Authored by Tom Mitchelhill via CoinTelegraph.com,

The number of long-term Ether holders steadily increased throughout 2024, while the number of Bitcoin holders fell over the last year amid rising confidence in ETH heading into the new year.

In a Dec. 30 post to X, citing data from its platform, IntoTheBlock shared that the total percentage of Ether who had held their tokens for the long haul had risen from 59% in January to 75% by the end of 2024.

Source: IntoTheBlock

Meanwhile, the number of long-term Bitcoin holders witnessed a steady decline from about 70% to 62% in the same timeframe.

As of Dec. 30, the proportion of long-term Bitcoin holders stood at 62.3% while the proportion of long-term Ethereum holders was at 75.1%.

IntoTheBlock has previously described long-term holders as those holding an asset for more than a year.

While this metric is one of many that investors can look at to gauge market sentiment toward major crypto assets, a continued shift toward long-term holding for ETH also suggests growing confidence in the asset heading into 2025.

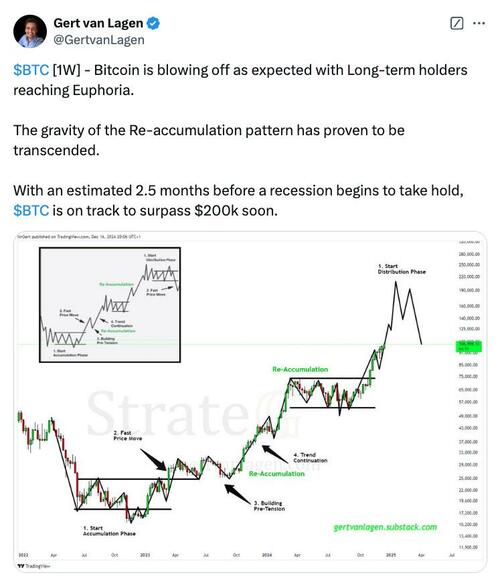

In a Dec. 17 post to X, technical analyst Ger Van Lagen said Bitcoin’s price was “blowing off,” with BTC later dropping from an all-time high of $106,000 to $93,000 between Dec. 16 and Dec. 30.

Source: Gert Van Lagen

Van Lagen suggested this move was driven largely by long-term holders cashing out amid a period of euphoria and maintained a distinctly bullish outlook on BTC, predicting the asset was on track to surpass $200,000 in the near future.

Meanwhile, in the last month, inflows into spot Ether ETFs have doubled, surging from $1 billion in net inflows in November to $2.1 billion worth of cumulative net inflows in December.

Several experts from different sectors of the crypto industry said that a Trump administration will prove beneficial to ETH in particular.

They cited a swathe of new developments for taking a bullish stance on ETH heading into 2025, ranging from the demise of “financial nihilism,” a complete overhaul of the SEC, the addition of staking to Ether ETFs and increased regulatory oversight from the Commodity Futures Trading Commission (CFTC).

Authored by Tom Mitchelhill via CoinTelegraph.com,

The number of long-term Ether holders steadily increased throughout 2024, while the number of Bitcoin holders fell over the last year amid rising confidence in ETH heading into the new year.

In a Dec. 30 post to X, citing data from its platform, IntoTheBlock shared that the total percentage of Ether who had held their tokens for the long haul had risen from 59% in January to 75% by the end of 2024.

Source: IntoTheBlock

Meanwhile, the number of long-term Bitcoin holders witnessed a steady decline from about 70% to 62% in the same timeframe.

As of Dec. 30, the proportion of long-term Bitcoin holders stood at 62.3% while the proportion of long-term Ethereum holders was at 75.1%.

IntoTheBlock has previously described long-term holders as those holding an asset for more than a year.

While this metric is one of many that investors can look at to gauge market sentiment toward major crypto assets, a continued shift toward long-term holding for ETH also suggests growing confidence in the asset heading into 2025.

In a Dec. 17 post to X, technical analyst Ger Van Lagen said Bitcoin’s price was “blowing off,” with BTC later dropping from an all-time high of $106,000 to $93,000 between Dec. 16 and Dec. 30.

Source: Gert Van Lagen

Van Lagen suggested this move was driven largely by long-term holders cashing out amid a period of euphoria and maintained a distinctly bullish outlook on BTC, predicting the asset was on track to surpass $200,000 in the near future.

Meanwhile, in the last month, inflows into spot Ether ETFs have doubled, surging from $1 billion in net inflows in November to $2.1 billion worth of cumulative net inflows in December.

Several experts from different sectors of the crypto industry said that a Trump administration will prove beneficial to ETH in particular.

They cited a swathe of new developments for taking a bullish stance on ETH heading into 2025, ranging from the demise of “financial nihilism,” a complete overhaul of the SEC, the addition of staking to Ether ETFs and increased regulatory oversight from the Commodity Futures Trading Commission (CFTC).

Loading…