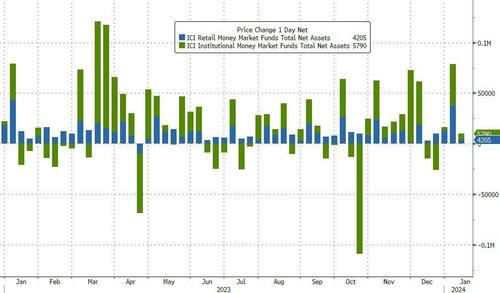

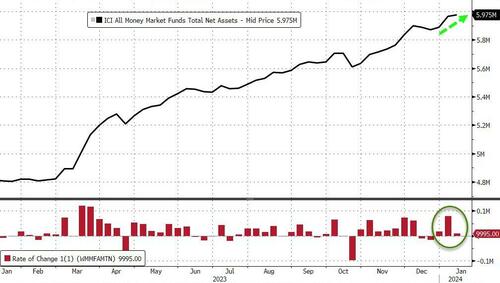

For the third week in a row, money-market funds saw sizable inflows (+$10BN) last week, pushing total AUM to a new record high of $5.975TN...

Source: Bloomberg

Both institutional and retail funds saw inflows (+$5.8BN and +$42.BN respectively), although it was smaller than last week's huge inflows...

Source: Bloomberg

In a breakdown for the week to Jan. 10, government funds - which invest primarily in securities like Treasury bills, repurchase agreements and agency debt - saw assets dip to $4.878 trillion, a $56 million decline.

Prime funds, however, which tend to invest in higher-risk assets such as commercial paper, saw assets rise to $973.1 billion, an $11.4 billion increase.

Interestingly though, both money-markets and bank deposits are seeing inflows (pretty consistently for the last two months - since The Fed started to pivot)...

Source: Bloomberg

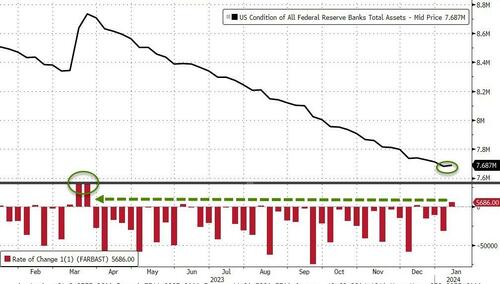

The Fed balance sheet expanded last week by $5.7BN - the most since March's SVB crisis...

Source: Bloomberg

Notably, The Fed's reverse repo facility saw a large drawdown today - to a new cycle low - continuing the trend towards zero-ing out in March...

Source: Bloomberg

Bank reserves at The Fed rebounded strongly last week, catching up a little with US equity market cap (but the drawdown in RRP is likely filling that liquidity gap)...

Source: Bloomberg

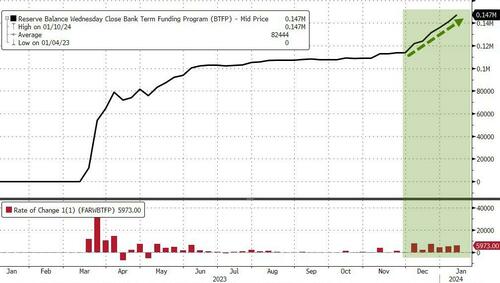

Usage of The Fed's bank bailout facility surged once again (on balance sheet-filling and now arbitrage-driven demand), up almost $6BN to $147BN

Source: Bloomberg

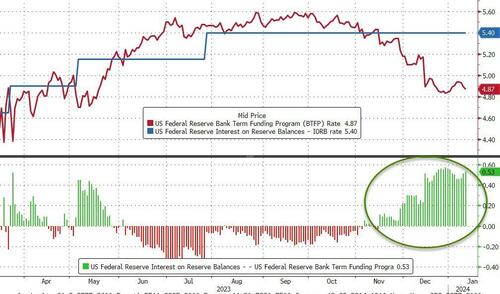

The BTFP-Fed Arb continues to offer 'free-money' (and usage of the BTFP has risen by $38BN since the arb existed), but the spread has narrowed a smidge from a peak near 60bps to 53bps today...

Source: Bloomberg

Regional bank stocks have been rising since the BTFP-Arb existed...

Source: Bloomberg

Which will make it hard for The Fed to defend leaving the facility open after March when its "temporary" nature is supposed to expire.

“In justifying the generous terms of the original program, the Fed cited the ‘unusual and exigent’ market conditions facing the banking industry following last spring’s deposit runs,” Wrightson ICAP economist Lou Crandall wrote in a note to clients.

“It would be difficult to defend a renewal in today’s more normal environment.”

Which means The Fed has a problem - the end of $140BN-plus BTFP facility and zero liquidity left to drawdown from the RRP. The Fed will be forced to taper QT (or restart QE) and

As we noted earlier, this has created the possibility of a worrying chain reaction - from the Fed’s balance sheet, via the money market funds and the private repo market, through the basis trade and on to the demand for Treasuries, at a time when the US government is coming to market with massive amounts of issuance.

Instead of scarce bank reserves creating liquidity problems and forcing the Fed to stop QT, it may well be the exhaustion of the ON RRP and the upending of the hedge fund basis trade that causes problems in 2024. The worrying difference now is that there is no Fed backstop for hedge funds and the high degree of leverage used in the trade could lead to liquidity problems proliferating even more quickly through the financial system.

This may be too late to avert a severe bout of bond market volatility, though.

Either way, the Fed is on course to end QT and restart QE in the coming months, against a backdrop of loose fiscal policy and a still-resilient economy, opening the door to a reappearance of inflationary pressures that the Fed may have little appetite (or ability) to restrain.

For the third week in a row, money-market funds saw sizable inflows (+$10BN) last week, pushing total AUM to a new record high of $5.975TN…

Source: Bloomberg

Both institutional and retail funds saw inflows (+$5.8BN and +$42.BN respectively), although it was smaller than last week’s huge inflows…

Source: Bloomberg

In a breakdown for the week to Jan. 10, government funds – which invest primarily in securities like Treasury bills, repurchase agreements and agency debt – saw assets dip to $4.878 trillion, a $56 million decline.

Prime funds, however, which tend to invest in higher-risk assets such as commercial paper, saw assets rise to $973.1 billion, an $11.4 billion increase.

Interestingly though, both money-markets and bank deposits are seeing inflows (pretty consistently for the last two months – since The Fed started to pivot)…

Source: Bloomberg

The Fed balance sheet expanded last week by $5.7BN – the most since March’s SVB crisis…

Source: Bloomberg

Notably, The Fed’s reverse repo facility saw a large drawdown today – to a new cycle low – continuing the trend towards zero-ing out in March…

Source: Bloomberg

Bank reserves at The Fed rebounded strongly last week, catching up a little with US equity market cap (but the drawdown in RRP is likely filling that liquidity gap)…

Source: Bloomberg

Usage of The Fed’s bank bailout facility surged once again (on balance sheet-filling and now arbitrage-driven demand), up almost $6BN to $147BN

Source: Bloomberg

The BTFP-Fed Arb continues to offer ‘free-money’ (and usage of the BTFP has risen by $38BN since the arb existed), but the spread has narrowed a smidge from a peak near 60bps to 53bps today…

Source: Bloomberg

Regional bank stocks have been rising since the BTFP-Arb existed…

Source: Bloomberg

Which will make it hard for The Fed to defend leaving the facility open after March when its “temporary” nature is supposed to expire.

“In justifying the generous terms of the original program, the Fed cited the ‘unusual and exigent’ market conditions facing the banking industry following last spring’s deposit runs,” Wrightson ICAP economist Lou Crandall wrote in a note to clients.

“It would be difficult to defend a renewal in today’s more normal environment.”

Which means The Fed has a problem – the end of $140BN-plus BTFP facility and zero liquidity left to drawdown from the RRP. The Fed will be forced to taper QT (or restart QE) and

As we noted earlier, this has created the possibility of a worrying chain reaction – from the Fed’s balance sheet, via the money market funds and the private repo market, through the basis trade and on to the demand for Treasuries, at a time when the US government is coming to market with massive amounts of issuance.

Instead of scarce bank reserves creating liquidity problems and forcing the Fed to stop QT, it may well be the exhaustion of the ON RRP and the upending of the hedge fund basis trade that causes problems in 2024. The worrying difference now is that there is no Fed backstop for hedge funds and the high degree of leverage used in the trade could lead to liquidity problems proliferating even more quickly through the financial system.

This may be too late to avert a severe bout of bond market volatility, though.

Either way, the Fed is on course to end QT and restart QE in the coming months, against a backdrop of loose fiscal policy and a still-resilient economy, opening the door to a reappearance of inflationary pressures that the Fed may have little appetite (or ability) to restrain.

Loading…