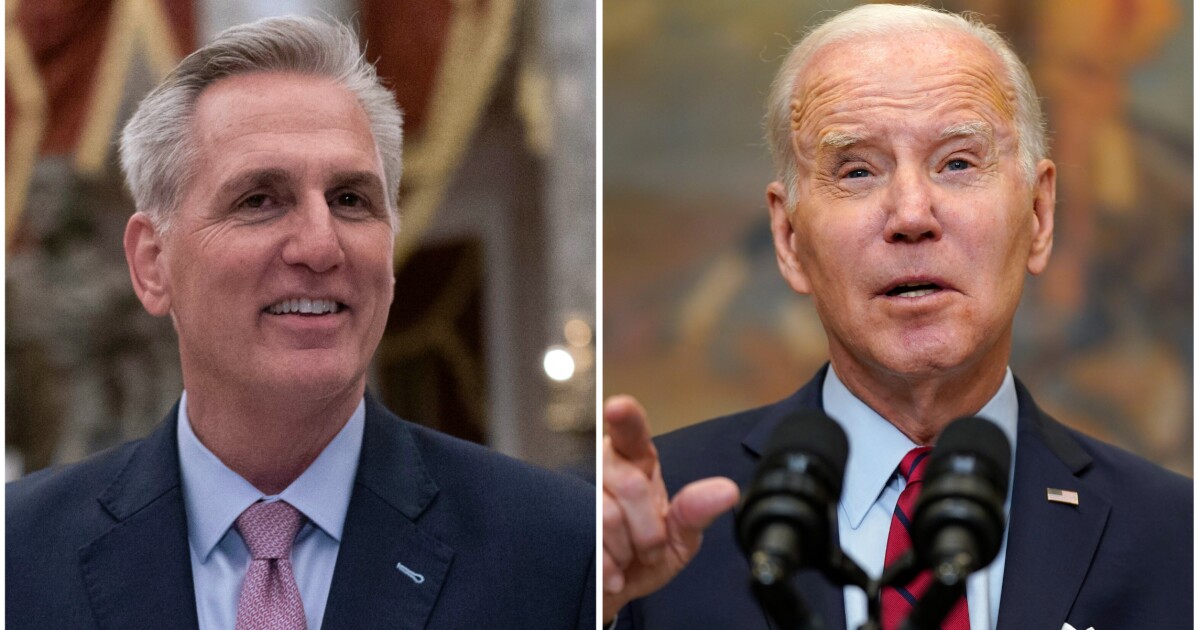

Speaking to union workers in Maryland on Wednesday, President Joe Biden took aim at House Republicans’ request that he negotiate spending cuts in exchange for a debt limit hike as he sought to defend his work on the economy.

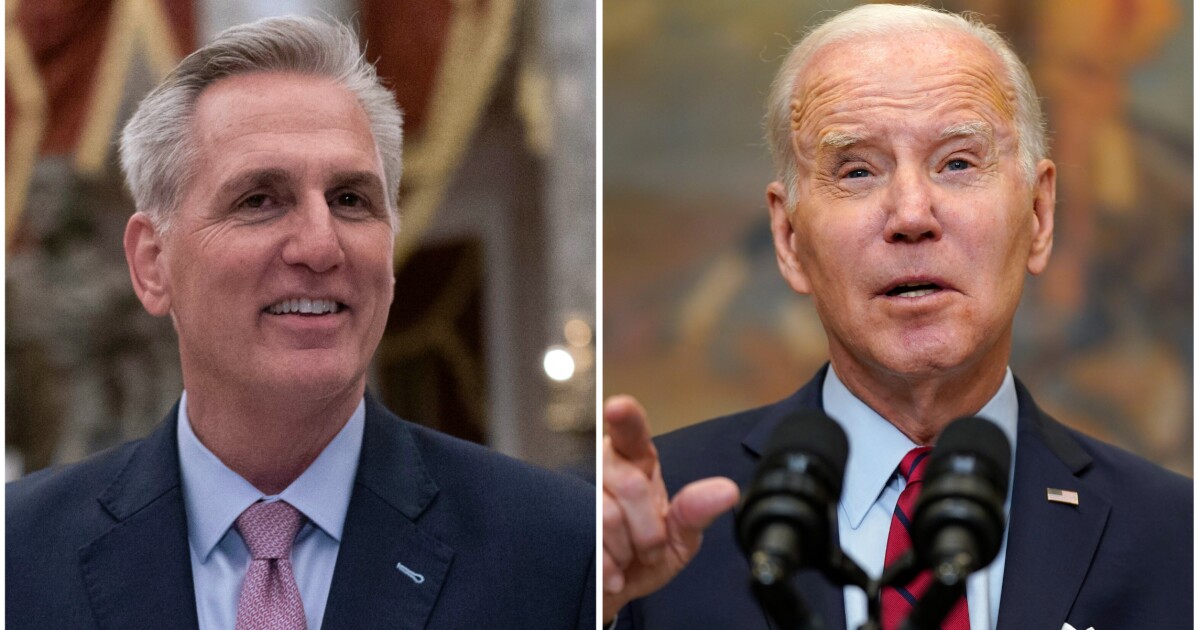

Biden relied on several misleading claims during an address aimed largely at discrediting House Speaker Kevin McCarthy (R-CA) and the GOP plan McCarthy unveiled earlier in the afternoon.

HOUSE GOP TAKES AX TO DEMOCRATIC CLEAN ENERGY CREDITS WITH DEBT CEILING PROPOSAL

Here are some of the instances in which Biden stretched the truth.

‘Putin’s war in Ukraine has disrupted energy supplies and food supplies, causing the price of everything from eggs to wheat to go up’

While the Russian invasion of Ukraine did affect grain prices last year, the spike in the cost of eggs has little to do with Ukraine.

Experts say a deadly outbreak of bird flu killed a record number of chickens and led to a shortage of eggs starting in 2022.

That led egg prices to climb at least 60% last year and contributed to higher costs for other kinds of food products that count eggs among their ingredients.

Biden has misleadingly cited the war in Ukraine in other contexts, such as while defending the rise in gas prices, but his efforts to connect the egg shortage to Ukraine are particularly far-fetched.

‘In my first two years in office, I brought the deficit down by a record $1.7 trillion’

This is a common claim Biden has made when defending his administration’s record on the economy.

Biden did indeed lower the deficit during his first two years in office — but not because he focused on fiscal responsibility.

Instead, the deficit fell because much of the unprecedented pandemic spending that began in 2020 under Biden’s predecessor expired, such as the end of enhanced unemployment benefits.

Spending still remains well above pre-pandemic levels under the Biden administration.

‘Under my plan, no one earning less than $400,000 has seen nor will see as long as I’m president a single solitary penny raised in their taxes’

Biden has maintained this line about taxes since the days of the 2020 campaign.

Regarding individual income tax brackets, Biden has not violated that pledge nor proposed a change that would.

But his proposed increases to corporate tax rates have caused some Republicans in the past to accuse him of pushing tax increases that would effectively tax people making less than $400,000 a year.

That’s because, some experts note, corporations would pass the higher tax burden on to their workers in the form of lower wages or layoffs and to their customers in the form of higher prices for goods or services.

The nonpartisan Tax Policy Center estimates that workers and customers feel at least some, if not a significant share, of all corporate tax burdens.

‘MAGA Republicans in Congress want to defund the FBI and the police’

Republicans are essentially unanimous in opposing defunding the police under any circumstances.

Not even Trump-aligned Republicans have proposed cutting funding to police.

Former President Donald Trump has called on congressional Republicans to cut FBI funding in retaliation for the multiple investigations he has faced since leaving office.

House Judiciary Chairman Jim Jordan (R-OH) has indeed floated the idea of threatening FBI and Justice Department funding but not specifically related to Trump.

Instead, Jordan has said House Republicans should consider using the “power of the purse” to hold the Justice Department to account on politically sensitive issues, such as its alleged disparate treatment of pro-abortion protesters and anti-abortion protesters.

‘MAGA Republicans in Congress have introduced a bill that could take food assistance away from 10 million kids, people, 4 million children, and put them at risk of going hungry’

The House Republican plan would expand work requirements to more people receiving food assistance, which could in theory result in some people being dropped from the program if they don’t actively look for a job and try to stay on the program.

But that doesn’t mean millions of people would lose their access to benefits overnight. The GOP proposal would simply raise the age at which existing work requirements would apply.

House Republicans are also pushing to end what they describe as loopholes that allow some states to waive existing requirements for people hoping to receive food assistance.

Roughly 42.5 million people rely on the food assistance benefits provided by the federal government. For Biden’s claim to come true, that means nearly 1 in 4 recipients of the benefits would have to fail to meet work requirements that already apply to recipients up to age 49. The GOP proposal would raise that age to 65.

The Trump tax cuts ‘overwhelmingly helped the super [wealthy],’ ‘and that tax cut ballooned the deficit by over 40%’

Both of these claims about the Trump-era Tax Cuts and Jobs Act are misleading at best.

First, those tax cuts reduced the tax burden for most households. People earning under $50,000 saw a modest tax cut, and virtually everyone making above $50,000 saw a substantial tax decrease.

While wealthy people did also receive a reduction in their taxes, as did corporations, the tax cuts by design helped most taxpayers.

The claim that the tax cuts are responsible for ballooning the national debt by 40% is also inaccurate.

CLICK HERE TO READ MORE FROM THE WASHINGTON EXAMINER

The national debt did indeed grow by nearly 40% on Trump’s watch, by $7.8 trillion, but again, pandemic-related spending was responsible for much of that growth,

The Tax Policy Institute estimated that the Trump tax cuts would add $1.9 trillion to the deficit over a decade, far less than the 40% increase over three years that Biden claimed.