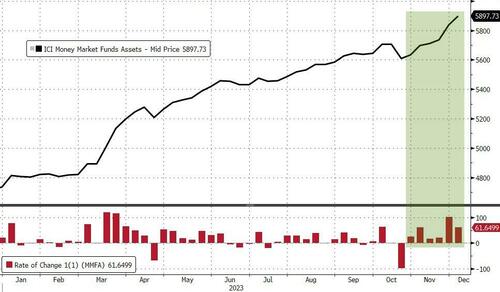

Money-market funds saw another large ($61.5BN) inflow last week. That is the sixth straight week of inflows, adding $290BN in that time to a new record high of $5.9TN...

Source: Bloomberg

In a breakdown for the week to Dec. 6, government funds - which invest primarily in securities like Treasury bills, repurchase agreements and agency debt - saw assets rise to $4.829TN, a $56.1BN increase.

Prime funds, which tend to invest in higher-risk assets such as commercial paper, meanwhile, saw assets climb to $946BN, a $6.1BN increase

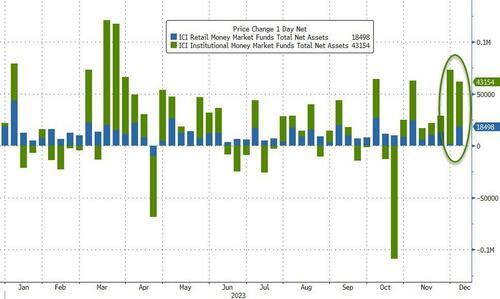

Institutional funds saw the bulk of the inflows once again (+$43BN) while the unbroken trend of inflow into Retail funds continues (+$18.5BN)...

Source: Bloomberg

The resurgence in money-market fund inflows is diverging parabolically from bank deposits (which are basically flat on a seasonally-adjusted basis)...

Source: Bloomberg

Meanwhile, after a small uptick into month-end, November's exodus from The Fed's reverse repo facility continued in December...

Source: Bloomberg

While reserve scarcity is not evident quite yet, we did get some angst this week. as SOFR spiked relative to O/N RRP.

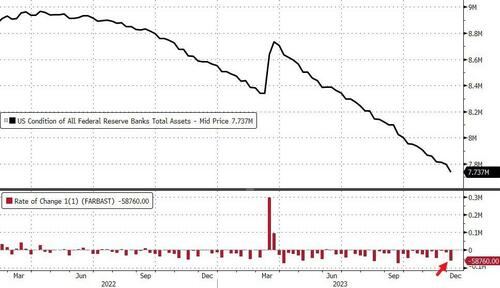

For now, The Fed balance sheet contraction accelerated last week, dropping $58.8BN (the biggest weekly decline since September)...

Source: Bloomberg

QT continued with a slight acceleration as 'securities held' fell $30.4BN...

Source: Bloomberg

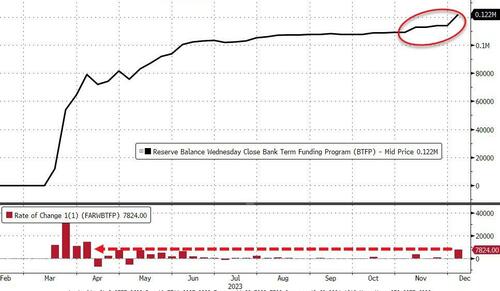

And usage of The Fed's Bank Term Funding Program (expensive bank bailout fund) exploded higher by $7.8BN (biggest increase since April) to $122BN (a new record high)...

Source: Bloomberg

For banks tapping the Fed's BTFP, there’s an arbitrage to be deployed where institutions borrow from the facility and park the proceeds in their account at the central bank, according to Bill Nelson, chief economist at the Bank Policy Institute in Washington and a former Federal Reserve economist.

The interest rate on BTFP loans was about 5.18% as of Dec. 1 — one-year OIS swap rate +10bp, while interest on reserve balances is 5.40%

BTFP loans have a term of one-year and the rate is fixed for the term of the loan and can be repaid without penalty, and only backed by securities the bank owned as of March 12

“So borrow from the BTFP, leave the proceeds on deposit at the Fed, and collect the 22bp spread,” Nelson wrote.

If the BTFP rate falls further, banks can repay the loan early and take out a new loan. If IORB falls below the rate on the BTFP loan, institutions can repay the loan

“A similar arbitrage opened up for AMLF loans in May 2009 and the Fed quickly adjusted the program to close it,” he said

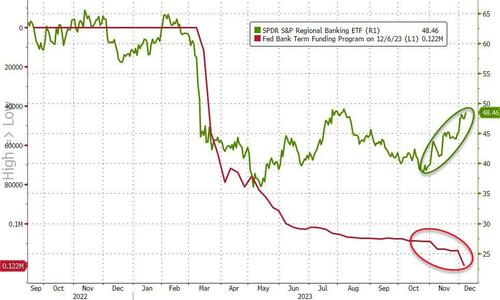

And for now, regional bank stocks continue to surge higher as their usage of The Fed's bailout facility also soars. Is the market betting on a big enough collapse in yields that this $100BN-plus hole in bank balance sheets is miraculously heeled? Just what kind of economic contraction would that take? (and what would that great depression-like scenario do for banks loan books?) Asking for a friend...

Source: Bloomberg

Finally, equity market caps continue to rebound after recoupling with bank reserves at The Fed (as the latter also expands once again thanks to the RRP drawdowns)...

Source: Bloomberg

The Fed's "temporary" bailout fund is up in March... and at the pace of exodus from the RRP facility, that could be the same time that reserve scarcity starts to rear its ugly head.

Money-market funds saw another large ($61.5BN) inflow last week. That is the sixth straight week of inflows, adding $290BN in that time to a new record high of $5.9TN…

Source: Bloomberg

In a breakdown for the week to Dec. 6, government funds – which invest primarily in securities like Treasury bills, repurchase agreements and agency debt – saw assets rise to $4.829TN, a $56.1BN increase.

Prime funds, which tend to invest in higher-risk assets such as commercial paper, meanwhile, saw assets climb to $946BN, a $6.1BN increase

Institutional funds saw the bulk of the inflows once again (+$43BN) while the unbroken trend of inflow into Retail funds continues (+$18.5BN)…

Source: Bloomberg

The resurgence in money-market fund inflows is diverging parabolically from bank deposits (which are basically flat on a seasonally-adjusted basis)…

Source: Bloomberg

Meanwhile, after a small uptick into month-end, November’s exodus from The Fed’s reverse repo facility continued in December…

Source: Bloomberg

While reserve scarcity is not evident quite yet, we did get some angst this week. as SOFR spiked relative to O/N RRP.

For now, The Fed balance sheet contraction accelerated last week, dropping $58.8BN (the biggest weekly decline since September)…

Source: Bloomberg

QT continued with a slight acceleration as ‘securities held’ fell $30.4BN…

Source: Bloomberg

And usage of The Fed’s Bank Term Funding Program (expensive bank bailout fund) exploded higher by $7.8BN (biggest increase since April) to $122BN (a new record high)…

Source: Bloomberg

For banks tapping the Fed’s BTFP, there’s an arbitrage to be deployed where institutions borrow from the facility and park the proceeds in their account at the central bank, according to Bill Nelson, chief economist at the Bank Policy Institute in Washington and a former Federal Reserve economist.

The interest rate on BTFP loans was about 5.18% as of Dec. 1 — one-year OIS swap rate +10bp, while interest on reserve balances is 5.40%

BTFP loans have a term of one-year and the rate is fixed for the term of the loan and can be repaid without penalty, and only backed by securities the bank owned as of March 12

“So borrow from the BTFP, leave the proceeds on deposit at the Fed, and collect the 22bp spread,” Nelson wrote.

If the BTFP rate falls further, banks can repay the loan early and take out a new loan. If IORB falls below the rate on the BTFP loan, institutions can repay the loan

“A similar arbitrage opened up for AMLF loans in May 2009 and the Fed quickly adjusted the program to close it,” he said

And for now, regional bank stocks continue to surge higher as their usage of The Fed’s bailout facility also soars. Is the market betting on a big enough collapse in yields that this $100BN-plus hole in bank balance sheets is miraculously heeled? Just what kind of economic contraction would that take? (and what would that great depression-like scenario do for banks loan books?) Asking for a friend…

Source: Bloomberg

Finally, equity market caps continue to rebound after recoupling with bank reserves at The Fed (as the latter also expands once again thanks to the RRP drawdowns)…

Source: Bloomberg

The Fed’s “temporary” bailout fund is up in March… and at the pace of exodus from the RRP facility, that could be the same time that reserve scarcity starts to rear its ugly head.

Loading…