Authored by Austin Mann via Knowledge Leaders Capital blog,

Investor concerns over the potential for poor European growth in the foreseeable future have eased thanks to the flurry of economic data coming out stronger than expected this year. That same data though has led investors to again fear what they thought was behind them – inflation and the central bank. With three consecutive PMI beats from Europe’s three largest economies this week and generally sticky CPI numbers, investors are noticing that the European economy is not slowing fast enough, and the ECB is back in play.

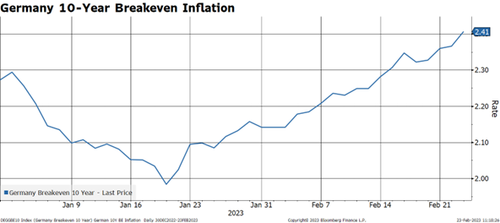

Notice how German 10-year breakeven inflation changed direction in mid-January. This escalation of inflation expectations for the next 10-years has been sharp since January 19, rising over 40bps.

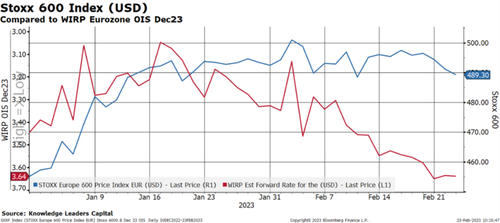

Equity markets have noticed and are beginning to price in the new, hawkish expectations.

With the Stoxx 600 closing down each day since Monday, we may be seeing investors begin to close the gap. According to the bond market, the expected main refinancing rate for December 2023 hit a low of 3.05% on January 17. From that date forward it has been steadily climbing higher.

At the same time, the solid uptrend in which European stocks began the year was halted by the turn in rates.

While we haven’t yet seen a reconciliation of equity prices downward like we have in the US markets, it’s clear that rising interest rates have halted the upward momentum in the European markets.

Authored by Austin Mann via Knowledge Leaders Capital blog,

Investor concerns over the potential for poor European growth in the foreseeable future have eased thanks to the flurry of economic data coming out stronger than expected this year. That same data though has led investors to again fear what they thought was behind them – inflation and the central bank. With three consecutive PMI beats from Europe’s three largest economies this week and generally sticky CPI numbers, investors are noticing that the European economy is not slowing fast enough, and the ECB is back in play.

Notice how German 10-year breakeven inflation changed direction in mid-January. This escalation of inflation expectations for the next 10-years has been sharp since January 19, rising over 40bps.

Equity markets have noticed and are beginning to price in the new, hawkish expectations.

With the Stoxx 600 closing down each day since Monday, we may be seeing investors begin to close the gap. According to the bond market, the expected main refinancing rate for December 2023 hit a low of 3.05% on January 17. From that date forward it has been steadily climbing higher.

At the same time, the solid uptrend in which European stocks began the year was halted by the turn in rates.

While we haven’t yet seen a reconciliation of equity prices downward like we have in the US markets, it’s clear that rising interest rates have halted the upward momentum in the European markets.

Loading…