Authored by Ven Ram, Bloomberg cross-asset strategist,

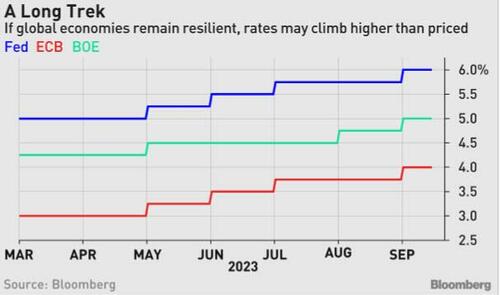

Investors now expect the major central banks to raise rates much more than they were just at the start of this month. They are still underpricing the risk of how much more tightening is to come.

The Federal Reserve may raise interest rates as high as 6%, the European Central Bank to 4% and the Bank of England to possibly 5% should the global economy continue to be resilient and inflation run rife.

Here’s why...

The tell-tale three-month/10-year Treasury curve has been in a consistent inversion since November, and typically, recessions have followed between 11 and 14 months.

That would suggest that the US economy is unlikely to roll over before October at the earliest - meaning central banks may be raising rates all through the summer as they try to get inflation to converge to their targets.

While traders have re-priced central bank trajectories considerably this month, they are still blasé: the markets currently see a terminal rate just shy of 5.50% in the US, about 3.75% in the euro zone and 4.50% in the UK.

The scenarios projected above are consistent with analysis that showed the Fed has, on average, been able to stop tightening only when its inflation-adjusted policy rate has reached a full 200 basis points.

The Fed’s current real policy rate is 95 basis points — meaning it still has a considerable distance to go.

Recent data in the US have upended expectations of quick disinflation, with consumer prices actually accelerating from a month earlier in January — spurred by the jobless rate sliding to the lowest since 1969 and retail sales rising the most in almost two years.

While the Fed has raised rates by a phenomenal 450 basis points in the current cycle, headline inflation is still running at 6.4%, more than three times its target.

Recent comments by euro-region policymakers suggest that the ECB may act forcefully.

The central bank currently projects inflation to average 6.3% this year, meaning its real policy rate is deeply negative, underscoring why many of its officials reckon the benchmark isn’t restrictive yet.

In the UK, recent comments suggest that policymakers are wary of taking interest rates too high, though BOE Governor Andrew Bailey’s remarks suggest that the central bank may make peace with a peak rate of 4.50%.

Even so, with both headline and retail-price inflation in the UK still running above 10%, a quick decline to 2% is unlikely. Also, in an environment where the Fed and the ECB keep raising rates, the BOE would find it hard to stop where it would like to in the absence of compelling evidence that inflation is crumbling.

At the start of the year, traders were working on the assumption that inflation is a problem of yesteryear. Now we know that it is still alive and kicking, while the economies are also more resilient than thought. That means only one thing: a re-calibration of central banks’ rate trajectories.

Authored by Ven Ram, Bloomberg cross-asset strategist,

Investors now expect the major central banks to raise rates much more than they were just at the start of this month. They are still underpricing the risk of how much more tightening is to come.

The Federal Reserve may raise interest rates as high as 6%, the European Central Bank to 4% and the Bank of England to possibly 5% should the global economy continue to be resilient and inflation run rife.

Here’s why…

The tell-tale three-month/10-year Treasury curve has been in a consistent inversion since November, and typically, recessions have followed between 11 and 14 months.

That would suggest that the US economy is unlikely to roll over before October at the earliest – meaning central banks may be raising rates all through the summer as they try to get inflation to converge to their targets.

While traders have re-priced central bank trajectories considerably this month, they are still blasé: the markets currently see a terminal rate just shy of 5.50% in the US, about 3.75% in the euro zone and 4.50% in the UK.

The scenarios projected above are consistent with analysis that showed the Fed has, on average, been able to stop tightening only when its inflation-adjusted policy rate has reached a full 200 basis points.

The Fed’s current real policy rate is 95 basis points — meaning it still has a considerable distance to go.

Recent data in the US have upended expectations of quick disinflation, with consumer prices actually accelerating from a month earlier in January — spurred by the jobless rate sliding to the lowest since 1969 and retail sales rising the most in almost two years.

While the Fed has raised rates by a phenomenal 450 basis points in the current cycle, headline inflation is still running at 6.4%, more than three times its target.

Recent comments by euro-region policymakers suggest that the ECB may act forcefully.

The central bank currently projects inflation to average 6.3% this year, meaning its real policy rate is deeply negative, underscoring why many of its officials reckon the benchmark isn’t restrictive yet.

In the UK, recent comments suggest that policymakers are wary of taking interest rates too high, though BOE Governor Andrew Bailey’s remarks suggest that the central bank may make peace with a peak rate of 4.50%.

Even so, with both headline and retail-price inflation in the UK still running above 10%, a quick decline to 2% is unlikely. Also, in an environment where the Fed and the ECB keep raising rates, the BOE would find it hard to stop where it would like to in the absence of compelling evidence that inflation is crumbling.

At the start of the year, traders were working on the assumption that inflation is a problem of yesteryear. Now we know that it is still alive and kicking, while the economies are also more resilient than thought. That means only one thing: a re-calibration of central banks’ rate trajectories.

Loading…