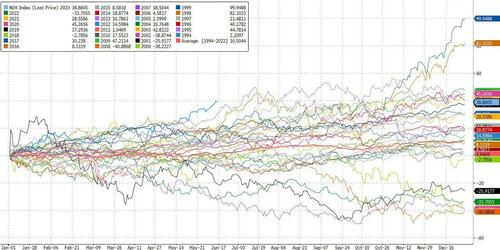

Over the weekend, Goldman's head of hedge fund sales Tony Pasquariello, wrote that while the Nasdaq was off to its best start in history...

... the easy money may have been made since "many folks - not all, but many - are now as long as they’ve been all year", and with many shorts already stopped in, the price indiscriminate buying is largely behind us (more here).

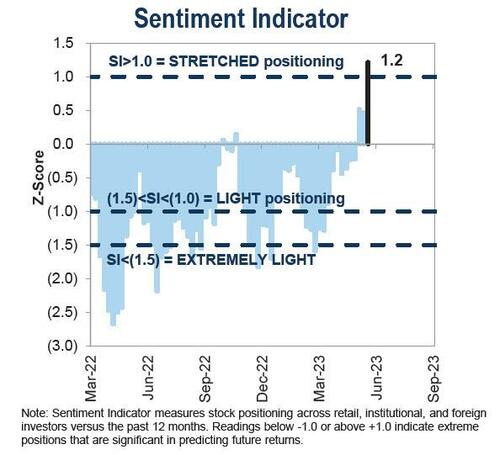

Indeed, both objective and subjective measures of sentiment are starting to look very overbought and lofty: as we noted last week, the Goldman sentiment indicator into stretched territory (1.2), its highest level in years...

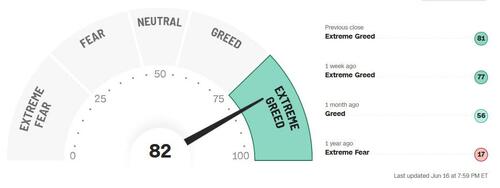

... the CNN/Fear greed indicator is in "extreme greed", the highest rating in well over a year...

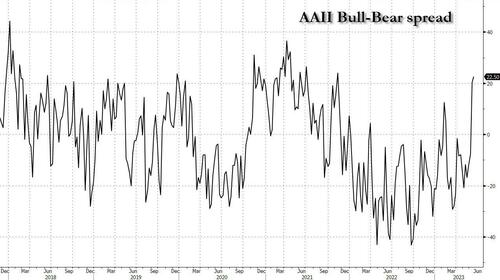

... and AAII Bull-Bear spread +22 at 1 year highs.

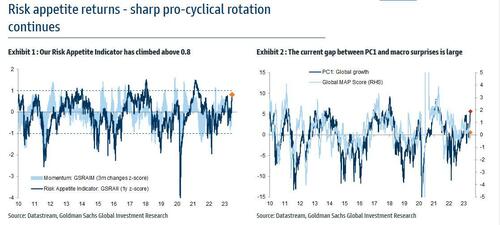

At the same time, Goldman's Risk Appetite Indicator (GSRAII Index) has climbed above 0.8, driven by a sharp pro-cyclical repricing across assets, pushing the bank's PC1 'Global Growth factor' to the highest level since early 2021, but as Goldman's Cecilia Mariotti cautions, "Markets have moved ahead of macro data - the current gap between PC1 and macro surprises as captured by the global MAP score is large" (full note available to pro subscribers).

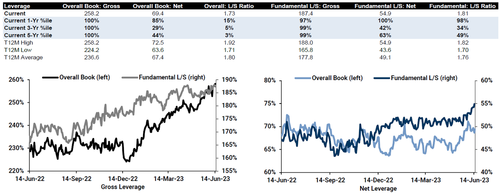

Flows in to Goldman's Prime Brokerage confirm both the directional movement and the frenzy behind it: of all the highlights, perhaps the most startling is the fundamental net length number where "Net leverage +2.2 pts on the week to 54.9% (100th percentile 1-year). Net buying in Macro Products was led by long buys – this week’s long buys were the largest in 3 months (while Single Stocks were modestly net sold for the first time in 6 weeks, led by short sales)." At the same time, fundamental L/S Gross leverage remains unchanged at 187.4% (97th percentile 1-year), indicating a scramble to go long both gross and net (more in the full Prime Insights note available to professional subs).

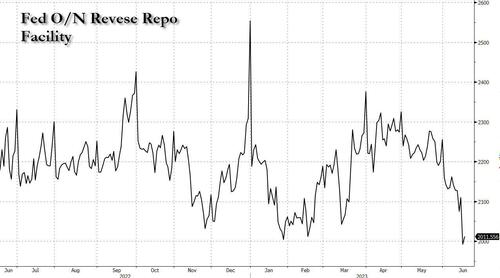

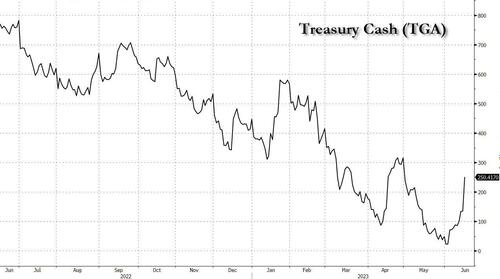

So is this one giant bull trap? Well, with the big central bank events now behind us - and with the Fed "skipping" if not pausing outright, the key catalyst for the market will be the ongoing focus on liquidity TGA/RRP; here Goldman's Rich Pirvorotsky notes that things seem to be quite stable and as the bank's research department puts it “Contrary to our expectations, bill yields (and some repo rates) have been settling above the RRP rate in many instances, incentivizing money funds to allocate away from the RRP facility to these higher yielding alternatives."

This has resulted in a "sharp decline in RRP balances, taking these balances lower to levels last seen about a year ago", and effectively funding much of the recent increase in the TGA, reducing the need for banks to drawdown on reserves.

That said, the next few weeks will be key to watch as data has likely been distorted by the June 15 tax payment; even so, to this point the liquidity drain has been pretty well tolerated (even with a sizeable increase in TGA on Friday, up $115BN).

Putting it all together, Goldman's Privorotsky writes that it has been a "difficult tape for bears and last few weeks has been about level setting expectations from a baseline of 2H recession to soft landing. The relative rally in cyclicality versus defensives and the resurgence in value stocks leaves a show me story on the data while sizeable China stimulus hopes seem somewhat misplaced."

His conclusion, after the VIX closed 13.54 on June expiry the lowest level since the Covid crash, "I wonder if we will look back on that as a prescient signal of a very durable economy or a local high of exuberance relative the range of uncertainty for the back half of the year."

More in the full note available to professional subscribers.

Over the weekend, Goldman’s head of hedge fund sales Tony Pasquariello, wrote that while the Nasdaq was off to its best start in history…

… the easy money may have been made since “many folks – not all, but many – are now as long as they’ve been all year”, and with many shorts already stopped in, the price indiscriminate buying is largely behind us (more here).

Indeed, both objective and subjective measures of sentiment are starting to look very overbought and lofty: as we noted last week, the Goldman sentiment indicator into stretched territory (1.2), its highest level in years…

… the CNN/Fear greed indicator is in “extreme greed”, the highest rating in well over a year…

… and AAII Bull-Bear spread +22 at 1 year highs.

At the same time, Goldman’s Risk Appetite Indicator (GSRAII Index) has climbed above 0.8, driven by a sharp pro-cyclical repricing across assets, pushing the bank’s PC1 ‘Global Growth factor’ to the highest level since early 2021, but as Goldman’s Cecilia Mariotti cautions, “Markets have moved ahead of macro data – the current gap between PC1 and macro surprises as captured by the global MAP score is large” (full note available to pro subscribers).

Flows in to Goldman’s Prime Brokerage confirm both the directional movement and the frenzy behind it: of all the highlights, perhaps the most startling is the fundamental net length number where “Net leverage +2.2 pts on the week to 54.9% (100th percentile 1-year). Net buying in Macro Products was led by long buys – this week’s long buys were the largest in 3 months (while Single Stocks were modestly net sold for the first time in 6 weeks, led by short sales).” At the same time, fundamental L/S Gross leverage remains unchanged at 187.4% (97th percentile 1-year), indicating a scramble to go long both gross and net (more in the full Prime Insights note available to professional subs).

So is this one giant bull trap? Well, with the big central bank events now behind us – and with the Fed “skipping” if not pausing outright, the key catalyst for the market will be the ongoing focus on liquidity TGA/RRP; here Goldman’s Rich Pirvorotsky notes that things seem to be quite stable and as the bank’s research department puts it “Contrary to our expectations, bill yields (and some repo rates) have been settling above the RRP rate in many instances, incentivizing money funds to allocate away from the RRP facility to these higher yielding alternatives.”

This has resulted in a “sharp decline in RRP balances, taking these balances lower to levels last seen about a year ago”, and effectively funding much of the recent increase in the TGA, reducing the need for banks to drawdown on reserves.

That said, the next few weeks will be key to watch as data has likely been distorted by the June 15 tax payment; even so, to this point the liquidity drain has been pretty well tolerated (even with a sizeable increase in TGA on Friday, up $115BN).

Putting it all together, Goldman’s Privorotsky writes that it has been a “difficult tape for bears and last few weeks has been about level setting expectations from a baseline of 2H recession to soft landing. The relative rally in cyclicality versus defensives and the resurgence in value stocks leaves a show me story on the data while sizeable China stimulus hopes seem somewhat misplaced.”

His conclusion, after the VIX closed 13.54 on June expiry the lowest level since the Covid crash, “I wonder if we will look back on that as a prescient signal of a very durable economy or a local high of exuberance relative the range of uncertainty for the back half of the year.”

More in the full note available to professional subscribers.

Loading…