As the Magnificent 7 tech stocks and home prices grind higher, there has been a massive surge in the number of Americans taking early retirement. Bloomberg has coined this phenomenon the "Great Retirement Boom."

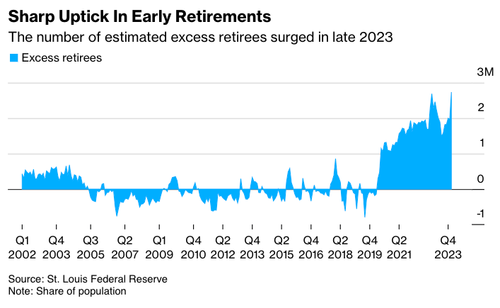

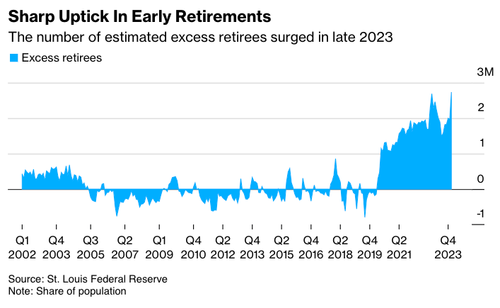

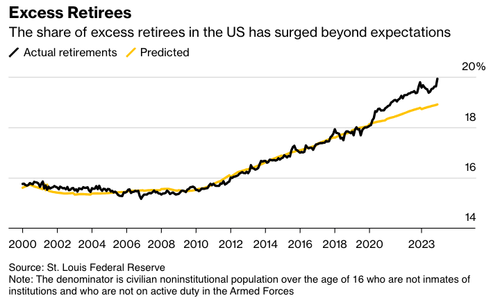

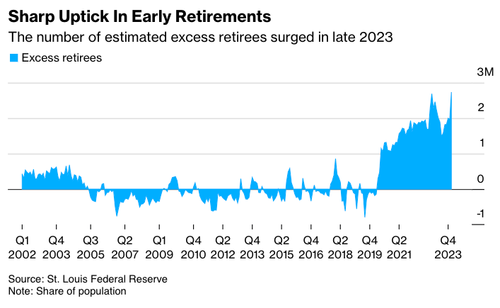

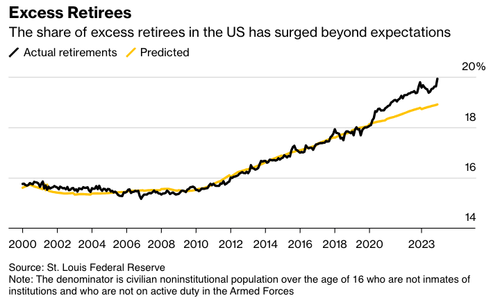

A model designed by economist Miguel Faria-e-Castro at the Federal Reserve Bank of St. Louis shows the US has around 2.7 million more retirees than initially forecasted.

Notice that the number of retirees in the US has surged beyond expectations.

This trend emerges as retirement savers pile into tech stocks (we've asked: Is this a good idea).

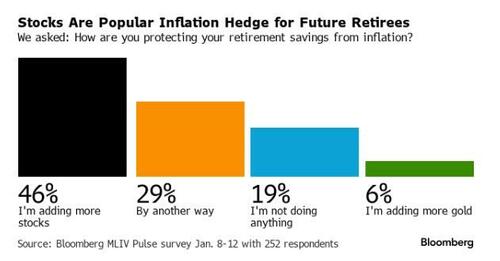

A recent Bloomberg Markets Live Pulse survey showed about half of the retirement savers were buying stocks as a direct response to soaring prices - far surpassing the 6% who said they had added the traditional inflation hedges.

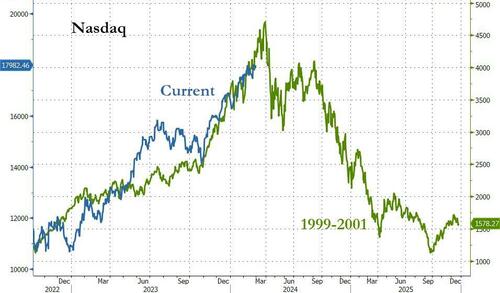

The latest expectations for interest-rate cuts from the Fed this year have fueled the artificial intelligence bubble - with signs of Dot Com lurking in markets.

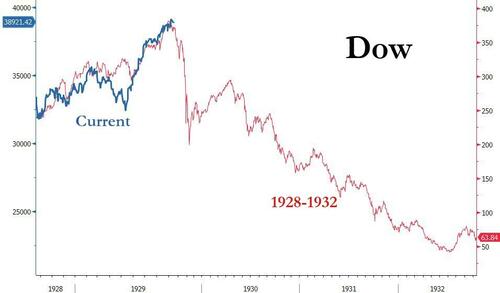

Or 1930s...

Maybe it's different this time.

According to Bloomberg, soaring stocks are already "convincing those already retired they needn't return to the workforce."

Unless the Fed is committed to a never-ending program of zero interest rates and quantitative easing... Then, retirement savers have nothing to worry about. However, when the financial elites prick the bubbles through a prolonged tightening cycle, we'll see some those retirees return to the workforce as Walmart greeters.

As the Magnificent 7 tech stocks and home prices grind higher, there has been a massive surge in the number of Americans taking early retirement. Bloomberg has coined this phenomenon the “Great Retirement Boom.”

A model designed by economist Miguel Faria-e-Castro at the Federal Reserve Bank of St. Louis shows the US has around 2.7 million more retirees than initially forecasted.

Notice that the number of retirees in the US has surged beyond expectations.

This trend emerges as retirement savers pile into tech stocks (we’ve asked: Is this a good idea?).

A recent Bloomberg Markets Live Pulse survey showed about half of the retirement savers were buying stocks as a direct response to soaring prices – far surpassing the 6% who said they had added the traditional inflation hedges.

The latest expectations for interest-rate cuts from the Fed this year have fueled the artificial intelligence bubble – with signs of Dot Com lurking in markets.

Or 1930s…

Maybe it’s different this time.

According to Bloomberg, soaring stocks are already “convincing those already retired they needn’t return to the workforce.”

Unless the Fed is committed to a never-ending program of zero interest rates and quantitative easing… Then, retirement savers have nothing to worry about. However, when the financial elites prick the bubbles through a prolonged tightening cycle, we’ll see some those retirees return to the workforce as Walmart greeters.

Loading…