Europe's study in paradoxical contrasts continues. On the same day, ECB's de Guindos said a June rate cut looks like a set deal (unless there are surprises) with the end of inflation fight is in sight, the Euro-area's private-sector activity advanced to the highest level since May 2023, driven by a buoyant services sector and Germany's return to growth; UK firms also reported the strongest growth in almost a year

Here are the details:

France

- Services Flash PMI (Apr) 50.5 vs. Exp. 49.0 (Prev. 48.3);

- Manufacturing Flash PMI (Apr) 44.9 vs. Exp. 47.0 (Prev. 46.2);

- Composite Flash PMI (Apr) 49.9 vs. Exp. 48.8 (Prev. 48.3);

- "Overall, our HCOB nowcast model for the second quarter points to a recovery of the French economy, driven by the services sector".

Germany

- Manufacturing Flash PMI (Apr) 42.2 vs. Exp. 42.9 (Prev. 41.9);

- Services Flash PMI (Apr) 53.3 vs. Exp. 50.5 (Prev. 50.1);

- Composite Flash PMI (Apr) 50.5 vs. Exp. 48.6 (Prev. 47.7);

- "Factoring in the PMI numbers into our GDP Nowcast, we estimate that GDP may expand by 0.2%".

UK

- Services PMI (Apr) 54.9 vs. Exp. 53.0 (Prev. 53.1);

- Manufacturing PMI (Apr) 48.7 vs. Exp. 50.4 (Prev. 50.3);

- Flash Composite PMI (Apr) 54.0 vs. Exp. 52.7 (Prev. 52.8)

Euro-Area

- Services Flash PMI (Apr) 52.9 vs. Exp. 51.8 (Prev. 51.5);

- Manufacturing Flash PMI (Apr) 45.6 vs. Exp. 46.6 (Prev. 46.1);

- Composite Flash PMI (Apr) 51.4 vs. Exp. 50.8 (Prev. 50.3);

- "Considering various factors including the HCOB PMIs, our GDP forecast suggests a 0.3% expansion in the second quarter".

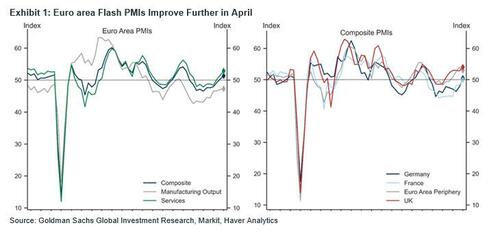

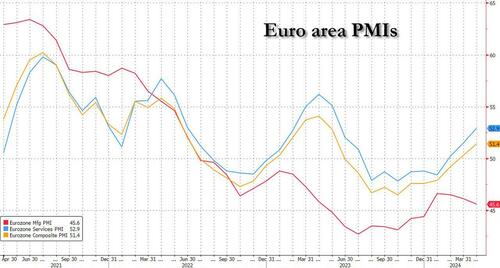

Putting it all together, the Euro area composite flash PMI increased by 1pt to 51.4 in April, above the 50.7 consensus estimate, in expansion (>50) for the second straight month and the highest since May 2023. As shown in the chart below, the improvement in the composite index was skewed heavily towards the services sector, where the index rose (by 1.4pt) to 52.9, while the manufacturing PMI continued to sink.

Across countries, the improvement in the area-wide index was driven by Germany - which was above that key 50 expansion mark for the first time in 10 months driven by services (even as manufacturing continued to shrink, though at a slower pace than the month before) defying analysts who had expected another sub-par reading - and France, partially offset by a slight deceleration in the periphery.

In the UK, the composite flash PMI improved notably to 54.0, above consensus expectations of a decline, on the back of a pick-up in services activity, where the index grew by 1.8pt to 54.9, which was partly offset by a slowdown in manufacturing activity.

Commenting on the results, Goldman saw three main takeaways from today's data.

- First, there are continued improvement in the Euro area headline numbers, coupled with continued, but moderating, optimism for the upcoming year.

- Second, the PMI price components ticked up in April, driven by both sectors, with the risks to cost inflation coming from higher wages and oil prices.

- Lastly, the UK saw another month of expanding activity, also driven by the services sector, which should support growth momentum going forward.

While output prices ticked up only marginally in both the Euro area and the UK, it is important that firms' pricing behavior remains supportive for the disinflationary process, Goldman's economists noted.

The positive figures suggest that the euro area will probably expand by 0.3% in the second quarter, matching the rate of growth in the January-March period, said Cyrus de la Rubia, chief economist at Hamburg Commercial Bank. That’s a more upbeat prediction than the Bloomberg consensus, which sees just 0.1% growth at the start of the year, with data due on April 30.

“It appears that the recession was predominantly concentrated within the manufacturing sector, while the broader economy may have narrowly skirted such a downturn,” de la Rubia said. “The service sector may serve as a catalyst for the overall economy.”

After contracting in the final quarter of last year, Germany was long expected to have had a shallow recession over the winter. But the Bundesbank last week said output may have grown slightly in the first three months of the year because of a pickup in industrial production, exports and construction — meaning the country would avoid such a scenario.

De la Rubia agreed, saying a Nowcast model points to economic expansion of 0.1% in the first quarter followed by 0.2% in the second. German bonds fell across the curve and money markets reduced wagers on the scope for interest-rate cuts after data for the country were published. The two-year maturity, which is sensitive to changes in monetary policy, rose as much as three basis points to 2.99%.

The overall performance was also better in France, where activity remained broadly stable after contracting for 10 months. That development was also driven by services, where rising demand resulted in the first expansion in almost a year. New orders placed with factories fell at the steepest pace since January, increasing the wedge between manufacturers and services firms.

“The French services sector is the workhorse of the economy,” said Norman Liebke, an economist at Hamburg Commercial Bank. “French manufacturing output stays subdued, but we expect it will soon follow the path of the services sector. The manufacturing sector delays the overall economy’s recovery for now, though.”

But the better momentum in both countries was flanked by stronger price pressures, which as Bloomberg notes is a potential source of concern for European Central Bank officials who are gearing up for a first interest-rate cut in June. That development was also centered on the services sector, where rising wages are playing a bigger role. Diverging fortunes were equally visible in the labor market. While German and French services firms added workers at a quicker pace, factories shed jobs.

Overall though, the currency bloc’s top two economies couldn’t keep pace with the rest of the region, which appears to be recovering after the energy crisis that stifled its post-Covid rebound.

The rise in power costs — triggered by Russia’s war in Ukraine — also fanned inflation, though consumer-price growth has since slowed markedly. The purchasing-manager data showed that price pressures “intensified slightly” this month.

“The PMI figures are poised to test the ECB’s willingness to cut interest rates in June,” de la Rubia said. “Accelerated increases in input costs, likely driven not only by higher oil prices but also, more concerningly, by higher wages, are a cause for scrutiny. Concurrently, service-sector companies have raised their prices at a faster rate than in March, fueling expectations that services inflation will persist.”

Still, he doesn’t expect that to derail a well-telegraphed easing at the ECB’s next monetary-policy meeting. “However, we doubt that the central bank will adopt a ‘pragmatic speed,’ as suggested by Francois Villeroy de Galhau” de la Rubia said. “Instead, we expect a more cautious approach.”

As noted above, comments by ECB Vice President Luis de Guindos earlier on Tuesday reinforce that approach. “The level of uncertainty makes it very difficult to say,” he told Le Monde, according to a transcript on the ECB website. “I already mentioned June. As for what happens afterwards, I’m inclined to be very cautious.”

A separate set of data for the UK showed the economy’s recovery from recession unexpectedly gathered pace at the start of the second quarter as private-sector firms reported the strongest growth in almost a year. PMIs are closely watched by markets as they arrive early in the month and are good at revealing trends and turning points in an economy. A measure of breadth of changes in output rather than depth, business surveys can sometimes be difficult to map directly to quarterly GDP.

US figures later are set to show continued growth. Earlier numbers from Australia, India and Japan pointed to faster expansion.

Europe’s study in paradoxical contrasts continues. On the same day, ECB’s de Guindos said a June rate cut looks like a set deal (unless there are surprises) with the end of inflation fight is in sight, the Euro-area’s private-sector activity advanced to the highest level since May 2023, driven by a buoyant services sector and Germany’s return to growth; UK firms also reported the strongest growth in almost a year

Here are the details:

France

- Services Flash PMI (Apr) 50.5 vs. Exp. 49.0 (Prev. 48.3);

- Manufacturing Flash PMI (Apr) 44.9 vs. Exp. 47.0 (Prev. 46.2);

- Composite Flash PMI (Apr) 49.9 vs. Exp. 48.8 (Prev. 48.3);

- “Overall, our HCOB nowcast model for the second quarter points to a recovery of the French economy, driven by the services sector”.

Germany

- Manufacturing Flash PMI (Apr) 42.2 vs. Exp. 42.9 (Prev. 41.9);

- Services Flash PMI (Apr) 53.3 vs. Exp. 50.5 (Prev. 50.1);

- Composite Flash PMI (Apr) 50.5 vs. Exp. 48.6 (Prev. 47.7);

- “Factoring in the PMI numbers into our GDP Nowcast, we estimate that GDP may expand by 0.2%”.

UK

- Services PMI (Apr) 54.9 vs. Exp. 53.0 (Prev. 53.1);

- Manufacturing PMI (Apr) 48.7 vs. Exp. 50.4 (Prev. 50.3);

- Flash Composite PMI (Apr) 54.0 vs. Exp. 52.7 (Prev. 52.8)

Euro-Area

- Services Flash PMI (Apr) 52.9 vs. Exp. 51.8 (Prev. 51.5);

- Manufacturing Flash PMI (Apr) 45.6 vs. Exp. 46.6 (Prev. 46.1);

- Composite Flash PMI (Apr) 51.4 vs. Exp. 50.8 (Prev. 50.3);

- “Considering various factors including the HCOB PMIs, our GDP forecast suggests a 0.3% expansion in the second quarter”.

Putting it all together, the Euro area composite flash PMI increased by 1pt to 51.4 in April, above the 50.7 consensus estimate, in expansion (>50) for the second straight month and the highest since May 2023. As shown in the chart below, the improvement in the composite index was skewed heavily towards the services sector, where the index rose (by 1.4pt) to 52.9, while the manufacturing PMI continued to sink.

Across countries, the improvement in the area-wide index was driven by Germany – which was above that key 50 expansion mark for the first time in 10 months driven by services (even as manufacturing continued to shrink, though at a slower pace than the month before) defying analysts who had expected another sub-par reading – and France, partially offset by a slight deceleration in the periphery.

In the UK, the composite flash PMI improved notably to 54.0, above consensus expectations of a decline, on the back of a pick-up in services activity, where the index grew by 1.8pt to 54.9, which was partly offset by a slowdown in manufacturing activity.

Commenting on the results, Goldman saw three main takeaways from today’s data.

- First, there are continued improvement in the Euro area headline numbers, coupled with continued, but moderating, optimism for the upcoming year.

- Second, the PMI price components ticked up in April, driven by both sectors, with the risks to cost inflation coming from higher wages and oil prices.

- Lastly, the UK saw another month of expanding activity, also driven by the services sector, which should support growth momentum going forward.

While output prices ticked up only marginally in both the Euro area and the UK, it is important that firms’ pricing behavior remains supportive for the disinflationary process, Goldman’s economists noted.

The positive figures suggest that the euro area will probably expand by 0.3% in the second quarter, matching the rate of growth in the January-March period, said Cyrus de la Rubia, chief economist at Hamburg Commercial Bank. That’s a more upbeat prediction than the Bloomberg consensus, which sees just 0.1% growth at the start of the year, with data due on April 30.

“It appears that the recession was predominantly concentrated within the manufacturing sector, while the broader economy may have narrowly skirted such a downturn,” de la Rubia said. “The service sector may serve as a catalyst for the overall economy.”

After contracting in the final quarter of last year, Germany was long expected to have had a shallow recession over the winter. But the Bundesbank last week said output may have grown slightly in the first three months of the year because of a pickup in industrial production, exports and construction — meaning the country would avoid such a scenario.

De la Rubia agreed, saying a Nowcast model points to economic expansion of 0.1% in the first quarter followed by 0.2% in the second. German bonds fell across the curve and money markets reduced wagers on the scope for interest-rate cuts after data for the country were published. The two-year maturity, which is sensitive to changes in monetary policy, rose as much as three basis points to 2.99%.

The overall performance was also better in France, where activity remained broadly stable after contracting for 10 months. That development was also driven by services, where rising demand resulted in the first expansion in almost a year. New orders placed with factories fell at the steepest pace since January, increasing the wedge between manufacturers and services firms.

“The French services sector is the workhorse of the economy,” said Norman Liebke, an economist at Hamburg Commercial Bank. “French manufacturing output stays subdued, but we expect it will soon follow the path of the services sector. The manufacturing sector delays the overall economy’s recovery for now, though.”

But the better momentum in both countries was flanked by stronger price pressures, which as Bloomberg notes is a potential source of concern for European Central Bank officials who are gearing up for a first interest-rate cut in June. That development was also centered on the services sector, where rising wages are playing a bigger role. Diverging fortunes were equally visible in the labor market. While German and French services firms added workers at a quicker pace, factories shed jobs.

Overall though, the currency bloc’s top two economies couldn’t keep pace with the rest of the region, which appears to be recovering after the energy crisis that stifled its post-Covid rebound.

The rise in power costs — triggered by Russia’s war in Ukraine — also fanned inflation, though consumer-price growth has since slowed markedly. The purchasing-manager data showed that price pressures “intensified slightly” this month.

“The PMI figures are poised to test the ECB’s willingness to cut interest rates in June,” de la Rubia said. “Accelerated increases in input costs, likely driven not only by higher oil prices but also, more concerningly, by higher wages, are a cause for scrutiny. Concurrently, service-sector companies have raised their prices at a faster rate than in March, fueling expectations that services inflation will persist.”

Still, he doesn’t expect that to derail a well-telegraphed easing at the ECB’s next monetary-policy meeting. “However, we doubt that the central bank will adopt a ‘pragmatic speed,’ as suggested by Francois Villeroy de Galhau” de la Rubia said. “Instead, we expect a more cautious approach.”

As noted above, comments by ECB Vice President Luis de Guindos earlier on Tuesday reinforce that approach. “The level of uncertainty makes it very difficult to say,” he told Le Monde, according to a transcript on the ECB website. “I already mentioned June. As for what happens afterwards, I’m inclined to be very cautious.”

A separate set of data for the UK showed the economy’s recovery from recession unexpectedly gathered pace at the start of the second quarter as private-sector firms reported the strongest growth in almost a year. PMIs are closely watched by markets as they arrive early in the month and are good at revealing trends and turning points in an economy. A measure of breadth of changes in output rather than depth, business surveys can sometimes be difficult to map directly to quarterly GDP.

US figures later are set to show continued growth. Earlier numbers from Australia, India and Japan pointed to faster expansion.

Loading…