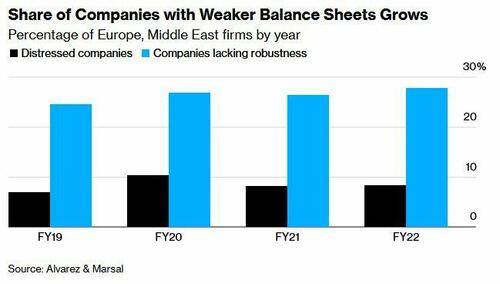

Nearly 30% of firms in Europe and the Middle East have weak balance sheets after companies loaded up on debt during the Covid-19 pandemic, and now face serious pressure due to rising interest rates and soaring inflation, Bloomberg reports, citing Alvarez & Marsal.

About 28% of companies were considered to be in this category in 2022, while 8.4% were deemed to be in distress, the consultancy firm said in a report, highlighting the Middle East, Spain and Germany as the regions with the highest proportion of distress. -Bloomberg

When compared to last year, the number of firms with balance sheet weakness is up slightly - and up 12% vs. pre-pandemic levels, according to the report.

This reflects the amount of state-backed debt that companies took on during the pandemic, leaving balance sheets "increasingly stretched by hefty debt loads and higher interest rates." according to the report.

"Companies’ ability to generate profits to pay for higher levels of debt is gradually being reduced," wrote the report's authors, which includes Paul Kirkbright, head of EMEA financial restructuring, and managing director Allesandro Farsaci.

What are the main drivers of the weakness? Metrics such as net debt-to-Ebitda, debt service coverage and interest coverage ratios.

Meanwhile, companies have been grappling with the ECB's 400-basis-point increase in key rates over the past year, compounded by record-breaking inflationary pressures across the eurozone. As such, weaker borrowers have found themselves locked out of capital markets and less able to roll over existing debt.

The A&M study looked at 7,000 listed and private companies with at least $22 million of annual revenues across 33 countries in Europe and the Middle East.

What are the weakest sectors?

- Non-food consumer businesses

- Media

- Entertainment

- Energy and Utilities

Businesses which rely on consumer discretionary spending saw their percentage of distress rise to around 13% in 2022 vs. 8.5% in 2021.

For energy and utility companies, the turmoil in Europe’s commodities markets had a “binary effect,” the report said. While some achieved higher operating margins following the surge in oil and gas prices, many utility companies struggled to pass on higher rates to customers. The percentage of gas companies in distress rose to 19% in 2022 from from 6.5% the prior year, according to the report.

On country-by-country basis, the authors pointed out that Germany could be “ahead of the curve” when it comes to restructuring activity due to tests around liquidity imposed by the country’s legal framework. In Spain, while there is a high proportion of companies in distress, levels have declined year-on-year, in part due a “spectacular rebound in tourism,” the report said. -Bloomberg

According to Kirkbright and Farsaci, even tighter financial conditions and recession will be compounding issues in the coming year, writing "We expect that tougher conditions will force more companies to actively pursue deleveraging and restructuring measures."

Nearly 30% of firms in Europe and the Middle East have weak balance sheets after companies loaded up on debt during the Covid-19 pandemic, and now face serious pressure due to rising interest rates and soaring inflation, Bloomberg reports, citing Alvarez & Marsal.

About 28% of companies were considered to be in this category in 2022, while 8.4% were deemed to be in distress, the consultancy firm said in a report, highlighting the Middle East, Spain and Germany as the regions with the highest proportion of distress. -Bloomberg

When compared to last year, the number of firms with balance sheet weakness is up slightly – and up 12% vs. pre-pandemic levels, according to the report.

This reflects the amount of state-backed debt that companies took on during the pandemic, leaving balance sheets “increasingly stretched by hefty debt loads and higher interest rates.” according to the report.

“Companies’ ability to generate profits to pay for higher levels of debt is gradually being reduced,” wrote the report’s authors, which includes Paul Kirkbright, head of EMEA financial restructuring, and managing director Allesandro Farsaci.

What are the main drivers of the weakness? Metrics such as net debt-to-Ebitda, debt service coverage and interest coverage ratios.

Meanwhile, companies have been grappling with the ECB’s 400-basis-point increase in key rates over the past year, compounded by record-breaking inflationary pressures across the eurozone. As such, weaker borrowers have found themselves locked out of capital markets and less able to roll over existing debt.

The A&M study looked at 7,000 listed and private companies with at least $22 million of annual revenues across 33 countries in Europe and the Middle East.

What are the weakest sectors?

- Non-food consumer businesses

- Media

- Entertainment

- Energy and Utilities

Businesses which rely on consumer discretionary spending saw their percentage of distress rise to around 13% in 2022 vs. 8.5% in 2021.

For energy and utility companies, the turmoil in Europe’s commodities markets had a “binary effect,” the report said. While some achieved higher operating margins following the surge in oil and gas prices, many utility companies struggled to pass on higher rates to customers. The percentage of gas companies in distress rose to 19% in 2022 from from 6.5% the prior year, according to the report.

On country-by-country basis, the authors pointed out that Germany could be “ahead of the curve” when it comes to restructuring activity due to tests around liquidity imposed by the country’s legal framework. In Spain, while there is a high proportion of companies in distress, levels have declined year-on-year, in part due a “spectacular rebound in tourism,” the report said. -Bloomberg

According to Kirkbright and Farsaci, even tighter financial conditions and recession will be compounding issues in the coming year, writing “We expect that tougher conditions will force more companies to actively pursue deleveraging and restructuring measures.“

Loading…