There are two things that need to happen for the Fed to stop hiking and pivot (or just one if the Fed were to raise its inflation target, which will happen but not for several years as Powell himself admitted last week): first, the labor market has to turn decidedly weaker with both the pace of monthly payrolls increase and hourly earnings having to come down drastically; and second, inflation has to drop sharply on a Y/Y basis and has to at worst flatten sequentially.

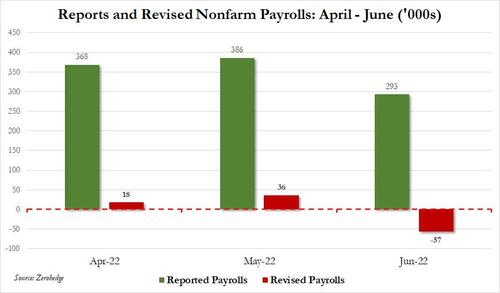

Regarding the first, we are almost there. Recall that as we first reported last week, the Philly Fed had effectively revised what was according to the BLS a gain of 1.1 million jobs to just 10,500 jobs, meaning that the Fed was looking at erroneously overstated, arguably politicized data, as it unleashed its burst of 75bps rate hikes in June... which happened just as June jobs number turned negative.

A few days after our report, politicians also jumped on the bandwagon with Florida Senator Rick Scott writing a letter to BLS Commissioner William Beach, noting that Biden has used data from his agency to support his agenda and policies.

"For the better part of his presidency, while the American economy has struggled and record inflation has brought historic pain to families and small businesses across the country, President Joe Biden has consistently bragged about job growth", Scott wrote adding that "now, thanks to the good work of analysts at the Federal Reserve Bank of Philadelphia, we know that the BLS inaccurately reported the creation more than one million jobs, and that much of what President Biden has claimed credit for as the economic achievements for his administration is a lie."

WRONG BY A MILLION JOBS. THIS IS OUTRAGEOUS.@JoeBiden's admin has been lying to the American people about our economy to prop up his failed agenda & I won't stand for it. I'm requesting an immediate meeting with the head of @BLS_gov. WE NEED ANSWERS NOW! pic.twitter.com/OKwsiYSoER

— Rick Scott (@SenRickScott) December 16, 2022

Today even Bloomberg, which is traditionally pro-Biden, admitted that the Fed "may be watching bad jobs data"...

... assuring it is now just a matter of time before the BLS is forced to admit its data was "wrong" (let's avoid calling it "rigged" and "manipulated" for now) and sparking a dramatic reappraisal of what the true state of the economy was when the Fed was busy hiking up a storm.

Fine, jobs may be about to crack but what about inflation: isn't that still red hot and giving the Fed enough cover to keep policy tight for months to come.

Well, no.

Recall that back in October we explained that when it comes to measuring inflation, the Fed is looking at inaccurate and stale data, the result of Shelter Inflation and Owner Equivalent Rent - the biggest chunk of the CPI basket - being about 9-12 months behind the curve when it comes to what is really taking place in the housing market.

Indeed, as we said in "Why Te CPI Is Making The Same Huge Mistake Now It Did One Year Ago", the time to panic about soaring rent was one year ago - as we did back in September 2021 - but not the Fed which was busy spreading the fake propaganda belief that inflation was transitory (it wasn't, and it's why the Fed is desperate to start a recession now to short circuit both inflation and the wage-price spiral). Since than all that happened this year is that the BLS has finally just caught up to reality 6-9 months ago, when rents and home prices were indeed soaring... meanwhile, real life rents are now dropping sharply across the country as the US slides into recession.

The time to panic about soaring rent was a year ago... as we did here, but not the Fed.

— zerohedge (@zerohedge) October 13, 2022

Now BLS has just caught up to reality 6-9 months ago. Meanwhile real life rents are finally fading https://t.co/sJtLFdfvND pic.twitter.com/sjJqpCB6Gt

We also said that all else equal, "the Fed will realize it has overtightened into a housing market that has peaked some time in the summer of 2023. By then, however, the economy will be in freefall and the central bank will be planning its next massive stimulus because just as we said in January, nothing really ever changes."

Which brings us to today's topic: while on one hand the Philly Fed provided Jerome Powell and the BLS with the loophole they need to admit that the jobs market was far weaker 'than expected' (because heaven forbid it was meant to paint a false picture of economic strength ahead of the midterms), it is the Cleveland Fed that this week provided a "rationalization" to the persistently high inflation print.

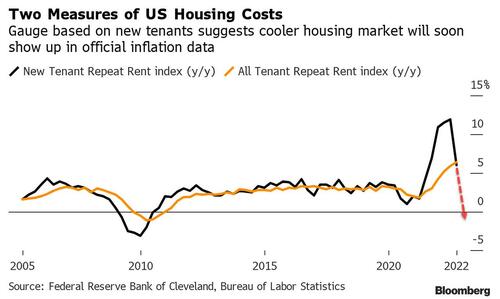

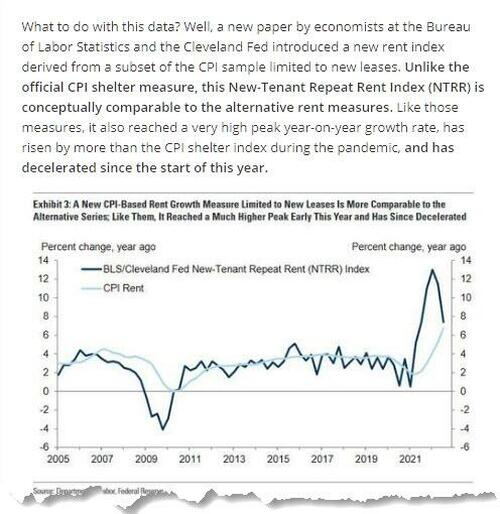

Here's what happened: to quietly set aside the notorious inaccurate Owners Equivalent Rent (which is based on data from all renters, not just new renters, and includes rollovers of historical rents), researchers at the Federal Reserve Bank of Cleveland and the Bureau of Labor Statistics built an index that’s based only on the leases of tenants who recently moved in - a shortcut meant to avoid the traditional lag in the CPI's historic rent metrics - and compared it with the conventional measure which looks at the average of rents for all tenants, to wit:

We create new indices from Bureau of Labor Statistics (BLS) rent microdata using a repeat-rent index methodology and show that this discrepancy is almost entirely explained by differences in rent growth for new tenants relative to the average rent growth for all tenants. Rent inflation for new tenants leads the official BLS rent inflation by four quarters. As rent is the largest component of the consumer price index, this has implications for our understanding of aggregate inflation dynamics and guiding monetary policy.

The researchers cited an ongoing debate over whether the headline inflation numbers should use housing data based on the entire rental market, or new tenants only. The former covers the financial experience of a much wider range of people, while the latter is better at capturing the latest shifts in market prices.

Here is a visual representation of why the new tenant repeat index is far more accurate than the stale "all tenant" index, at least when compared to such market-based indices as Zillow and Apartment List:

The results of the Cleveland Fed paper - it will come as a shock to precisely nobody - show the new-tenant index is now plunging from a peak around 12%. The researchers also "found" what we first said last summer, namely that there is a 12 month lag for legacy "all renter" data which is why the Fed is always so woefully wrong at timing inflection points; bottom line: the new-tenant data tends to run ahead of BLS housing measures in the consumer price index by about one year (in other words it is an accurate approximation of real-time data), while for the all-tenant measure the gap is about one quarter.

To be sure, the Cleveland Fed researchers discovered nothing new (we already wrote extensively in this topic two months ago when we laid out Goldman's thoughts on the issue in "This Is What Goldman Thinks True Rent Inflation Is"), they merely codified what everyone already knew, and more importantly there is now a benchmark for Powell to fall back to if and when he has to build the case for why inflation is far lower than what the CPI discloses.

For that reason alone, the praise from the career economist community was fast and furious: the new index built by the Fed and BLS teams (but really by Goldman) “might be the single most important new inflation indicator” right now, said Joseph Politano at Apricitas Economics.

Researchers at the BLS and Cleveland Fed released a data series today that might be the single most important new inflation indicator—and I don't say that lightly.

— Joey Politano 🏳️🌈 (@JosephPolitano) December 19, 2022

Introducing the New Tenant Repeat Rent Index—a new way of tracking housing inflation 🧵 pic.twitter.com/QU42dbQnhz

Others, such as Adam Ozimek of Modeled Behavior (who also never read the original Goldman report that the Cleveland Fed report is based on) said that the updated BLS/Fed paper on market rents vs average rents is "Arguably most important paper in the world rn."

Updated BLS/Fed paper market rents vs average rents using actual CPI data. Arguably most important paper in the world rn. However, they don't answer the most important question: what is the gap between the LEVEL of market rents vs LEVEL of average rents. https://t.co/jvSYq2cwC5

— Adam Ozimek (@ModeledBehavior) December 20, 2022

This suggests the gap will be closed already in the fourth quarter of 2022. But this depends on what is happening to NTRR month to month, which I can only impute using the year-to-year and applying it to levels. If it is indeed falling, NTRR will converge very soon with ATRR

— Adam Ozimek (@ModeledBehavior) December 20, 2022

Such inform praise, it brings a tear to the eye... - especially for something we first described two months ago:

But what is really going on here, however, is that this new rent inflation index is being aggressively institutionalized, and in doing so it is providing the Fed with cover to "determine" that not only was the BLS wrong in its "estimate" of strong jobs data, but that the rent inflation numbers the Fed was relying on were also overcooked, and in reality a more indicative sample using just new renter data would push the CPI much lower.

Of course, none of this would be necessary if the Fed simply had the guts to tell the world it will push its inflation target up to 3% (or more). However, since that is impossible - at least right now - various Feds are busy moving the goalposts, and after first "discovering" that the US had more than 1 million fewer jobs (crushing the strong jobs market narrative), it has also just "discovered" that the rent inflation number in the CPI which the Fed had used for so long, was substantially higher than the real number, which by the way, is something we have been saying for the past 18 months.

*MESTER: HAVEN'T SEEN IMPROVEMENT ON SERVICE-PRICE INFLATION

— zerohedge (@zerohedge) December 16, 2022

Maybe look at real-time housing data then, not 9 month stale OER

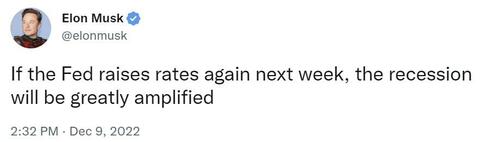

All that's left now is for the Fed to put two and two together and admit it has overtightened into a recession. We expect that it will take one or more phone calls from Joe Biden, Liz Warren...

Fed Chair Powell seems determined to push the economy over a cliff—even after he admitted rate hikes won’t lower key prices.

— Elizabeth Warren (@SenWarren) September 25, 2022

Destroying jobs and crushing wages of millions of workers is reckless and dangerous.

Recession is not the solution to inflation.https://t.co/V1CUP88uco

... and a few other politicians and celebs...

... but we will certainly be there within a month or two.

There are two things that need to happen for the Fed to stop hiking and pivot (or just one if the Fed were to raise its inflation target, which will happen but not for several years as Powell himself admitted last week): first, the labor market has to turn decidedly weaker with both the pace of monthly payrolls increase and hourly earnings having to come down drastically; and second, inflation has to drop sharply on a Y/Y basis and has to at worst flatten sequentially.

Regarding the first, we are almost there. Recall that as we first reported last week, the Philly Fed had effectively revised what was according to the BLS a gain of 1.1 million jobs to just 10,500 jobs, meaning that the Fed was looking at erroneously overstated, arguably politicized data, as it unleashed its burst of 75bps rate hikes in June… which happened just as June jobs number turned negative.

A few days after our report, politicians also jumped on the bandwagon with Florida Senator Rick Scott writing a letter to BLS Commissioner William Beach, noting that Biden has used data from his agency to support his agenda and policies.

“For the better part of his presidency, while the American economy has struggled and record inflation has brought historic pain to families and small businesses across the country, President Joe Biden has consistently bragged about job growth”, Scott wrote adding that “now, thanks to the good work of analysts at the Federal Reserve Bank of Philadelphia, we know that the BLS inaccurately reported the creation more than one million jobs, and that much of what President Biden has claimed credit for as the economic achievements for his administration is a lie.”

WRONG BY A MILLION JOBS. THIS IS OUTRAGEOUS.@JoeBiden‘s admin has been lying to the American people about our economy to prop up his failed agenda & I won’t stand for it. I’m requesting an immediate meeting with the head of @BLS_gov. WE NEED ANSWERS NOW! pic.twitter.com/OKwsiYSoER

— Rick Scott (@SenRickScott) December 16, 2022

Today even Bloomberg, which is traditionally pro-Biden, admitted that the Fed “may be watching bad jobs data”…

… assuring it is now just a matter of time before the BLS is forced to admit its data was “wrong” (let’s avoid calling it “rigged” and “manipulated” for now) and sparking a dramatic reappraisal of what the true state of the economy was when the Fed was busy hiking up a storm.

Fine, jobs may be about to crack but what about inflation: isn’t that still red hot and giving the Fed enough cover to keep policy tight for months to come.

Well, no.

Recall that back in October we explained that when it comes to measuring inflation, the Fed is looking at inaccurate and stale data, the result of Shelter Inflation and Owner Equivalent Rent – the biggest chunk of the CPI basket – being about 9-12 months behind the curve when it comes to what is really taking place in the housing market.

Indeed, as we said in “Why Te CPI Is Making The Same Huge Mistake Now It Did One Year Ago“, the time to panic about soaring rent was one year ago – as we did back in September 2021 – but not the Fed which was busy spreading the fake propaganda belief that inflation was transitory (it wasn’t, and it’s why the Fed is desperate to start a recession now to short circuit both inflation and the wage-price spiral). Since than all that happened this year is that the BLS has finally just caught up to reality 6-9 months ago, when rents and home prices were indeed soaring… meanwhile, real life rents are now dropping sharply across the country as the US slides into recession.

The time to panic about soaring rent was a year ago… as we did here, but not the Fed.

Now BLS has just caught up to reality 6-9 months ago. Meanwhile real life rents are finally fading https://t.co/sJtLFdfvND pic.twitter.com/sjJqpCB6Gt

— zerohedge (@zerohedge) October 13, 2022

We also said that all else equal, “the Fed will realize it has overtightened into a housing market that has peaked some time in the summer of 2023. By then, however, the economy will be in freefall and the central bank will be planning its next massive stimulus because just as we said in January, nothing really ever changes.”

Which brings us to today’s topic: while on one hand the Philly Fed provided Jerome Powell and the BLS with the loophole they need to admit that the jobs market was far weaker ‘than expected’ (because heaven forbid it was meant to paint a false picture of economic strength ahead of the midterms), it is the Cleveland Fed that this week provided a “rationalization” to the persistently high inflation print.

Here’s what happened: to quietly set aside the notorious inaccurate Owners Equivalent Rent (which is based on data from all renters, not just new renters, and includes rollovers of historical rents), researchers at the Federal Reserve Bank of Cleveland and the Bureau of Labor Statistics built an index that’s based only on the leases of tenants who recently moved in – a shortcut meant to avoid the traditional lag in the CPI’s historic rent metrics – and compared it with the conventional measure which looks at the average of rents for all tenants, to wit:

We create new indices from Bureau of Labor Statistics (BLS) rent microdata using a repeat-rent index methodology and show that this discrepancy is almost entirely explained by differences in rent growth for new tenants relative to the average rent growth for all tenants. Rent inflation for new tenants leads the official BLS rent inflation by four quarters. As rent is the largest component of the consumer price index, this has implications for our understanding of aggregate inflation dynamics and guiding monetary policy.

The researchers cited an ongoing debate over whether the headline inflation numbers should use housing data based on the entire rental market, or new tenants only. The former covers the financial experience of a much wider range of people, while the latter is better at capturing the latest shifts in market prices.

Here is a visual representation of why the new tenant repeat index is far more accurate than the stale “all tenant” index, at least when compared to such market-based indices as Zillow and Apartment List:

The results of the Cleveland Fed paper – it will come as a shock to precisely nobody – show the new-tenant index is now plunging from a peak around 12%. The researchers also “found” what we first said last summer, namely that there is a 12 month lag for legacy “all renter” data which is why the Fed is always so woefully wrong at timing inflection points; bottom line: the new-tenant data tends to run ahead of BLS housing measures in the consumer price index by about one year (in other words it is an accurate approximation of real-time data), while for the all-tenant measure the gap is about one quarter.

To be sure, the Cleveland Fed researchers discovered nothing new (we already wrote extensively in this topic two months ago when we laid out Goldman’s thoughts on the issue in “This Is What Goldman Thinks True Rent Inflation Is“), they merely codified what everyone already knew, and more importantly there is now a benchmark for Powell to fall back to if and when he has to build the case for why inflation is far lower than what the CPI discloses.

For that reason alone, the praise from the career economist community was fast and furious: the new index built by the Fed and BLS teams (but really by Goldman) “might be the single most important new inflation indicator” right now, said Joseph Politano at Apricitas Economics.

Researchers at the BLS and Cleveland Fed released a data series today that might be the single most important new inflation indicator—and I don’t say that lightly.

Introducing the New Tenant Repeat Rent Index—a new way of tracking housing inflation 🧵 pic.twitter.com/QU42dbQnhz

— Joey Politano 🏳️🌈 (@JosephPolitano) December 19, 2022

Others, such as Adam Ozimek of Modeled Behavior (who also never read the original Goldman report that the Cleveland Fed report is based on) said that the updated BLS/Fed paper on market rents vs average rents is “Arguably most important paper in the world rn.”

Updated BLS/Fed paper market rents vs average rents using actual CPI data. Arguably most important paper in the world rn. However, they don’t answer the most important question: what is the gap between the LEVEL of market rents vs LEVEL of average rents. https://t.co/jvSYq2cwC5

— Adam Ozimek (@ModeledBehavior) December 20, 2022

This suggests the gap will be closed already in the fourth quarter of 2022. But this depends on what is happening to NTRR month to month, which I can only impute using the year-to-year and applying it to levels. If it is indeed falling, NTRR will converge very soon with ATRR

— Adam Ozimek (@ModeledBehavior) December 20, 2022

Such inform praise, it brings a tear to the eye… – especially for something we first described two months ago:

But what is really going on here, however, is that this new rent inflation index is being aggressively institutionalized, and in doing so it is providing the Fed with cover to “determine” that not only was the BLS wrong in its “estimate” of strong jobs data, but that the rent inflation numbers the Fed was relying on were also overcooked, and in reality a more indicative sample using just new renter data would push the CPI much lower.

Of course, none of this would be necessary if the Fed simply had the guts to tell the world it will push its inflation target up to 3% (or more). However, since that is impossible – at least right now – various Feds are busy moving the goalposts, and after first “discovering” that the US had more than 1 million fewer jobs (crushing the strong jobs market narrative), it has also just “discovered” that the rent inflation number in the CPI which the Fed had used for so long, was substantially higher than the real number, which by the way, is something we have been saying for the past 18 months.

*MESTER: HAVEN’T SEEN IMPROVEMENT ON SERVICE-PRICE INFLATION

Maybe look at real-time housing data then, not 9 month stale OER

— zerohedge (@zerohedge) December 16, 2022

All that’s left now is for the Fed to put two and two together and admit it has overtightened into a recession. We expect that it will take one or more phone calls from Joe Biden, Liz Warren…

Fed Chair Powell seems determined to push the economy over a cliff—even after he admitted rate hikes won’t lower key prices.

Destroying jobs and crushing wages of millions of workers is reckless and dangerous.

Recession is not the solution to inflation.https://t.co/V1CUP88uco

— Elizabeth Warren (@SenWarren) September 25, 2022

… and a few other politicians and celebs…

… but we will certainly be there within a month or two.

Loading…