There goes any hope that despite the US economy sliding into a recession and global markets turmoiling, that inflation would finally relent.

Moments ago the BEA reported that in August, personal income and spending came in 0.3% and 0.4%, respectively, the former in line with expectations (0.3%) and slightly higher than the 0.2% increase in July, while the latter, spending, printing well above the consensus forecast of 0.2% and far above July's -0.2% decline...

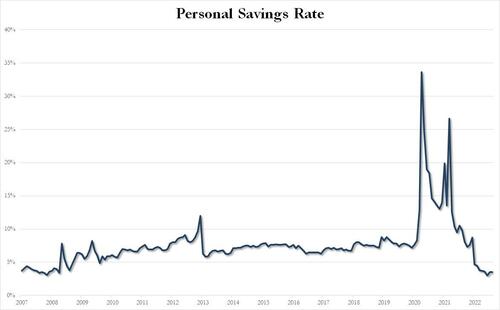

... which meant that the personal savings rate was unchanged on the month, and sticky at just above post Lehman record lows.

And even though as the next chart show, the frenzied growth in spending is slowing...

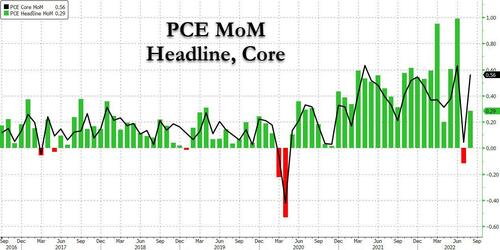

... there is still more than enough to keep inflation red-hot, and indeed the punchline from today's report is that both PCE and core PCE - the Fed's preferred inflation metric - came in well above expectations. To wit, on an annual basis, headline PCE printed 6.2% Y/Y, above the 6.0% expected (below July's 6.4%), while core PCE came in at 4.9%, also above the 4.7% expected, and unchanged from an upward revised July print.

But where the PCE data truly stood out was on a MoM basis, where the core print of 0.3%, came in far above last month's -0.1% drop and also well above consensus expectations of 0.1%, while the headline print of 0.6% unexpectedly came just shy of record highs, and above the expected 0.5% print.

Needless to say, this is not what the Fed had wanted to see, as it means even more hiking, even more things breaking in the market, and as a result futures slumped in kneejerk response even as 10Y yields slid to session lows, anticipating that even more tightening from the Fed will lead to inevitable recession.

As a bonus, here is Academy Securities' Peter Tchir's take on the PCE numbers:

Expectations on Bloomberg were for PCE Core Deflator YOY to be 4.7%, with the “whisper” number at 4.8% led by Nick Timiraos from the WSJ (believed by many to be the unofficial voice of the Fed). It came in a touch high at 4.9%, but just like European bonds largely held their own after a high Eurozone CPI of 10%, treasuries holding firm here – a sign that so much is priced in.

Spending was better than expected this month, but was ratcheted down last month – so take that with a grain of salt.

On the Core, for last month, it was reduced from 0.1% to 0.0%, but the YOY number was revised upward, meaning they found other revisions in even earlier months (a sign of just how “accurate” this data is).

Real personal spending has averaged 0% change for the last 2 months – showing signs of the consumer slowing?

Remember too, this is all as of end of August when the 10-year averaged 2.89% rather than the 3.5% it averaged this month (look at mortgage rates, credit spreads, and auto loan levels, and they all got worse in September).

The S&P 500 averaged 4,158 in August versus 3,868 in September, so any “wealth effect” should have hit the data.

I don’t pay close attention to individual stocks, but I went to the transcripts of their earnings calls. Inventory as a constraint was mentioned a couple of times back in the summer of 2021, and not at all in the most recent call.

The Manheim Used Car Index is likely to show a price decline YOY when the end of September data comes out.

We get Michigan sentiment data, but it would be surprising if inflation expectations went higher.

With AAII sentiment survey still 3:1 bears to bulls, the CNN fear and greed index near extreme fear, and QQQ RSI, as one example, at the oversold point, high put to call ratios, I’m adding risk here – specifically U.S. equity risk. (It doesn’t hurt, in my opinion that the GBP and EUR are off their lows from earlier this week).

By no means do I think we get a soft landing, but too much Fed based negativity is priced in, and the data could start tilting towards lower inflation than the market (and Fed) have been fixated on.

I continue to believe, the ultimate lows will be in a true “risk-off” scenario, where bonds rally while stocks fall, but I think for now, both can limp into month-end and get some strength.

There goes any hope that despite the US economy sliding into a recession and global markets turmoiling, that inflation would finally relent.

Moments ago the BEA reported that in August, personal income and spending came in 0.3% and 0.4%, respectively, the former in line with expectations (0.3%) and slightly higher than the 0.2% increase in July, while the latter, spending, printing well above the consensus forecast of 0.2% and far above July’s -0.2% decline…

… which meant that the personal savings rate was unchanged on the month, and sticky at just above post Lehman record lows.

And even though as the next chart show, the frenzied growth in spending is slowing…

… there is still more than enough to keep inflation red-hot, and indeed the punchline from today’s report is that both PCE and core PCE – the Fed’s preferred inflation metric – came in well above expectations. To wit, on an annual basis, headline PCE printed 6.2% Y/Y, above the 6.0% expected (below July’s 6.4%), while core PCE came in at 4.9%, also above the 4.7% expected, and unchanged from an upward revised July print.

But where the PCE data truly stood out was on a MoM basis, where the core print of 0.3%, came in far above last month’s -0.1% drop and also well above consensus expectations of 0.1%, while the headline print of 0.6% unexpectedly came just shy of record highs, and above the expected 0.5% print.

Needless to say, this is not what the Fed had wanted to see, as it means even more hiking, even more things breaking in the market, and as a result futures slumped in kneejerk response even as 10Y yields slid to session lows, anticipating that even more tightening from the Fed will lead to inevitable recession.

As a bonus, here is Academy Securities’ Peter Tchir’s take on the PCE numbers:

Expectations on Bloomberg were for PCE Core Deflator YOY to be 4.7%, with the “whisper” number at 4.8% led by Nick Timiraos from the WSJ (believed by many to be the unofficial voice of the Fed). It came in a touch high at 4.9%, but just like European bonds largely held their own after a high Eurozone CPI of 10%, treasuries holding firm here – a sign that so much is priced in.

Spending was better than expected this month, but was ratcheted down last month – so take that with a grain of salt.

On the Core, for last month, it was reduced from 0.1% to 0.0%, but the YOY number was revised upward, meaning they found other revisions in even earlier months (a sign of just how “accurate” this data is).

Real personal spending has averaged 0% change for the last 2 months – showing signs of the consumer slowing?

Remember too, this is all as of end of August when the 10-year averaged 2.89% rather than the 3.5% it averaged this month (look at mortgage rates, credit spreads, and auto loan levels, and they all got worse in September).

The S&P 500 averaged 4,158 in August versus 3,868 in September, so any “wealth effect” should have hit the data.

I don’t pay close attention to individual stocks, but I went to the transcripts of their earnings calls. Inventory as a constraint was mentioned a couple of times back in the summer of 2021, and not at all in the most recent call.

The Manheim Used Car Index is likely to show a price decline YOY when the end of September data comes out.

We get Michigan sentiment data, but it would be surprising if inflation expectations went higher.

With AAII sentiment survey still 3:1 bears to bulls, the CNN fear and greed index near extreme fear, and QQQ RSI, as one example, at the oversold point, high put to call ratios, I’m adding risk here – specifically U.S. equity risk. (It doesn’t hurt, in my opinion that the GBP and EUR are off their lows from earlier this week).

By no means do I think we get a soft landing, but too much Fed based negativity is priced in, and the data could start tilting towards lower inflation than the market (and Fed) have been fixated on.

I continue to believe, the ultimate lows will be in a true “risk-off” scenario, where bonds rally while stocks fall, but I think for now, both can limp into month-end and get some strength.