proposals and sunk costs, with lifelines extended to an array of debt-distressed nations. BRI will be placed at the heart of BRICS+ expansion – building on a consultation panel in May 2022 attended by foreign ministers and representatives from South America, Africa and Asia that showed, in practice, the global range of possible candidate countries.

Implications for the Global South

Xi’s fresh mandate from the 20th Communist Party Congress has signaled the irreversible institutionalization of BRI, which happens to be his signature policy. The Global South is fast drawing serious conclusions, especially in contrast with the glaring politicization of the G20 that was visible at its November summit in Bali.

So Poszar is a rare gem: a western analyst who understands that the BRICS are the new G5 that matter, and that they’re leading the road towards BRICS+. He also gets that the Quad that really matters is the three main BRICS-plus-Iran.

Acute supply chain decoupling, the crescendo of western hysteria over Beijing’s position on the war in Ukraine, and serious setbacks on Chinese investments in the west all play on the development of BRI 2.0. Beijing will be focusing simultaneously on several nodes of the Global South, especially neighbors in ASEAN and across Eurasia.

Think, for instance, the Beijing-funded Jakarta-Bandung high-speed railway, Southeast Asia’s first: a BRI project opening this year as Indonesia hosts the rotating ASEAN chairmanship. China is also building the East Coast Rail Link in Malaysia and has renewed negotiations with the Philippines for three railway projects.

Then there are the superposed interconnections. The EAEU will clinch a free trade zone deal with Thailand. On the sidelines of the epic return of Luiz Inácio Lula da Silva to power in Brazil, this past Sunday, officials of Iran and Saudi Arabia met amid smiles to discuss – what else – BRICS+. Excellent choice of venue: Brazil is regarded by virtually every geopolitical player as prime neutral territory.

From Beijing’s point of view, the stakes could not be higher, as the drive behind BRI 2.0 across the Global South is not to allow China to be dependent on western markets. Evidence of this is in its combined approach towards Iran and the Arab world.

China losing both US and EU market demand, simultaneously, may end up being just a bump in the (multipolar) road, even as the crash of the collective west may seem suspiciously timed to take China down.

The year 2023 will proceed with China playing the New Great Game deep inside, crafting a globalization 2.0 that is institutionally supported by a network encompassing BRI, BRICS+, the SCO, and with the help of its Russian strategic partner, the EAEU and OPEC+ too. No wonder the usual suspects are dazed and confused.

Authored by Pepe Escobar via The Cradle,

As Beijing’s Belt and Road Initiative enters its 10th year, a strong Sino-Russian geostrategic partnership has revitalized the BRI across the Global South…

The year 2022 ended with a Zoom call to end all Zoom calls: Presidents Vladimir Putin and Xi Jinping discussing all aspects of the Russia-China strategic partnership in an exclusive video call.

Putin told Xi how “Russia and China managed to ensure record high growth rates of mutual trade,” meaning “we will be able to reach our target of $200 billion by 2024 ahead of schedule.”

On their coordination to “form a just world order based on international law,” Putin emphasized how “we share the same views on the causes, course, and logic of the ongoing transformation of the global geopolitical landscape.”

Facing “unprecedented pressure and provocations from the west,” Putin noted how Russia-China are not only defending their own interests “but also all those who stand for a truly democratic world order and the right of countries to freely determine their own destiny.”

Earlier, Xi had announced that Beijing will hold the 3rd Belt and Road Forum in 2023. This has been confirmed, off the record, by diplomatic sources. The forum was initially designed to be bi-annual, first held in 2017 and then 2019. 2021 didn’t happen because of Covid-19.

The return of the forum signals not only a renewed drive but an extremely significant landmark as the Belt and Road Initiative (BRI), launched in Astana and then Jakarta in 2013, will be celebrating its 10th anniversary.

BRI version 2.0

That set the tone for 2023 across the whole geopolitical and geoeconomic spectrum. In parallel to its geoconomic breadth and reach, BRI has been conceived as China’s overarching foreign policy concept up to the mid-century. Now it’s time to tweak things. BRI 2.0 projects, along its several connectivity corridors, are bound to be re-dimensioned to adapt to the post-Covid environment, the reverberations of the war in Ukraine, and a deeply debt-distressed world.

Map of BRI (Photo Credit: The Cradle)

And then there’s the interlocking of the connectivity drive via BRI with the connectivity drive via the International North South Transportation Corridor (INTSC), whose main players are Russia, Iran and India.

Expanding on the geoeconomic drive of the Russia-China partnership as discussed by Putin and Xi, the fact that Russia, China, Iran and India are developing interlocking trade partnerships should establish that BRICS members Russia, India and China, plus Iran as one of the upcoming members of the expanded BRICS+, are the ‘Quad’ that really matter across Eurasia.

The new Politburo Standing Committee in Beijing, which are totally aligned with Xi’s priorities, will be keenly focused on solidifying concentric spheres of geoeconomic influence across the Global South.

How China plays ‘strategic ambiguity’

This has nothing to do with balance of power, which is a western concept that additionally does not connect with China’s five millennia of history. Neither is this another inflection of “unity of the center” – the geopolitical representation according to which no nation is able to threaten the center, China, as long as it is able to maintain order.

These cultural factors that in the past may have prevented China from accepting an alliance under the concept of parity have now vanished when it comes to the Russia-China strategic partnership.

Back in February 2022, days before the events that led to Russia’s Special Military Operation (SMO) in Ukraine, Putin and Xi, in person, had announced that their partnership had “no limits” – even if they hold different approaches on how Moscow should deal with a Kiev lethally instrumentalized by the west to threaten Russia.

In a nutshell: Beijing will not “abandon” Moscow because of Ukraine – as much as it will not openly show support. The Chinese are playing their very own subtle interpretation of what Russians define as “strategic ambiguity.”

Connectivity in West Asia

In West Asia, BRI projects will advance especially fast in Iran, as part of the 25-year deal signed between Beijing and Tehran and the definitive demise of the Joint Comprehensive Plan of Action (JCPOA) – or Iran nuclear deal – which will translate into no European investment in the Iranian economy.

Iran is not only a BRI partner but also a full-fledged Shanghai Cooperation Organization (SCO) member. It has clinched a free trade agreement with the Eurasia Economic Union (EAEU), which consists of post-Soviet states Russia, Armenia, Belarus, Kazakhstan and Kyrgyzstan.

And Iran is, today, arguably the key interconnector of the INSTC, opening up the Indian Ocean and beyond, interconnecting not only with Russia and India but also China, Southeast Asia, and even, potentially, Europe – assuming the EU leadership will one day see which way the wind is blowing.

Map of INSTC (Photo Credit: The Cradle)

So here we have heavily US-sanctioned Iran profiting simultaneously from BRI, INSTC and the EAEU free trade deal. The three critical BRICS members – India, China, Russia – will be particularly interested in the development of the trans-Iranian transit corridor – which happens to be the shortest route between most of the EU and South and Southeast Asia, and will provide faster, cheaper transportation.

Add to this the groundbreaking planned Russia-Transcaucasia-Iran electric power corridor, which could become the definitive connectivity link capable of smashing the antagonism between Azerbaijan and Armenia.

In the Arab world, Xi has already rearranged the chessboard. Xi’s December trip to Saudi Arabia should be the diplomatic blueprint on how to rapidly establish a post-modern quid pro quo between two ancient, proud civilizations to facilitate a New Silk Road revival.

Rise of the Petro-yuan

Beijing may have lost huge export markets within the collective west – so a replacement was needed. The Arab leaders who lined up in Riyadh to meet Xi saw ten thousand sharpened (western) knives suddenly approaching and calculated it was time to strike a new balance.

That means, among other things, that Saudi Crown Prince Mohammad bin Salman (MbS) has adopted a more multipolar agenda: no more weaponizing of Salafi-Jihadism across Eurasia, and a door wide open to the Russia-China strategic partnership. Hubris strikes hard at the heart of the Hegemon.

Credit Suisse strategist Zoltan Pozsar, in two striking successive newsletters, titled War and Commodity Encumbrance (December 27) and War and Currency Statecraft (December 29), pointed out the writing on the wall.

Pozsar fully understood what Xi meant when he said China is “ready to work with the GCC” to set up a “new paradigm of all-dimensional energy cooperation” within a timeline of “three to five years.”

China will continue to import a lot of crude, long-term, from GCC nations, and way more Liquified Natural Gas (LNG). Beijing will “strengthen our cooperation in the upstream sector, engineering services, as well as [downstream] storage, transportation, and refinery. The Shanghai Petroleum and Natural Gas Exchange platform will be fully utilized for RMB settlement in oil and gas trade…and we could start currency swap cooperation.”

Pozsar summed it all up, thus: “GCC oil flowing East + renminbi invoicing = the dawn of the petroyuan.”

And not only that. In parallel, the BRI gets a renewed drive, because the previous model – oil for weapons – will be replaced with oil for sustainable development (construction of factories, new job opportunities).

And that’s how BRI meets MbS’s Vision 2030.

Apart from Michael Hudson, Poszar may be the only western economic analyst who understands the global shift in power: “The multipolar world order,” he says,” is being built not by G7 heads of state but by the ‘G7 of the East’ (the BRICS heads of state), which is a G5 really.” Because of the move toward an expanded BRICS+, he took the liberty to round up the number.

And the rising global powers know how to balance their relations too. In West Asia, China is playing slightly different strands of the same BRI trade/connectivity strategy, one for Iran and another for the Persian Gulf monarchies.

China’s Comprehensive Strategic Partnership with Iran is a 25-year deal under which China invests $400 billion into Iran’s economy in exchange for a steady supply of Iranian oil at a steep discount. While at his summit with the GCC, Xi emphasized “investments in downstream petrochemical projects, manufacturing, and infrastructure” in exchange for paying for energy in yuan.

How to play the New Great Game

BRI 2.0 was also already on a roll during a series of Southeast Asian summits in November. When Xi met with Thai Prime Minister Prayut Chan-o-cha at the APEC (Asia-Pacific Economic Cooperation) Summit in Bangkok, they pledged to finally connect the up-and-running China-Laos high-speed railway to the Thai railway system. This is a 600km-long project, linking Bangkok to Nong Khai on the border with Laos, to be completed by 2028.

And in an extra BRI push, Beijing and Bangkok agreed to coordinate the development of China’s Shenzhen-Zhuhai-Hong Kong Greater Bay Area and the Yangtze River Delta with Thailand’s Eastern Economic Corridor (EEC).

In the long run, China essentially aims to replicate in West Asia its strategy across Southeast Asia. Beijing trades more with the ASEAN than with either Europe or the US. The ongoing, painful slow motion crash of the collective west may ruffle a few feathers in a civilization that has seen, from afar, the rise and fall of Greeks, Romans, Parthians, Arabs, Ottomans, Spanish, Dutch, British. The Hegemon after all is just the latest in a long list.

In practical terms, BRI 2.0 projects will now be subjected to more scrutiny: This will be the end of impractical proposals and sunk costs, with lifelines extended to an array of debt-distressed nations. BRI will be placed at the heart of BRICS+ expansion – building on a consultation panel in May 2022 attended by foreign ministers and representatives from South America, Africa and Asia that showed, in practice, the global range of possible candidate countries.

Implications for the Global South

Xi’s fresh mandate from the 20th Communist Party Congress has signaled the irreversible institutionalization of BRI, which happens to be his signature policy. The Global South is fast drawing serious conclusions, especially in contrast with the glaring politicization of the G20 that was visible at its November summit in Bali.

So Poszar is a rare gem: a western analyst who understands that the BRICS are the new G5 that matter, and that they’re leading the road towards BRICS+. He also gets that the Quad that really matters is the three main BRICS-plus-Iran.

Acute supply chain decoupling, the crescendo of western hysteria over Beijing’s position on the war in Ukraine, and serious setbacks on Chinese investments in the west all play on the development of BRI 2.0. Beijing will be focusing simultaneously on several nodes of the Global South, especially neighbors in ASEAN and across Eurasia.

Think, for instance, the Beijing-funded Jakarta-Bandung high-speed railway, Southeast Asia’s first: a BRI project opening this year as Indonesia hosts the rotating ASEAN chairmanship. China is also building the East Coast Rail Link in Malaysia and has renewed negotiations with the Philippines for three railway projects.

Then there are the superposed interconnections. The EAEU will clinch a free trade zone deal with Thailand. On the sidelines of the epic return of Luiz Inácio Lula da Silva to power in Brazil, this past Sunday, officials of Iran and Saudi Arabia met amid smiles to discuss – what else – BRICS+. Excellent choice of venue: Brazil is regarded by virtually every geopolitical player as prime neutral territory.

From Beijing’s point of view, the stakes could not be higher, as the drive behind BRI 2.0 across the Global South is not to allow China to be dependent on western markets. Evidence of this is in its combined approach towards Iran and the Arab world.

China losing both US and EU market demand, simultaneously, may end up being just a bump in the (multipolar) road, even as the crash of the collective west may seem suspiciously timed to take China down.

The year 2023 will proceed with China playing the New Great Game deep inside, crafting a globalization 2.0 that is institutionally supported by a network encompassing BRI, BRICS+, the SCO, and with the help of its Russian strategic partner, the EAEU and OPEC+ too. No wonder the usual suspects are dazed and confused.

Loading…