Authored by Matthew Piepenburg via GoldSwitzerland.com,

As one who loves metaphor, I can’t help but notice the recent and varying range of metaphorical macro warnings.

JP Morgan’s Jamie Dimon, for example, is now predicting a “market hurricane” ahead, which Peter Schiff has recently upgraded to a “Category 5.”

Meanwhile, the always blunt Michael Burry has compared the trajectory of our market economy and macro warnings to “watching a plane crash.”

In short, the bull vs. bear debate is behind us; even the TBTF banks are now openly alarmed.

The Shark Fins Approach

In fact, current macro warnings are more suggestive of a market shark rather than bear, and borrowing a line from Speilberg’s Jaws, we are all “gonna need a bigger boat” as these dorsal-finned macro warnings begin circling in plain sight.

Specifically, we are seeing three separate macro warnings rising simultaneously, each of which are eerily familiar to the pre-2008 conditions which preceded the last global implosion.

In short: Cue the John Williams music.

Shark-Fin 1: Counterparty Risk

As we’ve argued ever since the September 2019 implosion of the reverse repo market, this was a very big deal.

Of course, the corporate media and politicized Fed tried to downplay the repo crisis as Powell was losing control of the rates markets and banks were losing trust for each other (and each other’s collateral.)

The financial “leadership” were hoping an intentionally confusing and complex reverse repo market would be too difficult for the average citizen-investor to grasp. Thus, the 2019 Fed nervously whistled past that ticking timebomb as it dumped trillions of mouse-click money into the repo morass.

But to make better sense of these repo markets, let’s keep things clean and simple.

The Repo Fins Explained

The reverse repo market is a place where loans keep markets and banks greased in short-term (typically over-night) liquidity, as liquidity (i.e., borrowed money) is the grease that makes our debt-soaked, over-levered and counter-party heavy markets go round.

Given this important “grease,” when the counterparties in the reverse repo markets lose trust in each other, the wheels of the markets start to squeak, shake, rattle and roll…off.

In September of 2019, TBTF Bank 1 essentially stopped trusting TBTF Bank 2’s balance sheet, and thus wouldn’t lend each other money at normal rates.

The distrusting banks chose instead to charge each other painful rates, skyrocketing from the sub 2% range to the 10% range in one trading day.

That’s a counter-party crisis colliding with a liquidity crisis. Or, more simply: A trust crisis.

Net result? The Fed’s money printers came in as a repo lender of last resort, tossing trillions of “loaned” grease into this otherwise dysfunctional repo marriage among the big banks.

Counterparty Dysfunction Explained

Once again, and unbeknownst to just about everybody, those days of dysfunctional liquidity marriages (i.e., distrust) have returned.

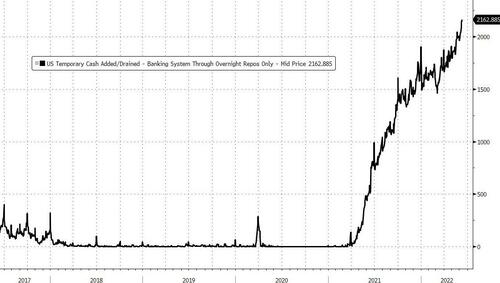

As of April 2021, the Fed has been making daily loans into the reverse repo market to the skyrocketing tune of $2T a day.

Please re-read that last line.

The eye-opening chart below looks a lot like a shark fin…

What ghastly data like the above chart boils down to is the Fed is providing the Money Market with mind-numbingly massive doses of daily liquidity to keep it alive. They do this by swapping out Treasuries for Money Market funds in what is the churning equivalent to treading water with fiat dollars.

Some experts claim that this insane level of Fed “support” is due to the TBTF banks off-loading deposits from their balance sheets onto the Fed’s balance sheet in order to meet the Basel 3 requirements.

A more likely scenario, however, boils down to counter-party distrust and hence counter-party risk among Wall Street’s broken moving parts.

That is, fund managers who run Money Market accounts no longer want to park their money with the TBTF banks for the simple reason that they see trouble ahead and frankly don’t trust them.

No wonder Jamie Dimon is so scared of hurricanes…

Stated otherwise: Distrust in the system is rising like a shark fin and the money markets are now swimming toward a “bigger boat”—namely the Fed.

Such distrust among counterparties is a major macro warning. In fact, it was precisely this kind of counterparty distrust/risk (and bad collateral) which brought down Bear Sterns and Lehman in 08.

Just saying…

Shark Fin 2: The Shift from Hysteria to Fear

Markets, no matter how artificially stimulated or can-kicked, move in cycles which are driven by the availability (or unavailability) of liquidity.

When cash is cheap (i.e., when rates are low), markets hysterically rip; and when cash is expensive (i.e., when rates rise), markets fearfully tank.

Ever since November of 2021 when Powell “forward guided” a June 2022 “tightening” of liquidity, markets have been slowly (and fearfully) tanking, as “tightening” is just a fancy way of telegraphing a rate hike.

And as stated above, rate hikes matter…They turn hysteria into fear.

Between 2006 and 2008, for example, we saw a crappy-credit housing market climb in euphoria and then tank in fear.

Today, as rates slowly rise into a Powel 2022 “taper,” today’s too-much-credit housing market will make a similar slow (and then rapid) shift from euphoria to “uh-oh.”

Equally (and eerily) reminiscent of the pre-2008 pivot from euphoria to fear is the teetering “tech will save you” meme, which like Cathie Wood’s ARKK fund, is tanking in real-time despite her rising spin-talk on primetime.

In short, we are seeing signs all over the hype-driven NASDAQ and S&P of a classic bear-trap, of which BTC was just one among many.

What’s far scarier today, however, is that the 2008 crisis (bubble) was limited to real estate; today, we are in an everything bubble, from meme stocks, inflated bonds and over-priced housing to bloated art, over-paid celebrity chefs and pricy used cars.

And remember: ALL bubbles pop, despite what your broker, central banker or 20-something financial journalist might tell you.

Shark Fin 3: MBS Toxic Waste

For those who remember 2008, then you also remember all those crappy mortgages packaged into Mortgage-Backed Securities (MBS) which Wall Street then syndicated to your broker like candy and which the rating agencies equated to magical beans.

You also know those MBS were toxic waste. And as Chernobyl reminds, toxic waste doesn’t just go away—it lingers and festers in deep, dark pits.

Sadly, the MBS waste of the 2008 era is still lingering and festering in the deep and dark pits of the Fed’s toxic and bloated balance sheet.

But now Powell wants to unload that MBS waste.

Great idea, but who wants to buy toxic waste?

How a Real Estate Bubble Dies

If, Powell sticks to his June unloading of unwanted MBS, this will add more supply of an asset class for which there is no demand.

And as high school economics reminds, such a over-supply & drying dynamic means tanking prices for those MBS radiation assets.

But again, who will buy radiation assets?

Sadly, the big banks will, which means they’ll now have more older and crappier MBS added to their balance sheets of the newer, less crappy loans, which they float through Freddie and Fannie to turn into more MBS.

But given the increasing supply and tanking demand for these MBS, their prices will go nowhere but south, which means their yields and hence interest rates (i.e., tomorrow’s mortgages) will have nowhere to go but north.

After all, banks survive by lending at a risk premium. As the Fed slowly takes the Fed Funds Rate from zero to 75 bps or more, the mortgage rates must rise at a much greater pace and slope, already climbing from 3% to 5% to date.

And that, folks, is how a housing bubble ends.

Where to Hide?

Investors facing these macro warnings and shark fins need a bigger boat.

Needless to say, our view lies partially in gold, which detractors will attribute to sell-side bias rather than informed conviction, private common sense, or a basic understanding of math or history.

As we’ve warned for years, all fraudulent banking, currency and market systems eventually collapse under their own weight.

This slow collapse is already in play, as the NASDAQ, S&P, TLT and even Muni bonds have all seen near 20% losses thus far into 2022.

Meanwhile, us boring gold investors are having to defend the only primary asset category that has kept its nose above the water level this year; we are constantly asked why gold is not ripping when in fact it has already done a noble job of not tanking.

Gold’s Bull Cycle Is Just Beginning

From its 2009 low to its high late last year, the Fed-created U.S. stock market became the biggest bubble in modern history.

But we believe the gold market’s rise has not even begun. In 1980, when gold topped an 8X move in just 3 years, stocks were flat. If anything, the only “bubble” then was gold itself.

But until recently, the only bubbles in sight were risk assets (from junk bonds to junk tech), which means gold’s time to shine is ahead of us, not behind us.

When considered in the larger backdrop of a commodities cycle, such confidence is an evolution rather than bias.

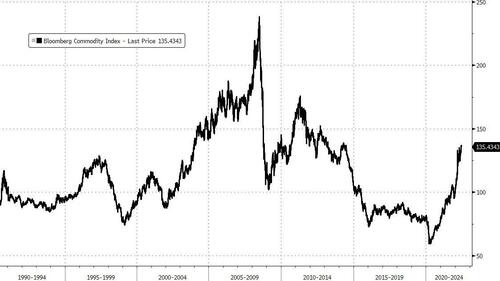

The recent uptrend in the Bloomberg Commodities Index, for example, is admirable, but does not even compare to the highs it reached in 2011 and prior.

In short, commodities in general, and precious metals in particular, are at the beginning of a bull cycle, whereas over-valued risk assets are approaching the traumatic end of theirs.

As for interim price action in gold, we are not promising a straight line. When risk asset markets tank, gold can temporarily follow, as seen in October of 2008 or March of 2020.

But just after joining those tanking markets, gold then divorced the tantrum trend and skyrocketed north. We see an inevitable gold surge in the tumultuous years ahead, and as investors rather than speculators, time is clearly on our side.

Still Trust the Fed?

Of course, there are still those who will trust the Fed and the “magical money theories” (MMT) of the so-called experts.

As the great Janet Yellen sits down with Powell and Biden this week, I wonder if anyone in that Oval Office will remind Yellen that she had described inflation as “transitory” throughout 2021, though now it has reached 40-year highs?

I wonder if anyone will remind her that for the entire first half of her term as Fed Cahir, she kept rates stapled to zero, and then took 2 more years just to reach 1.15%, thereby adding low-rate fuel to the current inflationary fire that always follows cheap debt paid for with mouse-klick money?

And I wonder if anyone will remind her that when she sat as President of the San Francisco Fed, her low-rate policies lead directly to the greatest housing bubble (I was there) in that state’s (and our nation’s) history, despite her continued promises that there was no risk of a housing bubble nor any damage to the broader economy?

Has Janet forgotten 2008?

Trust Hard Facts

But if the politico’s wish to pretend and shirk, we at least can be blunt and direct.

In the last 200+ years, 98% of all countries with a debt to GDP ratio of > 130% have defaulted via inflation, currency devaluation, restructuring or pure default. (Reinhart & Rogoff)

Sadly, the problem for the U.S., based on the global centric nature of USD structures, means the entire world has a sovereign debt problem.

As I have written and spoken many times, it’s my belief that debt-soaked sovereigns will publicly decry inflation while privately seeking more of it as a Main-Street-crushing “strategy” to inflate away their sovereign debt.

Big brother crushing Main Street? No shocker there…

Such “constructive” default via crippling inflation is a way of defaulting without having to publicly (i.e., politically) confess default, and God knows politicians like Yellen et al never admit to any faults.

Follow the Fed

Furthermore, given that natural supply and demand-driven price discovery (along with basic capitalism) died years ago in what is now a central-bank driven market, the only signal (headwind or tailwind) left for tracking future market direction is based upon central bank policy in general and Powell’s Fed in particular.

I mean let’s be honest: It’s a rigged Fed market, not a stock market.

So, what will Powell do? Will he 1) tighten QE into a topping market (and thus create an historical market blow-off and global meltdown) or 2) pivot, reverse course and start creating more fiat money faster than a bat out of Hell?

No one, of course, can know for certain.

Volatility Ahead

The Fed is in such a ridiculous corner that neither option is a sane option, and thus the base-case is to expect more market volatility ahead as investors stand on the razor’s edge of either a tanking market or a dying (inflated, devalued and debased) currency.

Meanwhile, Powell, Biden and Yellen can meet to “plan a strategy,” which in my mind is akin to Mickey Mouse sitting down with Tweedle-Dee and Tweedle-Dumb to diffuse a timebomb.

All three know that the economic data ahead is getting worse not better (all blamed conveniently on Putin and COVID, rather than the cancerous debt that pre-existed both crises and the insanely toxic policy reactions which they pursued).

Given political preferences for re-election self-interest over the public good or personal accountability, it’s hard to imagine any of these political parties actually confessing a recession with a mid-term election on the horizon.

The U.S. administration is already pre-telegraphing weaker economic data for the coming months, preparing the masses for more pain while pointing fingers at Putin or bat-made (man-made?) virus rather than assuming one iota of personal accountability.

In this backdrop, it is possible that the three stooges above may allow markets to tank by sticking to Powell’s QT schedule and hence “fight” money-supply-driven inflation with a tanking market-price-driven “deflation.”

Even if this desperate option is taken, my guess, and it’s only a guess based on human (political) nature and centuries of historical patterns, is that the Fed will then pivot and crank out the money printing once markets spiral into QT.

In short, I see lots of inflationary, deflationary and then again inflationary forces ahead—all screaming volatility ahead.

In short, amidst these clear macro warnings, I think we’re all gonna need a bigger boat—and mine will have a golden rudder.

Authored by Matthew Piepenburg via GoldSwitzerland.com,

As one who loves metaphor, I can’t help but notice the recent and varying range of metaphorical macro warnings.

JP Morgan’s Jamie Dimon, for example, is now predicting a “market hurricane” ahead, which Peter Schiff has recently upgraded to a “Category 5.”

Meanwhile, the always blunt Michael Burry has compared the trajectory of our market economy and macro warnings to “watching a plane crash.”

In short, the bull vs. bear debate is behind us; even the TBTF banks are now openly alarmed.

The Shark Fins Approach

In fact, current macro warnings are more suggestive of a market shark rather than bear, and borrowing a line from Speilberg’s Jaws, we are all “gonna need a bigger boat” as these dorsal-finned macro warnings begin circling in plain sight.

Specifically, we are seeing three separate macro warnings rising simultaneously, each of which are eerily familiar to the pre-2008 conditions which preceded the last global implosion.

In short: Cue the John Williams music.

Shark-Fin 1: Counterparty Risk

As we’ve argued ever since the September 2019 implosion of the reverse repo market, this was a very big deal.

Of course, the corporate media and politicized Fed tried to downplay the repo crisis as Powell was losing control of the rates markets and banks were losing trust for each other (and each other’s collateral.)

The financial “leadership” were hoping an intentionally confusing and complex reverse repo market would be too difficult for the average citizen-investor to grasp. Thus, the 2019 Fed nervously whistled past that ticking timebomb as it dumped trillions of mouse-click money into the repo morass.

But to make better sense of these repo markets, let’s keep things clean and simple.

The Repo Fins Explained

The reverse repo market is a place where loans keep markets and banks greased in short-term (typically over-night) liquidity, as liquidity (i.e., borrowed money) is the grease that makes our debt-soaked, over-levered and counter-party heavy markets go round.

Given this important “grease,” when the counterparties in the reverse repo markets lose trust in each other, the wheels of the markets start to squeak, shake, rattle and roll…off.

In September of 2019, TBTF Bank 1 essentially stopped trusting TBTF Bank 2’s balance sheet, and thus wouldn’t lend each other money at normal rates.

The distrusting banks chose instead to charge each other painful rates, skyrocketing from the sub 2% range to the 10% range in one trading day.

That’s a counter-party crisis colliding with a liquidity crisis. Or, more simply: A trust crisis.

Net result? The Fed’s money printers came in as a repo lender of last resort, tossing trillions of “loaned” grease into this otherwise dysfunctional repo marriage among the big banks.

Counterparty Dysfunction Explained

Once again, and unbeknownst to just about everybody, those days of dysfunctional liquidity marriages (i.e., distrust) have returned.

As of April 2021, the Fed has been making daily loans into the reverse repo market to the skyrocketing tune of $2T a day.

Please re-read that last line.

The eye-opening chart below looks a lot like a shark fin…

What ghastly data like the above chart boils down to is the Fed is providing the Money Market with mind-numbingly massive doses of daily liquidity to keep it alive. They do this by swapping out Treasuries for Money Market funds in what is the churning equivalent to treading water with fiat dollars.

Some experts claim that this insane level of Fed “support” is due to the TBTF banks off-loading deposits from their balance sheets onto the Fed’s balance sheet in order to meet the Basel 3 requirements.

A more likely scenario, however, boils down to counter-party distrust and hence counter-party risk among Wall Street’s broken moving parts.

That is, fund managers who run Money Market accounts no longer want to park their money with the TBTF banks for the simple reason that they see trouble ahead and frankly don’t trust them.

No wonder Jamie Dimon is so scared of hurricanes…

Stated otherwise: Distrust in the system is rising like a shark fin and the money markets are now swimming toward a “bigger boat”—namely the Fed.

Such distrust among counterparties is a major macro warning. In fact, it was precisely this kind of counterparty distrust/risk (and bad collateral) which brought down Bear Sterns and Lehman in 08.

Just saying…

Shark Fin 2: The Shift from Hysteria to Fear

Markets, no matter how artificially stimulated or can-kicked, move in cycles which are driven by the availability (or unavailability) of liquidity.

When cash is cheap (i.e., when rates are low), markets hysterically rip; and when cash is expensive (i.e., when rates rise), markets fearfully tank.

Ever since November of 2021 when Powell “forward guided” a June 2022 “tightening” of liquidity, markets have been slowly (and fearfully) tanking, as “tightening” is just a fancy way of telegraphing a rate hike.

And as stated above, rate hikes matter…They turn hysteria into fear.

Between 2006 and 2008, for example, we saw a crappy-credit housing market climb in euphoria and then tank in fear.

Today, as rates slowly rise into a Powel 2022 “taper,” today’s too-much-credit housing market will make a similar slow (and then rapid) shift from euphoria to “uh-oh.”

Equally (and eerily) reminiscent of the pre-2008 pivot from euphoria to fear is the teetering “tech will save you” meme, which like Cathie Wood’s ARKK fund, is tanking in real-time despite her rising spin-talk on primetime.

In short, we are seeing signs all over the hype-driven NASDAQ and S&P of a classic bear-trap, of which BTC was just one among many.

What’s far scarier today, however, is that the 2008 crisis (bubble) was limited to real estate; today, we are in an everything bubble, from meme stocks, inflated bonds and over-priced housing to bloated art, over-paid celebrity chefs and pricy used cars.

And remember: ALL bubbles pop, despite what your broker, central banker or 20-something financial journalist might tell you.

Shark Fin 3: MBS Toxic Waste

For those who remember 2008, then you also remember all those crappy mortgages packaged into Mortgage-Backed Securities (MBS) which Wall Street then syndicated to your broker like candy and which the rating agencies equated to magical beans.

You also know those MBS were toxic waste. And as Chernobyl reminds, toxic waste doesn’t just go away—it lingers and festers in deep, dark pits.

Sadly, the MBS waste of the 2008 era is still lingering and festering in the deep and dark pits of the Fed’s toxic and bloated balance sheet.

But now Powell wants to unload that MBS waste.

Great idea, but who wants to buy toxic waste?

How a Real Estate Bubble Dies

If, Powell sticks to his June unloading of unwanted MBS, this will add more supply of an asset class for which there is no demand.

And as high school economics reminds, such a over-supply & drying dynamic means tanking prices for those MBS radiation assets.

But again, who will buy radiation assets?

Sadly, the big banks will, which means they’ll now have more older and crappier MBS added to their balance sheets of the newer, less crappy loans, which they float through Freddie and Fannie to turn into more MBS.

But given the increasing supply and tanking demand for these MBS, their prices will go nowhere but south, which means their yields and hence interest rates (i.e., tomorrow’s mortgages) will have nowhere to go but north.

After all, banks survive by lending at a risk premium. As the Fed slowly takes the Fed Funds Rate from zero to 75 bps or more, the mortgage rates must rise at a much greater pace and slope, already climbing from 3% to 5% to date.

And that, folks, is how a housing bubble ends.

Where to Hide?

Investors facing these macro warnings and shark fins need a bigger boat.

Needless to say, our view lies partially in gold, which detractors will attribute to sell-side bias rather than informed conviction, private common sense, or a basic understanding of math or history.

As we’ve warned for years, all fraudulent banking, currency and market systems eventually collapse under their own weight.

This slow collapse is already in play, as the NASDAQ, S&P, TLT and even Muni bonds have all seen near 20% losses thus far into 2022.

Meanwhile, us boring gold investors are having to defend the only primary asset category that has kept its nose above the water level this year; we are constantly asked why gold is not ripping when in fact it has already done a noble job of not tanking.

Gold’s Bull Cycle Is Just Beginning

From its 2009 low to its high late last year, the Fed-created U.S. stock market became the biggest bubble in modern history.

But we believe the gold market’s rise has not even begun. In 1980, when gold topped an 8X move in just 3 years, stocks were flat. If anything, the only “bubble” then was gold itself.

But until recently, the only bubbles in sight were risk assets (from junk bonds to junk tech), which means gold’s time to shine is ahead of us, not behind us.

When considered in the larger backdrop of a commodities cycle, such confidence is an evolution rather than bias.

The recent uptrend in the Bloomberg Commodities Index, for example, is admirable, but does not even compare to the highs it reached in 2011 and prior.

In short, commodities in general, and precious metals in particular, are at the beginning of a bull cycle, whereas over-valued risk assets are approaching the traumatic end of theirs.

As for interim price action in gold, we are not promising a straight line. When risk asset markets tank, gold can temporarily follow, as seen in October of 2008 or March of 2020.

But just after joining those tanking markets, gold then divorced the tantrum trend and skyrocketed north. We see an inevitable gold surge in the tumultuous years ahead, and as investors rather than speculators, time is clearly on our side.

Still Trust the Fed?

Of course, there are still those who will trust the Fed and the “magical money theories” (MMT) of the so-called experts.

As the great Janet Yellen sits down with Powell and Biden this week, I wonder if anyone in that Oval Office will remind Yellen that she had described inflation as “transitory” throughout 2021, though now it has reached 40-year highs?

I wonder if anyone will remind her that for the entire first half of her term as Fed Cahir, she kept rates stapled to zero, and then took 2 more years just to reach 1.15%, thereby adding low-rate fuel to the current inflationary fire that always follows cheap debt paid for with mouse-klick money?

And I wonder if anyone will remind her that when she sat as President of the San Francisco Fed, her low-rate policies lead directly to the greatest housing bubble (I was there) in that state’s (and our nation’s) history, despite her continued promises that there was no risk of a housing bubble nor any damage to the broader economy?

Has Janet forgotten 2008?

Trust Hard Facts

But if the politico’s wish to pretend and shirk, we at least can be blunt and direct.

In the last 200+ years, 98% of all countries with a debt to GDP ratio of > 130% have defaulted via inflation, currency devaluation, restructuring or pure default. (Reinhart & Rogoff)

Sadly, the problem for the U.S., based on the global centric nature of USD structures, means the entire world has a sovereign debt problem.

As I have written and spoken many times, it’s my belief that debt-soaked sovereigns will publicly decry inflation while privately seeking more of it as a Main-Street-crushing “strategy” to inflate away their sovereign debt.

Big brother crushing Main Street? No shocker there…

Such “constructive” default via crippling inflation is a way of defaulting without having to publicly (i.e., politically) confess default, and God knows politicians like Yellen et al never admit to any faults.

Follow the Fed

Furthermore, given that natural supply and demand-driven price discovery (along with basic capitalism) died years ago in what is now a central-bank driven market, the only signal (headwind or tailwind) left for tracking future market direction is based upon central bank policy in general and Powell’s Fed in particular.

I mean let’s be honest: It’s a rigged Fed market, not a stock market.

So, what will Powell do? Will he 1) tighten QE into a topping market (and thus create an historical market blow-off and global meltdown) or 2) pivot, reverse course and start creating more fiat money faster than a bat out of Hell?

No one, of course, can know for certain.

Volatility Ahead

The Fed is in such a ridiculous corner that neither option is a sane option, and thus the base-case is to expect more market volatility ahead as investors stand on the razor’s edge of either a tanking market or a dying (inflated, devalued and debased) currency.

Meanwhile, Powell, Biden and Yellen can meet to “plan a strategy,” which in my mind is akin to Mickey Mouse sitting down with Tweedle-Dee and Tweedle-Dumb to diffuse a timebomb.

All three know that the economic data ahead is getting worse not better (all blamed conveniently on Putin and COVID, rather than the cancerous debt that pre-existed both crises and the insanely toxic policy reactions which they pursued).

Given political preferences for re-election self-interest over the public good or personal accountability, it’s hard to imagine any of these political parties actually confessing a recession with a mid-term election on the horizon.

The U.S. administration is already pre-telegraphing weaker economic data for the coming months, preparing the masses for more pain while pointing fingers at Putin or bat-made (man-made?) virus rather than assuming one iota of personal accountability.

In this backdrop, it is possible that the three stooges above may allow markets to tank by sticking to Powell’s QT schedule and hence “fight” money-supply-driven inflation with a tanking market-price-driven “deflation.”

Even if this desperate option is taken, my guess, and it’s only a guess based on human (political) nature and centuries of historical patterns, is that the Fed will then pivot and crank out the money printing once markets spiral into QT.

In short, I see lots of inflationary, deflationary and then again inflationary forces ahead—all screaming volatility ahead.

In short, amidst these clear macro warnings, I think we’re all gonna need a bigger boat—and mine will have a golden rudder.