In the aftermath of the "red hot" September jobs number (which, as we explained was neither red nor hot, but was merely the BLS's latest experiment in taking seasonal adjustments and top-line goalseeking to a ludicrous degree) markets initiall recoiled fearing that a November rate hike was now in the cards even as 10Y yields spiked just shy of 4.90%. And then stocks exploded higher amid a brutal short squeeze as sentiment suddenly shifted and the odds of another Fed hike slumped.

What happened? Well, as Goldman trader Cosimo Codacci-Pisanelli explained (full note available to pro subs), "the primary argument that can be made for the Fed not hiking again this year is that FCI is tightening enough and replaces the need for hikes."

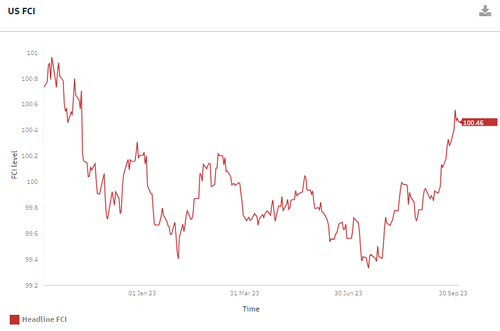

Indeed, as shown in the chart below, FCIs have tightened materially over the last few weeks as the long end rate sell off has begun to impact risk assets and the USD has rallied. And according to the Goldman trader, "long end rates selling off is a far more effective way of tightening FCI: 10y UST yields make up a 45.1% weighting of the index, whilst the Fed Funds rate only constitutes 4.4%."

This means, that thanks to the "magic" of market reflexivity, we are seeing much more effective monetary policy transmission than when the Fed hiked aggressively in 2021 when the aggressive curve flattening limited the FCI tightening. FCIs are currently ~75bps tighter vs the average level over the course of the summer.

As a reminder, a 25bp of FCI tightening is roughly equivalent to a 25bp rate hike and 25bp off growth over the next 12 months.

As such the 75bp tightening that has already taken place from the summer average is worth ~3 25bp hikes and will take ~75bps of 1y ahead growth if levels are maintained.

A similar point was made by Rabobank last week, after its Fed strategist Philip Marey noted the "interesting comments" from FOMC participant. Mary Daly (San Francisco Fed) who said “if we continue to see a cooling labor market and inflation heading back to our target, we can hold interest rates steady and let the effects of policy continue to work.” She added “Importantly, even when we hold rates where they are today, policy will grow increasingly restrictive as inflation and inflation expectations fall. So, holding rates steady is an active policy action.” What’s more, she said “Likewise, if financial conditions, which have tightened considerably in the past 90 days, remain tight, the need for us to take further action is diminished.”

In reaction to the recent bond sell-off, she said that the recent bond market tightening is equal to about 1 rate hike, which while less than Goldman's estimate of 3 rate hikes, is still an admission that the Fed is starting to freak out about the surge in long-term yields.

Here Goldman also notes that last week's comments from Daly pointed to the FCI move as a need for caution, and is also probably why the front end of the rates curve has struggled to price more into end 2023 Fed meetings dates despite the extent of the NFP beat. FCI tightening has prevented the curve from bear flattening more and keeps steepeners well supported despite the data set.

This morning, Dallas Fed President Lorie Logan (and former head of the NY Fed's Plunge Protection Team) echoed what Daly said, noting that the recent surge in long-term Treasury yields may mean less need for the US central bank to raise its benchmark interest rate again.

“Higher term premiums result in higher term interest rates for the same setting of the fed funds rate, all else equal,” Logan said Monday in remarks prepared for a speech at the National Association for Business Economics meeting in Dallas.

“Thus, if term premiums rise, they could do some of the work of cooling the economy for us, leaving less need for additional monetary policy tightening.” As a reminder, the term premium is often defined as the extra compensation that investors require for bearing interest-rate risk over the life of the bond. Logan said “there is a clear role for increased term premiums in recent yield curve moves,” though “the size and persistence of the contribution are subject to uncertainty.”

Logan is the latest Fed hawk to turn dovish as a result of soaring 10Y yields; since taking the top job at the Dallas Fed last year she had been mostly supportive of higher rates, warning that inflation was still the most important risk facing the US economy.

“I remain attentive to risks on both sides of our mandate,” she said. “In my view, high inflation remains the most important risk. We cannot allow it to become entrenched or reignite.”

That said, with DB calculating that the collapsing bond prices has wiped out $70 trillion in mark-to-market value from a global debt market which the IIF calculated is now over $300 trillion, even the Fed must realize that it is now just a matter of when not if something big breaks and the central banks is forced to scramble in the other direction, rushing to cut rates as it seeks to undo the damage of overtightening because it kept rates too low for too long in the first place, until we eventually go right back to square one.

More in the full Goldman note.

In the aftermath of the “red hot” September jobs number (which, as we explained was neither red nor hot, but was merely the BLS’s latest experiment in taking seasonal adjustments and top-line goalseeking to a ludicrous degree) markets initiall recoiled fearing that a November rate hike was now in the cards even as 10Y yields spiked just shy of 4.90%. And then stocks exploded higher amid a brutal short squeeze as sentiment suddenly shifted and the odds of another Fed hike slumped.

What happened? Well, as Goldman trader Cosimo Codacci-Pisanelli explained (full note available to pro subs), “the primary argument that can be made for the Fed not hiking again this year is that FCI is tightening enough and replaces the need for hikes.”

Indeed, as shown in the chart below, FCIs have tightened materially over the last few weeks as the long end rate sell off has begun to impact risk assets and the USD has rallied. And according to the Goldman trader, “long end rates selling off is a far more effective way of tightening FCI: 10y UST yields make up a 45.1% weighting of the index, whilst the Fed Funds rate only constitutes 4.4%.”

This means, that thanks to the “magic” of market reflexivity, we are seeing much more effective monetary policy transmission than when the Fed hiked aggressively in 2021 when the aggressive curve flattening limited the FCI tightening. FCIs are currently ~75bps tighter vs the average level over the course of the summer.

As a reminder, a 25bp of FCI tightening is roughly equivalent to a 25bp rate hike and 25bp off growth over the next 12 months.

As such the 75bp tightening that has already taken place from the summer average is worth ~3 25bp hikes and will take ~75bps of 1y ahead growth if levels are maintained.

A similar point was made by Rabobank last week, after its Fed strategist Philip Marey noted the “interesting comments” from FOMC participant. Mary Daly (San Francisco Fed) who said “if we continue to see a cooling labor market and inflation heading back to our target, we can hold interest rates steady and let the effects of policy continue to work.” She added “Importantly, even when we hold rates where they are today, policy will grow increasingly restrictive as inflation and inflation expectations fall. So, holding rates steady is an active policy action.” What’s more, she said “Likewise, if financial conditions, which have tightened considerably in the past 90 days, remain tight, the need for us to take further action is diminished.”

In reaction to the recent bond sell-off, she said that the recent bond market tightening is equal to about 1 rate hike, which while less than Goldman’s estimate of 3 rate hikes, is still an admission that the Fed is starting to freak out about the surge in long-term yields.

Here Goldman also notes that last week’s comments from Daly pointed to the FCI move as a need for caution, and is also probably why the front end of the rates curve has struggled to price more into end 2023 Fed meetings dates despite the extent of the NFP beat. FCI tightening has prevented the curve from bear flattening more and keeps steepeners well supported despite the data set.

This morning, Dallas Fed President Lorie Logan (and former head of the NY Fed’s Plunge Protection Team) echoed what Daly said, noting that the recent surge in long-term Treasury yields may mean less need for the US central bank to raise its benchmark interest rate again.

“Higher term premiums result in higher term interest rates for the same setting of the fed funds rate, all else equal,” Logan said Monday in remarks prepared for a speech at the National Association for Business Economics meeting in Dallas.

“Thus, if term premiums rise, they could do some of the work of cooling the economy for us, leaving less need for additional monetary policy tightening.” As a reminder, the term premium is often defined as the extra compensation that investors require for bearing interest-rate risk over the life of the bond. Logan said “there is a clear role for increased term premiums in recent yield curve moves,” though “the size and persistence of the contribution are subject to uncertainty.”

Logan is the latest Fed hawk to turn dovish as a result of soaring 10Y yields; since taking the top job at the Dallas Fed last year she had been mostly supportive of higher rates, warning that inflation was still the most important risk facing the US economy.

“I remain attentive to risks on both sides of our mandate,” she said. “In my view, high inflation remains the most important risk. We cannot allow it to become entrenched or reignite.”

That said, with DB calculating that the collapsing bond prices has wiped out $70 trillion in mark-to-market value from a global debt market which the IIF calculated is now over $300 trillion, even the Fed must realize that it is now just a matter of when not if something big breaks and the central banks is forced to scramble in the other direction, rushing to cut rates as it seeks to undo the damage of overtightening because it kept rates too low for too long in the first place, until we eventually go right back to square one.

More in the full Goldman note.

Loading…