–>

October 30, 2022

Governments, international organizations, and multinational businesses increasingly advance elements of the Great Reset, including, DEI, ESG, and ending use of fossil fuels. The Biden administration’s actions since January 2021 demonstrate significant support among U.S. elites for the Great Reset.

‘); googletag.cmd.push(function () { googletag.display(‘div-gpt-ad-1609268089992-0’); }); }

What can be done about it? Glenn Beck and Justin Haskins offer suggestions in Summary of the Great Reset. These include regulatory changes, a balanced budget amendment for Washington, educational choice, and defunding global institutions. They also recommend “Community First,” with economic, social, and political elements, like getting to know neighbors and supporting locally owned businesses. On politics, they recommend, “If you’re politically active, don’t spend all your time and money on congressional and presidential elections.” Building on this, I contend that a reinvigorated federalism offers protection against Great Reset policies.

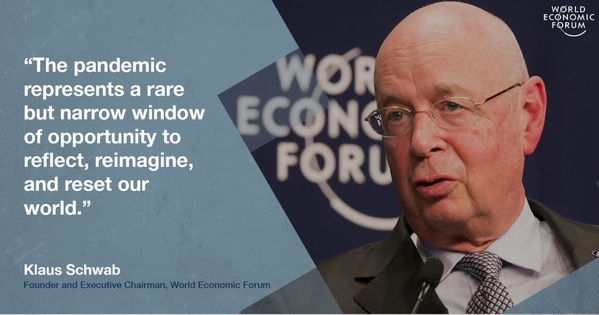

(Source: World Eceonomic Forum)

We can hope for and welcome political pushback. The Trump administration took helpful measures, like enacting the Fair Access to Financial Services rule to prevent discrimination in lending. Many more Americans are now aware of the Great Reset thanks to the efforts of folks like Haskins, Donald Kendal, and the Heartland Institute. A successor can undo President Biden’s executive orders.

Yet, improving policy through politics has limits. Given the balance between the parties nationally and the influence of globalist elites within the Democratic party, the result is likely to be enormous policy variation. Consider a future where Democratic presidents close gas stations and mandate lending exclusively based on ESG scores only for Republicans to reverse these. Now imagine operating an energy company or bank under such policy swings. We cannot plan and lead our lives or build functioning communities or economies under enormous policy swings.

‘); googletag.cmd.push(function () { googletag.display(‘div-gpt-ad-1609270365559-0’); }); }

Public choice and constitutional economics have long recognized the limits of electing better people as a solution for institutional problems. We need institutional changes to reduce progressive elites’ influence. Renewed federalism and a willingness of states to build their own policy and regulatory infrastructure offers a path for predictable, limited government.

Consider one industry in detail: higher education. The Trump administration took positive steps on higher education. These measures included rolling back the Obama’s rules on sexual harassment and allowing colleges to pursue accreditation from any of the regional accrediting bodies, yet these changes have not endured. President Biden’s initiatives include reimposing the Obama administration’s due process changes and student loan forgiveness.

States operate most of America’s public universities with many independently governed institutions; higher ed’s governance structure is already federal. Funding creates problems: the U.S. Department of Education exercises influence over colleges only because of Title IV of the Higher Education Act’s funding. Eligibility for federal financial aid is crucial to universities, who must adhere to the regulations and “Dear Colleague” letters issued under the Higher Education Act.

In addition to empowering progressive elites, federal financial aid contributes to rising tuition rates. The availability of federal dollars encourages state governments to cut appropriations and hike tuition. Subsidized student loans (and potential forgiveness) reduce students’ responsiveness to tuition hikes. The financial dependence of red states’ universities on Washington ensures vulnerability.

Yet states need not rely on Uncle Sam, as a new Martin Center report details. Hillsdale College created its own lending program when it stopped accepting federal support; being cut off from Title IV funding did not doom Hillsdale. State governments, in cooperation with banks and investors, could create their own student lending programs. Income Share Agreements could be strengthened. And states could even increase appropriations to lower tuition and reduce students’ borrowing.

State independence will reduce the influence of globalist elites on many different margins. Consider ESG. If the Federal Reserve, U.S. Treasury, FDIC, and SEC continue to push ESG mandates, states — which already charter banks — may need to assume more regulatory authority. State authority may be the only way to insulate banks from Washington.

‘); googletag.cmd.push(function () { googletag.display(‘div-gpt-ad-1609268078422-0’); }); } if (publir_show_ads) { document.write(“

Attaining financial independence will require state and local officials to act against their narrow electoral interest. Public choice economics models politicians as maximizing their reelection chances. They seek support and look to avoid opposition. Spending money generates support while raising taxes produces anger and opposition. Politicians choose spending when the support gained exceeds the opposition from taxes.

Letting Washington collect taxes for the states is a state legislator’s dream come true: they get the support from spending without the opposition from taxes. But money from Washington has always come with strings attached, from leveraging federal highway funds to make states raise the drinking age to 21 to the Affordable Care Act’s attempted forced expansion of Medicaid. The Great Reset makes such dependence unacceptable.

Ultimately, Washington only recirculates money. Individuals and businesses across the country pay taxes. Laundering tax dollars through Washington is at best a zero-sum game. On the other hand, keeping taxes and spending local can limit the influence of national elites.

An invigorated federalism devolves taxation and programs to states, allowing significant federal tax cuts. If political forces in Washington later reversed the tax cuts, Americans could face crushingly high tax rates. Keeping state and local taxes as low as possible might normally be wise for fiscal conservatives with more influence in the state capital than in Washington. But true federalism must involve significant taxation by states, making some risk here unavoidable.

The forces backing the Great Reset nationally are unlikely to dissipate soon. We can hope that educating Americans about the Great Reset will improve policy, public choice economics recognizes limits to addressing structural problems by electing the right people. Having states assume more fiscal and regulatory authority will enable Americans to build stout defenses against the policies and policy uncertainty of the Great Reset.

Daniel Sutter ([email protected]) is Affiliated Senior Scholar at the Mercatus Center and Professor of Economics at the Manuel H. Johnson Center for Political Economy at Troy University.

<!– if(page_width_onload <= 479) { document.write("

“); googletag.cmd.push(function() { googletag.display(‘div-gpt-ad-1345489840937-4’); }); } –> If you experience technical problems, please write to [email protected]

FOLLOW US ON

<!–

–>

<!– _qoptions={ qacct:”p-9bKF-NgTuSFM6″ }; ![]() –> <!—-> <!– var addthis_share = { email_template: “new_template” } –>

–> <!—-> <!– var addthis_share = { email_template: “new_template” } –>