-

End of QE? Check!

-

Interest-rate hikes? Check!

-

Peripheral spread-narrowing tools? Check!

ECB President Christine Lagarde started with the pre-approved hawkish comments, blaming Putin for both weaker growth forecasts and higher inflation outlooks, promising to end the bond-buying and start hiking rates in July.

But then, the question of 'fragmentation' loomed (the fact that peripheral bond yields/spreads are decoupling - in a bad way - from the core, since she stopped buying everything), and the ECB boss appeared to fold like cheap lawn chair.

Lagarde says it is necessary to ensure monetary policy is transmitted through the whole area:

“we need to make sure there is no fragmentation.”

She notes there are existing instruments with the reinvestment capacity under the PEPP.

“And if it is necessary, as we have amply demonstrated in the past, we will deploy either existing or new instruments that will be made available.”

Lagarde states that "within our mandate we are committed to preventing fragmentation risks within the euro area."

So some kind of asset purchase scheme for peripherals? The vagueness is intentional as it appears Lagarde is trying to pull off a Draghi 'Whatever it takes' moment while keeping her foot on the hawkish pedal.

As The IIF's Robin Brooks pointed out:

If the ECB says to markets: "we will defend Italy's spread," markets will for sure test that statement.

So - in effect - what the ECB did today is to raise the odds of markets trying to force its hand.

All this is avoidable. Don't hike. The Euro zone is going into recession...

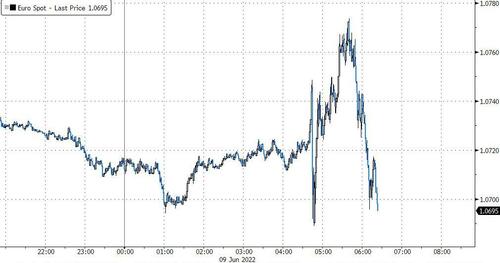

The Euro reacted to this 'dovish' stance immediately, erasing its gains and heading to the lows of the day...

European bond spreads were mixed interestingly with Italian spread compressing (Lagarde will save us) while Spain and Portugal widened...

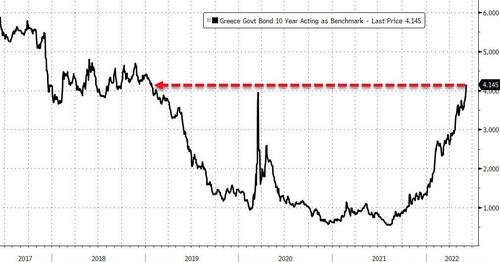

Greek yields are blowing out again...

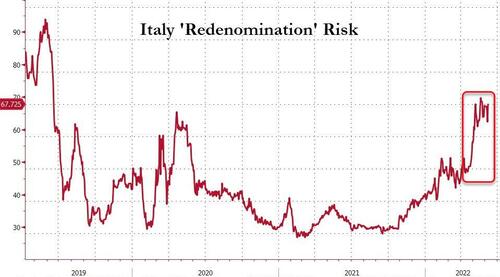

The reason this is worrisome is clear - markets are once again pricing in non-negligible possibility of 'Italeave'...

So which is it Christine? More money printing for the PIIGS and nothing for the core? Or a real effort to battle inflation?

ECB President Christine Lagarde started with the pre-approved hawkish comments, blaming Putin for both weaker growth forecasts and higher inflation outlooks, promising to end the bond-buying and start hiking rates in July.

But then, the question of ‘fragmentation’ loomed (the fact that peripheral bond yields/spreads are decoupling – in a bad way – from the core, since she stopped buying everything), and the ECB boss appeared to fold like cheap lawn chair.

Lagarde says it is necessary to ensure monetary policy is transmitted through the whole area:

“we need to make sure there is no fragmentation.”

She notes there are existing instruments with the reinvestment capacity under the PEPP.

“And if it is necessary, as we have amply demonstrated in the past, we will deploy either existing or new instruments that will be made available.”

Lagarde states that “within our mandate we are committed to preventing fragmentation risks within the euro area.”

So some kind of asset purchase scheme for peripherals? The vagueness is intentional as it appears Lagarde is trying to pull off a Draghi ‘Whatever it takes’ moment while keeping her foot on the hawkish pedal.

As The IIF’s Robin Brooks pointed out:

If the ECB says to markets: “we will defend Italy’s spread,” markets will for sure test that statement.

So – in effect – what the ECB did today is to raise the odds of markets trying to force its hand.

All this is avoidable. Don’t hike. The Euro zone is going into recession…

The Euro reacted to this ‘dovish’ stance immediately, erasing its gains and heading to the lows of the day…

European bond spreads were mixed interestingly with Italian spread compressing (Lagarde will save us) while Spain and Portugal widened…

Greek yields are blowing out again…

The reason this is worrisome is clear – markets are once again pricing in non-negligible possibility of ‘Italeave’…

So which is it Christine? More money printing for the PIIGS and nothing for the core? Or a real effort to battle inflation?