By Donovan Choy of Bankless

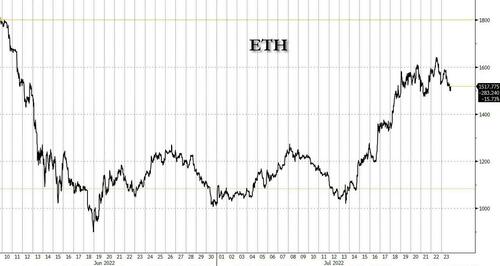

Is the bear market over already?

ETH is up 31% this week at ~1.5K, leading the market in the first substantial rally in many months after a 69% drawdown from its peak of ~4.8K this March.

Macro indicators are still bleak and bleaker. The ECB announced it’s getting in on rate hikes for the first time in over a decade. Over in the US, there are rumblings of a 100 basis point raise for July’s Fed meeting.

What explains the recent price rally? Is the impending Merge being priced in? Or just another bull trap?

* * *

Incoming zkEVM

It’s ETH CC week, and the biggest piece of news sweeping crypto is the launch of zkEVMs.

…So what are these bad boys?

-

EVM-compatibility (Ethereum Virtual Machine) allows any Web3 project to plug into Ethereum’s established infrastructure and user base.

-

Then zk-rollups (zero knowledge) are a major Layer 2 scaling boon. Vitalik himself said they were the end game.

zkEVMs combines them both.

Devs like it because they can deploy smart contracts and integrate Ethereum tools in the same way they would on Ethereum, yet with faster speeds and lower cost.

Ok so, zkEVMs are great. That means there’s big competition for optimistic rollups. A total of three zkEVM projects are coming out the bull gate this week by the Scroll team, zkSync and Polygon. They’re all in pre-alpha phases at the moment. It’s a sign of big things coming for Ethereum.

✨ Battle of the zkEVMs

— Socket (@SocketDotTech) July 21, 2022

Here is how the 3 zkEVMs stack up against each other:@Scroll_ZKP has EVM equivalence at the op-code level@0xPolygon has EVM equivalence with modified op-code @Zksync achieves EVM compatibility with a custom compiler pic.twitter.com/J4R44F2XMa

For more complete details, check out Bankless articles published this week: William Peaster’s coverage of zkEVMs and Ben Giove on under-the-radar L2s that are poised for growth.

Three Arrows Capital troubles, continued

I wrote last week in “DeFi Will Never Die” that the ongoing problems with centralized crypto banks isn’t one of risky trades per se, but rather how the rules of the system poorly deal with that risk.

DeFi mitigates that risk inherently through built-in transparency on the blockchain because protocols are forced to air their dirty laundry in public, and quickly start paying those loans if that laundry begins to pile up. David Hoffman calls this “The New Supreme Court”:

“The legal courts overseeing the Celsius and 3AC cases are subordinate to the court of the EVM; the code that enforces the smart contracts that power the DeFi lending applications. The EVM is the most superior court in the world. The legal contract system of nation-state courts is junior to Ethereum and the EVM.

When markets break down, they revert back to a system of lawyers and courts, and we are currently witnessing that in the cases of 3AC and Celcius. Long-drawn-out court proceedings are beginning; meanwhile, DeFi is still chugging away and onto the next thing. And no DeFi lenders lost a dime.”

Crypto banks, though, are opaque and prone to risky leveraging calls. In this case, that risk bubbled into a public health epidemic of sorts.

A thousand page legal document revealed this week that Three Arrows Capital owed 27 crypto companies a total of $3.5B, of which the largest chunk belongs to crypto lender Genesis that made an undercollaterized loan of $2.36B. In second place is Voyager with a loan of ~$685M, who filed bankruptcy two weeks ago.

Genesis’ loans were collateralized by 17.4M shares of Grayscale Bitcoin Trust, 447K of Grayscale Ethereum Trust; 2,7M AVAX, and 13,5M of NEAR — all of which are down bad in the past quarter.

While Genesis made the mistake of making a loan to the overleveraged 3AC, it had the good risk management sense to liquidate losses relatively early, thanks to a margin requirement of at least 80%.

1/ As part of our goal in providing transparency to the market, I wanted to share the latest update at @GenesisTrading.

— Michael Moro (@michaelmoro) July 6, 2022

Celsius, on the other hand, is suffering a shortfall of at least $1.2B based on a new filing, with $5.5B in liabilities and $4.3B in assets.

* * *

Web3 News Roundup

Aave and Balancer strategic partnership

A huge governance proposal proposed back in March was unanimously passed this week that saw both DAOs swapping 16,908 AAVE ($1.63M) for 200,000 BAL ($1.13M) to create more synergy within their ecosystems and diversify each other’s treasuries.

The strategy: This enables BAL tokens to be paired in Aave’s BAL:ETH pool on Balancer, which is then locked for a year to receive veBAL tokens that in turn can be used to vote for more BAL rewards on Aave-supported pools. More liquidity and better yields for Aave.

The Aave Balancer token swap proposal passed unanimously and has been executed!

— Llama (@llama) July 19, 2022

This is one of the larger strategic partnerships between two DeFi OGs and it's only the beginning of what's to come.

cc @AaveAave @BalancerLabs https://t.co/MuksWYyh5nhttps://t.co/HLF0kPRDIg

Minecraft bans NFTs

In Minecraft’s official release:

Each of these uses of NFTs and other blockchain technologies creates digital ownership based on scarcity and exclusion, which does not align with Minecraft values of creative inclusion and playing together. NFTs are not inclusive of all our community and create a scenario of the haves and the have-nots. The speculative pricing and investment mentality around NFTs takes the focus away from playing the game and encourages profiteering, which we think is inconsistent with the long-term joy and success of our players.

I think this is all wrong. An old piece I wrote for Bankless argued that gamers shouldn’t reject, but embrace NFTs. The introduction of a profit motive into NFTs is what will make video gaming better, not worse:

The non-fungible-tokenization of third-party skins, maps, and patches opens a lucrative door for the thousands of Skyrim, Half-Life, and Minecraft gaming modders and creators of user-generated content to distribute their creations for free while getting paid for it by their “100 true fans”.

It’s also particularly rich for Microsoft to lambast NFTs for chasing a “profit motive,” when the company itself takes a cut from user-generated content:

For many years, Microsoft enforced intellectual property laws that allowed Minecraft users to modify and create user-generated content, but prohibited them from selling officially licensed code for profit, effectively maintaining a gray economy of passionate fans that lived to serve them.

In other words, Microsoft is saying: Profit for me and not for thee.

Other news:

The Merge has an unofficial date…?; Opensea lays off 20% of their staff due to an “unprecedented combination of crypto winter and broad macroeconomic instability”; Circle is increasing transparency around USDC in a monthly report; Curve Finance rumors of a stablecoin; Across Protocol launches; Three Arrows Founders break silence over collapse of crypto hedge fund.

By Donovan Choy of Bankless

Is the bear market over already?

ETH is up 31% this week at ~1.5K, leading the market in the first substantial rally in many months after a 69% drawdown from its peak of ~4.8K this March.

Macro indicators are still bleak and bleaker. The ECB announced it’s getting in on rate hikes for the first time in over a decade. Over in the US, there are rumblings of a 100 basis point raise for July’s Fed meeting.

What explains the recent price rally? Is the impending Merge being priced in? Or just another bull trap?

* * *

Incoming zkEVM

It’s ETH CC week, and the biggest piece of news sweeping crypto is the launch of zkEVMs.

…So what are these bad boys?

-

EVM-compatibility (Ethereum Virtual Machine) allows any Web3 project to plug into Ethereum’s established infrastructure and user base.

-

Then zk-rollups (zero knowledge) are a major Layer 2 scaling boon. Vitalik himself said they were the end game.

zkEVMs combines them both.

Devs like it because they can deploy smart contracts and integrate Ethereum tools in the same way they would on Ethereum, yet with faster speeds and lower cost.

Ok so, zkEVMs are great. That means there’s big competition for optimistic rollups. A total of three zkEVM projects are coming out the bull gate this week by the Scroll team, zkSync and Polygon. They’re all in pre-alpha phases at the moment. It’s a sign of big things coming for Ethereum.

✨ Battle of the zkEVMs

Here is how the 3 zkEVMs stack up against each other:@Scroll_ZKP has EVM equivalence at the op-code level@0xPolygon has EVM equivalence with modified op-code @Zksync achieves EVM compatibility with a custom compiler pic.twitter.com/J4R44F2XMa

— Socket (@SocketDotTech) July 21, 2022

For more complete details, check out Bankless articles published this week: William Peaster’s coverage of zkEVMs and Ben Giove on under-the-radar L2s that are poised for growth.

Three Arrows Capital troubles, continued

I wrote last week in “DeFi Will Never Die” that the ongoing problems with centralized crypto banks isn’t one of risky trades per se, but rather how the rules of the system poorly deal with that risk.

DeFi mitigates that risk inherently through built-in transparency on the blockchain because protocols are forced to air their dirty laundry in public, and quickly start paying those loans if that laundry begins to pile up. David Hoffman calls this “The New Supreme Court”:

“The legal courts overseeing the Celsius and 3AC cases are subordinate to the court of the EVM; the code that enforces the smart contracts that power the DeFi lending applications. The EVM is the most superior court in the world. The legal contract system of nation-state courts is junior to Ethereum and the EVM.

When markets break down, they revert back to a system of lawyers and courts, and we are currently witnessing that in the cases of 3AC and Celcius. Long-drawn-out court proceedings are beginning; meanwhile, DeFi is still chugging away and onto the next thing. And no DeFi lenders lost a dime.”

Crypto banks, though, are opaque and prone to risky leveraging calls. In this case, that risk bubbled into a public health epidemic of sorts.

A thousand page legal document revealed this week that Three Arrows Capital owed 27 crypto companies a total of $3.5B, of which the largest chunk belongs to crypto lender Genesis that made an undercollaterized loan of $2.36B. In second place is Voyager with a loan of ~$685M, who filed bankruptcy two weeks ago.

Genesis’ loans were collateralized by 17.4M shares of Grayscale Bitcoin Trust, 447K of Grayscale Ethereum Trust; 2,7M AVAX, and 13,5M of NEAR — all of which are down bad in the past quarter.

While Genesis made the mistake of making a loan to the overleveraged 3AC, it had the good risk management sense to liquidate losses relatively early, thanks to a margin requirement of at least 80%.

1/ As part of our goal in providing transparency to the market, I wanted to share the latest update at @GenesisTrading.

— Michael Moro (@michaelmoro) July 6, 2022

Celsius, on the other hand, is suffering a shortfall of at least $1.2B based on a new filing, with $5.5B in liabilities and $4.3B in assets.

* * *

Web3 News Roundup

Aave and Balancer strategic partnership

A huge governance proposal proposed back in March was unanimously passed this week that saw both DAOs swapping 16,908 AAVE ($1.63M) for 200,000 BAL ($1.13M) to create more synergy within their ecosystems and diversify each other’s treasuries.

The strategy: This enables BAL tokens to be paired in Aave’s BAL:ETH pool on Balancer, which is then locked for a year to receive veBAL tokens that in turn can be used to vote for more BAL rewards on Aave-supported pools. More liquidity and better yields for Aave.

The Aave <> Balancer token swap proposal passed unanimously and has been executed!

This is one of the larger strategic partnerships between two DeFi OGs and it’s only the beginning of what’s to come.

cc @AaveAave @BalancerLabs https://t.co/MuksWYyh5nhttps://t.co/HLF0kPRDIg

— Llama (@llama) July 19, 2022

Minecraft bans NFTs

In Minecraft’s official release:

Each of these uses of NFTs and other blockchain technologies creates digital ownership based on scarcity and exclusion, which does not align with Minecraft values of creative inclusion and playing together. NFTs are not inclusive of all our community and create a scenario of the haves and the have-nots. The speculative pricing and investment mentality around NFTs takes the focus away from playing the game and encourages profiteering, which we think is inconsistent with the long-term joy and success of our players.

I think this is all wrong. An old piece I wrote for Bankless argued that gamers shouldn’t reject, but embrace NFTs. The introduction of a profit motive into NFTs is what will make video gaming better, not worse:

The non-fungible-tokenization of third-party skins, maps, and patches opens a lucrative door for the thousands of Skyrim, Half-Life, and Minecraft gaming modders and creators of user-generated content to distribute their creations for free while getting paid for it by their “100 true fans”.

It’s also particularly rich for Microsoft to lambast NFTs for chasing a “profit motive,” when the company itself takes a cut from user-generated content:

For many years, Microsoft enforced intellectual property laws that allowed Minecraft users to modify and create user-generated content, but prohibited them from selling officially licensed code for profit, effectively maintaining a gray economy of passionate fans that lived to serve them.

In other words, Microsoft is saying: Profit for me and not for thee.

Other news:

The Merge has an unofficial date…?; Opensea lays off 20% of their staff due to an “unprecedented combination of crypto winter and broad macroeconomic instability”; Circle is increasing transparency around USDC in a monthly report; Curve Finance rumors of a stablecoin; Across Protocol launches; Three Arrows Founders break silence over collapse of crypto hedge fund.