US and European bonds are extending their gains following yesterday's dovish comments from Fed Gov. Waller as German CPI plunged far more than expected and European Industrial Confidence dipped back towards 10-year-lows (ex-COVID-lockdowns).

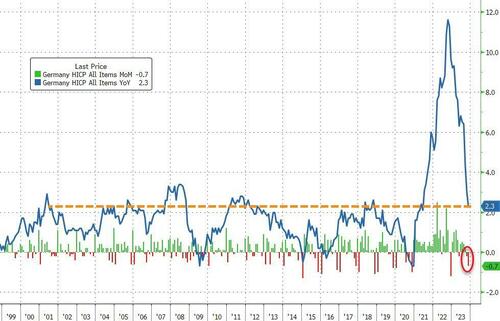

German inflation eased more than forecast in November on retreating energy and travel costs, putting the European Central Bank’s 2% target within reach.

Consumer prices rose 2.3% from a year ago, down from 3% in October and less than the 2.5% estimated by economists in a Bloomberg survey. They fell 0.7% on the month, with package tours alone responsible for 0.15 percentage point of the decline.

Source: Bloomberg

However, President Christine Lagarde reiterated Monday that inflation remains too high and has been so for too long.

What’s more, price pressures are widely anticipated to pick up again from December as statistical effects play out.

Some punchy disinflation in Germany and Spain, setting up a dovish outlook for this week's EZ data. The ECB's hawkish facade will crack soon enough. In Germany, meanwhile, watch out for a rebound in Dec (energy base effects) and broadly unch core (our call).

— Claus Vistesen (@ClausVistesen) November 29, 2023

And while Euro-area economic confidence increased very marginally in November, Industrial Confidence dipped back towards its lowest level since 2013 (ex-COVID lockdowns)

Source: Bloomberg

All of which sent Bund yields plunging to four-month lows...

Source: Bloomberg

And 2Y TSY yields are back near July lows...

Source: Bloomberg

The rally in bonds began after Spain earlier Wednesday reported a similar slowdown in inflation, but Bundesbank President Joachim Nagel has warned against letting up on the inflation fight too soon.

Officials can’t assume that price pressures will continue easing as rapidly as they have been during the past year, he said Tuesday.

Interestingly, despite today's 'cool' print, Goldman Sachs revises their EU area headline forecast up 11bp to 4.04%yoy. This revision nets off stronger-than-expected German package holiday prints, and weaker-than-expected Spanish and German energy inflation.

Hold up on those 'Mission Accomplished' banners for now.

US and European bonds are extending their gains following yesterday’s dovish comments from Fed Gov. Waller as German CPI plunged far more than expected and European Industrial Confidence dipped back towards 10-year-lows (ex-COVID-lockdowns).

German inflation eased more than forecast in November on retreating energy and travel costs, putting the European Central Bank’s 2% target within reach.

Consumer prices rose 2.3% from a year ago, down from 3% in October and less than the 2.5% estimated by economists in a Bloomberg survey. They fell 0.7% on the month, with package tours alone responsible for 0.15 percentage point of the decline.

Source: Bloomberg

However, President Christine Lagarde reiterated Monday that inflation remains too high and has been so for too long.

What’s more, price pressures are widely anticipated to pick up again from December as statistical effects play out.

Some punchy disinflation in Germany and Spain, setting up a dovish outlook for this week’s EZ data. The ECB’s hawkish facade will crack soon enough. In Germany, meanwhile, watch out for a rebound in Dec (energy base effects) and broadly unch core (our call).

— Claus Vistesen (@ClausVistesen) November 29, 2023

And while Euro-area economic confidence increased very marginally in November, Industrial Confidence dipped back towards its lowest level since 2013 (ex-COVID lockdowns)

Source: Bloomberg

All of which sent Bund yields plunging to four-month lows…

Source: Bloomberg

And 2Y TSY yields are back near July lows…

Source: Bloomberg

The rally in bonds began after Spain earlier Wednesday reported a similar slowdown in inflation, but Bundesbank President Joachim Nagel has warned against letting up on the inflation fight too soon.

Officials can’t assume that price pressures will continue easing as rapidly as they have been during the past year, he said Tuesday.

Interestingly, despite today’s ‘cool’ print, Goldman Sachs revises their EU area headline forecast up 11bp to 4.04%yoy. This revision nets off stronger-than-expected German package holiday prints, and weaker-than-expected Spanish and German energy inflation.

Hold up on those ‘Mission Accomplished’ banners for now.

Loading…