Authored by Lance Roberts via RealInvestmentAdvice.com,

ESG underperformance will be the strategy’s eventual undoing. We have discussed the many problems with ESG investing in previous posts.

In those previous articles, we primarily focused on the excessive expense ratios charged for funds that are essentially duplicates of low costs benchmark indexes. To wit:

With ESG now the rage, the “demand” drives product development. However, there is also an understanding of why large asset managers have embraced the strategy so readily – higher fees.

Yes, you too can own an ESG fund that is almost three times as expensive as the S&P 500 index, all for the sake of “feeling good about yourself.”

While ESG investing gets promoted as a way for individuals to “invest with their principals,” such has been a windfall marketing scheme by Wall Street firms.

Been There, Done That

In the late ’90s, Wall Street moved to limit investing in “sin” stocks such as gambling, tobacco, etc. Just as it was then, investors initially jumped on board, but when returns failed to outperform the benchmark index, that “fad” died.

The same occurs today as investors who want to be “woke” are demanding products that make them feel good to purchase. However, just as we have witnessed with the various ARKK ETFs, while you may “feel good” about owning “disruptive” companies, that changes quickly when those companies are no longer performing.

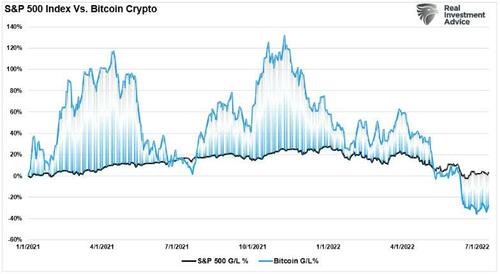

The same occurred with the allure of cryptocurrencies as “laser-eyed” zealots retreated into the abyss following a crushing decline.

Such is inherently the issue facing ESG funds. Investors might be willing to pay higher expense ratios as long as they earn higher returns. However, ultimately they will focus on ESG underperformance, which will likely become more prevalent as funds that previously underperformed and lost assets simply rebranded themselves.

“Epic greenwashing is everywhere: Out of 253 funds that switched to an ESG focus in 2020 in the US, 87 per cent of them rebranded by adding words such as ‘sustainable’ or “ESG” or ‘green’ or ‘climate’ to their names.

None changed their stock or bond holdings at that point.” – Eco-Business

Unsurprisingly, the buzzword of “investing scam” is gaining more traction.

“The Securities and Exchange Commission said this month that it was planning on cracking down on misleading ESG claims. New rules ‘would specify disclosures to be made by investment funds when they mention terms like ‘ESG,’ ‘low-carbon’, or ‘sustainable’ in their names.

Regulators are also looking at ‘ESG funds marketing and how environmental, social and governance is incorporated into investing along with these funds voting at companies’ annual meetings.” – Bloomberg

Not surprisingly, outflows are rising as ESG underperformance continues.

Inflation Could Kill ESG

Another problem for the ESG “investing scam” is inflation. If you believe inflation is here to stay, ESG underperformance will continue. While 2022 has been a year of “inflation” concerns by the Fed, the underperformance of ESG relative to the energy sector has been quite profound.

“As Deutsche Bank’s Jim Reid puts it, ‘one of the side effects of the hawkish pivot from the Fed in 2022, that continued this week’ is that it could finally crack the facade of ESG and make January a catastrophic month for ESG investors; this is shown in Reid’s Chart of the Day which lays out the 1-month rolling difference between S&P 500 Energy sector returns and the NASDAQ.” – Zerohedge

However, that underperformance didn’t just start in January of 2022. In 2021 the surge in money supply led to increasing rates of inflationary pressures. As we showed previously, inflation is currently running well above the Fed’s target inflation rate.

Not surprisingly, that inflationary surge showed up at the gasoline pump as oil prices rocketed higher. As a consequence, and of no real surprise, investors dumped ESG funds in favor of “dirty energy.” (It is worth noting that ESG funds also underperformed the SPY tracking index.)

ESG investing may be great for headlines, but it is all about performance when it comes to investors.

Want To Be ESG, Plant A Tree

Another problem with ESG investing is that it makes NO difference to the environment.

Think about how mutual fund investing works for a moment.

As investors buy shares of a mutual fund, the fund manager then purchases shares of the underlying investments from the open market. The underlying companies receive no capital from the transaction, nor are they aware a transaction occurred.

In this scenario, how were carbon emissions reduced? Were trees planted? Did companies take a different direction with their management teams?

If you want to be a socially responsible investor, there is only ONE way to achieve that goal. You must invest directly in private startup companies tackling climate change effectively. Once a company is public, all you do is trade dollars for another investor’s shares. As noted, that transaction has ZERO impact on the environment or the company.

ESG Is In Trouble

RBC Wealth Management surveyed over 900 US-based clients recently. 49% said that performance and returns were a higher priority than ESG impact, up from 42% last year.

“The story told is you don’t have to give up returns in order to do ESG. But everyone assumed that you would get the same exact return profile as a traditional benchmark. Which is absolutely not true because traditional benchmarks are not looking at ESG factors.” – Kent McClanahan, VP Responsible Investing at RBC.

RBC clients also expressed skepticism about the ESG label. 74% of those surveyed said many companies provide misleading information about their ESG initiatives. As noted, the SEC’s proposal for new restrictions to ensure ESG funds accurately describe their investments could address that problem.

“ESG is in trouble. For proof, look no further than the Bloomberg Opinion headline “The Virtue Bubble Is About to Burst, Good Riddance,” Or, the news the head of Deutsche Bank’s fund management unit got toppled after police raided looking into alleged “greenwashing.”

Much of this is an understandable overreaction to the understandable over-praise that the concept enjoyed for many years. It also reflects the growing realization that ESG only seemed to be a good idea because it delivered great returns. At first, with big money flows being directed into places that hadn’t received so much capital before. ESG was almost a self-fulfilling prophecy. A big element of its success to date, it now becomes apparent, is good old-fashioned return-chasing.” – John Authers, Bloomberg

Ultimately, investors constantly seek out investment performance over time. As such, ESG investing will either evolve or give way to a new breed of “Sin Stocks.”

I suspect that Wall Street will win whichever way it eventually turns out.

Authored by Lance Roberts via RealInvestmentAdvice.com,

ESG underperformance will be the strategy’s eventual undoing. We have discussed the many problems with ESG investing in previous posts.

In those previous articles, we primarily focused on the excessive expense ratios charged for funds that are essentially duplicates of low costs benchmark indexes. To wit:

With ESG now the rage, the “demand” drives product development. However, there is also an understanding of why large asset managers have embraced the strategy so readily – higher fees.

Yes, you too can own an ESG fund that is almost three times as expensive as the S&P 500 index, all for the sake of “feeling good about yourself.”

While ESG investing gets promoted as a way for individuals to “invest with their principals,” such has been a windfall marketing scheme by Wall Street firms.

Been There, Done That

In the late ’90s, Wall Street moved to limit investing in “sin” stocks such as gambling, tobacco, etc. Just as it was then, investors initially jumped on board, but when returns failed to outperform the benchmark index, that “fad” died.

The same occurs today as investors who want to be “woke” are demanding products that make them feel good to purchase. However, just as we have witnessed with the various ARKK ETFs, while you may “feel good” about owning “disruptive” companies, that changes quickly when those companies are no longer performing.

The same occurred with the allure of cryptocurrencies as “laser-eyed” zealots retreated into the abyss following a crushing decline.

Such is inherently the issue facing ESG funds. Investors might be willing to pay higher expense ratios as long as they earn higher returns. However, ultimately they will focus on ESG underperformance, which will likely become more prevalent as funds that previously underperformed and lost assets simply rebranded themselves.

“Epic greenwashing is everywhere: Out of 253 funds that switched to an ESG focus in 2020 in the US, 87 per cent of them rebranded by adding words such as ‘sustainable’ or “ESG” or ‘green’ or ‘climate’ to their names.

None changed their stock or bond holdings at that point.” – Eco-Business

Unsurprisingly, the buzzword of “investing scam” is gaining more traction.

“The Securities and Exchange Commission said this month that it was planning on cracking down on misleading ESG claims. New rules ‘would specify disclosures to be made by investment funds when they mention terms like ‘ESG,’ ‘low-carbon’, or ‘sustainable’ in their names.

Regulators are also looking at ‘ESG funds marketing and how environmental, social and governance is incorporated into investing along with these funds voting at companies’ annual meetings.” – Bloomberg

Not surprisingly, outflows are rising as ESG underperformance continues.

Inflation Could Kill ESG

Another problem for the ESG “investing scam” is inflation. If you believe inflation is here to stay, ESG underperformance will continue. While 2022 has been a year of “inflation” concerns by the Fed, the underperformance of ESG relative to the energy sector has been quite profound.

“As Deutsche Bank’s Jim Reid puts it, ‘one of the side effects of the hawkish pivot from the Fed in 2022, that continued this week’ is that it could finally crack the facade of ESG and make January a catastrophic month for ESG investors; this is shown in Reid’s Chart of the Day which lays out the 1-month rolling difference between S&P 500 Energy sector returns and the NASDAQ.” – Zerohedge

However, that underperformance didn’t just start in January of 2022. In 2021 the surge in money supply led to increasing rates of inflationary pressures. As we showed previously, inflation is currently running well above the Fed’s target inflation rate.

Not surprisingly, that inflationary surge showed up at the gasoline pump as oil prices rocketed higher. As a consequence, and of no real surprise, investors dumped ESG funds in favor of “dirty energy.” (It is worth noting that ESG funds also underperformed the SPY tracking index.)

ESG investing may be great for headlines, but it is all about performance when it comes to investors.

Want To Be ESG, Plant A Tree

Another problem with ESG investing is that it makes NO difference to the environment.

Think about how mutual fund investing works for a moment.

As investors buy shares of a mutual fund, the fund manager then purchases shares of the underlying investments from the open market. The underlying companies receive no capital from the transaction, nor are they aware a transaction occurred.

In this scenario, how were carbon emissions reduced? Were trees planted? Did companies take a different direction with their management teams?

If you want to be a socially responsible investor, there is only ONE way to achieve that goal. You must invest directly in private startup companies tackling climate change effectively. Once a company is public, all you do is trade dollars for another investor’s shares. As noted, that transaction has ZERO impact on the environment or the company.

ESG Is In Trouble

RBC Wealth Management surveyed over 900 US-based clients recently. 49% said that performance and returns were a higher priority than ESG impact, up from 42% last year.

“The story told is you don’t have to give up returns in order to do ESG. But everyone assumed that you would get the same exact return profile as a traditional benchmark. Which is absolutely not true because traditional benchmarks are not looking at ESG factors.” – Kent McClanahan, VP Responsible Investing at RBC.

RBC clients also expressed skepticism about the ESG label. 74% of those surveyed said many companies provide misleading information about their ESG initiatives. As noted, the SEC’s proposal for new restrictions to ensure ESG funds accurately describe their investments could address that problem.

“ESG is in trouble. For proof, look no further than the Bloomberg Opinion headline “The Virtue Bubble Is About to Burst, Good Riddance,” Or, the news the head of Deutsche Bank’s fund management unit got toppled after police raided looking into alleged “greenwashing.”

Much of this is an understandable overreaction to the understandable over-praise that the concept enjoyed for many years. It also reflects the growing realization that ESG only seemed to be a good idea because it delivered great returns. At first, with big money flows being directed into places that hadn’t received so much capital before. ESG was almost a self-fulfilling prophecy. A big element of its success to date, it now becomes apparent, is good old-fashioned return-chasing.” – John Authers, Bloomberg

Ultimately, investors constantly seek out investment performance over time. As such, ESG investing will either evolve or give way to a new breed of “Sin Stocks.”

I suspect that Wall Street will win whichever way it eventually turns out.