By John Kemp, Senior Market Analyst at Reuters

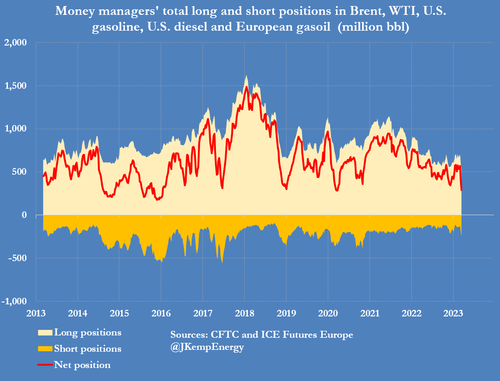

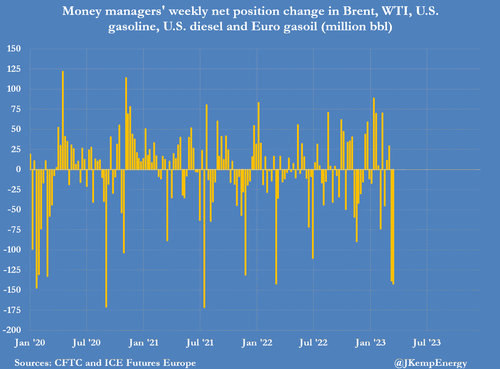

Portfolio investors sold oil-related futures and options contracts at the fastest rate for almost six years as traders prepared for the onset of a recession driven by tighter credit conditions in the aftermath of the banking crisis. Hedge funds and other money managers sold the equivalent of 142 million barrels in the six most important contracts in the seven days ending on March 21, after selling 139 million barrels in the week to March 14.

Total sales over the two weeks were the fastest for any fortnight since May 2017, according to records published by ICE Futures Europe and the U.S. Commodity Futures Trading Commission.

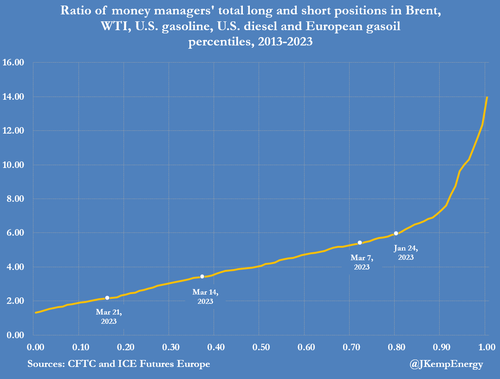

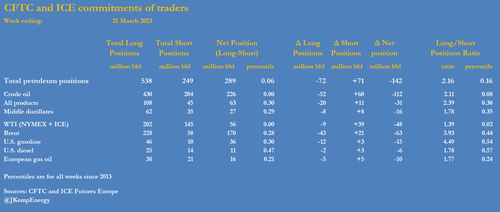

Fund managers have slashed their combined position to just 289 million barrels (6th percentile for all weeks since 2013) from 570 million (46th percentile) on March 7. The fund community liquidated 163 million barrels of previous bullish long positions in the two most recent weeks, while establishing 115 million barrels of new bearish short ones.

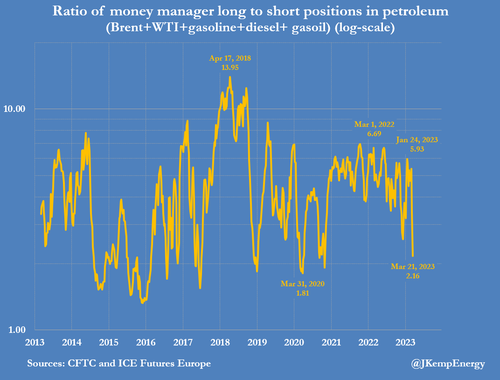

As a result, the ratio of bullish longs to bearish shorts slumped to 2.16:1 (16th percentile) on March 21 from 5.38:1 (71st percentile) on March 7.

The most recent week saw heavy sales across the board, including Brent (-63 million barrels), NYMEX and ICE WTI (-48 million), U.S. gasoline (-15 million), U.S. diesel (-6 million) and European gas oil (-10 million).

In absolute terms, the change in positions over the two most recent weeks is one of the largest to occur in either direction in the last decade, three times more than average, implying a fundamental change in the outlook.

The banking crisis, which has resulted in the failure of several U.S. regional banks and the enforced rescue of Credit Suisse by UBS, is expected to result in a marked tightening of credit conditions.

Even before the crisis, economic growth in North America and Europe was expected to slow in response to persistent inflation, rising interest rates, and the squeeze on household and business spending.

But credit creation and loan growth is now expected to decelerate more abruptly as financial institutions, especially smaller ones, attempt to fortify their balance sheets hurriedly to reduce the risk of runs. At the same time, Russia’s crude and diesel exports have continued uninterrupted, despite sanctions imposed by the United States and its allies, contributing to near-term supply in crude and product markets.

Doubts have also emerged about the speed of China’s rebound as the country’s manufacturers and service suppliers deal with cautious consumers following the lifting of coronavirus controls.

Crude has been hit hardest while contracts for refined fuels have held up more strongly because of the current low level of inventories and limits on refining capacity. The previously expected tightening of the production-consumption balance has been pushed further back into the second half of 2023.

Funds now anticipate a much larger surplus in the meantime, leading many to abandon bullish positions and create bearish ones, at least for the short term.

US Gas Positions

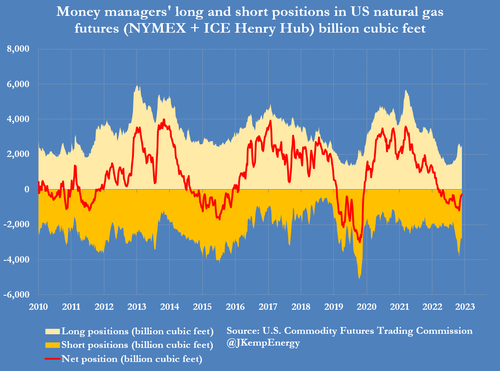

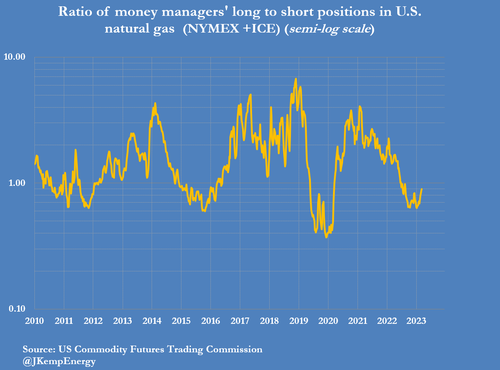

Hedge funds and other money managers increased their net position in U.S. Henry Hub natural gas futures and options for the sixth time in seven weeks over the seven days ending on March 21.

Working gas inventories remain well above the seasonal average, but with prices already close to the lowest level in real terms for three decades, the surplus is expected to erode over the remainder of 2023.

Ultra-low prices are likely to compel a slowdown in new drilling and well completions as well as encourage more gas-fired power generation at the expense of the remaining coal units.

The restart of exports from Freeport LNG following repairs and safety checks should also tighten the production-consumption-exports balance.

Anticipating the erosion of the surplus, funds have bought the equivalent of 774 billion cubic feet in the last seven weeks.

As a result, the fund community’s overall net position has been trimmed to 287 billion cubic feet (25th percentile for all weeks since 2010) from 1,061 bcf (9th percentile) on January 31.

By John Kemp, Senior Market Analyst at Reuters

Portfolio investors sold oil-related futures and options contracts at the fastest rate for almost six years as traders prepared for the onset of a recession driven by tighter credit conditions in the aftermath of the banking crisis. Hedge funds and other money managers sold the equivalent of 142 million barrels in the six most important contracts in the seven days ending on March 21, after selling 139 million barrels in the week to March 14.

Total sales over the two weeks were the fastest for any fortnight since May 2017, according to records published by ICE Futures Europe and the U.S. Commodity Futures Trading Commission.

Fund managers have slashed their combined position to just 289 million barrels (6th percentile for all weeks since 2013) from 570 million (46th percentile) on March 7. The fund community liquidated 163 million barrels of previous bullish long positions in the two most recent weeks, while establishing 115 million barrels of new bearish short ones.

As a result, the ratio of bullish longs to bearish shorts slumped to 2.16:1 (16th percentile) on March 21 from 5.38:1 (71st percentile) on March 7.

The most recent week saw heavy sales across the board, including Brent (-63 million barrels), NYMEX and ICE WTI (-48 million), U.S. gasoline (-15 million), U.S. diesel (-6 million) and European gas oil (-10 million).

In absolute terms, the change in positions over the two most recent weeks is one of the largest to occur in either direction in the last decade, three times more than average, implying a fundamental change in the outlook.

The banking crisis, which has resulted in the failure of several U.S. regional banks and the enforced rescue of Credit Suisse by UBS, is expected to result in a marked tightening of credit conditions.

Even before the crisis, economic growth in North America and Europe was expected to slow in response to persistent inflation, rising interest rates, and the squeeze on household and business spending.

But credit creation and loan growth is now expected to decelerate more abruptly as financial institutions, especially smaller ones, attempt to fortify their balance sheets hurriedly to reduce the risk of runs. At the same time, Russia’s crude and diesel exports have continued uninterrupted, despite sanctions imposed by the United States and its allies, contributing to near-term supply in crude and product markets.

Doubts have also emerged about the speed of China’s rebound as the country’s manufacturers and service suppliers deal with cautious consumers following the lifting of coronavirus controls.

Crude has been hit hardest while contracts for refined fuels have held up more strongly because of the current low level of inventories and limits on refining capacity. The previously expected tightening of the production-consumption balance has been pushed further back into the second half of 2023.

Funds now anticipate a much larger surplus in the meantime, leading many to abandon bullish positions and create bearish ones, at least for the short term.

US Gas Positions

Hedge funds and other money managers increased their net position in U.S. Henry Hub natural gas futures and options for the sixth time in seven weeks over the seven days ending on March 21.

Working gas inventories remain well above the seasonal average, but with prices already close to the lowest level in real terms for three decades, the surplus is expected to erode over the remainder of 2023.

Ultra-low prices are likely to compel a slowdown in new drilling and well completions as well as encourage more gas-fired power generation at the expense of the remaining coal units.

The restart of exports from Freeport LNG following repairs and safety checks should also tighten the production-consumption-exports balance.

Anticipating the erosion of the surplus, funds have bought the equivalent of 774 billion cubic feet in the last seven weeks.

As a result, the fund community’s overall net position has been trimmed to 287 billion cubic feet (25th percentile for all weeks since 2010) from 1,061 bcf (9th percentile) on January 31.

Loading…