Authored by Mike Shedlock via MishTalk.com,

A Fed study shows the obvious... But Fed presidents never believe the few studies that ever make any sense...

Please consider the San Francisco Fed paper, Loose Monetary Policy and Financial Instability.

Much of the Fed report is truly Geek stuff and incomprehensible formulas. But the conclusions and many snippets ring home.

Snips That Make Sense

Do periods of persistently loose monetary policy increase financial fragility and the likelihood of a financial crisis? This is a central question for policymakers, yet the literature does not provide systematic empirical evidence about this link at the aggregate level. In this paper we fill this gap by analyzing long-run historical data. We find that when the stance of monetary policy is accommodative over an extended period, the likelihood of financial turmoil down the road increases considerably.

Kindleberger (1978) noted that “Speculative manias gather speed through expansion of money and credit or perhaps, in some cases, get started because of an initial expansion of money and credit” (p. 52).

The originator of the natural rate concept, Wicksell (1898) hypothesized that low interest rates— and low-for-long periods in particular—spur house prices (p. 88). He even went further and argued that such increase in house prices could generate feedback as entrepreneurs expect further price increases (p. 88). Eventually, speculation starts to dominate markets (pp. 89–90), resulting in a boom-and-bust cycle (p. 90). Such a mechanism running from low interest rates set by the central bank, through behavioral responses in credit quantities and asset prices, also figures in the recent model of Kashyap and Stein (2023).

Mian, Sufi, and Verner (2017) provide evidence that household debt booms are accompanied by a temporary boost in real activity. This boost, though, is short-lived and eventually reverses. Loose financial conditions boost the left tail of the predicted real GDP growth distribution in the short term at the expense of strong negative effects in the medium term without affecting the economy’s expected growth path.

When interest rates are relatively loose, financial intermediaries have incentives—or are even required—to search for yield and thus risk. This incentive to “search for yield” was famously put forward by Rajan (2005) as one source of financial risk. One example he gave was insurance companies. These institutions often face fixed long-term commitments and therefore increase their risk appetite when rates are low.

Drechsler, Savov, and Schnabl (2018) also establish a theoretical link between lower interest rates and increasing leverage and thus risk exposure.

Finally, from the experimental literature, Lian, Ma, and Wang (2019) find evidence for reference dependence and salience. In their experiments, an individual starting the experiment in a high interest rate environment will tend to make riskier investment decisions when shifted to a low interest rate environment. T

The danger of low for long monetary policy is stressed in Boissay, Collard, Gal´ı, and Manea (2022). In their model, financial crises are the consequence of a central bank that keeps the policy rate too low for too long which in turn fosters an investment boom and eventually a capital overhang. Given this concern, we explicitly consider the consequences of persistently loose monetary policy as opposed to single periods of policy undershooting relative to the natural rate of interest.

Our empirical analysis is based on the latest release of the Jorda-Schularick-Taylor (JST ` henceforth) Macrohistory Database which combines macro-financial data with a banking crisis chronology for 18 advanced economies over the period from 1870 until 2020. The database is described in Jorda, Schularick, and Taylor ` (2017). For this study, we shall ignore the world war periods (1914–18 & 1939–45) and we also exclude the German economy during hyperinflation (1922 & 1923), but we keep all other data points of the JST Database in the analysis that follows. Our final sample has 2457 country-year observations.

Are periods of persistently loose monetary policy more crisis-prone? This section argues that the answer to this question is in the affirmative. We see significant estimates in the medium term, that is around horizons of 5 to 10 years. Financial crises are predicted by loose monetary policy several years ahead. The importance of this empirical finding does not only arise from its high level of statistical significance and—as we will see below—robustness to model specification, but also from economic relevance.

We do not find evidence for a positive link between loose monetary policy and financial vulnerabilities in the short term. If anything, point estimates indicate a negative relation between financial fragility and a loose stance at horizons below 4 years.

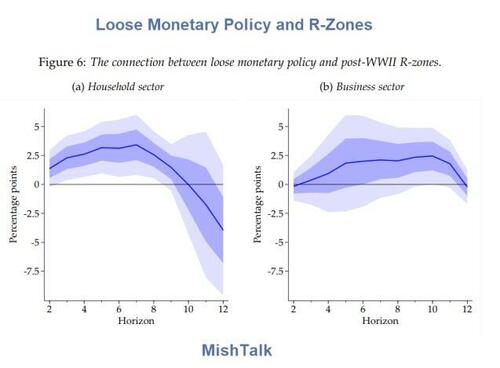

Panels (a) and (b) of Figure 6 now show that, at this point, it is likely that the country has already experienced financial fragility by entering an R-zone. A loose stance of monetary policy predicts the emergence of credit market overheating in post-WWII advanced economies both in the household and in the business sector.

Our historical evidence suggests that running such a high-pressure economy may not be sustainable in general. In the following, we argue that potential short-term gains come at the considerable cost in the form of heightened risk of disasters in real economic activity.

Fed Conclusion

This study provides the first evidence that the stance of monetary policy has implications for the stability of the financial system. A loose stance over an extended period of time leads to increased financial fragility several years down the line. The source of this fragility is associated with swings in those financial variables that have been identified by the literature as harbingers of financial turmoil.

Policymakers should take the dangers imposed by keeping policy rates low for long seriously, and thus weigh the potential short-run gains of loose monetary policy against potentially adverse medium-term consequences. Such policies increase the risk of financial crises and thus the risk of high social, political, and economic costs.

My Conclusion

The study is welcome but the conclusion was obvious. The Fed kept interest rates too low, too long three times in the past twenty-some years.

The result was a dotcom boom and bust, a housing bubble followed by the Great Recession, and what many call an "everything bubble" right now.

These crises take time to brew, at least four years and up to ten or more. The Great Recession ended in 2009, so this crisis (ignoring the pandemic), is right on time.

The asininity of this setup is a Fed again trying to produce inflation while ignoring raging inflation all around.

The Fed only looks at consumer inflation, not all inflation. The Fed again ignored a massive speculative mania in housing, the stock market, and a new phenomenon, cryptocurrencies.

The Fed Uncertainty Principle

If you think the Fed will learn from this, you are mistaken. I have written about this several times.

One of my favorite posts ever is "The Fed Uncertainty Principle" written April 3, 2008, well before the economic collapse.

I reposted a shortened version on February 11, 2022.

Please consider The Fed Uncertainty Principle and a Big Swift Kick in the Pants

The Observer Affects The Observed

The Fed, in conjunction with all the players watching the Fed, distorts the economic picture. I liken this to Heisenberg’s Uncertainty Principle where observation of a subatomic particle changes the ability to measure it accurately.

The Fed, by its very existence, alters the economic horizon. Compounding the problem are all the eyes on the Fed attempting to game the system.

What happened in 2002-2004 was an observer/participant feedback loop that continued even after the recession had ended. The Fed held rates rates too low too long. This spawned the biggest housing bubble in history. The Greenspan Fed compounded the problem by endorsing derivatives and ARMs at the worst possible moment.

Fed Uncertainty Principle

The Fed, by its very existence, has completely distorted the market via self-reinforcing observer/participant feedback loops. Thus, it is fatally flawed logic to suggest the Fed is simply following the market, therefore the market is to blame for the Fed’s actions. There would not be a Fed in a free market, and by implication, there would not be observer/participant feedback loops either.

There are four corollaries the the Fed Uncertainty Rule. If you have not yet read the principle or need a refresher course, please click on the preceding link.

* * *

Authored by Mike Shedlock via MishTalk.com,

A Fed study shows the obvious… But Fed presidents never believe the few studies that ever make any sense…

Please consider the San Francisco Fed paper, Loose Monetary Policy and Financial Instability.

Much of the Fed report is truly Geek stuff and incomprehensible formulas. But the conclusions and many snippets ring home.

Snips That Make Sense

Do periods of persistently loose monetary policy increase financial fragility and the likelihood of a financial crisis? This is a central question for policymakers, yet the literature does not provide systematic empirical evidence about this link at the aggregate level. In this paper we fill this gap by analyzing long-run historical data. We find that when the stance of monetary policy is accommodative over an extended period, the likelihood of financial turmoil down the road increases considerably.

Kindleberger (1978) noted that “Speculative manias gather speed through expansion of money and credit or perhaps, in some cases, get started because of an initial expansion of money and credit” (p. 52).

The originator of the natural rate concept, Wicksell (1898) hypothesized that low interest rates— and low-for-long periods in particular—spur house prices (p. 88). He even went further and argued that such increase in house prices could generate feedback as entrepreneurs expect further price increases (p. 88). Eventually, speculation starts to dominate markets (pp. 89–90), resulting in a boom-and-bust cycle (p. 90). Such a mechanism running from low interest rates set by the central bank, through behavioral responses in credit quantities and asset prices, also figures in the recent model of Kashyap and Stein (2023).

Mian, Sufi, and Verner (2017) provide evidence that household debt booms are accompanied by a temporary boost in real activity. This boost, though, is short-lived and eventually reverses. Loose financial conditions boost the left tail of the predicted real GDP growth distribution in the short term at the expense of strong negative effects in the medium term without affecting the economy’s expected growth path.

When interest rates are relatively loose, financial intermediaries have incentives—or are even required—to search for yield and thus risk. This incentive to “search for yield” was famously put forward by Rajan (2005) as one source of financial risk. One example he gave was insurance companies. These institutions often face fixed long-term commitments and therefore increase their risk appetite when rates are low.

Drechsler, Savov, and Schnabl (2018) also establish a theoretical link between lower interest rates and increasing leverage and thus risk exposure.

Finally, from the experimental literature, Lian, Ma, and Wang (2019) find evidence for reference dependence and salience. In their experiments, an individual starting the experiment in a high interest rate environment will tend to make riskier investment decisions when shifted to a low interest rate environment. T

The danger of low for long monetary policy is stressed in Boissay, Collard, Gal´ı, and Manea (2022). In their model, financial crises are the consequence of a central bank that keeps the policy rate too low for too long which in turn fosters an investment boom and eventually a capital overhang. Given this concern, we explicitly consider the consequences of persistently loose monetary policy as opposed to single periods of policy undershooting relative to the natural rate of interest.

Our empirical analysis is based on the latest release of the Jorda-Schularick-Taylor (JST ` henceforth) Macrohistory Database which combines macro-financial data with a banking crisis chronology for 18 advanced economies over the period from 1870 until 2020. The database is described in Jorda, Schularick, and Taylor ` (2017). For this study, we shall ignore the world war periods (1914–18 & 1939–45) and we also exclude the German economy during hyperinflation (1922 & 1923), but we keep all other data points of the JST Database in the analysis that follows. Our final sample has 2457 country-year observations.

Are periods of persistently loose monetary policy more crisis-prone? This section argues that the answer to this question is in the affirmative. We see significant estimates in the medium term, that is around horizons of 5 to 10 years. Financial crises are predicted by loose monetary policy several years ahead. The importance of this empirical finding does not only arise from its high level of statistical significance and—as we will see below—robustness to model specification, but also from economic relevance.

We do not find evidence for a positive link between loose monetary policy and financial vulnerabilities in the short term. If anything, point estimates indicate a negative relation between financial fragility and a loose stance at horizons below 4 years.

Panels (a) and (b) of Figure 6 now show that, at this point, it is likely that the country has already experienced financial fragility by entering an R-zone. A loose stance of monetary policy predicts the emergence of credit market overheating in post-WWII advanced economies both in the household and in the business sector.

Our historical evidence suggests that running such a high-pressure economy may not be sustainable in general. In the following, we argue that potential short-term gains come at the considerable cost in the form of heightened risk of disasters in real economic activity.

Fed Conclusion

This study provides the first evidence that the stance of monetary policy has implications for the stability of the financial system. A loose stance over an extended period of time leads to increased financial fragility several years down the line. The source of this fragility is associated with swings in those financial variables that have been identified by the literature as harbingers of financial turmoil.

Policymakers should take the dangers imposed by keeping policy rates low for long seriously, and thus weigh the potential short-run gains of loose monetary policy against potentially adverse medium-term consequences. Such policies increase the risk of financial crises and thus the risk of high social, political, and economic costs.

My Conclusion

The study is welcome but the conclusion was obvious. The Fed kept interest rates too low, too long three times in the past twenty-some years.

The result was a dotcom boom and bust, a housing bubble followed by the Great Recession, and what many call an “everything bubble” right now.

These crises take time to brew, at least four years and up to ten or more. The Great Recession ended in 2009, so this crisis (ignoring the pandemic), is right on time.

The asininity of this setup is a Fed again trying to produce inflation while ignoring raging inflation all around.

The Fed only looks at consumer inflation, not all inflation. The Fed again ignored a massive speculative mania in housing, the stock market, and a new phenomenon, cryptocurrencies.

The Fed Uncertainty Principle

If you think the Fed will learn from this, you are mistaken. I have written about this several times.

One of my favorite posts ever is “The Fed Uncertainty Principle” written April 3, 2008, well before the economic collapse.

I reposted a shortened version on February 11, 2022.

Please consider The Fed Uncertainty Principle and a Big Swift Kick in the Pants

The Observer Affects The Observed

The Fed, in conjunction with all the players watching the Fed, distorts the economic picture. I liken this to Heisenberg’s Uncertainty Principle where observation of a subatomic particle changes the ability to measure it accurately.

The Fed, by its very existence, alters the economic horizon. Compounding the problem are all the eyes on the Fed attempting to game the system.

What happened in 2002-2004 was an observer/participant feedback loop that continued even after the recession had ended. The Fed held rates rates too low too long. This spawned the biggest housing bubble in history. The Greenspan Fed compounded the problem by endorsing derivatives and ARMs at the worst possible moment.

Fed Uncertainty Principle

The Fed, by its very existence, has completely distorted the market via self-reinforcing observer/participant feedback loops. Thus, it is fatally flawed logic to suggest the Fed is simply following the market, therefore the market is to blame for the Fed’s actions. There would not be a Fed in a free market, and by implication, there would not be observer/participant feedback loops either.

There are four corollaries the the Fed Uncertainty Rule. If you have not yet read the principle or need a refresher course, please click on the preceding link.

* * *

Loading…